Industrial x-ray inspection equipment and imaging software are used to perform non-destructive testing (NDT) for uncovering subsurface defects in various industrial products. The x-ray inspection equipment aids in detecting hidden inconsistencies, flaws, cracks, and voids in a wide array of solid materials, such as plastic, rubber, silicone, metal, and composites, without harming the test item. On the other hand, the imaging software produces a clear image of the inspected location for evaluation by NDT inspectors and to maintain a record of the internal condition of the test piece. In recent years, industrial x-ray inspection equipment and imaging software have gained traction in manufacturing facilities for quality control and risk management.

Industrial X-ray Inspection Equipment and Imaging Software Market Trends:

Industrial x-ray inspection equipment and imaging software assist in enhancing the production quality, determining the soundness of products or materials, and verifying the integrity of the internal structure. As a result, their emerging applications across various end use industries, including oil and gas, semiconductor and electronics, aerospace, automotive, construction, and food and beverage, represents the primary factor driving the market growth. Besides this, the escalating demand for compact devices and the emerging trend of electronics miniaturization are augmenting the product demand for detailed inspection and quality analysis. Additionally, the leading players are developing next-gen digital radiography (DR) machines integrated with flat-panel detectors (FPDs) to offer higher resolution and faster processing. This, in confluence with the introduction of computer tomography (CT) equipped with FPDs and other innovative technologies, is catalyzing the market growth. Furthermore, the growing consumer demand for high-quality products and the increasing number of semiconductor fabrication plants are accelerating the product adoption rates. Other factors, including the rising oil and gas exploration activities, favorable government initiatives, stringent safety and quality standards, and ongoing research and development activities, are also creating a positive market outlook.Market Segmentation:

This report provides an analysis of the key trends in each sub-segment of the global industrial X-ray inspection equipment and imaging software market report, along with forecasts at the global, regional and country level from 2025-2033. The report categorizes the market based on image type, technology, offering and end use industry.Breakup by Image Type:

- 2D

- 3D

- 4D

Breakup by Technology:

- Film-Based Imaging

- Digital Imaging

- Computed Tomography

- Computed Radiography

- Direct Radiography

Breakup by Offering:

- Equipment

- Software

Breakup by End Use Industry:

- Oil and Gas

- Aerospace

- Food Industry and Construction

- Automotive and Manufacturing

- Energy and Power

- Semiconductor and Electronics

- Others

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players being Carestream Health, DÜRR NDT GmbH & Co. KG, General Electric Company, Hamamatsu Photonics K.K., Hitachi Ltd., Nikon Corporation, North Star Imaging Inc. (Illinois Tool Works Inc.), Olympus Corporation, OMRON Corporation, Rigaku Corporation, Teledyne Technologies Inc, Thermo Fisher Scientific Inc. and YXLON International (Comet Holding).Key Questions Answered in This Report

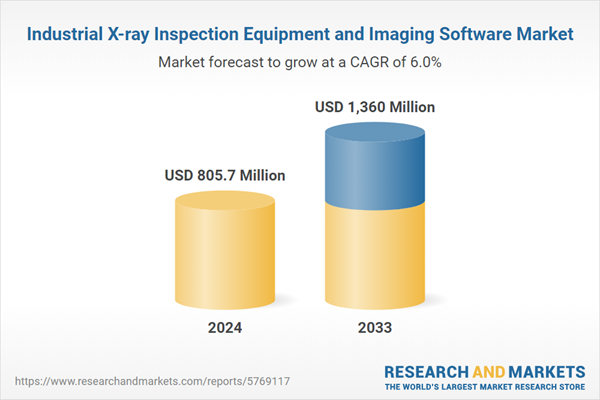

1. What was the size of the global industrial X-ray inspection equipment and imaging software market in 2024?2. What is the expected growth rate of the global industrial X-ray inspection equipment and imaging software market during 2025-2033?

3. What has been the impact of COVID-19 on the global industrial X-ray inspection equipment and imaging software market?

4. What are the key factors driving the global industrial X-ray inspection equipment and imaging software market?

5. What is the breakup of the global industrial X-ray inspection equipment and imaging software market based on the technology?

6. What is the breakup of the global industrial X-ray inspection equipment and imaging software market based on the end use industry?

7. What are the key regions in the global industrial X-ray inspection equipment and imaging software market?

8. Who are the key players/companies in the global industrial X-ray inspection equipment and imaging software market?

Table of Contents

Companies Mentioned

- Carestream Health

- DÜRR NDT GmbH & Co. KG

- General Electric Company

- Hamamatsu Photonics K.K.

- Hitachi Ltd.

- Nikon Corporation

- North Star Imaging Inc. (Illinois Tool Works Inc.)

- Olympus Corporation

- OMRON Corporation

- Rigaku Corporation

- Teledyne Technologies Inc

- Thermo Fisher Scientific Inc. and YXLON International (Comet Holding).

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 805.7 Million |

| Forecasted Market Value ( USD | $ 1360 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |