This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

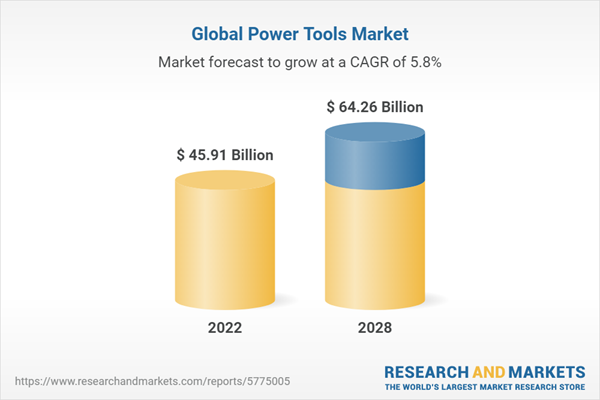

According to the research report, "Global Power Tools Market Outlook, 2028," published by Bonafide Research, the market was valued at USD 45.91 billion in 2021 and is anticipated to reach USD 64.26 billion during the forecast period. Also, the market is projected to grow at a 5.84% CAGR from 2023 to 2028. In car production, over 55 different types of power tools are used, including torque wrenches, impact drivers, air wrenches, power drills, polishing machines, air compressors, spray guns, and others. The increasing production of vehicles is likely to boost demand for the power tool market. Steel, aluminum, zinc, and others are the key materials used in manufacturing power tools. Apart from this, batteries, motors, and other electronic components are used in the production of power tools. Also, with the surge in demand for power tools in the automotive and manufacturing industries, the market for power tools is expected to grow exponentially. Furthermore, power tools are widely used in automotive production and assembly lines, assisting with faster results.It also helps a lot in minimising the overall time that it takes to complete the task within the stipulated time frame. Furthermore, the increasing use of sanders, wrenches, drills, and other tools in the construction sector is enhancing the demand for these power tools.

According to the report, the global power tools market is segmented into five major regions, including North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. Among them, the Asia-Pacific segment is leading with more than 34% market share in 2022, whereas Europe and North America are expected to grow at a significant rate during the forecast period. These regions are considered to be relatively mature and therefore are not able to witness substantial construction expenditures. Similarly, South America is also expected to grow at a steady rate, owing to the stable growth of the industrial sector. Prominent market participants have a strong presence in Asia-Pacific, North America, and Europe. Hence, these companies are focusing on acquiring small and midsized companies with a strong local presence in the market. It allows them to expand their businesses and customer bases in other regions and countries. Based on the countries, the USA is projected to lead the global market with more than 16% of the market by 2028, followed by China with around 11%. In the USA, there has been an increased demand for efficient power tools due to the growing popularity of flexible battery systems that eliminate redundancy and galvanise the productivity of power tool operators. On the other hand, parameters like the growing manufacturing industry, increasing automotive sales, and rising urbanisation in this region are the key factors that propel the enhancement of the market in China.

Technological advancements are another factor influencing the growth of the market. Companies are introducing technologically advanced products in order to enhance the efficiency of their products. For instance, the Flexvolt battery offered by Dewalt automatically switches battery voltage depending on the tool you attach to it. An automatic switch of voltage helps with manually adjusting the power before using different corded power tools. Similarly, in January 2019, Bosch Power Tools introduced the X-Lock angle grinder lock interface. The changing system for grinders ejects wheels with just a pull of a lever and helps eliminate the use of other tools. The Pro Tool Innovation Awards (PTIA) are an annual programme to recognise innovation in the tools, accessories, and fasteners used in the residential and commercial construction industries and related fields. Their goal is to recognise and award manufacturers for releasing tools that are going to change the way we work in the residential and commercial construction industry. Cordless tools made up the largest category in the 2018 edition of the awards.

On the basis of mode of operation, the market is categorised into electric, pneumatic, and others, including hydraulic tools. Among these, the electric tools segment includes cordless and corded tools. It would remain dominant and is also anticipated to witness notable growth. Additionally, it is observed that the global market has revolutionised the work culture of construction, the automotive industry, and others. The cordless electric mode dominated the power tool market in 2022 and is expected to continue to do so throughout the forecast period.Many power tool manufacturers are modifying their product portfolios and increasing the cordless power tool offerings for their customers. Moreover, the cordless tools are user-friendly and easy to use for industrial as well as household applications. For instance, in 2018, Stanley Black & Decker and Robert Bosch diversified their product portfolios as the companies launched several cordless power tools and introduced intelligent power tools for professionals. Pneumatic tools work on compressed air and are conventional, but they result in the overuse of energy. According to the U.S. Department of Energy, tools that are powered by compressed air are less efficient for any manufacturing plant. Also, such tools are frequently used inaccurately. Other tools, such as hydraulic power tools, are anticipated to showcase moderate growth over the forecast period.

Based on tool type, the market is divided into drilling and fastening tools, demolition tools, sawing and cutting tools, material removal tools, routing tools, and others. The drilling and fastening tools segment was estimated to hold the highest power tool market share in 2022. This is attributed to advancements inculcated in the drilling technology by manufacturers. These advancements have enhanced resistance to unbalanced temperatures, high resistance to shocks and vibrations, and increased durability. The worldwide drilling tools market is projected to be driven by an increase in oil exploration and production activities, growing concern about energy security, advancements in drilling technologies enabling greater efficiency and condensed drilling times, and simple supplier access. Another element boosting the drilling tool markets is the increase in shale gas exploration activities. Also, wind turbine installation requires the use of electric fastening tools. Bolts, gearboxes, rotor-bearing tools, and wind turbine foundations all require these fastening tools. Electric fastening tools are considered to be the most suitable power tools for this business since wind turbine installation demands accurate torque. Growing installation capacity may present profitable prospects for power tool manufacturers.

On the other hand, sawing and demolition tools are projected to grow moderately, as they do not have as much hold as drilling and material removal tools. Further, the material removal tools segment is anticipated to witness the highest growth of more than 7%, owing to their demand across car factories, metal processing workshops, and other industrial sites. Material removal tools, such as grinders, sanders, and others, also exhibit considerable penetration across various residential and industrial projects. Based on application, the "industrial" market segment held around 60% of the global market revenue share in 2022. The various industrial applications include using the tools in various industries like construction, automotive, aerospace, energy, and shipbuilding. Increased technological innovation and adoption of advanced technologies among these industries are the pivotal factors for the dominance of industrial applications over the residential segment. Automotive production and assembly lines involve a lot of fastening jobs. Power tools help in reducing the time associated with these redundant tasks, along with providing increased efficiency. Thus, power tools are increasingly used by vehicle manufacturers as well as repair and maintenance service providers in the automotive industry.

Furthermore, among other industry segments, the residential market segment is anticipated to hold the highest CAGR throughout the forecasted period. Power tools are gaining popularity in household applications owing to their easy operability and ease of mobility. The growing trend of do-it-Yourself (DIY) activities has resulted in increased demand from household users. In order to cater to the requirements of users who are not trained professionals, companies are offering products with enhanced safety features. For instance, Bosch Power Tools offers special Bosch Protection features that include a rotation control clutch in rotary hammer drills and restart protection in angle grinders. Such features help in reducing injury risks associated with products and help in the adoption of power tools in household applications.

Recent Developments:

- May 2022: Makita Corporation, one of the key players in the global power tool market and cordless technology, announced the addition of 19 new items to its 40V and 80V max XGT® System. Residential building, metalworking, and woodworking, as well as dust extraction, outdoor power equipment, and other crafts and applications, are among the 19 XGT® releases.

- On January 18, 2022, VTOMAN launched All-in-One Cordless Power Tool Kits on the crowdfunding platform Indiegogo. Every tool in the kit offers a common power supply, which eliminates the need for a different power source for each power tool. VTOMAN utilises a polymer ternary lithium battery, which supports fast charging and takes almost an hour and a half to fully charge. The toolkit consists of a power supply, tyre inflator, and impact wrench, which features a brushless motor delivering up to 517 ft-lbs of breakaway torque with an auto mode control board designed to provide high, medium, and low speeds and prevent over-tightening while offering controlled removal in reverse.

- Craftsman introduced five new products to its expanding V20 platform of portable power tools designed for hobbyists and makers for woodworking, electrical, and on-the-go projects on May 24, 2022.These new tools comprise a V20 rotary tool, a compact personal fan, a soldering iron, an LED light with a magnifying lens, and a power inverter. The rotary tool is intended to provide a variable speed range that can be easily adjusted based on project requirements.It is ideal for cutting, sanding, grinding, carving, and polishing various materials, as it comes with 33 tips and an accessory box.

- In January 2022, Bosch Power Tools, the global leader in power tools and power tool accessories, launched a new hammer drill/driver under the PROFACTOR system. The hammer drill/driver includes Bosch Power Tools' BITURBO Brushless technology to help energise the next generation of high-powered cordless tools.

- In August 2022, a group of scientists from MIT, Massachusetts, developed a highly efficient power tool known as "self-propelled transporters" for boosting the energy output of wind farms. The total energy output of such wind farm installations can be improved by adequately modelling the process of wind flow for the turbines and optimising the methods of control of the individual parts associated with it.

Partnerships, collaborations, and agreements:

- June 2020: Robert Bosch Power Tools GmbH entered into a partnership with Gardena GmbH. The partnership was aimed at enabling users to operate power tools, garden tools, and household appliances from Bosch as well as products bearing the Gardena and other brand names with the same 18-volt battery.

- April 2020: Stanley Black & Decker teamed up with Ford and 3M to supply a DEWALT portable battery solution for their new Powered Air-Purifying Respirators (PAPR). PAPR would be used to protect healthcare professionals on the front lines as they treat COVID-19 pandemic patients.

Acquisitions and mergers:

- November 2019: Atlas Copco acquired the WestRon Group of companies, a group focused on sales, installations, and service of small industrial compressors and blowers. The acquisition broadened its service offering and expanded its presence in the region.

- April 2019: Snap-on completed the acquisition of Power Hawk Technologies, Inc., a company that designs, manufactures, and distributes rescue tools and related equipment. The acquisition enhanced and expanded Snap-on’s capabilities in providing solutions that make work easier for serious professionals who apply their skills in workplaces of consequence, where the costs and penalties of failure are high.

Product Launches and Product Expansions:

- January 2020: Makita released several new cordless models to its product portfolio, for various applications. Chief among them is the new 82mm DKP181 18V brushless LXT planer. The planer was powered by a single 18V lithium-ion battery and incorporated a brushless motor that delivered up to 12,000 rpm. The XRU18 is ideal for professional landscapers because they can use it in robust applications, such as cutting bushes and tall weeds.

- December 2019: Makita U.S.A., Inc. unveiled two new 18-volt LXT brushless cordless rivet tools (XVR01 and XVR02) for assembly and construction needs. The 18-volt LXT brushless cordless rivet tools provide power, speed, and convenience for the application. The BL Brushless Motor provides 10 kN of pulling force on the XVR01 and 20 kN of pulling force on the XVR02.

- November 2019: Apex Tool Group launched the APEX Industrial Fastening brand under the Crescent umbrella as Crescent APEX. Crescent APEX is a new brand that provides innovative power tool accessories used by industrial and construction tradesmen, including their professional line of u-GUARD non-marring covered tools.

Covid-19 Impacts:

The power tool market has been negatively impacted in recent months owing to the lockdowns imposed in the majority of countries across the globe. These lockdowns have resulted in halting the manufacturing of power tools temporarily since the pandemic outbreak in December 2019. The lockdowns imposed have also hampered household tasks, construction, gardening, and repair services, which require power tools as the main equipment, thereby affecting the demand for power tools, which are various types of tools and mechanical devices that are operated using a power source and a mechanism and cannot be operated manually. These could generally include electric motors and compressed air or internal combustion engines. Power tools include many types of devices, from handheld machine drills to hydraulic presses and pneumatic tools. Power tools can be used for various kinds of applications, such as automobiles, household tasks, construction, gardening, etc. The outbreak of COVID-19 has negatively impacted the power tool market; however, the demand for these products is anticipated to recover in the coming months as several governments prepare to lift the lockdowns in a phased manner.Major companies present in the market:

Robert Bosch Gmbh, Stanley Black & Decker, Inc., Hilti Corporation, Atlas Copco Ab, Makita Corporation, Emerson Electric Co., Koki Holdings Co., Ltd., Ingersoll Rand, Techtronic Industries Co., Ltd., Enerpac Tool Group, Apex Tool Group, L.L.C., Snap-On Incorporated, Ferm, Festool Gmbh, Panasonic Corporation, Honeywell International Inc., Kyocera Corporation, Husqvarna Ab, Chevron Group, 3M, and.Considered in this report

- Geography: Global

- 2017 was a historic year.

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report

- The global power tool market with its value and forecast, along with its segments

- Power Tools market analysis by region

- Various drivers and challenges

- Ongoing trends and developments

- Top-profiled companies

- Strategic suggestion

Regions and countries covered in the report:

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- South America (Brazil, Argentina, Colombia)

- Middle East & Africa (UAE, Saudi Arabia, South Africa)

By Tool Type:

- Drilling and fastening tools

- Demolition Tools

- Sawing and cutting tools

- Material Removal Tools

- Routing Tools

- Others

By Operation Mode:

- Electric

- Pneumatic

- Others (hydraulic)

By Application Type:

- Industrial

- Residential

The approach of the report is

This report consists of a combined approach of primary and secondary research. Secondary research was initially used to gain an understanding of the market and list the companies that are present in it.The secondary research consists of third-party sources such as press releases and annual reports of companies, as well as government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephonic interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Following this, we began making primary calls to consumers, segmenting them equally into regional aspects, tier aspects, age groups, and gender.Once we had primary data with us, we started verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations and organisations related to the power tools industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

1. Executive Summary2. Market Dynamics

2.1. Market Drivers

2.2. Challenges

2.3. Opportunity

2.4. Restraints

2.5. Market Trends

2.6. Covid-19 Effect

2.7. Supply chain Analysis

2.8. Policy & Regulatory Framework

2.9. Industry Experts Views

3. Research Methodology

3.1. Secondary Research

3.2. Primary Data Collection

3.3. Market Formation & Validation

3.4. Report Writing, Quality Check & Delivery

4. Market Structure

4.1. Market Considerate

4.2. Assumptions

4.3. Limitations

4.4. Abbreviations

4.5. Sources

4.6. Definitions

5. Economic /Demographic Snapshot

6. Competitive Landscape

6.1. Competitive Dashboard

6.2. Business Strategies Adopted by Key Players

6.3. Key Players Market Share Insights and Analysis, 2022

6.4. Key Players Market Positioning Matrix

6.5. Consolidated SWOT Analysis of Key Players

6.6. Porter's Five Forces

7. Global Power Tools Market Outlook

7.1. Market Size By Value

7.2. Market Size and Forecast, By Geography

7.3. Market Size and Forecast, By Tools Type

7.4. Market Size and Forecast, By Mode of Operation

7.5. Market Size and Forecast, By Application Type

8. North America Power Tools Market Outlook

8.1. Market Size By Value

8.2. Market Share By Country

8.3. Market Size and Forecast By Tools Type

8.4. Market Size and Forecast By Mode of Operation

8.5. Market Size and Forecast By Application Type

8.6. US Power Tools Market Outlook

8.6.1. Market Size By Value

8.6.2. Market Size and Forecast By Tools Type

8.6.3. Market Size and Forecast By Mode of Operation

8.6.4. Market Size and Forecast By Application Type

8.7. Canada Power Tools Market Outlook

8.7.1. Market Size By Value

8.7.2. Market Size and Forecast By Tools Type

8.7.3. Market Size and Forecast By Mode of Operation

8.7.4. Market Size and Forecast By Application Type

8.8. Mexico Power Tools Market Outlook

8.8.1. Market Size By Value

8.8.2. Market Size and Forecast By Tools Type

8.8.3. Market Size and Forecast By Mode of Operation

8.8.4. Market Size and Forecast By Application Type

9. Europe Power Tools Market Outlook

9.1. Market Size By Value

9.2. Market Share By Country

9.3. Market Size and Forecast By Tools Type

9.4. Market Size and Forecast By Mode of Operation

9.5. Market Size and Forecast By Application Type

9.6. Germany Power Tools Market Outlook

9.6.1. Market Size By Value

9.6.2. Market Size and Forecast By Tools Type

9.6.3. Market Size and Forecast By Mode of Operation

9.6.4. Market Size and Forecast By Application Type

9.7. UK Power Tools Market Outlook

9.7.1. Market Size By Value

9.7.2. Market Size and Forecast By Tools Type

9.7.3. Market Size and Forecast By Mode of Operation

9.7.4. Market Size and Forecast By Application Type

9.8. France Power Tools Market Outlook

9.8.1. Market Size By Value

9.8.2. Market Size and Forecast By Tools Type

9.8.3. Market Size and Forecast By Mode of Operation

9.8.4. Market Size and Forecast By Application Type

9.9. Italy Power Tools Market Outlook

9.9.1. Market Size By Value

9.9.2. Market Size and Forecast By Tools Type

9.9.3. Market Size and Forecast By Mode of Operation

9.9.4. Market Size and Forecast By Application Type

9.10. Spain Power Tools Market Outlook

9.10.1. Market Size By Value

9.10.2. Market Size and Forecast By Tools Type

9.10.3. Market Size and Forecast By Mode of Operation

9.10.4. Market Size and Forecast By Application Type

9.11. Russia Power Tools Market Outlook

9.11.1. Market Size By Value

9.11.2. Market Size and Forecast By Tools Type

9.11.3. Market Size and Forecast By Mode of Operation

9.11.4. Market Size and Forecast By Application Type

10. Asia-Pacific Power Tools Market Outlook

10.1. Market Size By Value

10.2. Market Share By Country

10.3. Market Size and Forecast By Tools Type

10.4. Market Size and Forecast By Mode of Operation

10.5. Market Size and Forecast By Application Type

10.6. China Power Tools Market Outlook

10.6.1. Market Size By Value

10.6.2. Market Size and Forecast By Tools Type

10.6.3. Market Size and Forecast By Mode of Operation

10.6.4. Market Size and Forecast By Application Type

10.7. Japan Power Tools Market Outlook

10.7.1. Market Size By Value

10.7.2. Market Size and Forecast By Tools Type

10.7.3. Market Size and Forecast By Mode of Operation

10.7.4. Market Size and Forecast By Application Type

10.8. India Power Tools Market Outlook

10.8.1. Market Size By Value

10.8.2. Market Size and Forecast By Tools Type

10.8.3. Market Size and Forecast By Mode of Operation

10.8.4. Market Size and Forecast By Application Type

10.9. Australia Power Tools Market Outlook

10.9.1. Market Size By Value

10.9.2. Market Size and Forecast By Tools Type

10.9.3. Market Size and Forecast By Mode of Operation

10.9.4. Market Size and Forecast By Application Type

10.10. South Korea Power Tools Market Outlook

10.10.1. Market Size By Value

10.10.2. Market Size and Forecast By Tools Type

10.10.3. Market Size and Forecast By Mode of Operation

10.10.4. Market Size and Forecast By Application Type

11. South America Power Tools Market Outlook

11.1. Market Size By Value

11.2. Market Share By Country

11.3. Market Size and Forecast By Tools Type

11.4. Market Size and Forecast By Mode of Operation

11.5. Market Size and Forecast By Application Type

11.6. Brazil Power Tools Market Outlook

11.6.1. Market Size By Value

11.6.2. Market Size and Forecast By Tools Type

11.6.3. Market Size and Forecast By Mode of Operation

11.6.4. Market Size and Forecast By Application Type

11.7. Argentina Power Tools Market Outlook

11.7.1. Market Size By Value

11.7.2. Market Size and Forecast By Tools Type

11.7.3. Market Size and Forecast By Mode of Operation

11.7.4. Market Size and Forecast By Application Type

11.8. Columbia Power Tools Market Outlook

11.8.1. Market Size By Value

11.8.2. Market Size and Forecast By Tools Type

11.8.3. Market Size and Forecast By Mode of Operation

11.8.4. Market Size and Forecast By Application Type

12. Middle East & Africa Power Tools Market Outlook

12.1. Market Size By Value

12.2. Market Share By Country

12.3. Market Size and Forecast By Tools Type

12.4. Market Size and Forecast By Mode of Operation

12.5. Market Size and Forecast By Application Type

12.6. UAE Power Tools Market Outlook

12.6.1. Market Size By Value

12.6.2. Market Size and Forecast By Tools Type

12.6.3. Market Size and Forecast By Mode of Operation

12.6.4. Market Size and Forecast By Application Type

12.7. Saudi Arabia Power Tools Market Outlook

12.7.1. Market Size By Value

12.7.2. Market Size and Forecast By Tools Type

12.7.3. Market Size and Forecast By Mode of Operation

12.7.4. Market Size and Forecast By Application Type

12.8. South Africa Power Tools Market Outlook

12.8.1. Market Size By Value

12.8.2. Market Size and Forecast By Tools Type

12.8.3. Market Size and Forecast By Mode of Operation

12.8.4. Market Size and Forecast By Application Type

13. Company Profile

13.1. Robert Bosch Gmbh

13.1.1. Company Snapshot

13.1.2. Company Overview

13.1.3. Financial Highlights

13.1.4. Geographic Insights

13.1.5. Business Segment & Performance

13.1.6. Product Portfolio

13.1.7. Key Executives

13.1.8. Strategic Moves & Developments

13.2. Stanley Black & Decker, Inc

13.3. Hilti Corporation

13.4. Atlas Copco Ab

13.5. Makita Corporation

13.6. Emerson Electric Co

13.7. Koki Holdings Co, Ltd

13.8. Ingersoll Rand

13.9. Techtronic Industries Co Ltd

13.10. Enerpac Tool Group

13.11. Apex Tool Group, Llc

13.12. Snap-On Incorporated

13.13. Ferm

13.14. Festool Gmbh

13.15. Panasonic Corporation

13.16. Honeywell International Inc.

13.17. Kyocera Corporation

13.18. Husqvarna Ab

13.19. Chevron Group

13.20. 3M

14. Strategic Recommendations

15. Annexure

15.1. FAQ`s

15.2. Notes

15.3. Related Reports

16. Disclaimer

List of Figures

Figure 1: Global Power Tools Market Size (USD Billion) By Region, 2022 & 2028

Figure 2: Market attractiveness Index, By Region 2028

Figure 3: Market attractiveness Index, By Segment 2028

Figure 4: Competitive Dashboard of top 5 players, 2022

Figure 5: Market Share insights of key players, 2022

Figure 6: Porter's Five Forces of Global Power Tools Market

Figure 7: Global Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 8: Global Power Tools Market Share By Region (2022)

Figure 9: North America Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 10: North America Power Tools Market Share By Country (2022)

Figure 11: US Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 12: Canada Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 13: Mexico Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 14: Europe Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 15: Europe Power Tools Market Share By Country (2022)

Figure 16: Germany Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 17: UK Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 18: France Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 19: Italy Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 20: Spain Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 21: Russia Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 22: Asia-Pacific Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 23: Asia-Pacific Power Tools Market Share By Country (2022)

Figure 24: China Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 25: Japan Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 26: India Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 27: Australia Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 28: South Korea Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 29: South America Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 30: South America Power Tools Market Share By Country (2022)

Figure 31: Brazil Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 32: Argentina Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 33: Columbia Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 34: Middle East & Africa Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 35: Middle East & Africa Power Tools Market Share By Country (2022)

Figure 36: UAE Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 37: Saudi Arabia Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

Figure 38: South Africa Power Tools Market Size By Value (2017, 2022 & 2028F) (in USD Billion)

List of Table

Table 1: Global Power Tools Market Snapshot, By Segmentation (2022 & 2028) (in USD Billion)

Table 2: Influencing Factors for Global Power Tools Market, 2022

Table 3: Top 10 Counties Economic Snapshot 2020

Table 4: Economic Snapshot of Other Prominent Countries 2020

Table 5: Average Exchange Rates for Converting Foreign Currencies into U.S. Dollars

Table 6: Global Power Tools Market Size and Forecast, By Geography (2017 to 2028F) (In USD Billion)

Table 7: Global Power Tools Market Size and Forecast, By Tools Type (2017 to 2028F) (In USD Billion)

Table 8: Global Power Tools Market Size and Forecast, By Mode of Operation (2017 to 2028F) (In USD Billion)

Table 9: Global Power Tools Market Size and Forecast, By Application Type (2017 to 2028F) (In USD Billion)

Table 10: North America Power Tools Market Size and Forecast By Tools Type (2017 to 2028F) (In USD Billion)

Table 11: North America Power Tools Market Size and Forecast By Mode of Operation (2017 to 2028F) (In USD Billion)

Table 12: North America Power Tools Market Size and Forecast By Application Type (2017 to 2028F) (In USD Billion)

Table 13: US Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 14: US Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 15: US Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 16: Canada Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 17: Canada Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 18: Canada Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 19: Mexico Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 20: Mexico Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 21: Mexico Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 22: Europe Power Tools Market Size and Forecast By Tools Type (2017 to 2028F) (In USD Billion)

Table 23: Europe Power Tools Market Size and Forecast By Mode of Operation (2017 to 2028F) (In USD Billion)

Table 24: Europe Power Tools Market Size and Forecast By Application Type (2017 to 2028F) (In USD Billion)

Table 25: Germany Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 26: Germany Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 27: Germany Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 28: UK Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 29: UK Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 30: UK Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 31: France Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 32: France Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 33: France Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 34: Italy Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 35: Italy Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 36: Italy Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 37: Spain Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 38: Spain Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 39: Spain Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 40: Russia Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 41: Russia Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 42: Russia Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 43: Asia-Pacific Power Tools Market Size and Forecast By Tools Type (2017 to 2028F) (In USD Billion)

Table 44: Asia-Pacific Power Tools Market Size and Forecast By Mode of Operation (2017 to 2028F) (In USD Billion)

Table 45: Asia-Pacific Power Tools Market Size and Forecast By Application Type (2017 to 2028F) (In USD Billion)

Table 46: China Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 47: China Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 48: China Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 49: Japan Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 50: Japan Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 51: Japan Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 52: India Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 53: India Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 54: India Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 55: Australia Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 56: Australia Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 57: Australia Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 58: South Korea Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 59: South Korea Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 60: South Korea Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 61: South America Power Tools Market Size and Forecast By Tools Type (2017 to 2028F) (In USD Billion)

Table 62: South America Power Tools Market Size and Forecast By Mode of Operation (2017 to 2028F) (In USD Billion)

Table 63: South America Power Tools Market Size and Forecast By Application Type (2017 to 2028F) (In USD Billion)

Table 64: Brazil Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 65: Brazil Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 66: Brazil Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 67: Argentina Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 68: Argentina Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 69: Argentina Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 70: Columbia Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 71: Columbia Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 72: Columbia Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 73: Middle East & Africa Power Tools Market Size and Forecast By Tools Type (2017 to 2028F) (In USD Billion)

Table 74: Middle East & Africa Power Tools Market Size and Forecast By Mode of Operation (2017 to 2028F) (In USD Billion)

Table 75: Middle East & Africa Power Tools Market Size and Forecast By Application Type (2017 to 2028F) (In USD Billion)

Table 76: UAE Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 77: UAE Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 78: UAE Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 79: Saudi Arabia Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 80: Saudi Arabia Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 81: Saudi Arabia Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table 82: South Africa Power Tools Market Size and Forecast By Tools Type (2017, 2022 & 2028F)

Table 83: South Africa Power Tools Market Size and Forecast By Mode of Operation (2017, 2022 & 2028F)

Table 84: South Africa Power Tools Market Size and Forecast By Application Type (2017, 2022 & 2028F)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 165 |

| Published | January 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( $ | $ 45.91 Billion |

| Forecasted Market Value ( $ | $ 64.26 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |