The global high intensity sweeteners industry is significantly impacted by the sweeteners market, which reached a value of around USD 81.7 billion in 2020. Within the sweeteners industry, sugar is the leading type, controlling a significant share in the market by value. While sugar substitutes account for less than a quarter of the market, the rising health consciousness and continuous availability of the products are expected to drive the growth of the segment in the coming years. High intensity sweeteners (HIS) followed sugar as the second largest segment in the sweeteners industry. Within the HIS industry, aspartame is the leading type, accounting for more than 30% of the global market share. The growing demand for aspartame is attributed to its increased application in pharmaceuticals and beverage industries. China is the largest manufacturer of the type, having seven of the major aspartame manufacturers located within the country. Apart from China, the European Union, Japan, and South Korea are the leading producers of aspartame.

The major high-intensity sweeteners producing countries include China, accounting for around 75% of their global production. China is followed by the United States, Western Europe, and others. Asia-Pacific is the largest region, accounting for 35.5% of the global market. It is followed by Europe, North America, and Latin America. The Middle East and Africa is expected to witness a robust growth in the coming years, driven by the product’s rising demand within the region. This growing demand can be attributed to the expanding food and beverage industry.

High Intensity Sweeteners: Market Segmentation

High-intensity sweeteners refer to sugar substitutes, which are used to sweeten as well as enhance the taste of food products. They are widely used in the food and beverage industry. These are usually sweeter than sugar but are required in a much smaller proportion than sugar to achieve the same level of sweetness. It is abundantly used in the place of sugar because despite being much sweeter than sugar, its calorie content is extremely low or negligible.Market Breakup by Type

- Aspartame

- Acesulfame

- Sucralose

- Saccharin

- Cyclamate

- Stevia

- Others

Market Breakup by Application

- Beverage

- Food

- Health Care

- Tabletop Sweeteners

- Others

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Market Analysis

The thriving food and beverage industries are driving the global high-intensity sweeteners market. In the food industry, sugar substitutes are extensively used in industries like bakery, confectionery, frozen foods, and RTE foods. The increasing use of high-intensity sweeteners in soda is propelling the global high intensity sweeteners market growth further. The consumption of beverages is increasing at a rapid rate, especially among the millennials. The use of these sugar substitutes in the beverage and convenience food industries is a significant driver for the industry growth, especially in emerging regions like the Asia-Pacific and Latin America. The rising disposable income of consumers in Asian countries is also supporting the growth of the market.The market growth is aided by the cost-effectiveness of high-intensity sweeteners, as compared to sugar. The growing demand from health-conscious consumers is now shifting from sugar to high-intensity sweeteners due to its low or zero-calorie content. With the increased cases of diseases like obesity and diabetes, people are now opting for healthier options like sugar substitutes. The introduction and approval of new high intensity sweeteners by regulatory authorities like the FDA are also expected to drive the industry growth in the forecast period. The rising popularity of HIS blends is projected to further propel the industry forward.

Key Industry Players in the Global High Intensity Sweeteners Market

The report gives a detailed analysis of the following key players in the global high intensity sweeteners market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:- Sinosweet Co., Ltd.

- Vitasweet Co., Ltd.

- Anhui Jinhe Industrial Co., Ltd.

- Cargill Inc.

- Ingredion Incorporated

- Celanese Corporation

- Pure Circle

- Tate & Lyle PLC

- Others

Table of Contents

Companies Mentioned

The key companies featured in this High Intensity Sweeteners market report include:- Sinosweet Co., Ltd.

- Vitasweet Co., Ltd.

- Anhui Jinhe Industrial Co., Ltd.

- Cargill Inc.

- Ingredion Incorporated

- Celanese Corporation

- Pure Circle

- Tate & Lyle PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 155 |

| Published | August 2025 |

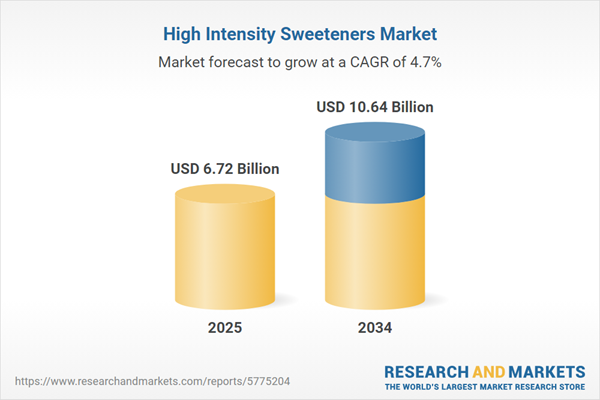

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 6.72 Billion |

| Forecasted Market Value ( USD | $ 10.64 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |