The COVID-19 pandemic brought a sharp focus on the need for healthcare reforms that promote universal access to affordable care. The rise in demand for health insurance was due to the increased awareness about health insurance policies and how it can cut down the overall burden to pay huge amounts of bills on healthcare services led to increased adoption post the covid-19 outbreak.

In addition, the COVID-19 pandemic has also led to a rise in the prevalence of mental illnesses.Isolation, fears of contracting the virus, and economic uncertainty have contributed to a growing mental health crisis. For instance, according to WHO, in the first year of the pandemic, the global prevalence of anxiety and depression increased by a massive 25%, Thus, this has highlighted the need to focus on mental health. Therefore, insurers are now focusing on developing products that can also cover mental illnesses representing lucrative growth opportunities for the U.S. family floater health insurance market.

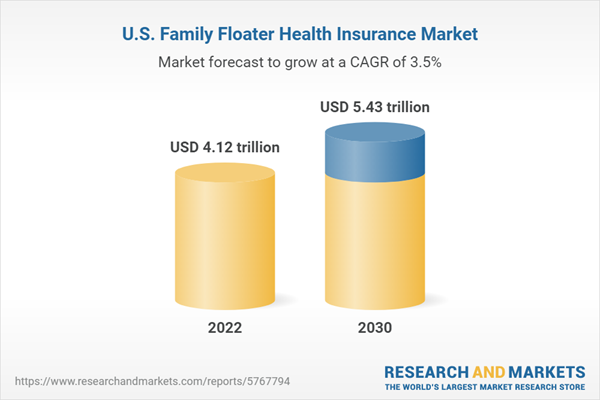

U.S. Family Floater Health Insurance Market Report Highlights

- The private segment dominated the market with the largest revenue share in 2022 owing to a large number of people opting for private health insurance to avail better healthcare facilities and services

- Married couple family segment accounted for the highest revenue share in 2022 owing to the presence of a large number of married couples opting for family health insurance in the country

- Unmarried female reference person segment is expected to witness maximum growth over the forecast period owing to the rising number of single mothers in the country

- At or above 400 percent of poverty segment held the highest share as affordability plays an important role in purchasing health insurance

- South U.S. region dominated the market due to the widespread presence of insured population in the region

Table of Contents

Chapter 1. Methodology and Scope1.1. Market Segmentation & Scope

1.1.1. Type

1.1.2. Household Relations

1.1.3. Income-to-Poverty Ratio

1.1.4. Regional scope

1.1.5. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.3.5.1. Data for primary interviews in the U.S.

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Premium price

1.6.2. Country-wise market estimation using a bottom-up approach

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

1.9.1. Objective 1

1.9.2. Objective 2

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Type Outlook

2.2.2. Household Relations Outlook

2.2.3. Income-to-Poverty Ratio Outlook

2.2.4. Regional Outlook

2.3. Competitive Insights

Chapter 3. U.S. Family Floater Health Insurance Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Reimbursement framework

3.4. Market Dynamics

3.4.1. Market driver analysis

3.4.1.1. Increasing prevalence of chronic diseases

3.4.1.2. Growing awareness regarding health insurance

3.4.1.3. Rising healthcare costs

3.4.2. Market restraint analysis

3.4.2.1. Limitation on different family floater policies

3.5. U.S. Family Floater Health Insurance Market Analysis Tools

3.5.1. Industry Analysis - Porter’s

3.5.1.1. Supplier power

3.5.1.2. Buyer power

3.5.1.3. Substitution threat

3.5.1.4. Threat of new entrant

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Technological landscape

3.5.2.3. Economic landscape

3.5.3. Major Deals & Strategic Alliances Analysis

3.5.4. Market Entry Strategies

Chapter 4. U.S. Family Floater Health Insurance: Type Estimates & Trend Analysis

4.1. Definitions and Scope

4.1.1. Public

4.1.2. Private

4.2. Type Market Share, 2022 & 2030

4.3. Segment Dashboard

4.4. U.S. U.S. Family Floater Health Insurance Market by Type Outlook

4.5. Market Type & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.5.1. Public

4.5.1.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

4.5.2. Private

4.5.2.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

Chapter 5. U.S. Family Floater Health Insurance: Household Relations Estimates & Trend Analysis

5.1. Definitions and Scope

5.1.1. Married Couple Family

5.1.2. Unmarried Male Reference Person

5.1.3. Unmarried Female Reference Person

5.1.4. Unrelated Subfamilies

5.1.5. Secondary Individuals

5.2. Household Relations Market Share, 2022 & 2030

5.3. Segment Dashboard

5.4. U.S. Family Floater Health Insurance Market by Household Relations Outlook

5.5. Market Type & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.5.1. Married Couple Family

5.5.1.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

5.5.2. Unmarried Male Reference Person

5.5.2.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

5.5.3. Unmarried Female Reference Person

5.5.3.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

5.5.4. Unrelated Subfamilies

5.5.4.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

5.5.5. Secondary Individuals

5.5.5.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

Chapter 6. U.S. Family Floater Health Insurance: Income-to-Poverty Ratio Estimates & Trend Analysis

6.1. Definitions and Scope

6.1.1. Below 100 percent of poverty

6.1.2. Between 100 and 199 percent of poverty

6.1.3. Between 200 and 299 percent of poverty

6.1.4. Between 300 and 399 percent of poverty

6.1.5. At or above 400 percent of poverty

6.2. Sales Channel Market Share, 2022 & 2030

6.3. Segment Dashboard

6.4. U.S. U.S. Family Floater Health Insurance Market by Sales Channel Outlook

6.5. Market Type & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.5.1. Below 100 percent of poverty

6.5.1.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

6.5.2. Between 100 and 199 percent of poverty

6.5.2.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

6.5.3. Between 200 and 299 percent of poverty

6.5.3.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

6.5.4. Between 300 and 399 percent of poverty

6.5.4.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

6.5.5. At or above 400 percent of poverty

6.5.5.1. Market estimates and forecast, 2018 - 2030 (Revenue in USD Billion)

Chapter 7. U.S. Family Floater Health Insurance Market: Regional Estimates & Trend Analysis

7.1. Regional market share analysis, 2022 & 2030

7.2. Regional Market Dashboard

7.3. U.S. Regional Market Snapshot

7.4. Regional Market Share and Leading Players, 2022

7.4.1. U.S.

7.5. Market Service, & Forecasts and Trend Analysis, 2018 to 2030:

7.6. U.S.

7.6.1. Northeast

7.6.1.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Billion)

7.6.1.2. Connecticut

7.6.1.2.1. Connecticut Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.1.3. Massachusetts

7.6.1.3.1. Massachusetts Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.1.4. Pennsylvania

7.6.1.4.1. Pennsylvania Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.1.5. New Jersey

7.6.1.5.1. New Jersey Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.1.6. New York

7.6.1.6.1. New York Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.1.7. Others (Maine, New Hampshire, Rhode Island, Vermont)

7.6.1.7.1. Others Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.2. Midwest

7.6.2.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Billion)

7.6.2.2. Illinois

7.6.2.2.1. Illinois Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.2.3. Indiana

7.6.2.3.1. Indiana Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.2.4. Michigan

7.6.2.4.1. Michigan Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.2.5. Ohio

7.6.2.5.1. Ohio Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.2.6. Wisconsin

7.6.2.6.1. Wisconsin Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.2.7. Iowa

7.6.2.7.1. lowa Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.2.8. Minnesota

7.6.2.8.1. Minnesota Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.2.9. Missouri

7.6.2.9.1. Missouri Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.2.10. Others (Kansas, Nebraska, North Dakota, South Dakota)

7.6.2.10.1. Others Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.3. South

7.6.3.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Billion)

7.6.3.2. Florida

7.6.3.2.1. Florida Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.3.3. Georgia

7.6.3.3.1. Georgia Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.3.4. Maryland

7.6.3.4.1. Maryland Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.3.5. North Carolina

7.6.3.5.1. North Carolina Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.3.6. South Carolina

7.6.3.6.1. South Carolina Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.3.7. Virginia

7.6.3.7.1. Virginia Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.3.8. Alabama

7.6.3.8.1. Alabama Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.3.9. Kentucky

7.6.3.9.1. Kentucky Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.3.10. Tennessee

7.6.3.10.1. Tennessee Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.3.11. Louisiana

7.6.3.11.1. Louisiana Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.3.12. Texas

7.6.3.12.1. Texas Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.3.13. Others (Delaware, West Virginia, Mississippi, Arkansas, Oklahoma)

7.6.3.13.1. Others Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.4. West

7.6.4.1. Market estimates and forecast, 2018 - 2030 (Revenue, USD Billion)

7.6.4.2. Arizona

7.6.4.2.1. Arizona Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.4.3. Colorado

7.6.4.3.1. Colorado Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.4.4. Nevada

7.6.4.4.1. Nevada Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.4.5. California

7.6.4.5.1. California Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.4.6. Oregon

7.6.4.6.1. Oregon Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.4.7. Washington

7.6.4.7.1. Washington Market estimates and forecast, by product, 2018 - 2030 (Billion)

7.6.4.8. Others (Idaho, Montana, New Mexico, Utah, Wyoming, Alaska, Hawaii)

7.6.4.8.1. Others Market estimates and forecast, by product, 2018 - 2030 (Billion)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company/Competition Categorization

8.2.1. Innovators

8.2.2. Market Leaders

8.2.3. Emerging Players

8.3. Vendor Landscape

8.3.1. List of key distributors and channel partners

8.3.2. Key customers

8.3.3. Key company market share analysis, 2022

8.3.4. Cigna

8.3.4.1. Company overview

8.3.4.2. Financial performance

8.3.4.3. Product benchmarking

8.3.4.4. Strategic initiatives

8.3.5. Bupa

8.3.5.1. Company overview

8.3.5.2. Financial performance

8.3.5.3. Product benchmarking

8.3.5.4. Strategic initiatives

8.3.6. Now Health International

8.3.6.1. Company overview

8.3.6.2. Financial performance

8.3.6.3. Product benchmarking

8.3.6.4. Strategic initiatives

8.3.7. Blue Cross Blue Shield Association

8.3.7.1. Company overview

8.3.7.2. Financial performance

8.3.7.3. Product benchmarking

8.3.7.4. Strategic initiatives

8.3.8. Anthem, Inc. (Now Elevance Health)

8.3.8.1. Company overview

8.3.8.2. Financial performance

8.3.8.3. Product benchmarking

8.3.8.4. Strategic initiatives

8.3.9. The IHC Group

8.3.9.1. Company overview

8.3.9.2. Financial performance

8.3.9.3. Product benchmarking

8.3.9.4. Strategic initiatives

8.3.10. Health Partners Group Ltd

8.3.10.1. Company overview

8.3.10.2. Financial performance

8.3.10.3. Product benchmarking

8.3.10.4. Strategic initiatives

8.3.11. Aviva

8.3.11.1. Company overview

8.3.11.2. Financial performance

8.3.11.3. Product benchmarking

8.3.11.4. Strategic initiatives

8.3.12. Providence Health Plan

8.3.12.1. Company overview

8.3.12.2. Financial performance

8.3.12.3. Product benchmarking

8.3.12.4. Strategic initiatives

8.3.13. Harvard Pilgrim Health Care, Inc.

8.3.13.1. Company overview

8.3.13.2. Financial performance

8.3.13.3. Product benchmarking

8.3.13.4. Strategic initiatives

List of Tables

Table 1 List of Abbreviations

Table 2 U.S. family floater health insurance market, by region, 2018 - 2030 (USD Billion)

Table 3 U.S. family floater health insurance market, by type, 2018 - 2030 (USD Billion)

Table 4 U.S. family floater health insurance market, by household relations, 2018 - 2030 (USD Billion)

Table 5 U.S. family floater health insurance market, by income-to-poverty ratio, 2018 - 2030 (USD Billion)

Table 6 Northeast family floater health insurance market, by type, 2018 - 2030 (USD Billion)

Table 7 Northeast family floater health insurance market, by household relations, 2018 - 2030 (USD Billion)

Table 8 Northeast family floater health insurance market, by income-to-poverty ratio, 2018 - 2030 (USD Billion)

Table 9 Midwest family floater health insurance market, by type, 2018 - 2030 (USD Billion)

Table 10 Midwest family floater health insurance market, by household relations, 2018 - 2030 (USD Billion)

Table 11 Midwest family floater health insurance market, by income-to-poverty ratio, 2018 - 2030 (USD Billion)

Table 12 South family floater health insurance market, by type, 2018 - 2030 (USD Billion)

Table 13 South family floater health insurance market, by household relations, 2018 - 2030 (USD Billion)

Table 14 South family floater health insurance market, by income-to-poverty ratio, 2018 - 2030 (USD Billion)

Table 15 West family floater health insurance market, by type, 2018 - 2030 (USD Billion)

Table 16 West family floater health insurance market, by household relations, 2018 - 2030 (USD Billion)

Table 17 West family floater health insurance market, by income-to-poverty ratio, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews in U.S.

Fig. 5 Market research approaches

Fig. 6 Value-chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 U.S. family floater health insurance: market outlook

Fig. 10 U.S. family floater health insurance market competitive insights

Fig. 11 Parent market outlook

Fig. 12 Related/ancillary market outlook

Fig. 13 Penetration and growth prospect mapping

Fig. 14 Industry value chain analysis

Fig. 15 U.S. family floater health insurance market driver impact

Fig. 16 U.S. family floater health insurance market restraint impact

Fig. 17 U.S. family floater health insurance market strategic initiatives analysis

Fig. 18 U.S. family floater health insurance market: type movement analysis

Fig. 19 U.S. family floater health insurance market: type outlook and key takeaways

Fig. 20 Public estimates and forecast, 2018 - 2030

Fig. 21 Private estimates and forecast, 2018 - 2030

Fig. 22 U.S. family floater health insurance market: household relations movement analysis

Fig. 23 U.S. family floater health insurance market: household relations outlook and key takeaways

Fig. 24 Married couple family estimates and forecast, 2018 - 2030

Fig. 25 Unmarried male reference person members estimates and forecast, 2018 - 2030

Fig. 26 Unmarried female reference person estimates and forecast, 2018 - 2030

Fig. 27 Unrelated subfamilies estimates and forecast, 2018 - 2030

Fig. 28 Secondary individuals estimates and forecast, 2018 - 2030

Fig. 29 U.S. family floater health insurance market: income-to-poverty ratio movement analysis

Fig. 30 U.S. family floater health insurance market: income-to-poverty ratio outlook and key takeaways

Fig. 31 Below 100 percent of poverty estimates and forecast, 2018 - 2030

Fig. 32 Below 100 and 199 percent of poverty estimates and forecast, 2018 - 2030

Fig. 33 Below 200 and 299 percent of poverty estimates and forecast, 2018 - 2030

Fig. 34 Below 300 and 399 percent of poverty estimates and forecast, 2018 - 2030

Fig. 35 At or above 400 percent of poverty estimates and forecast, 2018 - 2030

Fig. 36 U.S. family floater health insurance market: Regional movement analysis

Fig. 37 U.S. family floater health insurance market: regional outlook and key takeaways

Fig. 38 U.S. market share and leading players

Fig. 39 U.S. SWOT

Fig. 40 U.S.

Fig. 41 U.S. market estimates and forecast, 2018 - 2030

Fig. 42 Northeast

Fig. 43 Northeast market estimates and forecast, 2018 - 2030

Fig. 44 Midwest

Fig. 45 Midwest market estimates and forecast, 2018 - 2030

Fig. 46 South

Fig. 47 South market estimates and forecast, 2018 - 2030

Fig. 48 West

Fig. 49 West market estimates and forecast, 2018 - 2030

Fig. 50 Participant categorization- U.S. family floater health insurance market

Fig. 51 Market share of key market players- U.S. family floater health insurance market

Companies Mentioned

- Cigna

- Bupa

- Now Health International

- Blue Cross Blue Shield Association

- Anthem, Inc. (Now Elevance Health)

- The IHC Group

- Health Partners Group Ltd

- Aviva

- Providence Health Plan

- Harvard Pilgrim Health Care, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | March 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 4.12 trillion |

| Forecasted Market Value ( USD | $ 5.43 trillion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |