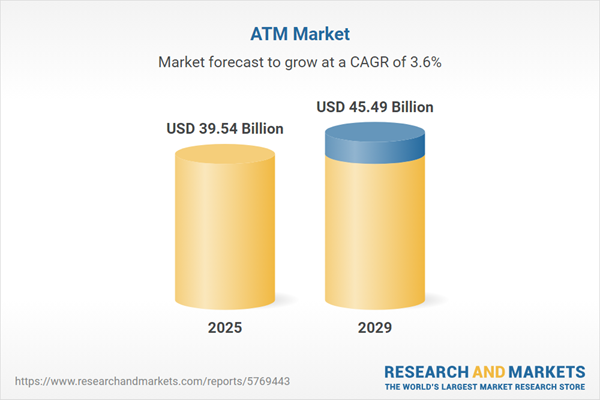

The ATM market size is expected to see steady growth in the next few years. It will grow to $45.49 billion in 2029 at a compound annual growth rate (CAGR) of 3.6%. The growth in the forecast period can be attributed to growing cash usage trends, global economic growth, evolution of banking services, government initiatives and policies, adaptation to changing consumer behaviors. Major trends in the forecast period include focus on accessibility and inclusion features, cash recycling and deposit automation, remote ATM management and monitoring, enhanced user experience with interactive interfaces, sustainability initiatives in ATM design and operation.

The growing consumer use of ATMs is projected to propel the growth of the ATM market in the future. In many countries, customers prefer cash as their payment method due to its convenience. As technology advances, consumers are seeking faster, more reliable, safe, and convenient ways to access cash. ATMs, which are self-service vending machines, allow customers to bank anywhere and at any time. They help users save time, money, and effort by reducing transaction costs while enhancing accuracy and speed. For example, in September 2023, the ATM Industry Association (ATMIA), a U.S.-based non-profit trade organization, reported that the U.S. ATM population increased by approximately 21,000 terminals from 2021 to the end of 2022. ATMIA currently estimates that the total number of active ATMs is between 520,000 and 540,000. Thus, the rising consumer usage of ATMs will significantly contribute to the growth of the ATM market.

The increasing number of small businesses is expected to boost the growth of the ATM market in the coming years. Small businesses are defined as privately owned and operated enterprises characterized by their relatively modest size regarding employees, revenue, and assets. These businesses utilize ATMs to offer convenient cash access to customers, attract foot traffic, and improve overall customer service. The presence of on-site ATMs also allows businesses to lessen their dependence on traditional banks, manage cash flow effectively, and promote financial inclusion in underserved regions. For instance, in September 2024, the U.S. Department of the Treasury, a U.S. government agency, reported that the United States is witnessing an average of 430,000 new business applications each month in 2024. Additionally, the number of applications from businesses anticipating hiring employees has risen to 140,000 per month. Therefore, the growing number of small businesses is driving the growth of the ATM market.

The emergence of Smart ATMs is a recent trend gaining traction in the ATM market. Smart ATMs are automated teller machines (ATMs) that provide more functionalities than just dispensing cash. These machines incorporate advanced technologies to enhance the customer experience while also reducing the risk of fraud. For instance, in June 2023, Bank of Baroda, a prominent public sector bank in India, introduced a new service called Interoperable Cardless Cash Withdrawal (ICCW). This innovative feature enables customers to withdraw cash from Bank of Baroda ATMs using only their UPI app and mobile phone, eliminating the need for a physical debit card. To utilize ICCW, customers select the UPI Cash Withdrawal option on the ATM, scan the QR code displayed with their UPI app, and authorize the transaction using their UPI PIN. This service provides increased security, convenience, and flexibility for customers by removing the risk of card-related fraud and allowing withdrawals from multiple linked accounts. Bank of Baroda is the first public sector bank in India to offer this service, showcasing its dedication to digital innovation and customer convenience.

Major companies in the ATM market are forming partnerships to develop new products and strengthen their market positions. These collaborations enhance innovation, expand service offerings, and improve accessibility by leveraging the strengths of different stakeholders. For instance, in September 2023, Hitachi Payment Services Private Limited partnered with the National Payments Corporation of India to introduce India's first UPI-ATM, named Hitachi Money Spot UPI ATM. Operating on Android OS, this White Label ATM offers cardless cash withdrawals through the UPI app, focusing on promoting financial inclusion in areas with limited traditional banking infrastructure. This collaboration emphasizes the seamless integration of UPI convenience into traditional ATMs, providing quick access to cash without the need for a physical card.

In February 2023, Paramount, a US-based firm involved in ATM management and processing, acquired First National ATM for an undisclosed sum. This acquisition aims to broaden its market reach, diversify its product offerings, and enhance operational efficiencies. It bolsters Paramount's position in the ATM market and expands its customer base. First National ATM is a US-based company that specializes in the deployment and management of ATMs.

Major companies operating in the ATM market include IBM Corporation, Tata Consultancy Services Limited, Atlas ATM, NCR Corporation, Diebold Nixdorf, Wincor Nixdorf, Euronet Worldwide Inc., Hyosung Corporation, GRG Banking Equipment Co. Ltd., Fujitsu Frontech Ltd., Eastcompeace, Nautilus Hyosung Corporation, Oki Electric Industry Co. Ltd., Forbes Technosys Ltd., KingTeller, Hantle, Triton Systems of Delaware LLC, HCL Infosystems Ltd., EFT Networks Inc., RapidCash ATM Ltd., Hitachi-Omron Terminal Solutions Corporation, Triton System of Delaware LLC, G4S plc, Lipi Data Systems Ltd., Itautec, Shenzhen Yihua Computer, HESS Cash Systems GmbH & Co KG.

Asia-Pacific was the largest region in the ATM market in 2024. The regions covered in the atm market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the atm market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

An ATM, or automated teller machine, is a specialized computer designed for the convenient management of a bank account holder's funds. It serves as a computerized banking terminal that enables consumers to carry out basic transactions without requiring assistance from a branch operator or teller. ATMs offer convenience by allowing customers to perform self-service operations such as deposits, cash withdrawals, bill payments, and account transfers. This accessibility extends to 24/7 banking services through ATMs.

The primary types of ATMs include location-based ATMs and operation-based ATMs. ATMs offer various solutions, including on-site, off-site, work site, and mobile options, and they are classified as white-label, green label, and yellow label. On-site ATMs are situated either within the branch or near the bank's premises, providing customers with the advantage of bypassing long lines and saving time during transactions. ATMs are utilized for different banking applications, including the withdrawal, transfer, and deposit of funds.

The ATM market research report is one of a series of new reports that provides ATM statistics, including ATM industry global market size, regional shares, competitors with ATM market share, detailed ATM market segments, market trends and opportunities, and any further data you may need to thrive in the ATM industry. This ATM market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The ATM market consists of revenues earned by entities by providing services such as balance enquiry, cheque deposit, updating PIN, and money transfer. The market value includes the value of related goods sold by the service provider or included within the service offering. The ATM market also includes sales of card reader, display screen, receipt printer, and cash dispenser. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

ATM Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on atm market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for atm? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The atm market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By ATM Type: Location Based ATM; Operation Based ATM2) By Solution: On Site; Off Site; Work Site; Mobile

3) By Operation: White Label; Green Label; Yellow Label

4) By Application: Withdrawal; Transfer; Deposits

Subsegments:

1) By Location-Based ATM: Off-Premise ATMs; on-Premise ATMs; Kiosk ATMs2) By Operation-Based ATM: Cash Dispenser ATMs; Full-Service ATMs; Smart ATMs; Drive-Up ATMs

Key Companies Mentioned: IBM Corporation; Tata Consultancy Services Limited; Atlas ATM; NCR Corporation; Diebold Nixdorf

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- IBM Corporation

- Tata Consultancy Services Limited

- Atlas ATM

- NCR Corporation

- Diebold Nixdorf

- Wincor Nixdorf

- Euronet Worldwide Inc.

- Hyosung Corporation

- GRG Banking Equipment Co. Ltd.

- Fujitsu Frontech Ltd.

- Eastcompeace

- Nautilus Hyosung Corporation

- Oki Electric Industry Co. Ltd.

- Forbes Technosys Ltd.

- KingTeller

- Hantle

- Triton Systems of Delaware LLC

- HCL Infosystems Ltd.

- EFT Networks Inc.

- RapidCash ATM Ltd.

- Hitachi-Omron Terminal Solutions Corporation

- Triton System of Delaware LLC

- G4S plc

- Lipi Data Systems Ltd.

- Itautec

- Shenzhen Yihua Computer

- HESS Cash Systems GmbH & Co KG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 39.54 Billion |

| Forecasted Market Value ( USD | $ 45.49 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |