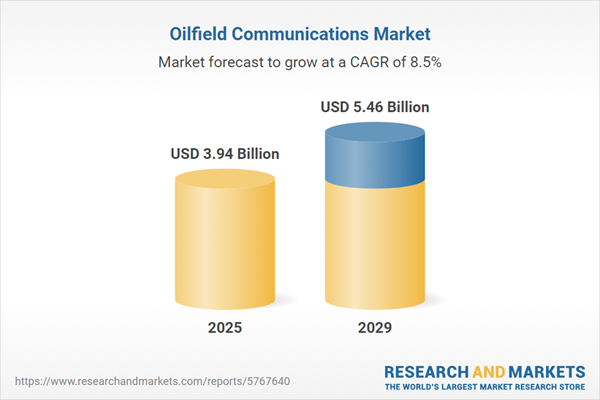

The oilfield communications market size has grown steadily in recent years. It will grow from $3.77 billion in 2024 to $3.94 billion in 2025 at a compound annual growth rate (CAGR) of 4.6%. The growth in the historic period can be attributed to expansion of oil and gas exploration activities, remote monitoring and control needs in oilfields, demand for real-time data transmission, growth in offshore drilling operations, advances in satellite communication technologies.

The oilfield communications market size is expected to see strong growth in the next few years. It will grow to $5.46 billion in 2029 at a compound annual growth rate (CAGR) of 8.5%. The growth in the forecast period can be attributed to adoption of 5g technology in oilfield communications, increased integration of internet of things (IoT), expansion of digital oilfield initiatives, emphasis on cybersecurity in oilfield networks, integration of artificial intelligence for data analysis. Major trends in the forecast period include edge computing for real-time data processing, hybrid communication networks for oilfields, autonomous vehicles and drones for oilfield surveillance, advanced data analytics for predictive maintenance, emphasis on environmental monitoring and sustainability in oilfield operations.

The anticipated growth of the oilfield communications market is expected to be propelled by an increase in oil production. Oil production involves drilling into the earth with the aim of extracting petroleum. Oilfield communications are essential in providing the connectivity, data, and insights necessary to efficiently manage production operations, reduce accidents, and minimize waste. This enhances production by removing communication barriers. For example, in June 2023, the International Energy Agency, a France-based intergovernmental economic organization, reported that global oil demand is projected to rise by 6% between 2022 and 2028, reaching 105.7 million barrels per day (mb/d), driven by strong demand from the petrochemical and aviation sectors. As a result, the increase in oil production is a key factor fueling the growth of the oilfield communications market.

The expansion of the Internet of Things (IoT) integration is expected to contribute to the growth of the oilfield communications market. IoT refers to the network of physical objects embedded with sensors, software, and network connectivity for data collection and exchange. In the oil and gas industry, successful integration of IoT relies on reliable connectivity in remote and challenging environments, facilitated by oilfield communication solutions. As an example, in July 2023, CompTIA, a US-based non-profit trade association, reported that the global IoT market reached $399. 41 billion in 2022, projected to grow to $486 billion in 2023, with connected IoT devices expected to reach 15. 9 billion by 2030. Hence, the surge in IoT platforms is a significant driver for the oilfield communications market.

Technological innovations represent a prominent trend in the oilfield communications market, with major companies focusing on developing new solutions to strengthen their positions. For instance, in May 2022, Baker Hughes, a US-based company in the oilfield communications sector, introduced the MS-2 Annulus Seal, a subsea wellhead technology aimed at reducing operational rig costs and enhancing overall wellhead installation efficiency. This integrated sealing solution, showcased at the 2022 offshore technology conference in Houston, gained adoption by multiple customers in North and South America. The MS-2 Annulus Seal instills operator confidence in well integrity, extends well life, lowers well construction and intervention costs, expands intervention options, and ensures integrity in challenging conditions.

Key players in the oilfield communications market are strategically developing innovative products like the AssetCare Digital Oilfield solutions to fortify their market positions. The AssetCare Digital Oilfield solution is recognized as the only complete, end-to-end digital upstream oil and gas solution in the industry. For instance, in June 2022, mCloud, a Canada-based software solutions company, launched the AssetCare Digital Oilfield solutions, employing cloud-based artificial intelligence (AI) and predictive maintenance to automate production management and continually optimize wellsite performance. Integrated connected worker capabilities enable wellsite operators to address methane emissions and eliminate unscheduled downtime within hours rather than weeks or months.

In August 2023, Exertherm, a UK-based company specializing in thermal management solutions, including oil accumulators and related technologies for various industrial applications, acquired Jacknife Oilfield for an undisclosed amount. Trimac aims to expand its operations and enhance its service offerings through the acquisition of Jacknife Oilfield Services, thereby solidifying its position in the oil and gas industry and boosting its capabilities in drilling and completions. Jacknife Oilfield Services is a Canada-based company that provides a range of services for the oil and gas sector, including drilling and completions.

Major companies operating in the oilfield communications market include Huawei Technologies Co. Ltd, Siemens AG, Speedcast International Limited, ABB Ltd, Commscope Inc, Inmarsat Plc, Tait Communications, Baker Hughes Incorporated, Rad Data Communications, Hughes Network Systems LLC, Ceragon Networks Ltd, RigNet Inc, Airspan Networks, Commtel Networks Pvt. Ltd, GE Digital, Mostar Oilfield Communications, Redline Communications, Rignet, Hitachi ABB Power Grids, Weatherford, ALE International, MR Control Systems, RigNet Inc., HP Co, SAP AG, Oracle Corp, Dell EMC, International Business Machines Corporation, Microsoft Corp.

North America will be the largest region in the oilfield communications market in 2024. North America is expected to be the fastest-growing region in the forecast period. The regions covered in the oilfield communications market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the oilfield communications market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Oilfield communications involve the incorporation and automation of technologies in oilfield operations, aiming to furnish information and reduce the gap between supply and demand. These communications play a crucial role in enhancing equipment productivity, optimizing infrastructure operations, and ensuring the safety of personnel.

The primary communication methods in oilfield operations encompass cellular communication networks, VSAT communication networks, fiber optic-based communication networks, microwave communication networks, and tetra networks. Microwave communication networks, specifically, utilize line-of-sight wireless communication technology employing high-frequency radio wave beams. This technology facilitates high-speed wireless connections for the transmission and reception of voice, video, and data information. The components include solutions and services, and the diverse technologies involved encompass cellular networks, VoIP, unified communications, M2M, microwave communication, WiMAX, VSAT, TETRA, fiber optics, WAN, and LAN. Field sites are situated both onshore and offshore.

The oilfield communications market research report is one of a series of new reports that provides oilfield communications market statistics, including oilfield communications industry global market size, regional shares, competitors with an oilfield communications market share, detailed oilfield communications market segments, market trends and opportunities, and any further data you may need to thrive in the oilfield communications industry. This oilfield communications market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The oilfield communications market consists of revenues earned by entities by providing cellular communication network. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Oilfield Communications Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on oilfield communications market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for oilfield communications? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The oilfield communications market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Communication Network: Cellular Communication Network; VSAT Communication Network; Fiber Optic-Based Communication Network; Microwave Communication Network; Tetra Network2) by Component: Solutions; Services

3) by Technology: Cellular Network; VoIP; Unified Communications; M2M; Microwave Communication; WiMAX; VSAT; TETRA; Fiber Optics; WAN; LAN

4) by Field Site: Onshore; Offshore

Subsegments:

1) by Cellular Communication Network: 3G Networks; 4G or LTE Networks; 5G Networks2) by VSAT Communication Network: Ku-Band VSAT; Ka-Band VSAT; C-Band VSAT

3) by Fiber Optic-Based Communication Network: Onshore Fiber Optic Networks; Offshore Fiber Optic Networks; Hybrid Fiber Optic Networks

4) by Microwave Communication Network: Point-To-Point Microwave Links; Point-To-Multipoint Microwave Systems; Millimeter Wave Communication

5) by Tetra Network: Tetra Voice Communication; Tetra Data Communication; Tetra Radio Systems

Key Companies Mentioned: Huawei Technologies Co. Ltd; Siemens AG; Speedcast International Limited; ABB Ltd; Commscope Inc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Oilfield Communications market report include:- Huawei Technologies Co. Ltd

- Siemens AG

- Speedcast International Limited

- ABB Ltd

- Commscope Inc

- Inmarsat Plc

- Tait Communications

- Baker Hughes Incorporated

- Rad Data Communications

- Hughes Network Systems LLC

- Ceragon Networks Ltd

- RigNet Inc

- Airspan Networks

- Commtel Networks Pvt. Ltd

- GE Digital

- Mostar Oilfield Communications

- Redline Communications

- Rignet

- Hitachi ABB Power Grids

- Weatherford

- ALE International

- MR Control Systems

- RigNet Inc.

- HP Co

- SAP AG

- Oracle Corp

- Dell EMC

- International Business Machines Corporation

- Microsoft Corp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.94 Billion |

| Forecasted Market Value ( USD | $ 5.46 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |