Several packaged food companies, including Nestlé, are adding plant-based ingredients to their products owing to the rising demand for clean-label products. In addition, food & beverage companies are increasingly participating in Protein Challenge 2040, an initiative started by Forum for the Future, which brings together a group of companies and civil society organizations to promote a more balanced approach to how protein is derived. Such initiatives are likely to increase the use of plant-based protein ingredients by food companies in the coming years.

In addition, the current method of producing protein through livestock has an adverse impact on the environment. The growing demand for protein increases livestock production, resulting in a significant rise in greenhouse gas emissions. As a result, there is a growing emphasis on finding alternative protein sources to reduce greenhouse gas emissions and promote sustainability. This trend is anticipated to fuel market growth in the foreseeable future.

Furthermore, in November 2020, Sweden-based IKEA announced that 50% of its restaurant meals and 80% of its packaged food would be plant-based by 2025. Nestlé’s sales of plant-based foods witnessed a 40% increase in the first half of 2020. In addition, in September 2020, Nestlé improved its flagship plant-based ‘Garden Gourmet Sensational Burger’ which is meatier in taste and texture. The growing demand for plant-based foods is mainly attributed to the growing popularity of alternative and clean sources of protein amid the pandemic.

Asia Pacific is anticipated to grow at a substantial CAGR from 2022-2030 due to an increase in the consumption of healthy food products. The demand for healthy and functional foods in India has been on the rise, driven by increased health awareness among consumers and an expanding food & beverage industry. Pea derivatives, which are rich in protein and fiber, are gaining popularity as key ingredient in various food and beverage products. This trend is expected to continue over the next few years, thus boosting the growth of the market. Additionally, the increasing purchasing power of consumers in India is likely to contribute to the growth of the pea derivatives market in the country.

The popularity of meat alternatives is significantly increasing in India with a steady rise in the vegan population due to environmental and health concerns. The entry of meat alternative companies, including Ahimsa Food, The Vegan Eatery, Vegeta Gold, Imagine Meats, and Vezlay in recent years, validates the growing popularity and shifting consumer trends. The growing awareness of the health benefits of plant-based proteins is likely to provide lucrative opportunities for pea protein companies in the coming years.

Pea Derivatives Market Report Highlights

- Pea protein held the largest market share in 2021 owing to its wide application usage in the sports supplement industry

- Meat substitute emerged as the largest application segment with the highest revenue share in 2021 owing to rising demand for plant-based ingredients among consumers

- Bakery goods in the application segment are expected to expand at a significant CAGR from 2022-2030. The growth can be attributed to rising consumer demand for gluten-free based baked goods

- Asia Pacific is estimated to grow significantly over the forecast period owing to the growing demand for plant-based foods in the region

Table of Contents

Chapter 1 Methodology and Scope1.1 Market Segmentation & Scope

1.2 Research Methodology

1.3 Assumptions

1.4 Information Procurement

1.4.1 Purchased Database

1.4.2 Internal Database

1.4.3 Secondary Sources

1.4.4 Third Party Perspective

1.4.5 Primary Research

1.5 Information Analysis

1.5.1 Data Analysis Models

1.6 Market Formulation And Data Visualization

1.7 List Of Sources

Chapter 2 Executive Summary

2.1 Market Insights

2.2 Segmental Insights

2.3 Competitive Insights

Chapter 3 Pea Derivatives Market Variables And Trends

3.1 Market Lineage Outlook

3.2 Industry Value Chain Analysis

3.2.1 Raw Material Outlook

3.2.2 Manufacturing & Technology Trends

3.3 Price Trend Analysis, 2017 - 2030

3.4 Market Dynamics

3.4.1 Market Driver Impact Analysis

3.4.1.1 Increasing Preference For Plant-Based Protein

3.4.1.2 Expansion Of The Nutraceuticals Industry

3.4.2 Market Restraint Impact Analysis

3.4.2.1 Fluctuating Prices Of Peas

3.4.3 Industry Challenges

3.4.4 Industry Opportunities

3.5 Industry Analysis Tools

3.5.1 Porter’s Analysis

3.5.2 Macroeconomic Analysis

3.6 Impact of COVID-19 Pandemic

3.7 Impact of European Geopolitical Conflict

Chapter 4 Pea Derivatives Market: Type Estimates & Trend Analysis

4.1 Type Movement Analysis & Market Share, 2022 & 2030

4.2 Pea Derivatives Market Estimates & Forecast, By Type (Kilo Tons) (USD Million)

4.3 Pea Protein

4.4 Pea Starch

4.5 Pea Fiber

4.6 Others

Chapter 5 Pea Protein Market: Type Estimates & Trend Analysis

5.1 Type Movement Analysis & Market Share, 2022 & 2030

5.2 Isolates

5.3 Concentrates

5.4 Textured

5.5 Hydrolysate

Chapter 6 Pea Derivatives Market: Application Estimates & Trend Analysis

6.1 Application Movement Analysis & Market Share, 2022 & 2030

6.1.1 Meat Substitutes

6.1.2 Bakery Goods

6.1.3 Dietary Supplements

6.1.4 Beverage

6.1.5 Others

Chapter 7 Pea Derivatives Market: Regional Estimates & Trend Analysis

7.1 North America Pea Derivatives Market: Regional Outlook

7.2 North America

7.2.1 North America Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons) (USD Million)

7.2.2 U.S.

7.2.2.1 U.S. Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons) (USD Million)

7.2.3 Canada

7.2.3.1 Canada Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons) (USD Million)

7.2.4 Mexico

7.2.4.1 Mexico Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons) (USD Million)

7.3 Europe

7.3.1 Europe Pea Derivatives Market: Regional Outlook

7.3.2 Europe Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons) (USD Million)

7.3.3 Germany

7.3.3.1 Germany Pea Derivatives Market Estimates And Forecast, 2017 - 2030 (Kilo Tons)

7.3.3.2 Germany Pea Derivatives Market Estimates And Forecast, 2017 - 2030 (USD Million)

7.3.4 France

7.3.4.1 France Pea Derivatives Market Estimates And Forecast, 2017 - 2030 (Kilo Tons)

7.3.4.2 France Pea Derivatives Market Estimates And Forecast, 2017 - 2030 (Us D Million)

7.3.5 Italy

7.3.5.1 Italy Pea Derivatives Market Estimates And Forecast, 2017 - 2030 (Kilo Tons)

7.3.5.2 Italy Pea Derivatives Market Estimates And Forecast, 2017 - 2030 (USD Million)

7.3.6 U.K.

7.3.6.1 U.K. Pea Derivatives Market Estimates And Forecast, 2017 - 2030 (Kilo Tons)

7.3.6.2 U.K. Pea Derivatives Market Estimates And Forecast, 2017 - 2030 (USD Million)

7.4 Asia Pacific

7.4.1 Asia Pacific Pea Derivatives Market: Regional Outlook

7.4.1 Asia Pacific Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons) (USD Million)

7.4.2 China

7.4.2.1 China Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons) (USD Million)

7.4.3 Japan

7.4.3.1 Japan Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons) (USD Million)

7.4.4 India

7.4.4.1 India Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons) (USD Million)

7.4.5 Australia

7.4.5.1 Australia Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons) (USD Million)

7.4.6 South Korea

7.4.6.1 South Korea Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons) (USD Million)

7.5 Central & South America

7.5.1 Central & South America Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons)

7.5.2 Brazil

7.5.2.1 Brazil Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons)

7.5.2.2 Brazil Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Million)

7.5.3 Argentina

7.5.3.1 Argentina Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons)

7.5.3.2 Argentina Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (USD Million)

7.6 Middle East & Africa

7.6.1 Middle East & Africa Pea Derivatives Market: Regional Outlook

7.6.2 Middle East & Africa Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons)

7.6.3 South Africa

7.6.3.1 South Africa Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Kilo Tons)

7.6.3.2 South Africa Pea Derivatives Market Estimates & Forecast, 2017 - 2030 (Million)

Chapter 8 Competitive Landscape

8.1 Key Players, Recent Developments, And Their Impact On The Industry

8.1.1 Key Company/Competition Categorization (Key Innovators, Market Leaders, And Emerging Players)

8.1.2 List Of Key Producers

8.2 Vendor Landscape

8.2.1 List Of Key Distributors And Channel Partners

8.2.2 Key Potential Customers Globally

8.3 Public Companies

8.3.1 Company Market Position Analysis

8.4 Private Companies

8.4.1 List Of Key Emerging Companies

8.4.2 Company Market Position Analysis

8.5 Company Profiles

8.6 Product Benchmarking

8.7 Strategic Initiatives

List of Tables

1. North America pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

2. North America pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

3. North America pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

4. North America pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

5. North America pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

6. North America pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

7. U.S. pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

8. U.S. pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

9. U.S. pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

10. U.S. pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

11. U.S. pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

12. U.S. pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

13. Canada pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

14. Canada pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

15. Canada pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

16. Canada pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

17. Canada pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

18. Canada pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

19. Mexico pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

20. Mexico pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

21. Mexico pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

22. Mexico pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

23. Mexico pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

24. Mexico pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

25. Europe pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

26. Europe pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

27. Europe pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

28. Europe pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

29. Europe pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

30. Europe pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

31. Germany pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

32. Germany pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

33. Germany pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

34. Germany pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

35. Germany pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

36. Germany pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

37. France pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

38. France pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

39. France pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

40. France pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

41. France pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

42. France pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

43. Italy pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

44. Italy pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Millions)

45. Italy pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

46. Italy pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

47. Italy pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

48. Italy pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

49. U.K. pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

50. U.K. pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

51. U.K. pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

52. U.K. pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

53. U.K. pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

54. U.K. pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

55. Asia Pacific pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

56. Asia Pacific pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

57. Asia Pacific pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

58. Asia Pacific pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

59. Asia Pacific pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

60. Asia Pacific pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

61. China pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

62. China pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

63. China pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

64. China pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

65. China pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

66. China pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

67. Japan pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

68. Japan pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

69. Japan pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

70. Japan pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

71. Japan pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

72. Japan pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

73. India pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

74. India pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

75. India pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

76. India pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

77. India pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

78. India pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

79. Australia pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

80. Australia pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

81. Australia pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

82. Australia pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

83. Australia pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

84. Australia pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

85. South Korea pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

86. South Korea pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

87. South Korea pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

88. South Korea pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

89. South Korea pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

90. South Korea pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

91. Central & South America pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

92. Central & South America pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

93. Central & South America pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

94. Central & South America pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

95. Central & South America pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

96. Central & South America pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

97. Brazil pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

98. Brazil pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

99. Brazil pea proteins market estimates and forecasts, by type, 2017 - 2030 (in kilo tons)

100. Brazil pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

101. Brazil pea derivatives market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

102. Brazil pea proteins market estimates and forecasts, by derivatives, 2017 - 2030 (in USD Million)

103. Argentina pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

104. Argentina pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

105. Argentina pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

106. Argentina pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

107. Argentina pea derivatives market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

108. Argentina pea proteins market estimates and forecasts, by derivatives, 2017 - 2030 (in USD Million)

109. Middle East & Africa pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

110. Middle East & Africa pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

111. Middle East & Africa pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

112. Middle East & Africa pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

113. Middle East & Africa pea proteins market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

114. Middle East & Africa pea proteins market estimates and forecasts, by application, 2017 - 2030 (in USD Million)

115. South Africa pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

116. South Africa pea derivatives market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

117. South Africa pea proteins market estimates and forecasts, by type, 2017 - 2030 (in Kilo Tons)

118. South Africa pea proteins market estimates and forecasts, by type, 2017 - 2030 (in USD Million)

119. South Africa pea derivatives market estimates and forecasts, by application, 2017 - 2030 (in Kilo Tons)

120. South Africa pea proteins market estimates and forecasts, by derivatives, 2017 - 2030 (in USD Million)

List of Figures

Fig. 1 Pea derivatives market segmentation & scope

Fig. 2 Information procurement

Fig. 3 Primary research pattern

Fig. 4 Primary research process

Fig. 5 Market research approaches - Bottom-Up Approach

Fig. 6 Market research approaches - Top-Down Approach

Fig. 7 Market research approaches - Combined Approach

Fig. 8 Pea Derivatives Market: Market Insights

Fig. 9 Pea Derivatives Market: Segmental Insights

Fig. 10 Pea Derivatives Market: Competitive Insights

Fig. 11 Pea Derivatives - Industry Value Chain Analysis

Fig. 12 Global Pea Derivatives Prices, 2017 - 2030 (USD/metric ton)

Fig. 13 Pea Derivatives Market Dynamics

Fig. 14 Pea Derivatives Market: Porter’s Analysis

Fig. 15 Pea Derivatives Market: PESTEL Analysis

Fig. 16 Pea Derivatives Market, by Type: Key Takeaways

Fig. 17 Pea Derivatives Market, by Type: Market Share, 2022 & 2030

Fig. 18 Pea Protein isolate market estimates & forecasts, 2017 - 2030 (Kilo Tons)

Fig. 19 Pea Protein isolate market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 20 Pea Starch market estimates & forecasts, 2017 - 2030 (Kilo Tons)

Fig. 21 Pea Starch market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 22 Pea Fiber market estimates & forecasts, 2017 - 2030 (Kilo Tons)

Fig. 23 Pea Fiber market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 24 Others market estimates & forecasts, 2017 - 2030 (Kilo Tons)

Fig. 25 Others market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 26 Pea Protein Market, by Type: Key Takeaways

Fig. 27 Pea Protein Market, by Type: Market Share, 2022 & 2030

Fig. 28 Isolates market estimates & forecasts, 2017 - 2030 (Kilo Tons)

Fig. 29 Isolates market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 30 Concentrates market estimates & forecasts, 2017 - 2030 (Kilo Tons)

Fig. 31 Concentrates market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 32 Textured market estimates & forecasts, 2017 - 2030 (Kilo Tons)

Fig. 33 Textured market estimates & forecasts, 2017 - 2030 (USD Millions)

Fig. 34 Hydrolysate market estimates & forecasts, 2017 - 2030 (Kilo Tons)

Fig. 35 Hydrolysate market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 36 Pea Derivatives Market, by Application: Key Takeaways

Fig. 37 Pea Derivatives Market, by Application: Market Share, 2022 & 2030

Fig. 38 Meat substitutes market estimates & forecasts, 2017 - 2030 (Kilo Tons)

Fig. 39 Meat substitutes market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 40 Bakery goods market estimates & forecasts, 2017 - 2030 (Kilo Tons)

Fig. 41 Bakery goods market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 42 Dietary supplements market estimates & forecasts, 2017 - 2030 (Kilo Tons)

Fig. 43 Dietary supplements market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 44 Beverage market estimates & forecasts, 2017 - 2030 (Kilo Tons)

Fig. 45 Beverage market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 46 others pea derivatives market estimates & forecasts, 2017 - 2030 (Kilo Tons)

Fig. 47 others pea derivatives market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 48 North America pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 49 North America pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 50 U.S. pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 51 U.S. pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 52 Canada pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 53 Canada pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 54 Mexico pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 55 Mexico pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 56 Europe pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 57 Europe pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 58 Germany pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 59 Germany pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 60 France pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 61 France pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 62 Italy pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 63 Italy pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 64 U.K. pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 65 U.K. pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 66 Asia Pacific pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 67 Asia Pacific pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 68 China pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 69 China pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 70 Japan pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 71 Japan pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 72 India pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 73 India pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 74 Australia pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 75 Australia pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 76 South Korea pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 77 South Korea pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 78 Central & South America pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 79 Central & South America pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 80 Brazil pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 81 Brazil pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 82 Argentina pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 83 Argentina pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 84 Middle East & Africa pea derivatives market estimates & forecast, 2017 - 2030 (Kilo Tons)

Fig. 85 Middle East & Africa pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 86 South Africa pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 87 South Africa pea derivatives market estimates & forecast, 2017 - 2030 (USD Million)

Fig. 88 Key Company/Competition Categorization

Fig. 89 Company market position analysis

Fig. 90 Company market position analysis

Companies Mentioned

- International Flavors & Fragrances Inc.

- Nutri-Pea

- COSCURA

- Roquette Frères

- PURIS

- Burcon

- Shandong Jianyuan Group

- SOTEXPRO

- The Scoular Company

- FENCHEM

- The Green Labs LLC

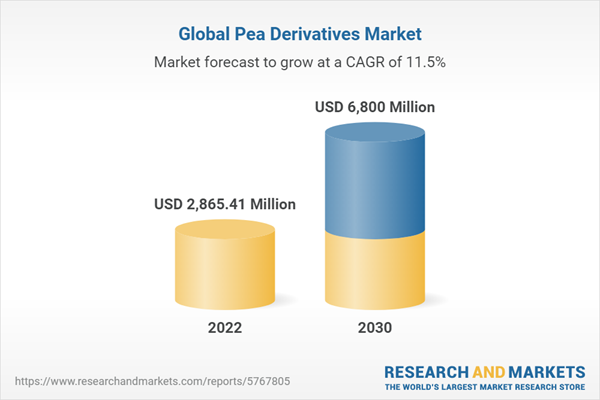

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | March 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 2865.41 Million |

| Forecasted Market Value ( USD | $ 6800 Million |

| Compound Annual Growth Rate | 11.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |