This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

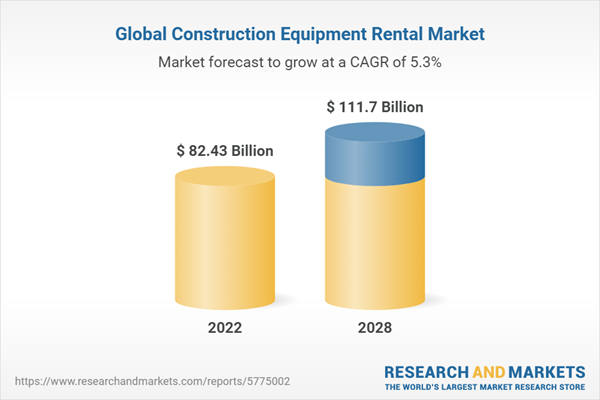

According to the research report, "Global Construction Equipment Rental Market Outlook, 2028," published by Bonafide Research, the market is projected to reach a size of USD 111.70 billion by 2028, up from USD 82.43 billion in 2022. Furthermore, the market is expected to grow at a CAGR of 5.30% between 2023 and 2028. The increase in government spending on public infrastructure development has accelerated construction and mining activity in the world's emerging economies. This factor has resulted in high market demand for construction equipment. Rising construction machine prices are encouraging construction companies and contractors to shift their focus to renting construction equipment. Furthermore, the emergence of advanced technologies and an increasing level of automation are expected to drive market growth. During the forecast period, advancements such as equipment service tracking and mapping and digital service for automated service improvements are expected to drive market growth. The global construction equipment rental market is expected to grow in the coming years due to an increase in mining and construction activity, particularly in developing countries. The global construction equipment rental market is expected to expand significantly in the coming years as new technologies such as mapping features, equipment service tracking, and automated service improvement become available.

According to the report, the global market is divided into five major regions: North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. North America leads the market with a roughly 30% share in 2022. Industry participants are expected to concentrate on expanding their footprint in North America, with Canada expected to see increased demand for construction equipment rental services, prompting the government to increase investments in the region. However, the Asia-Pacific region is expected to gain traction in the global construction equipment rental market in the near future. Because of the increasing emphasis by governments on developing infrastructure for a sustainable economy, Asia-Pacific is one of the largest markets that has seen a boom in infrastructure and construction development. This region saw an increase in the number of Special Economic Zones (SEZs), hydroelectric projects, dams, highway constructions, metro constructions, airports, and other infrastructure projects to support high-level industrial activities, rising energy demand, and improved connectivity.

The global construction equipment rental market is segmented into earthmoving machinery, material handling machinery, concrete and road construction machinery, and others. The earthmoving machinery segment accounted for a major market share of over 50% in 2022. The increasing application of earthmoving excavators for mining, agriculture, and construction industries significantly contributes to segmental growth. Excavators, loaders, dozers, backhoes, and motor graders all have a high load capacity and improved engine performance. These features of earthmoving equipment make them suitable for use in harsh working environments. Moreover, the growing construction of residential and large-scale commercial civil projects has increased the inclination of construction companies and contractors towards leasing earthmoving equipment. On the other hand, the concrete and road construction machinery segment is anticipated to register a higher compound annual growth rate compared to other segments from 2023 to 2028.

Road connectivity has the potential to define the future economy of the country, as an established infrastructure plays a crucial role in improving trade and commerce activities. In November 2021, the U.S. federal government passed the Bipartisan Infrastructure Deal (Infrastructure Investment and Jobs Act), which enables investments worth $110 billion to rebuild roads, bridges, and others in five years. Safe streets and roads will be developed to reduce traffic fatalities and improve connectivity. Moreover, many developing countries in the Asia Pacific, such as China and India, focus on creating better road connectivity. For instance, China's "One Belt, One Road" initiative will connect China with European countries. The total estimated cost for the overall project is USD 1.3 trillion. Similarly, according to the new budget for 2022-23, the Indian government has planned to invest $529.7 billion to improve road connectivity by developing new highways. Thus, the government's increasing investment in mega road and highway construction projects is expected to create a demand for concrete and road construction machinery across the world. Concrete and road construction equipment includes cement and transit mixers, compactors and road rollers, pavers and asphalt finishers, and others.

Furthermore, rapid industrialization and rising demand for construction equipment for industrial applications are expected to drive significant market growth in the material handling equipment segment. Dumpers dump trucks, and tippers (articulated and rigid), cranes (tower cranes and mobile cranes), mast- and telescopic handlers, and forklifts are examples of material handling construction equipment. With a greater emphasis on maximising output, industries are seeking to reduce capital expenditures, a large portion of which is spent on purchasing material handling machinery. Major corporations can increase their profit margins by taking advantage of the same rental benefit.

Over the medium term, the expanding construction industry, particularly in developing countries, will drive market growth due to numerous growth opportunities in the residential, non-residential, and infrastructure sectors. For example, the increased construction of multi-family houses (due to the growing trend of nuclear families) as well as increased investments in the construction of motorways, bridges, metros, smart cities, highways, and roads as a result of rising population and urbanisation Furthermore, the rising trend towards automation is expected to fuel market growth. Based on these factors, residential construction equipment rental is dominating the market. However, increased commercial use is driving market growth for non-residential applications. This segment is expected to grow at a CAGR of more than 6% in the coming years.

Factors such as stringent emission regulations for construction machinery are anticipated to hamper the growth of the market by 2028. Constant improvements in the infrastructure industry and a diverse range of cutting-edge construction equipment in rental fleets are anticipated to spur demand for construction equipment rental services across the globe. Companies in the market are skilled at identifying consumers and accordingly repositioning construction equipment in diverse locations to control the swelling demand from the real estate sector in residential and commercial areas. Furthermore, stringent guidelines, the cumulative ownership price, and financial restraints are some of the important motives stimulating the growth of the global construction equipment rental market.

In addition to rentals, industry companies provide new and used equipment sales, maintenance, and safety training to meet users’ earnings and revenue goals. The construction equipment rental market share is growing due to strong demand for heavy machinery equipment and increasing economic growth around the world. Furthermore, as the number of smart city initiatives grows, the market will expand rapidly. Large construction projects by various regional governments, such as Al Maktoum Airport in Dubai, the South-to-North Water Transfer Project in China, the Crossrail Project in the UK, and the Rashtriya Rajmarg Zila Sanjoyokta Pariyojna in India, are expected to contribute to the construction equipment rental market's growth. Nowadays, contractors and dealers are opting for rentals to reduce the size of their fleets and lower the complexity in organisations that may otherwise affect activities, namely asset disposals, logistics, maintenance, and procurement. The Construction Equipment Rental Association (CERA) stated that there is a substantial growth in the number of rental service consumers in emerging economies, such as Mexico, India, and China. It is mainly occurring as small and medium-sized enterprises (SMEs) focus on gaining more flexibility.

Rapid technological advancement in the automobile and heavy equipment sectors has increased the efficiency and performance of construction machines. The prominent players in the equipment market are primarily focusing on developing smarter machines by incorporating proprietary technology systems. The telematics system provides brief information about the location and level of performance of construction equipment as well as the vehicle. Data relayed through the system includes engine hours idling, GPS location, and fuel consumption; however, the systems require huge investment, which makes them unaffordable for many small builders and contractors. Thus, the construction equipment rental service has overcome the issue by removing the total cost of ownership and providing them with rental options. However, many factors are driving the growth of the construction equipment rental market, and the pandemic has posed a severe challenge to its market. The 2019-20 pandemic has resulted in global supply chain disruptions, shutting down several production facilities, which has harshly affected the infrastructure industry and subsequently affected the equipment rental industry.

Construction Equipment Rental Start-ups:

- EquipmentShare is a SaaS-powered marketplace for construction equipment leasing and smart digital solutions. It offers a means for contractors to rent and lease contracting equipment such as excavators, construction equipment rental, skid loaders, lifts, and more. It also offers a cloud-connected infrastructure outfitted with telematics and machine hardware to provide construction and industrial firms with a real-time picture of project locations.

- Bigrenttz rents out heavy construction equipment. Users can explore its equipment collection on its webpage and hire it on an hourly, daily, weekly, or recurring basis. Customers can hire the equipment by completing an online form. BigRentz both delivers and collects the equipment.

The Most Rented Construction Equipment

Scaffolding (Estimated Price: $15 to $40 per day), Forklift (Estimated Price: $225 to $750 per day), Trencher (Estimated Price: $125 to $300 per day), Lift (Estimated Price: $100 to $400 per day), Scissor Lift (Estimated Price: $100 to $300 per day), Auger (Estimated Price: $25 to $100 per day), Mini-Excavator (Estimated Price: $200 to $500 per day), Excavator (Estimated Price: $225 to $750 per day), Sod Cutter (Estimated Price: $75 to $125 per day), Backhoe (Estimated Price: $150 to $500 per day), Floor Sander (Estimated Price: $50 to $100 per day), Ladder (Estimated Price: $20 to $50 per day), Boom Lift (Estimated Price: $250 to $400 per day), Heavy Equipment (Estimated Price: $400 to $2,000 per day), Log-Splitter (Estimated Price: $50 to $100 per day), Paint Sprayer (Estimated Price: $40 to $120 per day), Crane (Estimated Price: $200 to $1,000 per day), Bucket Truck (Estimated Price: $650 to $950 per day), Lawn Mower (Estimated Price: $30 to $100 per day), Chainsaw (Estimated Rental Price: $50 to $150 per day)Recent Developments

- December 2022: Online crane rental service based in Dubai MyCrane has its own operation in the United States. The company stated that it chose to set up its own operations in the United States rather than appointing a franchisee, as it has done in other locations.

- On November 1, 2022, United Rentals, Inc., one of the leading global providers of equipment rentals, declared that Shell had received a fleet of all-electric vehicles for use at its Geismar (Louisiana) Chemical Manufacturing facility. As part of a pilot programme for on-site electric vehicle (EV) mobility, Shell is employing rental equipment to support plant maintenance activities. To support the planned creation of low-carbon, environmentally friendly fleet policies for rental and Shell-owned vehicles, the program will test and assess the use of electric vehicles at the manufacturing site.

- In July 2022, United Rentals, Inc. declared that it would provide Turner Construction with environmentally friendly options such as all-electric trucks and zero-emission power systems. Turner will use the rented machinery to lessen the impact of the construction site on the environment when building a hyper-scale data centre in Kansas City, Missouri, for Meta, formerly the Facebook firm. The equipment package comprises a 9.6-kilowatt Pro Power onboard generator system in addition to an all-electric, zero-emissions Ford F-150 Lightning pickup truck with a range of up to 320 miles and a maximum towing capability of 10,000 pounds.

- October, 2022: The 50-tonne 653 E Electro Battery is Sennebogen's first battery-powered telescopic crawler crane. It was created in collaboration with dealer Van den Heuvel for the Dutch crane rental and construction markets, and it features coordinated battery technology and analogue charging management.

- March 20, 2022: MyCrane has released a free crane selector tool to assist users in determining the best crane for their lift, as well as the crane's capacity and optimal configuration. The company has completed its digital crane rental tool and improved the customer's work process.

- August 20, 2022: Atlas Crane Service, LLC, a full-service crane rental company primarily serving the wind industry, announced that a fund managed by Ares Management's Infrastructure Opportunities strategy has purchased a controlling interest in the company.

- July 19, 2022: Joint Rent, Inc. announced today that it will provide Turner Construction with sustainable solutions that include all-electric trucks and zero-emissions power systems. Turner will use rental equipment to build a hyper-scale data centre in Kansas City, Missouri, for Meta, formerly the Facebook Company, to reduce the environmental impact of the job site.

- March 11, 2022: Sunbelt Rentals announced the availability of the Sunbelt Rentals mobile app to help customers manage all aspects of their rental experience.

- 12 May 2022: Giken and Actio Corporation enter into a rental business alliance

Product Launches

- CanLift Equipment Ltd., a material handling manufacturer, expanded its product line by adding nine new aerial lift machines from XCMG, a leading construction manufacturing company.

- Sandvik is bringing its financial muscle and ambition to the rental market in the United States. The company will begin by supplying Sandvik DX700 tracked drills, which are often used in quarrying and highway construction, as part of a long-term expansion plan for the service. The company is launching its service in five states at first, with Tennessee, Kentucky, Georgia, North Carolina, and South Carolina being chosen since the rental concept is most well-established on the East Coast.

- Eqpme is an out-of-the-box idea that creates a seamless platform for renting out equipment. It’s a digital marketplace where those looking to rent equipment may connect with others who already have it without having to leave their house. Large and micro excavators, wheel loaders, scissor and boom lifts, industrial forklifts, rough terrain forklifts, skid steers, backhoe loaders, and telehandlers are among the construction equipment available on the platform. Compressors, cranes, generators, tractors, light towers, and bulldozers are just a few examples of construction equipment.

- Getable, a major provider of online equipment rental reservations, announced a new tool and equipment rental product offering last week. General contractors and the businesses from which they rent construction equipment will benefit from the mobile-first solution.

- Getable’s new construction rental app is mobile software for contractors that is intended for the iPhone and provides complete equipment management on and off the jobsite. This includes making new reservations, requesting service and maintenance, scheduling pickup, and seeing what is currently on the jobsite.

- November 20, 2022: Maxim Crane Works L.P. has announced the launch of Maxim MarketplaceTM, a new online marketplace for used equipment sales. With hundreds of fleet-owned cranes and support equipment to sell, the US rental giant is refreshing its fleet via its own cutting-edge online used equipment sales platform, developed in collaboration with Krank, the industry's first software developer.

Merger & Acquisition

- June 2022: Sunbelt Rentals announced its partnership with Britishvolt to support the development of Britishvolt’s first full-scale Cambois-based battery, the Gigaplant. This long-term deal will also see the companies work closely together to favour the development of battery solutions for power plants and heavy equipment to help decarbonize the construction and equipment rental sectors.

- In September 2022, H&E Equipment Services, a leading integrated equipment firm, announced the acquisition of Illinois-based One Source Equipment Rental. The transaction aided the corporation in expanding its geographic reach.

- In January 2019, Nationwide Platforms Limited, Loxam’s wholly-owned UK subsidiary, completed the acquisition of UK Platforms Limited from HSS Hire Group Plc. UKP has approximately 120 employees and operates a fleet of circa 3000 powered access units.

- In October 2018, United Rental Inc. acquired WesternOne Rentals & Sales LP, a Canada-based leading equipment rental provider of aerial lifts and heat solutions, to expand its business in Western Canada.

- For instance, in April 2021, United Rental Inc. announced the complete asset acquisition of General Finance Corporation; this acquisition was part of the company’s strategic moves to expand its existing product portfolio.

- In March 2018, Ashtead Group acquired the business and assets of Above and Beyond Equipment Rentals LLC and Above and Beyond of Fairfield Country Inc. A&B is an aerial work platform rental business in Connecticut, US.

- In November 2021, Herc Holdings Inc., which is a leading equipment rental supplier based in Florida, U.S., announced the acquisition of all assets of Reliable Equipment, LLC, which is a New Hampshire-based equipment rental company with branches in Dover and Londonderry. The addition of Reliable Equipment expanded the company's presence in New England to eight other locations, allowing the company to serve existing and new customers with a larger fleet and improved responsiveness while also providing greater scale to operate more efficiently across the Northeast U.S.

- In June 2021, The Loxam Group, which is a reputed equipment rental company headquartered in Paris, France, announced the acquisition of MaskinSlussen in Lidköping, Sweden, by its wholly owned subsidiary, Ramirent. The acquisition had strengthened Ramirent's core business of local equipment rental and expanded its geographical coverage, allowing it to better serve all customers.

Covid-19 Impacts:

The demand from the equipment rental industry was impacted by the COVID-19 pandemic. The global lockdown restrictions prevented the fulfilment of contractual obligations, resulting in a sharp decline in market revenue. The pandemic has delayed the completion of public infrastructure and private housing projects. Additionally, after the outbreak of the COVID-19 pandemic across the key economies, most of the leading market players registered a significant drop in their revenue generation and profit margins. Further, the sudden closure of the manufacturing facility, which affected the rate of daily output from the production facilities, played a pivotal role in plummeting the sales of these market players. However, the market witnessed substantial growth in 2021 as many rental businesses took advantage of the uncertainty caused by the pandemic. The global construction industry moved at an erratic pace each time a wave of COVID-19 hit, prompting small and medium-sized construction firms to rent rather than buy equipment. The uncertainty in the construction sector is expected to be exacerbated by rising commodity prices, a shortage of skilled labour, and high interest rates for construction companies. Therefore, the above factors are expected to increase the acceptance of rental construction equipment in the market.Major Companies present in the market:

Atiko Corporation, Nishio Rent All Co., Nikken Corporation, Mtandt Group, Caterpillar Inc., Sumitomo Corp., Hitachi Construction Machinery (Hitachi Group), Hyundai Construction Equipment Ltd., Loxam Group, Finning International Inc, Maxima Carne Works Lp, Ashtead Group Plc, Byrne Group, Liebherr - International Ag, Boels Rental, United Rental Inc, H&E Equipment Services Inc., Sunbelt, Kanamoto Co Ltd, Herc Rentals Inc.Considered in this report

- Geography: Global

- Historic year: 2017

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report

- Global Construction Equipment Rental market with its value and forecast along with its segments

- Region-wise Construction Equipment Rental market analysis

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

Regions & Countries covered in the report:

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- South America (Brazil, Argentina, Colombia)

- Middle-East & Africa (UAE, Saudi Arabia, South Africa)

By Equipment Type:

- Earthmoving

- Material Handling

- Concrete & Road Construction

- Others

By Application Type:

- Residential

- Non-Residential

- Others (Infrastructure, industrial, real estate, etc)

By Propulsion Type:

- ICE

- Electric

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and list out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, and annual reports of companies, analyzing the government-generated reports and databases. After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this the publisher has started doing primary calls to consumers by equally segmenting consumers into regional aspects, tier aspects, age groups, and gender. Once the publisher has primary data with us we started verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to the Construction Equipment Rental industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.Table of Contents

1. Executive Summary2. Market Dynamics

2.1. Market Drivers

2.2. Challenges

2.3. Opportunity

2.4. Restraints

2.5. Market Trends

2.6. Covid-19 Effect

2.7. Supply chain Analysis

2.8. Policy & Regulatory Framework

2.9. Industry Experts Views

3. Research Methodology

3.1. Secondary Research

3.2. Primary Data Collection

3.3. Market Formation & Validation

3.4. Report Writing, Quality Check & Delivery

4. Market Structure

4.1. Market Considerate

4.2. Assumptions

4.3. Limitations

4.4. Abbreviations

4.5. Sources

4.6. Definitions

5. Economic /Demographic Snapshot

6. Competitive Landscape

6.1. Competitive Dashboard

6.2. Business Strategies Adopted by Key Players

6.3. Key Players Market Share Insights and Analysis, 2022

6.4. Key Players Market Positioning Matrix

6.5. Consolidated SWOT Analysis of Key Players

6.6. Porter's Five Forces

7. Global Construction Equipment Rental Market Outlook

7.1. Market Size By Value

7.2. Market Size and Forecast, By Geography

7.3. Market Size and Forecast, By Equipment Type

7.4. Market Size and Forecast, By Application Type

7.5. Market Size and Forecast, By Propulsion System

8. North America Construction Equipment Rental Market Outlook

8.1. Market Size By Value

8.2. Market Share By Country

8.3. Market Size and Forecast By Equipment Type

8.4. Market Size and Forecast By Application Type

8.5. US Construction Equipment Rental Market Outlook

8.5.1. Market Size By Value

8.5.2. Market Size and Forecast By Equipment Type

8.5.3. Market Size and Forecast By Application Type

8.6. Canada Construction Equipment Rental Market Outlook

8.6.1. Market Size By Value

8.6.2. Market Size and Forecast By Equipment Type

8.6.3. Market Size and Forecast By Application Type

8.7. Mexico Construction Equipment Rental Market Outlook

8.7.1. Market Size By Value

8.7.2. Market Size and Forecast By Equipment Type

8.7.3. Market Size and Forecast By Application Type

9. Europe Construction Equipment Rental Market Outlook

9.1. Market Size By Value

9.2. Market Share By Country

9.3. Market Size and Forecast By Equipment Type

9.4. Market Size and Forecast By Application Type

9.5. Germany Construction Equipment Rental Market Outlook

9.5.1. Market Size By Value

9.5.2. Market Size and Forecast By Equipment Type

9.5.3. Market Size and Forecast By Application Type

9.6. UK Construction Equipment Rental Market Outlook

9.6.1. Market Size By Value

9.6.2. Market Size and Forecast By Equipment Type

9.6.3. Market Size and Forecast By Application Type

9.7. France Construction Equipment Rental Market Outlook

9.7.1. Market Size By Value

9.7.2. Market Size and Forecast By Equipment Type

9.7.3. Market Size and Forecast By Application Type

9.8. Italy Construction Equipment Rental Market Outlook

9.8.1. Market Size By Value

9.8.2. Market Size and Forecast By Equipment Type

9.8.3. Market Size and Forecast By Application Type

9.9. Spain Construction Equipment Rental Market Outlook

9.9.1. Market Size By Value

9.9.2. Market Size and Forecast By Equipment Type

9.9.3. Market Size and Forecast By Application Type

9.10. Russia Construction Equipment Rental Market Outlook

9.10.1. Market Size By Value

9.10.2. Market Size and Forecast By Equipment Type

9.10.3. Market Size and Forecast By Application Type

10. Asia-Pacific Construction Equipment Rental Market Outlook

10.1. Market Size By Value

10.2. Market Share By Country

10.3. Market Size and Forecast By Equipment Type

10.4. Market Size and Forecast By Application Type

10.5. China Construction Equipment Rental Market Outlook

10.5.1. Market Size By Value

10.5.2. Market Size and Forecast By Equipment Type

10.5.3. Market Size and Forecast By Application Type

10.6. Japan Construction Equipment Rental Market Outlook

10.6.1. Market Size By Value

10.6.2. Market Size and Forecast By Equipment Type

10.6.3. Market Size and Forecast By Application Type

10.7. India Construction Equipment Rental Market Outlook

10.7.1. Market Size By Value

10.7.2. Market Size and Forecast By Equipment Type

10.7.3. Market Size and Forecast By Application Type

10.8. Australia Construction Equipment Rental Market Outlook

10.8.1. Market Size By Value

10.8.2. Market Size and Forecast By Equipment Type

10.8.3. Market Size and Forecast By Application Type

10.9. South Korea Construction Equipment Rental Market Outlook

10.9.1. Market Size By Value

10.9.2. Market Size and Forecast By Equipment Type

10.9.3. Market Size and Forecast By Application Type

11. South America Construction Equipment Rental Market Outlook

11.1. Market Size By Value

11.2. Market Share By Country

11.3. Market Size and Forecast By Equipment Type

11.4. Market Size and Forecast By Application Type

11.5. Brazil Construction Equipment Rental Market Outlook

11.5.1. Market Size By Value

11.5.2. Market Size and Forecast By Equipment Type

11.5.3. Market Size and Forecast By Application Type

11.6. Argentina Construction Equipment Rental Market Outlook

11.6.1. Market Size By Value

11.6.2. Market Size and Forecast By Equipment Type

11.6.3. Market Size and Forecast By Application Type

11.7. Columbia Construction Equipment Rental Market Outlook

11.7.1. Market Size By Value

11.7.2. Market Size and Forecast By Equipment Type

11.7.3. Market Size and Forecast By Application Type

12. Middle East & Africa Construction Equipment Rental Market Outlook

12.1. Market Size By Value

12.2. Market Share By Country

12.3. Market Size and Forecast By Equipment Type

12.4. Market Size and Forecast By Application Type

12.5. UAE Construction Equipment Rental Market Outlook

12.5.1. Market Size By Value

12.5.2. Market Size and Forecast By Equipment Type

12.5.3. Market Size and Forecast By Application Type

12.6. Saudi Arabia Construction Equipment Rental Market Outlook

12.6.1. Market Size By Value

12.6.2. Market Size and Forecast By Equipment Type

12.6.3. Market Size and Forecast By Application Type

12.7. South Africa Construction Equipment Rental Market Outlook

12.7.1. Market Size By Value

12.7.2. Market Size and Forecast By Equipment Type

12.7.3. Market Size and Forecast By Application Type

13. Company Profile

13.1. Atiko Corporation

13.1.1. Company Snapshot

13.1.2. Company Overview

13.1.3. Financial Highlights

13.1.4. Geographic Insights

13.1.5. Business Segment & Performance

13.1.6. Product Portfolio

13.1.7. Key Executives

13.1.8. Strategic Moves & Developments

13.2. Nishio Rent All Co.

13.3. Nikken Corporation

13.4. Mtandt Group

13.5. Caterpillar Inc.

13.6. Sumitomo Corp.

13.7. Hitachi Construction Machinery (Hitachi Group)

13.8. Hyundai Construction Equipment Ltd.

13.9. Loxam Group

13.10. Finning International Inc

13.11. Maxima Carne Works Lp

13.12. Ashtead Group Plc

13.13. Byrne Group

13.14. Liebherr - International Ag

13.15. Boels Rental

13.16. United Rental Inc

13.17. H&E Equipment Services Inc.

13.18. Sunbelt

13.19. Kanamoto Co Ltd

13.20. Herc Rentals Inc.

14. Strategic Recommendations

15. Annexure

15.1. FAQ`s

15.2. Notes

15.3. Related Reports

16. Disclaimer

List of Figures

Figure 1: Global Construction Equipment Rental Market Size (USD Billion) By Region, 2022 & 2028

Figure 2: Market attractiveness Index, By Region 2028

Figure 3: Market attractiveness Index, By Segment 2028

Figure 4: Competitive Dashboard of top 5 players, 2022

Figure 5: Market Share insights of key players, 2022

Figure 6: Porter's Five Forces of Global Construction Equipment Rental Market

Figure 7: Global Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 8: Global Construction Equipment Rental Market Share By Region (2022)

Figure 9: North America Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 10: North America Construction Equipment Rental Market Share By Country (2022)

Figure 11: US Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 12: Canada Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 13: Mexico Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 14: Europe Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 15: Europe Construction Equipment Rental Market Share By Country (2022)

Figure 16: Germany Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 17: UK Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 18: France Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 19: Italy Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 20: Spain Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 21: Russia Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 22: Asia-Pacific Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 23: Asia-Pacific Construction Equipment Rental Market Share By Country (2022)

Figure 24: China Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 25: Japan Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 26: India Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 27: Australia Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 28: South Korea Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 29: South America Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 30: South America Construction Equipment Rental Market Share By Country (2022)

Figure 31: Brazil Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 32: Argentina Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 33: Columbia Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 34: Middle East & Africa Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 35: Middle East & Africa Construction Equipment Rental Market Share By Country (2022)

Figure 36: UAE Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 37: Saudi Arabia Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 38: South Africa Construction Equipment Rental Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

List of Table

Table 1: Global Construction Equipment Rental Market Snapshot, By Segmentation (2022 & 2028) (in USD Billion)

Table 2: Influencing Factors for Global Construction Equipment Rental Market, 2022

Table 3: Top 10 Counties Economic Snapshot 2020

Table 4: Economic Snapshot of Other Prominent Countries 2020

Table 5: Average Exchange Rates for Converting Foreign Currencies into U.S. Dollars

Table 6: Global Construction Equipment Rental Market Size and Forecast, By Geography (2017 to 2028F) (In USD Billion)

Table 7: Global Construction Equipment Rental Market Size and Forecast, By Equipment Type (2017 to 2028F) (In USD Billion)

Table 8: Global Construction Equipment Rental Market Size and Forecast, By Application Type (2017 to 2028F) (In USD Billion)

Table 9: Global Construction Equipment Rental Market Size and Forecast, By Propulsion System (2017 to 2028F) (In USD Billion)

Table 10: North America Construction Equipment Rental Market Size and Forecast By Equipment Type (2017 to 2028F) (In USD Billion)

Table 11: North America Construction Equipment Rental Market Size and Forecast By Application Type (2017 to 2028F) (In USD Billion)

Table 12: US Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 13: US Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 14: Canada Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 15: Canada Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 16: Mexico Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 17: Mexico Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 18: Europe Construction Equipment Rental Market Size and Forecast By Equipment Type (2017 to 2028F) (In USD Billion)

Table 19: Europe Construction Equipment Rental Market Size and Forecast By Application Type (2017 to 2028F) (In USD Billion)

Table 20: Germany Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 21: Germany Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 22: UK Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 23: UK Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 24: France Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 25: France Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 26: Italy Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 27: Italy Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 28: Spain Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 29: Spain Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 30: Russia Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 31: Russia Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 32: Asia-Pacific Construction Equipment Rental Market Size and Forecast By Equipment Type (2017 to 2028F) (In USD Billion)

Table 33: Asia-Pacific Construction Equipment Rental Market Size and Forecast By Application Type (2017 to 2028F) (In USD Billion)

Table 34: China Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 35: China Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 36: Japan Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 37: Japan Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 38: India Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 39: India Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 40: Australia Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 41: Australia Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 42: South Korea Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 43: South Korea Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 44: South America Construction Equipment Rental Market Size and Forecast By Equipment Type (2017 to 2028F) (In USD Billion)

Table 45: South America Construction Equipment Rental Market Size and Forecast By Application Type (2017 to 2028F) (In USD Billion)

Table 46: Brazil Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 47: Brazil Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 48: Argentina Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 49: Argentina Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 50: Columbia Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 51: Columbia Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 52: Middle East & Africa Construction Equipment Rental Market Size and Forecast By Equipment Type (2017 to 2028F) (In USD Billion)

Table 53: Middle East & Africa Construction Equipment Rental Market Size and Forecast By Application Type (2017 to 2028F) (In USD Billion)

Table 54: UAE Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 55: UAE Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 56: Saudi Arabia Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 57: Saudi Arabia Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 58: South Africa Construction Equipment Rental Market Size and Forecast By Equipment Type (2017, 2022 & 2028F)

Table 59: South Africa Construction Equipment Rental Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | January 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( $ | $ 82.43 Billion |

| Forecasted Market Value ( $ | $ 111.7 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |