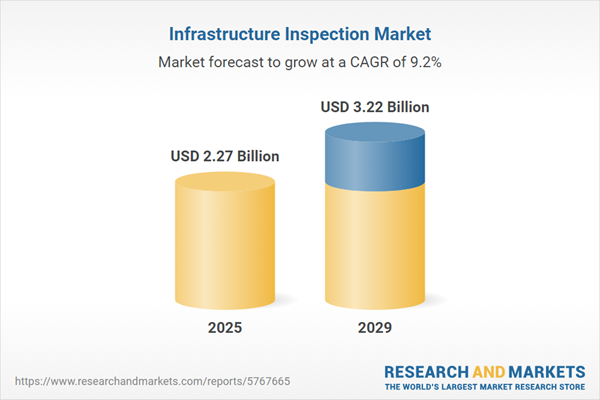

The infrastructure inspection market size is expected to see strong growth in the next few years. It will grow to $3.22 billion in 2029 at a compound annual growth rate (CAGR) of 9.2%. The growth in the forecast period can be attributed to remote inspection solutions, increased emphasis on sustainability, focus on cybersecurity, predictive maintenance solutions. Major trends in the forecast period include drone technology advancements, technological advancements, enhanced safety measures, automation for efficiency.

The infrastructure inspection market size is expected to see strong growth in the next few years. It will grow to $2.93 billion in 2028 at a compound annual growth rate (CAGR) of 7.5%. The projected growth in the forecast period can be attributed to the adoption of remote inspection solutions, a heightened focus on sustainability, an increased emphasis on cybersecurity, and the implementation of predictive maintenance solutions. Major trends in this period include advancements in drone technology, overall technological progress, the implementation of enhanced safety measures, and the adoption of automation for improved efficiency.

The surge in capital investments for structural health monitoring (SHM) is expected to propel the growth of the infrastructure inspection market. SHM systems are essential for monitoring the structural integrity of aging infrastructure, such as bridges, highways, buildings, dams, and tunnels, to ensure public safety. For instance, in March 2022, the US government allocated a budget of $12 million to the Engineer Research and Development Centre (ERDC) for the advancement of SHM technologies, indicating significant investment in this sector. This surge in capital investments is driving the growth of the infrastructure inspection market.

A global transition to renewable energy is expected to drive growth in the infrastructure inspection market. Renewable energy encompasses energy sources that are naturally replenished, including sunlight, wind, rain, tides, waves, and geothermal heat. Infrastructure inspection involves evaluating and maintaining the condition of renewable energy facilities, such as wind turbines and solar farms, to ensure optimal performance and longevity. For example, in July 2023, a report from the International Energy Agency, an autonomous intergovernmental organization based in France, indicated that the production of renewable energy from solar, wind, hydropower, geothermal, and ocean sources increased by over 8% in 2022. Consequently, the global shift toward renewable energy is significantly driving the infrastructure inspection market.

The infrastructure inspection market is witnessing a significant trend centered on technological advancement, with major companies focusing on innovative solutions to fortify their position. An exemplar in this space is Toshiba, a Japan-based company entrenched in infrastructure inspection. In May 2022, Toshiba unveiled its cutting-edge Infrastructure Inspection AI, a groundbreaking technology adept at detecting anomalies with unparalleled accuracy, drawing from a limited set of reference images. Diverging from conventional AI models that necessitate real-world training, this innovation leverages pre-trained deep learning models to compare inspection shots against reference images. What sets this AI apart is its capacity to detect anomalies with remarkable precision, even when inspection photos are captured from varying perspectives than those in the reference images, courtesy of Toshiba's proprietary rectification technology. Furthermore, this innovation significantly reduces false positives, discerning abnormal patterns accurately within the realm of normalcy.

Major players in the infrastructure inspection market are actively pursuing strategic collaborations to ensure reliable services for their customers. Strategic collaboration involves mutually beneficial partnerships between independent entities working together to achieve shared goals aligned with their respective strategic objectives. For instance, in July 2023, Infotech, a US-based provider of e-construction solutions, forged a partnership with Seiler Geospatial, a US-based company specializing in optical instrument design, manufacturing, and service. Their collaboration aims to advance civil infrastructure projects by leveraging digitalization. Through the synergy of their expertise and technology, this collaboration facilitates more efficient, precise, and cost-effective inspections, ultimately contributing to higher-quality infrastructure projects.

In July 2022, DroneBase, a US-based leader in intelligent imaging, acquired the UK-based company Inspection2 for an undisclosed amount. This strategic acquisition is aimed at expanding DroneBase's AI-enabled inspection capabilities across the telecom and transmission and distribution sectors. By incorporating Inspection2 into its operations, DroneBase aims to offer a comprehensive solution for owners, operators, and investors in renewable energy infrastructure and systems. Inspection2 is known for its expertise in infrastructure inspection.

Major companies operating in the infrastructure inspection market include Jacobs Engineering Group Inc., AES Engineering Ltd., Bureau Veritas, Xylem Inc., FLIR Systems Inc., Eddyfi Technologies, Honeybee Robotics, Golder Associates Ltd., ERM Group, MISTRAS Group, Parrot Drone SAS, Lockheed Martin Corporation, Geokon Inc., Northrop Grumman Corporation, Campbell Scientific Inc., Geocomp Corporation, AVT Reliability Ltd., DJI Technology Co. Ltd., Pure Technologies Ltd Company, RAE Systems by Honeywell, Sisgeo S.r.l., Structural Monitoring Systems plc, Acellent Technologies Inc.

Infrastructure inspection involves collecting and analyzing data about essential infrastructure such as bridges, pipelines, and power grids to assess their condition and safety.

The main methods used for infrastructure inspection are drones, unmanned aerial vehicles (UAVs), crawlers, and submersibles. Crawlers are programs that visit websites to read their pages and other information to create entries for a search engine index. These operations can be autonomous or semi-autonomous. The applications of infrastructure inspection include pipes, tanks, and vessels, sewers, roads and bridges, underwater inspection, wind turbines, nuclear applications, and auxiliary structures. The end-users of infrastructure inspection services include building and construction, oil and gas, power generation, chemicals, petrochemicals, municipal, and general purposes.

The infrastructure inspection market size has grown strongly in recent years. It will grow from $2.05 billion in 2023 to $2.19 billion in 2024 at a compound annual growth rate (CAGR) of 7.1%. The growth in the historic period can be attributed to aging infrastructure, regulatory compliance, cost reduction and efficiency, data analytics and reporting, environmental concerns.

North America was the largest region in the infrastructure inspection market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the infrastructure inspection market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the infrastructure inspection market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The infrastructure inspection market consists of revenues earned by entities by providing infrastructure inspection that are used in pipes, sewers and wind turbines. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Infrastructure Inspection Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on infrastructure inspection market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for infrastructure inspection? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The infrastructure inspection market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Drones or Unmanned Aerial Vehicles (UAVs); Crawlers; Submersibles2) By Operation: Autonomous; Semi-Autonomous

3) By Application: Pipes; Tanks and Vessels; Sewers; Roads and Bridges; Underwater Inspection; Wind Turbines; Nuclear Applications; Auxiliary Structures

4) By End-Use: Building and Construction; Oil and Gas; Power Generation; Chemical; Petrochemical; Municipal; General Purpose

Subsegments:

1) By Drones or Unmanned Aerial Vehicles (UAVs): Fixed-Wing Drones; Rotary-Wing Drones (Quadcopters); Hybrid Drones; Drone Mapping and Surveying Equipment2) By Crawlers: Tracked Crawlers; Wheeled Crawlers; Remote-Controlled Crawlers; Crawler Inspection Robots

3) By Submersibles: Remotely Operated Vehicles (ROVs); Autonomous Underwater Vehicles (AUVs); Inspection-Class Submersibles; Heavy-Duty Submersibles

Key Companies Mentioned: Jacobs Engineering Group Inc.; AES Engineering Ltd.; Bureau Veritas; Xylem Inc.; FLIR Systems Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Jacobs Engineering Group Inc.

- AES Engineering Ltd.

- Bureau Veritas

- Xylem Inc.

- FLIR Systems Inc.

- Eddyfi Technologies

- Honeybee Robotics

- Golder Associates Ltd.

- ERM Group

- MISTRAS Group

- Parrot Drone SAS

- Lockheed Martin Corporation

- Geokon Inc.

- Northrop Grumman Corporation

- Campbell Scientific Inc.

- Geocomp Corporation

- AVT Reliability Ltd.

- DJI Technology Co. Ltd.

- Pure Technologies Ltd Company

- RAE Systems by Honeywell

- Sisgeo S.r.l.

- Structural Monitoring Systems plc

- Acellent Technologies Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.27 Billion |

| Forecasted Market Value ( USD | $ 3.22 Billion |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |