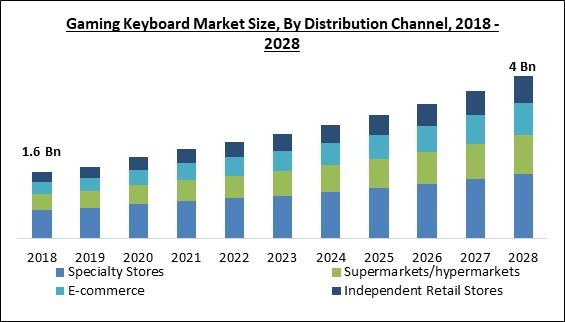

The Global Gaming Keyboard Market size is expected to reach $4 billion by 2028, rising at a market growth of 9.0% CAGR during the forecast period.

A keyboard designed exclusively for gaming on computers is known as a gaming keyboard. Similar to an ultra-light gaming mouse with a perfect sensor or an e-sports gaming monitor with a high refresh rate, a gaming keyboard is a necessary piece of equipment for any gamer's setup because having one can offer the user an advantage over their opponents. In order to enhance the gaming experience, a decent gaming keyboard equips the conventional keyboard with cutting-edge functions.

This can be in terms of aesthetics and performance, such as RGB backlighting to make it easier to discern between keys during late-night gaming sessions and fast-actuation switches to quickly register inputs. With gaming keyboards, users can choose between mechanical and membrane switches. The mechanical keyboards for gamers have key switches that need fewer presses and speed up gameplay.

Additional keys for commonly used key sequences can also be user-configurable. The most crucial element is the speed of the key switch. The 'actuation distance'is the pressure needed to push the key before it makes electrical contact with the circuit. The shorter the distance, the more quickly the key reacts.

For example, the actuation point of a typical mechanical key is 2 millimeters, while on other keyboards, it is 0.4 millimeters. It takes sophisticated software, hardware, and drivers to work with gaming peripherals and devices to provide adequate performance. Market players are working to offer users advanced gaming keyboards with peak performance and a variety of features to provide a great gaming experience.

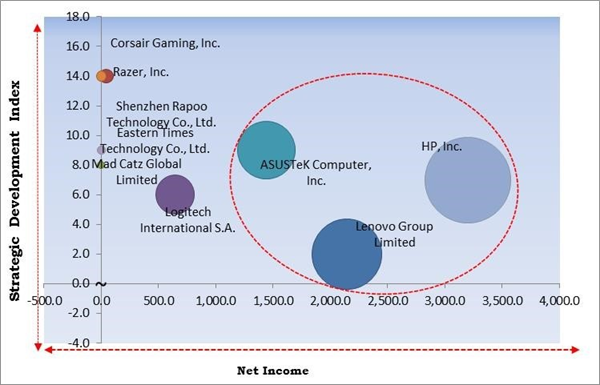

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; ASUSTeK Computer, Inc., Lenovo Group Limited, HP, Inc. are the forerunners in the Gaming Keyboard Market. Companies such as Corsair Gaming, Inc., Razer, Inc. and Logitech International S.A. are some of the key innovators in Gaming Keyboard Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Razer, Inc., Corsair Gaming, Inc., Logitech International S.A., ASUSTeK Computer, Inc., Lenovo Group Limited, HP, Inc., Mad Catz Global Limited, Shenzhen Rapoo Technology Co., Ltd., Eastern Times Technology Co., Ltd. (Redragon), and Mionix AB.

A keyboard designed exclusively for gaming on computers is known as a gaming keyboard. Similar to an ultra-light gaming mouse with a perfect sensor or an e-sports gaming monitor with a high refresh rate, a gaming keyboard is a necessary piece of equipment for any gamer's setup because having one can offer the user an advantage over their opponents. In order to enhance the gaming experience, a decent gaming keyboard equips the conventional keyboard with cutting-edge functions.

This can be in terms of aesthetics and performance, such as RGB backlighting to make it easier to discern between keys during late-night gaming sessions and fast-actuation switches to quickly register inputs. With gaming keyboards, users can choose between mechanical and membrane switches. The mechanical keyboards for gamers have key switches that need fewer presses and speed up gameplay.

Additional keys for commonly used key sequences can also be user-configurable. The most crucial element is the speed of the key switch. The 'actuation distance'is the pressure needed to push the key before it makes electrical contact with the circuit. The shorter the distance, the more quickly the key reacts.

For example, the actuation point of a typical mechanical key is 2 millimeters, while on other keyboards, it is 0.4 millimeters. It takes sophisticated software, hardware, and drivers to work with gaming peripherals and devices to provide adequate performance. Market players are working to offer users advanced gaming keyboards with peak performance and a variety of features to provide a great gaming experience.

COVID-19 Impact Analysis

The government's lockdown during COVID-19 helped the internet and offline gaming industries build their markets. Despite the COVID-19 pandemic having a significant negative impact on the worldwide economy, the gaming industry continued to grow at an astounding rate. Additionally, players increased significantly during the lockdown as people worldwide started investing in offline and online games. As a result, developers of video games like Sony, Tencent, and others saw increased sales during the pandemic. Therefore, during the initial phases of the pandemic, market growth declined, but as more people grew accustomed to gaming, the market began to expand.Market Growth Factors

Growth of E-sports and gaming worldwide

Many e-sports championships have been established worldwide due to the e-sports and gaming industries' tremendous growth over the past ten years. In order to draw people into the electronic gaming industry, numerous corporations and businesses have stepped up and assisted in forming teams in various e-sports leagues. Young people have been motivated to pursue gaming as a career owing to the introduction of e-sports contests, which have raised awareness of electronic gaming. As a result, the popularity of gaming has increased, which has increased sales of gaming peripherals like keyboards and mouse.Introduction of improved and novel technologies and content

The gaming business is always eager to provide its customers with the best and most recent material as technology develops. Graphics are becoming progressively more inventive in the twenty-first century. As a result, games today are of the greatest quality and function at higher frame rates than in the past. The improved visuals have helped the games look more realistic, and many of them have stunning detail and rich, lifelike pictures. Augmented reality (AR) and virtual reality (VR) technical breakthroughs are the primary drivers of the gaming technology industry. The gaming keyboard market will grow with the development of new and improved technology and content.Market Restraining Factor

Slow production of gaming keyboards because of raw material shortage and unavailability of the device in underdeveloped regions

The availability of commonplace electronics like gaming consoles, computers, and technology-driven gaming keyboards has been impeded by a severe shortage of semiconductors. Since there aren't enough raw materials on the market, the main game companies' production goals have been delayed, and their introduction of new products has decreased. A gaming PC or high-end GPU from companies like Nvidia or AMD may not be available for months due to the shortage of semiconductors induced by the COVID-19 pandemic. Also, the biggest gaming accessory producers declared they would cut production over several years. Sales are anticipated to suffer, and the demand for gaming keyboards will suffer due to the lack of gaming accessories on the world market.Product Type Outlook

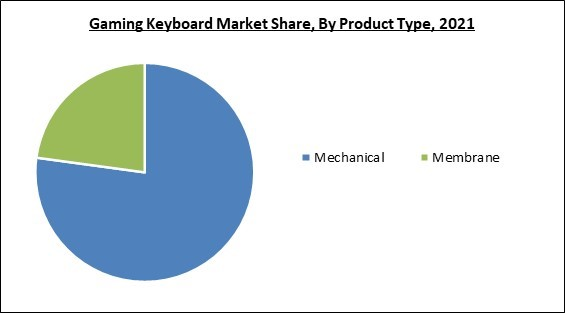

Based on product type, the gaming keyboard market is categorized into mechanical and membrane. The membrane segment procured a considerable growth rate in the gaming keyboard market in 2021. The materials used in the construction of a membrane keyboard are gentle. It, therefore, doesn't produce the distinctive clicking noise either. The continual sound of the keyboard does not require the user to invest extra effort or annoyance. Its simplistic design makes it simple to push the keys and type. Although the keys are silent and enable speedier typing.Price Point Outlook

On the basis of price point, the gaming keyboard market is divided into low-priced, medium-priced, and high-priced. The high-priced segment recorded a significant revenue share in the gaming keyboard market in 2021. The segment is growing as high-priced keyboards are preferred by gamers owing to their numerous advantages. A gaming keyboard's price over a conventional keyboard rises as more features are added. A top-notch gaming keyboard contains additional parts backed by precise key specifications to satisfy the needs of professional-grade users.Distribution Channel Outlook

Based on distribution channel, the gaming keyboard market is segmented into supermarkets/hypermarkets, specialty stores, e-commerce, and independent retail stores. The specialty stores segment witnessed the maximum revenue share in the gaming keyboard market in 2021. A specialty store's key advantage is its focus on several subcategories of gaming accessories. By concentrating on a particular line of products, business owners and staff can show competency and receive respect for their knowledge and uniqueness in the chosen specialization of the company. Consumers visit a specialty store because it has a broader assortment of items within its area of specialization.Connectivity Type Outlook

On the basis of connectivity type, the gaming keyboard market is bifurcated into wired and wireless. The wired segment procured the highest revenue share in the gaming keyboard market in 2021. The number of gamers is rising, fostering the segment's expansion. Due to their suitability for gaming applications, professional gamers often prefer wired keyboards. They are more sensitive to complicated key combinations and have no lags. Users like wired keyboards because they can play games and type without having to worry about replacing the battery or occasionally draining the battery.Regional Outlook

Region wise, the gaming keyboard market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region recorded the largest revenue share in the gaming keyboard market in 2021. MMORPGs (Massively Multiplayer Online Role-Playing Games) and competitive online gaming are well-liked in Asia Pacific, especially in China, Japan, and South Korea. Many select wired gaming keyboards as they can be used with PCs and consoles and are less expensive, where PC gaming is prevalent. Manufacturers are introducing keyboards with features like dual connection to facilitate hassle-free connectivity as well as a better gaming experience in response to rising demand for high-quality goods.The Cardinal Matrix - Gaming Keyboard Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; ASUSTeK Computer, Inc., Lenovo Group Limited, HP, Inc. are the forerunners in the Gaming Keyboard Market. Companies such as Corsair Gaming, Inc., Razer, Inc. and Logitech International S.A. are some of the key innovators in Gaming Keyboard Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Razer, Inc., Corsair Gaming, Inc., Logitech International S.A., ASUSTeK Computer, Inc., Lenovo Group Limited, HP, Inc., Mad Catz Global Limited, Shenzhen Rapoo Technology Co., Ltd., Eastern Times Technology Co., Ltd. (Redragon), and Mionix AB.

Recent Strategies Deployed in Gaming Keyboard Market

Partnerships, Collaborations and Agreements:

- Mar-2023: Razer teamed up with Evisu, a japan based denim and streetwear Fashion Company. Under this collaboration, both companies would together design gaming peripherals including the Razer BlackWidow V3 mechanical keyboard and the Razer Orochi V2 ultra-lightweight wireless mouse.

- Jan-2023: Lenovo came into partnership with Google, a US technology company, Acer, a Taiwanese multinational hardware and electronics corporation, and ASUS, a Taiwanese global computer, and phone hardware electronics company. Under this partnership, Google would unveil Chromebooks ever built by Acer, ASUS, and Lenovo that are designed particularly for cloud gaming.

Product Launches and Product Expansions:

- Feb-2023: Razer introduced BlackWidow V4 Pro, the new gaming Keyboard. This launch broadens Razer's offering of the premium mechanical keyboard. Additionally, the product consists of various features including the options for silent or clicky switches and eight macro keys to rapidly control the battle station.

- Feb-2023: Redragon, a brand owned by Eastern Times, unveiled FIZZ PRO K616, a gaming keyboard. The keyboard is 60% the size of a traditional keyboard, could work with multiple connectivity modes, and accelerates hot-swappable mechanical soft keys for FPS gamers.

- Dec-2022: Redragon, a brand owned by Eastern Times, introduced the Draconic K530 Pro, a diverse and highly ergonomic mechanical keyboard. The product would be designed to be a personal gaming accessory. The K530 Pro is incredibly compact and highly portable with better ergonomics and multi-device pairing.

- Oct-2022: Redragon, a brand owned by Eastern Times, rolled out Castor K631 Pro, a wireless mechanical keyboard for gaming. The product features a compact form factor and consists of RGB abilities as well. Additionally, Redragon delivers a spectrum of controls for the RGB styles utilizing the software to enable higher customizability.

- Oct-2022: CORSAIR released CORSAIR K100 AIR, a Wireless Mechanical Gaming Keyboard. The product is CORSAIR's simple gaming keyboard, with only 11mm at the thinnest point of its stylish brushed aluminum frame. Additionally, the keyboard features Tactile CHERRY MX Ultra Low-Profile mechanical key switches to provide a hyper-responsive, 0.8mm actuation with a satisfying keystroke.

- Sep-2022: CORSAIR introduced the K60 PRO TKL and K70 PRO OPX, the two enticing new optical-mechanical keyboards with CORSAIR OPX key switches. The product provides superior gaming with smooth durable aluminum frames, with enhanced performance with OPX optical-mechanical key switches. Moreover, both product feature hyper-fast CORSAIR OPX optical-mechanical key switches, offering 1.0mm actuation distance and highly smooth linear motion, better for smooth typing and competitive play

- Jul-2022: Razer announced the launch of DeathStalker V2 Pro, DeathStalker V2 Pro Tenkeyless, and DeathStalker V2, the three latest gaming keyboards in its DeathStalker lineup. The product consists of a smooth, shiny, and low-profile design, as well as laser-etched keycaps and a thin aluminum top plate for durability. With this launch, Razer would deliver its gamers a fast, feature-packed gaming keyboard experience.

- Jun-2022: HP’s HyperX Introduced the Pulsefire Haste Wireless gaming mouse and the Alloy Origins 65 mechanical gaming keyboard, across India. The product consists of premium double shot PBT keycaps and mechanical switches and secondary key functions, for enhanced performance and with a lifetime of 80 million clicks per switch.

- Apr-2022: CORSAIR unveiled K70 RGB TKL, a new optical-mechanical version CHAMPION SERIES Gaming Keyboard. The product showcases the stylish aluminum build and tournament-ready tenkeyless design, as well as adding hyper-fast CORSAIR OPX optical-mechanical key switches in its feature. Additionally, The K70 RGB TKL, CORSAIR OPX optical-mechanical key switches consist of a very short 1.0mm actuation distance to smoothly register inputs.

- Apr-2022: Rapoo introduced the all-new Rapoo V500 Pro Strawberry Milk Edition, the latest special edition VC500 Pro. The product includes multiple features like Added Wireless connection support, an entirely new design, and looks and retains all the features of the VC500 Pro standard model.

- Mar-2022: Mad Catz Global Limited introduced the S.T.R.I.K.E. 6, the latest mechanical gaming keyboard. The S.T.R.I.K.E 6 consists of the space-saving relaxation of the compact 60% form factor with high functionality and customization. Additionally, the product takes less desk space for better comfort and an ergonomic gaming experience.

- Feb-2022: CORSAIR announced the launch of K70 RGB PRO, a Mechanical Gaming Keyboard. The K70 RGB PRO provides tournament-grade a completely new meaning with a custom-built tournament switch that rapidly locks to static backlighting and cancels any probable macro activations as gamers compete at the highest level.

- Jan-2022: Rapoo launched The Rapoo V700 RGB, a Gaming Keyboard, across India. The product comes with 108 keys and a considerable chin for palm rest. Rapoo V700 Gaming Keyboard's every key is programmable, and gamers can customize the functionality of the keys as well. Moreover, the product provides onboard storage to enable users to play games based on their customized or preferred controls.

- Jan-2022: Logitech announced the launch of G413 SE and G413 TKL, the latest wired mechanical keyboards. The product consists of a black-brushed aluminum-magnesium alloy top case and white LED lighting. Additionally, both keyboards feature tactile mechanical switches built from PBT plastic and are asserted to be highly durable.

- Oct-2021: RAPOO announced the launch of the GK500 wired Mechanical Backlit Gaming keyboard, a mechanical-key-based wired gaming keyboard, across India. The product showcases a stylish design with multi-colored RGB backlit keys. Additionally, The GK500 is created for tough gaming occasions, with a spill-resistant feature, and also built a gaming atmosphere for a smooth and fatigue-free experience.

- May-2021: ASUS upgraded the Claymore II, a tenkeyless 9TKL) keyboard with a detachable numpad, with the modular keyboard. With the updated version, Asus would deliver both wireless and wired connectivity. Moreover, the product features wireless Aura Sync, intuitive media controls, a battery level LED indicator, and full-length leatherette wrist rest.

- May-2021: Razer unveiled Blackwidow V3 Mini Hyperspeed, a mechanical keyboard. The product features the OEM's HyperSpeed Wireless Technology, a choice of 2 switch types, and an aluminum frame. This launch accelerates Razer's HyperSpeed Wireless Technology, a single-band Wi-Fi-based technology.

Acquisitions and Mergers:

- Jun-2021: HP took over HyperX, the gaming division of Kingston Technology Company. This acquisition strengthens its abilities to build the computing experiences of the future, broaden into valuable adjacencies, and find new sources of growth. Moreover, the acquisition supports HP's strategy to propel growth in its personal systems business, where gaming and accessories are attractive segments.

Scope of the Study

By Distribution Channel

- Specialty Stores

- Supermarkets/hypermarkets

- E-commerce

- Independent Retail Stores

By Product Type

- Mechanical

- Membrane

By Connectivity Type

- Wired

- Wireless

By Price point

- Medium-priced

- High-priced

- Low-priced

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Razer, Inc.

- Corsair Gaming, Inc.

- Logitech International S.A.

- ASUSTeK Computer, Inc.

- Lenovo Group Limited

- HP, Inc.

- Mad Catz Global Limited

- Shenzhen Rapoo Technology Co., Ltd.

- Eastern Times Technology Co., Ltd. (Redragon)

- Mionix AB

Unique Offerings

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 3. Competition Analysis - Global

Chapter 4. Global Gaming Keyboard Market by Distribution Channel

Chapter 5. Global Gaming Keyboard Market by Product Type

Chapter 6. Global Gaming Keyboard Market by Connectivity Type

Chapter 7. Global Gaming Keyboard Market by Price point

Chapter 8. Global Gaming Keyboard Market by Region

Chapter 9. Company Profiles

Companies Mentioned

- Razer, Inc.

- Corsair Gaming, Inc.

- Logitech International S.A.

- ASUSTeK Computer, Inc.

- Lenovo Group Limited

- HP, Inc.

- Mad Catz Global Limited

- Shenzhen Rapoo Technology Co., Ltd.

- Eastern Times Technology Co., Ltd. (Redragon)

- Mionix AB