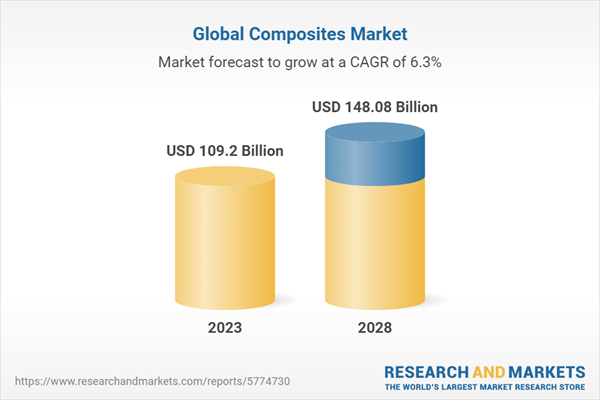

The market value is expected to grow at a CAGR of 6.28% during the forecast period of 2023-2028. Composites market is expected to continue to grow as industries look for materials that offer high strength, durability, and lightweight properties. Furthermore, the factors such as growing demand for carbon fiber composites, development of new resin systems and advancements in development technology are expected to drive the market growth in the coming years.

Market Dynamics

Growth Drivers: One of the most important factors impacting the global composites market is the increasing demand for EVs. Composites are materials made from two or more constituent materials with different physical or chemical properties. They offer several advantages over traditional materials such as metals, including high strength-to-weight ratios, corrosion resistance, and design flexibility. These properties make composites ideal for use in the automotive industry, especially in the production of EVs. One of the key advantages of composites is their ability to reduce the weight of vehicles without compromising on strength or safety. This is particularly important for EVs, as the batteries that power them are heavy and can add significant weight to the vehicle. Furthermore, the market has been growing over the past few years, due to factors such as growing construction sector, increasing demand for renewable energy, use of 3D printing technology, increasing demand for consumer goods and focus on lightweighting.Challenges: However, the market has been confronted with some challenges specifically, issues related to recycling, high processing & manufacturing costs, etc. Composites are increasingly being used in aerospace, transportation, and other sectors such as construction and electronics. However, the high material and manufacturing expenses limit their use. To reduce the cost of composite products, it is essential to use tools to correctly determine costs during the early design stages. Composites manufacturing is a capital-intensive procedure that necessitates significant investment. Because composites take a long curing period, the molding process is slow. Furthermore, raw ingredients such as carbon fibers and thermoplastic resins are expensive. As a result, despite its numerous advantages over traditional materials such as steel and aluminum, the use of composites remains low. The high investment required for composite production limits market development.

Trends: The market is projected to grow at a fast pace during the forecast period, due to increasing demand from the aerospace & aviation industry, growing demand for ceramic matrix composites, sustainable use of composites for bootbuilding and marine structures and growing concept of automation. Aerospace has always been a technologically advanced business. Aerospace engineering has been a driving force behind the creation of advanced engineering materials. With the creation of space transport vehicles and the next wave of supersonic aircraft, the industry continues to push innovation to new heights. Composite materials have a wide range of proven uses in the aircraft and aerospace industries. The use of advanced composite materials in the aerospace sector is steadily increasing due to several advantages of composites over metals, such as lightweight, high strength, corrosion resistance, superior fatigue and fracture properties, and multifunctional performances such as SHM and self-assembly.

Market Segmentation Analysis

By Resin Type: The report provides the bifurcation of the market into two segments based on the resin type: Thermoset Composites, and Thermoplastic Composites. In 2022, the thermoset composites segment held the major share in the market. Thermoset composites are the polymers that are made with thermoset matrices having great strength and low impact-toughness making. These are based on glass, carbon and aramid fibers. The thermoset composites can be remolded without degradation on heating and on cooling they solidify into a finished shape. There is a substantial rise in the demand for thermoset composites by the various end user industries owing to it beneficial properties such as strength, rigidity and high temperature resistance. Due to the rapid growth and expansion of aerospace industry, the demand for thermoset composites has multiplied over the years.By Fiber Type: The report further provides the segmentation based on the fiber type: Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites and Other Fiber Composites. Glass fiber emerged as a prominent segment, accounting for a major share in the global market. This phenomenal rise can be due to its high demand in the building, electronics and electrical, wind energy, and transportation sectors. It has enhanced qualities such as lightweight, high durability, high strength, and weather resistance. Such exceptional attributes are driving the segment's demand in a wide range of applications.

By End User: The outlook of the global composites market seems eye-catching with alluring prospects in numerous end-use sectors. The composites market is further bifurcated based on the end user: Automotive & Transportation, Electrical & Electronics, Construction & Infrastructure, Wind Energy, Pipes & Tanks, Marine, and Others. In 2022, the automotive and transportation segment dominated the market. Composites are used in automobiles, trucks, trailers, buses, railways, subways, and motorcycles. These industries use composites to replace metal in the manufacture of strong and lightweight components. The material possesses the stiffness and strength of metals but is lighter, allowing for the production of lightweight pieces.

By Region: The report provides insight into the composites market based on the geographical operations, namely Asia Pacific, Europe, North America and ROW. The Asia Pacific region dominated the composites market and is expected to expand rapidly during the forecast period. Due to the presence of important manufacturers in significant economies such as China, India, and Japan, the area is one of the most lucrative destinations for automotive, construction, aerospace, and electronics manufacturers. Considerable investment in the construction sector is expected to augment the demand for composites in the region which will drive the regional market growth. The presence of key market players in the region is again contributing to the growth of the composites market in Asia-Pacific.

Europe is a significant market for composites due to the increasing demand for electric vehicles and the presence of stringent emission regulations. The growing use of composites in the construction sector, as a result of rapid urbanization and rising living standards, is driving the composites market in Europe. Meanwhile, rising thermoplastics production in the region in response to rising demand in the electronics industry is expected to support market growth.

Impact Analysis of COVID-19 and Way Forward

The COVID-19 pandemic has had a significant impact on the composites market. The impact has been seen in various areas of the composites market, including supply chain disruptions, demand fluctuations, production slowdowns, and changes in consumer behavior. The pandemic has disrupted supply chains due to lockdowns, travel restrictions, and labor shortages, leading to delays in the delivery of raw materials and components, and increasing transportation costs. This has resulted in challenges for composites manufacturers in sourcing materials and components, leading to production delays and increased costs. Moreover, several end-use sectors, such as aerospace, automotive, and construction, which are major consumers of composites, have experienced reduced demand due to economic downturns, travel restrictions, and decreased consumer spending.The growing focus on lightweight, high-strength materials for various applications and the increasing need for sustainable solutions are expected to drive the demand for composites in the post-COVID-19 era. The composites manufacturing process, which involves complex fabrication techniques, could also witness increased automation and digitalization in the post-COVID-19 era. Technologies such as robotics, 3D printing, and virtual simulations could be utilized to streamline composites production, reduce labor costs, and improve product quality.

Competitive Landscape

Global composites market is a rapidly evolving and highly fragmented market. The global composites market is characterized by the presence of several companies, with established players driving industry trends. The majority of these companies focus on forward integration, selling their products directly to end-users in various business verticals. Some of these businesses also rely on an established distribution and sales network to readily interact with customers across geographies. The competitive battle among composites makers is fierce, as the industry is characterized by the existence of a significant number of global and regional companies.The key players in the global composites market are:

- Celanese Corporation

- DuPont de Nemours, Inc.

- Owens Corning

- Teijin Ltd.

- Toray Industries, Inc.

- Huntsman Corporation

- Hexcel Corporation

- Mitsubishi Chemical Holdings Corporation

- Solvay S.A.

- China Jushi Co., Ltd.

- Kineco Limited

- Shanghai Huayuan New Composite Materials Co. Ltd.

- Strongwell Corporation

Table of Contents

1. Executive Summary2. Introduction

2.1 Composites: An Overview

2.1.1 Definition of Composites

2.2 Composites Segmentation: An Overview

2.2.1 Composites Segmentation

2.2.2 Composites Segmentation by End User

3. Global Market Analysis

3.1 Global Composites Market: An Analysis

3.1.1 Global Composites Market: An Overview

3.1.2 Global Composites Market by Value

3.1.3 Global Composites Market by Fiber Type (Glass Fiber, Carbon Fiber, Natural Fiber & Others)

3.1.4 Global Composites Market by Resin Type (Thermoset & Thermoplastic)

3.1.5 Global Composites Market by End User (Automotive & Transportation, Electrical & Electronics, Construction & Infrastructure, Wind Energy, Pipes & Tanks, Marine, & Other)

3.1.6 Global Composites Market by Region (Asia Pacific, Europe, North America, ROW)

3.2 Global Composites Market: Fiber Type Analysis

3.2.1 Global Composites Market by Fiber Type: An Overview

3.2.2 Global Glass Fiber Composites Market by Value

3.2.3 Global Carbon Fiber Composites Market by Value

3.2.4 Global Natural Fiber Composites Market by Value

3.2.5 Global Other Fiber Composites Market by Value

3.3 Global Composites Market: Resin Type Analysis

3.3.1 Global Composites Market by Resin Type: An Overview

3.3.2 Global Thermoset Composites Market by Value

3.3.3 Global Thermoplastic Composites Market by Value

3.4 Global Composites Market: End User Analysis

3.4.1 Global Composites Market by End User: An Overview

3.4.2 Global Automotive & Transportation Composites Market by Value

3.4.3 Global Electrical & Electronics Composites Market by Value

3.4.4 Global Construction & Infrastructure Composites Market by Value

3.4.5 Global Wind Energy Composites Market by Value

3.4.6 Global Pipes & Tanks Composites Market by Value

3.4.7 Global Marine Composites Market by Value

3.4.8 Global Other Composite End Users Market by Value

4. Regional Market Analysis

4.1 Asia Pacific Composites Market: An Analysis

4.1.1 Asia Pacific Composites Market: An Overview

4.1.2 Asia Pacific Composites Market by Value

4.1.3 Asia Pacific Composites Market by Region (China, India, Japan, South Korea, Australia and Rest of Asia Pacific)

4.1.4 China Composites Market by Value

4.1.5 India Composites Market by Value

4.1.6 Japan Composites Market by Value

4.1.7 South Korea Composites Market by Value

4.1.8 Australia Composites Market by Value

4.1.9 Rest of Asia Pacific Composites Market by Value

4.2 Europe Composites Market: An Analysis

4.2.1 Europe Composites Market: An Overview

4.2.2 Europe Composites Market by Value

4.2.3 Europe Composites Market by Region (Germany, UK, France, Italy, Spain and Rest of the Europe)

4.2.4 Germany Composites Market by Value

4.2.5 The UK Composites Market by Value

4.2.6 France Composites Market by Value

4.2.7 Italy Composites Market by Value

4.2.8 Spain Composites Market by Value

4.2.9 Rest of Europe Composites Market by Value

4.3 North America Composites Market: An Analysis

4.3.1 North America Composites Market: An Overview

4.3.2 North America Composites Market by Value

4.3.3 North America Composites Market by Region (The US, Canada & Mexico)

4.3.4 The US Composites Market by Value

4.3.5 The US Composites Market by Fiber Type (Glass Fiber, Carbon Fiber & Others)

4.3.6 The US Glass Fiber Composites Market by Value

4.3.7 The US Carbon Fiber Composites Market by Value

4.3.8 The US Other Fiber Composites Market by Value

4.3.9 Canada Composites Market by Value

4.3.10 Mexico Composites Market by Value

4.4 Rest of the World Composites Market: An Analysis

4.4.1 Rest of the World Composites Market: An Overview

4.4.2 Rest of the World Composites Market by Value

5. Impact of COVID-19

5.1 Impact of COVID-19

5.1.1 Impact of COVID-19 on Composites Market

5.1.2 Post COVID Scenario

6. Market Dynamics

6.1 Growth Drivers

6.1.1 Increasing Demand for EVs

6.1.2 Growing Construction Sector

6.1.3 Increasing Demand for Renewable Energy

6.1.4 Use of 3D Printing Technology

6.1.5 Increasing Demand for Consumer Goods

6.1.6 Focus on Lightweighting

6.2 Challenges

6.2.1 Issues Related to Recycling

6.2.2 High Processing & Manufacturing Costs

6.3 Market Trends

6.3.1 Increasing Demand From the Aerospace & Aviation Industry

6.3.2 Growing Demand for Ceramic Matrix Composites

6.3.3 Sustainable Use of Composites for Bootbuilding and Marine Structures

6.3.4 Growing Concept of Automation

6.3.5 Increasing Focus on Green Composites

7. Competitive Landscape

7.1 Global Composites Market Players: Key Comparison

8. Company Profiles

8.1 Celanese Corporation

8.1.1 Business Overview

8.1.2 Operating Segment

8.1.3 Business Strategies

8.2 DuPont de Nemours, Inc.

8.2.1 Business Overview

8.2.2 Operating Segments

8.2.3 Business Strategies

8.3 Hexcel Corporation

8.3.1 Business Overview

8.3.2 Operating Segments

8.3.3 Business Strategies

8.4 Huntsman Corporation

8.4.1 Business Overview

8.4.2 Operating Segments

8.4.3 Business Strategies

8.5 Mitsubishi Chemical Group Corporation

8.5.1 Business Overview

8.5.2 Sales Revenue by Business Divisions

8.5.3 Business Strategy

8.6 Owens Corning

8.6.1 Business Overview

8.6.2 Operating Segment

8.6.3 Business Strategies

8.7 Solvay SA

8.7.1 Business Overview

8.7.2 Operating Segment

8.7.3 Business Strategies

8.8 Teijin Limited

8.8.1 Business Overview

8.8.2 Net Sales by Business Field

8.8.2 Business Strategies

8.9 Toray Industries, Inc.

8.9.1 Business Overview

8.9.2 Operating Segment

8.9.3 Business Strategies

8.10 KineCo. Ltd.

8.10.1 Business Overview

8.10.2 Business Strategies

8.11 Strongwell Corporation

8.11.1 Business Overview

8.11.2 Business Strategies

8.12 Shanghai Huayuan New Composite Materials Co. Ltd.

8.12.1 Business Overview

8.13 China Jushi Co., Ltd.

8.13.1 Business Overview

List of Figures

Figure 1: Advantages of Composite Materials

Figure 2: Composites Segmentation

Figure 3: Composites Segmentation by End User

Figure 4: Global Composites Market by Value; 2018-2022 (US$ Billion)

Figure 5: Global Composites Market by Value; 2023-2028 (US$ Billion)

Figure 6: Global Composites Market by Fiber Type; 2022 (Percentage, %)

Figure 7: Global Composites Market by Resin Type; 2022 (Percentage, %)

Figure 8: Global Composites Market by End User; 2022 (Percentage, %)

Figure 9: Global Composites Market by Region; 2022 (Percentage, %)

Figure 10: Global Glass Fiber Composites Market by Value; 2018-2022 (US$ Billion)

Figure 11: Global Glass Fiber Composites Market by Value; 2023-2028 (US$ Billion)

Figure 12: Global Carbon Fiber Composites Market by Value; 2018-2022 (US$ Billion)

Figure 13: Global Carbon Fiber Composites Market by Value; 2023-2028 (US$ Billion)

Figure 14: Global Natural Fiber Composites Market by Value; 2018-2022 (US$ Billion)

Figure 15: Global Natural Fiber Composites Market by Value; 2023-2028 (US$ Billion)

Figure 16: Global Other Fiber Composites Market by Value; 2018-2022 (US$ Billion)

Figure 17: Global Other Fiber Composites Market by Value; 2023-2028 (US$ Billion)

Figure 18: Global Thermoset Composites Market by Value; 2018-2022 (US$ Billion)

Figure 19: Global Thermoset Composites Market by Value; 2023-2028 (US$ Billion)

Figure 20: Global Thermoplastic Composites Market by Value; 2018-2022 (US$ Billion)

Figure 21: Global Thermoplastic Composites Market by Value; 2023-2028 (US$ Billion)

Figure 22: Global Automotive & Transportation Composites Market by Value; 2018-2022 (US$ Billion)

Figure 23: Global Automotive & Transportation Composites Market by Value; 2023-2028 (US$ Billion)

Figure 24: Global Electrical & Electronics Composites Market by Value; 2018-2022 (US$ Billion)

Figure 25: Global Electrical & Electronics Composites Market by Value; 2023-2028 (US$ Billion)

Figure 26: Global Construction & Infrastructure Composites Market by Value; 2018-2022 (US$ Billion)

Figure 27: Global Construction & Infrastructure Composites Market by Value; 2023-2028 (US$ Billion)

Figure 28: Global Wind Energy Composites Market by Value; 2018-2022 (US$ Billion)

Figure 29: Global Wind Energy Composites Market by Value; 2023-2028 (US$ Billion)

Figure 30: Global Pipes & Tanks Composites Market by Value; 2018-2022 (US$ Billion)

Figure 31: Global Pipes & Tanks Composites Market by Value; 2023-2028 (US$ Billion)

Figure 32: Global Marine Composites Market by Value; 2018-2022 (US$ Billion)

Figure 33: Global Marine Composites Market by Value; 2023-2028 (US$ Billion)

Figure 34: Global Other Composite End Users Market by Value; 2018-2022 (US$ Billion)

Figure 35: Global Other Composite End Users Market by Value; 2023-2028 (US$ Billion)

Figure 36: Asia Pacific Composites Market by Value; 2018-2022 (US$ Billion)

Figure 37: Asia Pacific Composites Market by Value; 2023-2028 (US$ Billion)

Figure 38: Asia Pacific Composites Market by Region; 2022 (Percentage, %)

Figure 39: China Composites Market by Value; 2018-2022 (US$ Billion)

Figure 40: China Composites Market by Value; 2023-2028 (US$ Billion)

Figure 41: India Composites Market by Value; 2018-2022 (US$ Billion)

Figure 42: India Composites Market by Value; 2023-2028 (US$ Billion)

Figure 43: Japan Composites Market by Value; 2018-2022 (US$ Billion)

Figure 44: Japan Composites Market by Value; 2023-2028 (US$ Billion)

Figure 45: South Korea Composites Market by Value; 2018-2022 (US$ Billion)

Figure 46: South Korea Composites Market by Value; 2023-2028 (US$ Billion)

Figure 47: Australia Composites Market by Value; 2018-2022 (US$ Billion)

Figure 48: Australia Composites Market by Value; 2023-2028 (US$ Billion)

Figure 49: Rest of Asia Pacific Composites Market by Value; 2018-2022 (US$ Billion)

Figure 50: Rest of Asia Pacific Composites Market by Value; 2023-2028 (US$ Billion)

Figure 51: Europe Composites Market by Value; 2018-2022 (US$ Billion)

Figure 52: Europe Composites Market by Value; 2023-2028 (US$ Billion)

Figure 53: Europe Composites Market by Region; 2022 (Percentage, %)

Figure 54: Germany Composites Market by Value; 2018-2022 (US$ Billion)

Figure 55: Germany Composites Market by Value; 2023-2028 (US$ Billion)

Figure 56: The UK Composites Market by Value; 2018-2022 (US$ Billion)

Figure 57: The UK Composites Market by Value; 2023-2028 (US$ Billion)

Figure 58: France Composites Market by Value; 2018-2022 (US$ Billion)

Figure 59: France Composites Market by Value; 2023-2028 (US$ Billion)

Figure 60: Italy Composites Market by Value; 2018-2022 (US$ Billion)

Figure 61: Italy Composites Market by Value; 2023-2028 (US$ Billion)

Figure 62: Spain Composites Market by Value; 2018-2022 (US$ Billion)

Figure 63: Spain Composites Market by Value; 2023-2028 (US$ Billion)

Figure 64: Rest of Europe Composites Market by Value; 2018-2022 (US$ Billion)

Figure 65: Rest of Europe Composites Market by Value; 2023-2028 (US$ Billion)

Figure 66: North America Composites Market by Value; 2018-2022 (US$ Billion)

Figure 67: North America Composites Market by Value; 2023-2028 (US$ Billion)

Figure 68: North America Composites Market by Region; 2022 (Percentage, %)

Figure 69: The US Composites Market by Value; 2018-2022 (US$ Billion)

Figure 70: The US Composites Market by Value; 2023-2028 (US$ Billion)

Figure 71: The US Composites Market by Fiber Type; 2022 (Percentage, %)

Figure 72: The US Glass Fiber Composites Market by Value; 2018-2022 (US$ Billion)

Figure 73: The US Glass Fiber Composites Market by Value; 2023-2028 (US$ Billion)

Figure 74: The US Carbon Fiber Composites Market by Value; 2018-2022 (US$ Billion)

Figure 75: The US Carbon Fiber Composites Market by Value; 2023-2028 (US$ Billion)

Figure 76: The US Other Fiber Composites Market by Value; 2018-2022 (US$ Billion)

Figure 77: The US Other Fiber Composites Market by Value; 2023-2028 (US$ Billion)

Figure 78: Canada Composites Market by Value; 2018-2022 (US$ Billion)

Figure 79: Canada Composites Market by Value; 2023-2028 (US$ Billion)

Figure 80: Mexico Composites Market by Value; 2018-2022 (US$ Billion

Figure 81: Mexico Composites Market by Value; 2023-2028 (US$ Billion)

Figure 82: Rest of the World Composites Market by Value; 2018-2022 (US$ Billion)

Figure 83: Rest of the World Composites Market by Value; 2023-2028 (US$ Billion)

Figure 84: Global Electric Vehicle Sales, 2017-2022 (Million)

Figure 85: Global Construction market, 2020-2030 (US$ Trillion)

Figure 86: Global Electricity Generation by Source; 2022 & 2025 (TWh)

Figure 87: Global Electric Aircraft Market Size, 2019-2026 (US$ Million)

Figure 88: Celanese Corporation Net Sales by Segment; 2022 (Percentage, %)

Figure 89: DuPont de Nemours, Inc. Net Revenue by Segments; 2022 (Percentage, %)

Figure 90: Hexcel Corporation Net Sales by Segment; 2022 (Percentage, %)

Figure 91: Huntsman Corporation Revenues by Segments; 2022 (Percentage, %)

Figure 92: Mitsubishi Chemical Group Corporation Sales Revenue by Business Divisions; 2021 (Percentage, %)

Figure 93: Owens Corning Net Sales by Segment; 2022 (Percentage, %)

Figure 94: Solvay SA Net Sales by Segment; 2022 (Percentage, %)

Figure 95: Teijin Limited Net Sales by Business Field; 2022 (Percentage, %)

Figure 96: Toray Industries, Inc. Revenue by Segment; 2022 (Percentage, %)

List of Tables

Table 1: Global Composites Market Players: Key Comparison

Companies Mentioned

- Celanese Corporation

- DuPont de Nemours, Inc.

- Hexcel Corporation

- Huntsman Corporation

- Mitsubishi Chemical Group Corporation

- Owens Corning

- Solvay SA

- Teijin Limited

- Toray Industries, Inc.

- KineCo. Ltd.

- Strongwell Corporation

- Shanghai Huayuan New Composite Materials Co. Ltd.

- China Jushi Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | April 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 109.2 Billion |

| Forecasted Market Value ( USD | $ 148.08 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |