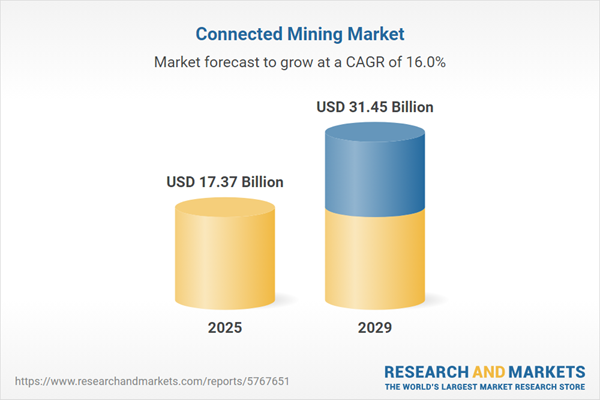

The connected mining market size is expected to see rapid growth in the next few years. It will grow to $31.45 billion in 2029 at a compound annual growth rate (CAGR) of 16%. The growth in the forecast period can be attributed to increased focus on sustainability and ESG practices, rising energy costs and environmental concerns, growing demand for minerals and metals, need for improved safety and productivity, rising energy costs and environmental concerns. Major trends in the forecast period include digital twin technology in mining operations, edge computing for real-time data processing, robotics and automation in mining processes, blockchain for transparent and secure transactions, cloud-based platforms for collaborative mining operations.

Increasing demand for digitalization is expected to propel the growth of the connected mining market going forward. Digitalization is the transition to a digital business that involves the use of digital technologies to alter a business model and offer new revenue and value-producing opportunities. Digitalization in connected mining involves the usage of advanced technology such as mixed reality, automation, IoT-driven temperature sensors, and others. For instance, in May 2022, according to the International Business Machines Corporation (IBM), a US-based technology company, 35% of businesses worldwide used artificial intelligence (AI) in 2022, which is an increase of 4% from 2021. In addition, there was a 13% increase in organizations adopting artificial intelligence (AI) in 2022 compared to 2021. Therefore, the increasing demand for digitalization is driving the connected mining market growth.

The increasing demand for metals and minerals is expected to drive the growth of the connected mining market. Metals and minerals, including both metallic elements and non-metallic substances, are essential for various industrial applications such as manufacturing, construction, and energy production. Connected mining enables real-time monitoring of equipment, mineral extraction processes, and operational conditions, leading to improved decision-making, predictive maintenance, and optimized resource utilization in mining operations. For example, in July 2023, the International Energy Agency reported strong growth in demand for critical minerals, with lithium demand rising by 30%, and demand for nickel, cobalt, graphite, and rare earth elements increasing by 8% to 15%. Additionally, China's overseas mining investments, particularly in battery metals like lithium and cobalt, reached a record $10 billion in the first half of 2023, continuing a decade-long growth trend. Consequently, the rising demand for metals and minerals is propelling the expansion of the connected mining market.

Leading companies in the connected mining market are focusing on advancing digital technologies, such as IoT and data analytics, to improve operational efficiency, safety, and sustainability. One example is ABB Care for Hoisting, a proactive maintenance service by ABB aimed at optimizing the performance and availability of mining hoisting systems while reducing downtime through advanced digital solutions. In September 2024, ABB Ltd., a Switzerland-based automation company, introduced a new suite of service offerings: ABB Care for Mining Automation and ABB Care for Hoisting. These services are designed to shift mining operations from traditional reactive maintenance to proactive solutions, improving productivity and operational health while minimizing downtime. ABB’s Care framework provides preventive services to ensure smooth and efficient operations in mining.

Major companies operating in the market are developing an innovative solution such as SmartFloat Reagent Optimization System to gain a competitive advantage and expand their customer base. SmartFloat reagent optimization system is a solution designed specifically for base metal flotation in mining operations. For instance, In October 2022, Solvay, a Belgium based chemical company, unveiled 'SmartFloat', a pioneering AI-driven reagent optimization system for the mining industry, revolutionizing base metal flotation by enhancing operational efficiency, metallurgical outcomes, and sustainability. Similar to SolvExtract's impact on solvent extraction, SmartFloat offers an additional means for flotation operations to incorporate enhancements. Leveraging Solvay’s Flotation Matrix 100 strategy, SmartFloat utilizes real-time flotation data to suggest optimal reagent formulations and dosages, considering ore characteristics and operational factors. This allows operators to promptly adapt to ore composition changes, minimizing metal loss, conserving energy, and cutting reagent expenses. Additionally, the system can be customized to meet individual customer process requirements.

In January 2022, Hexagon AB, a Sweden-based information technology company, acquired Minnovare for an undisclosed amount. With the acquisition, Hexagon will provide innovative technologies to improve the accuracy, cost, and speed of underground drilling. The acquisition strengthens Hexagon’s formidable drill and blast portfolio while also accelerating and enhancing its underground development roadmap. Minnovare is an Australia-based mining technology company that offers drilling technology services.

Major companies operating in the connected mining market include ABB Ltd., International Business Machines Corporation (IBM), SAP SE, Cisco Systems Inc., Schneider Electric SE, Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery Co. Ltd., Hexagon AB, Sandvik AB, Epiroc AB, Wenco International Mining Systems Ltd., MineWare Pty Ltd., RPMGlobal Holdings Limited, Siemens AG, Rockwell Automation Inc., Trimble Inc., OSIsoft LLC, Maptek Pty Ltd., Dassault Systèmes SE, IntelliSense. io Ltd., Motion Metrics International Corp., MST Global Pty Ltd., Fluidmesh Networks LLC, Swift Navigation Inc., MineSense Technologies Ltd., Micromine Pty Ltd.

Connected mining refers to a process that uses variously integrated and, indeed, connected mining solutions to manage industrial mining operations more efficiently. Connected mine is a multi-value solution that makes use of mobile, tracking, analytics, and cloud technology.

The main types of connected mining market components are solutions and services. Solutions are used in plant and mine operations, industrial safety and security, mobile fleet operations, and workforce enabled. A solution is an offering that uses a product that is customized for each client to address a particular or common issue. The services are professional and managed. The various solutions are asset tracking and optimization, industrial safety and security, analytics and reporting, process control, operational performance, and quality optimization solutions. The various automated types of equipment are driller and breaker, load haul dump, mining excavator, and robotic truck. The various end users are engineering and maintenance, consulting services, production training service, and implementation and integration service.

The connected mining market research report is one of a series of new reports that provides connected mining market statistics, including connected mining industry global market size, regional shares, competitors with a connected mining market share, detailed connected mining market segments, market trends and opportunities, and any further data you may need to thrive in the connected mining industry. This connected mining market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

North America was the largest region in the connected mining market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the connected mining market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the connected mining market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

The connected mining market consists of revenues earned by entities by providing connected mining for surface and underground mining enabling companies to gather data to gain complete visibility of their operations and to make wise business decisions that help to enhance mining operations. The market value includes the value of related goods sold by the service provider or included within the service offering. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Connected Mining Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on connected mining market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for connected mining ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The connected mining market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Solution; Services2) By Mining Type: Surface; Underground

3) By Deployment Mode: On-premises; Cloud

4) By Application: Exploration; Processing and Refining; Transportation

Subsegments:

1) By Solution: Asset Tracking And Optimization; Industrial Safety And Security; Analytics And Reporting; Process Control; Operational Performance; Quality Optimization Solutions2) By Services: Professional Services; Managed Services

Key Companies Mentioned: ABB Ltd.; International Business Machines Corporation (IBM); SAP SE; Cisco Systems Inc.; Schneider Electric SE

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- ABB Ltd.

- International Business Machines Corporation (IBM)

- SAP SE

- Cisco Systems Inc.

- Schneider Electric SE

- Caterpillar Inc.

- Komatsu Ltd.

- Hitachi Construction Machinery Co. Ltd.

- Hexagon AB

- Sandvik AB

- Epiroc AB

- Wenco International Mining Systems Ltd.

- MineWare Pty Ltd.

- RPMGlobal Holdings Limited

- Siemens AG

- Rockwell Automation Inc.

- Trimble Inc.

- OSIsoft LLC

- Maptek Pty Ltd.

- Dassault Systèmes SE

- IntelliSense. io Ltd.

- Motion Metrics International Corp.

- MST Global Pty Ltd.

- Fluidmesh Networks LLC

- Swift Navigation Inc.

- MineSense Technologies Ltd.

- Micromine Pty Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 17.37 Billion |

| Forecasted Market Value ( USD | $ 31.45 Billion |

| Compound Annual Growth Rate | 16.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |