Extended Reality (XR) Market Analysis:

Major Market Drivers: The increasing adoption of immersive technologies in industries such as gaming, entertainment, healthcare, and education is a significant driver for the extended reality market share.Key Market Trends: The integration of augmented reality (AR), virtual reality (VR), and mixed reality (MR) technologies into enterprise workflows is a key trend shaping the extended reality market trends.

Geographical Trends: North America is leading the market, driven by early adoption, technological advancements, and a strong ecosystem of XR companies and developers.

Competitive Landscape: Accenture PLC, AugRay LLC, Semcon, and SoftServe Inc. are some of the key market players driving the extended reality market demand.

Challenges and Opportunities: While technical challenges like hardware limitations and user experience remain, extended reality market opportunities abound in sectors such as industrial training, virtual events, and immersive storytelling, driving innovation and growth in the extended reality market recent developments.

Extended Reality (XR) Market Trends:

Rising availability and affordability of XR devices and equipment

The extended reality market statistics have been benefited by the rising availability and affordability of XR devices and equipment. In the past, there were expensive XR devices that were limited to certain sectors or enthusiasts. However, technology advancements, economies of scale, and increased competition have resulted in more accessible and cost-effective XR solutions. It is through the expansion of smartphones that people have managed to make use of this tech.Nowadays, most smartphones possess AR features making it possible for individuals to experience augmented reality without any other gadgets. This led to explosion in user base and greater AR applications market due to adoption of AR-ready mobile phones. With standalone VR headsets being less costly than before, they are also friendlier for users which makes virtual reality a more accessible experience for anyone wanting to try it out.

Rising use in the retail and e-commerce industry

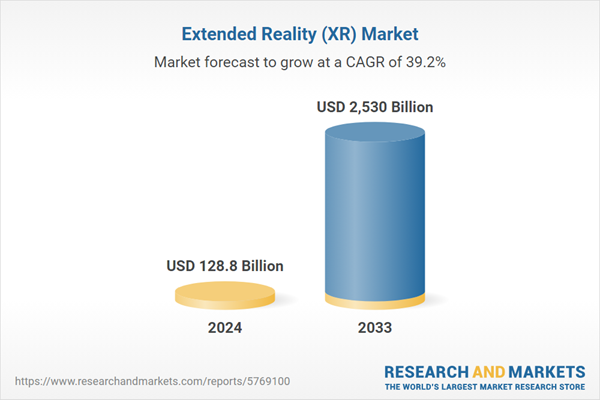

The use of XR technologies in the retail and e-commerce industry has been rising, leading to a positive extended reality market outlook. The global extended reality market 2021 value reached US$ 42.86 Billion, and as of the current year, is expected to grow at 39.2%, which indicates an impressive market expansion rate. XR is changing how shoppers browse and engage with products. AR also enables virtual product visualization where using their smartphones or AR glasses, customers are able to place digital furniture or décor items within real-life settings.This interactive experience helps consumers envision how products will fit into their homes thus bolstering confidence in purchase decisions made thereof. Furthermore, XR enhances the in-store experience through interactive displays and personalized recommendations. Retailers can utilize AR/VR technology to develop interactive product introductions, an immersive brand narrative, or virtual showrooms that will provide distinctive customer journeys.

Growing demand for marketing and advertising campaigns

There is a growing demand for XR in marketing and advertising campaigns. This is driving the extended reality market revenue. XR presents an opportunity to create more interactive marketing which is different from the old ways of doing things. One of the main applications of XR in marketing is augmented reality (AR). AR brands may create interactive commercials, whereby customers can scan print media or use mobile apps to receive extra digital content like 3D models, animations, or product information. Such kind of interaction enhances customer engagement and brand recall. Virtual reality (VR) is another strong tool that can be used in marketing campaigns.Brands can build VR experiences that take users into virtual environments matching their brand identity. These experiences could demonstrate products, simulate real-life scenarios, or produce branded entertainment content that strikes a chord with people. Mixed reality (MR) combines both virtual and physical landscapes into a single seamless experience where users interact together with them.

Extended Reality (XR) Industry Segmentation:

This report provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on component, type, organization size, application, and end user industry.Breakup by Component:

- Hardware

- Software

- Services

Breakup by Type:

- Consumer Engagement

- Business Engagement

Consumer engagement holds the largest share of the industry

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes consumer and business engagement. According to the report, consumer engagement accounted for the largest market share.Customer engagement is increasing the extended reality market price. XR technologies engage customers with some unique and interactive touch. Customers want unique experiences even if it is virtual reality (VR) or mixed reality (MR). Marketing campaigns that are innovative, virtual try-on, and branded content are some of the efforts made for consumer engagement by businesses on XR. High consumer engagement will enhance brand visibility and customer loyalty, thus driving market demand.

Breakup by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Breakup by Application:

- Virtual Reality (VR)

- Augmented Reality (AR)

- Mixed Reality (MR)

Virtual reality (VR) represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes virtual reality (VR), augmented reality (AR), and mixed reality (MR). According to the report, the virtual reality (VR) represented the largest segment.Virtual reality (VR) means creating computer-generated environments that can immerse users into entirely synthetic worlds. VR applications include gaming and entertainment up to training and simulations. This has resulted in the rise in demand for VR games as well as other forms of entertainment such as virtual travels, digital social interactions, and online training programs in a variety of fields among others.

Businesses use XR for better product visualizations, remote collaboration, and interactive marketing purposes. Over time as technology matures cost reduction makes XR more affordable across various industries including education where it is used for experiential learning through institutions adopting it in other sectors like healthcare which employs it to conduct surgical simulations besides treating patients.

Breakup by End User Industry:

- Education

- Retail

- Industrial and Manufacturing

- Healthcare

- Media and Entertainment

- Others

Media and entertainment holds the largest share of the market

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes education, retail, industrial and manufacturing, healthcare, media and entertainment, and others. According to the report, media and entertainment accounted for the largest market share.The media and entertainment industry propels the growth of the market. XR technologies are revolutionizing content consumption. This is through VR headsets that provide immersive gaming experiences and interactive storytelling. In AR, real-time information overlays and interactive advertisements are used to enrich live events while MR creates captivating experiences by blurring the line between physical and digital worlds. Companies with a stake in XR content production promote innovation, as well as assist in broadening consumer uptake. As demand for immersive entertainment grows, the media and entertainment sector continues to push the boundaries of XR, thus enlarging this market and shaping future experiences.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest extended reality (XR) market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.In the XR market, North America leads in innovation. The region has a vibrant XR development ecosystem due to the presence of tech giants, startups, and research organizations. It is home to some of the major companies who are leading in VR, AR, and MR technologies. For example, North America has a strong investment culture and supportive regulatory environment that promotes the growth of XR. Also, diverse industries in this region such as gaming and entertainment as well as healthcare and education are embracing XR for various applications. Due to a large number of consumers demanding immersion experiences, North America remains at the top most global markets.

Leading Key Players in the Extended Reality (XR) Industry:

The key market players are key drivers behind market growth through innovation, investment, and collaboration. They develop cutting-edge VR and AR. It is because they spend heavily on research, product development, and content creation aimed at expanding capabilities and accessibilities within XR solutions. This helps them to expand their ecosystems by working with hardware manufacturers, software developers, and content creators. New innovative start-ups contribute towards specialized solutions thus driving competition among niche players. Strategic partnerships with industries such as gaming or education contribute greatly in driving the adoption of XR leading to its expansion on the market.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Accenture PLC

- AugRay LLC

- Dassault Systèmes SolidWorks Corporation (Dassault Systèmes)

- Qualcomm Incorporated

- Semcon

- SoftServe Inc.

- Softweb Solutions Inc. (Avnet Inc.)

- SphereGen Technologies LLC

- Varjo

- VertexPlus Technologies Limited

Key Questions Answered in This Report:

- How big is the global extended reality (XR) market?

- What is the expected growth rate of the global extended reality (XR) market during 2025-2033?

- What has been the impact of COVID-19 on the global extended reality (XR) market?

- What are the key factors driving the global extended reality (XR) market?

- What is the breakup of the global extended reality (XR) market based on the type?

- What is the breakup of the global extended reality (XR) market based on the application?

- What is the breakup of the global extended reality (XR) market based on the end user industry?

- What are the key regions in the global extended reality (XR) market?

- Who are the key players/companies in the global extended reality (XR) market?

- What is the potential of the global extended reality (XR) market?

Table of Contents

Companies Mentioned

- Accenture PLC

- AugRay LLC

- Dassault Systèmes SolidWorks Corporation (Dassault Systèmes)

- Qualcomm Incorporated

- Semcon

- SoftServe Inc.

- Softweb Solutions Inc. (Avnet Inc.)

- SphereGen Technologies LLC

- Varjo

- VertexPlus Technologies Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 128.8 Billion |

| Forecasted Market Value ( USD | $ 2530 Billion |

| Compound Annual Growth Rate | 39.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |