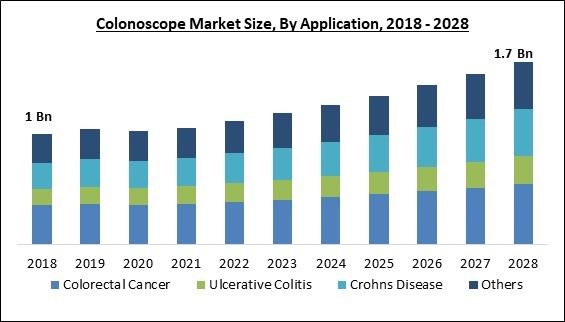

The Global Colonoscope Market size is expected to reach $1.7 billion by 2028, rising at a market growth of 6.8% CAGR during the forecast period.

The colonoscopy is the primary instrument used in basic colonoscopy. In circumstances where cecal intubation is problematic due to significant colonic stricture and curvature, this instrument has a longer length and diameter than a gastroscope. It includes a control section, an instrument channel with forceps, snare, injector, and clip device, a shaft to be introduced into the patient, the tip, a connecting section, and the line.

Certain variants additionally include a lever for varying stiffness. Colonoscopy requires the use of a colonoscope. It provides superior diagnostic specificity and sensitivity compared to barium enema,stool occult blood test, and computed tomography colonography. Colonoscopy permits accurate diagnosis and treatment without the need for invasive surgery. The increasing incidence of colorectal cancer is a major factor behind expanding the colonoscope market.

Moreover, as the therapeutic capacities of colonoscopes increase, the number of colonoscopy procedures is anticipated to skyrocket. The market for colonoscope is driven by the increasing inclination for minimally invasive treatments, technological advancements, and the prevalence of colorectal cancer. However, it is uncertain what causes colorectal cancer. Increased treatment rates, a high prevalence of colon cancer globally, and elevated drug expenses relative to other major regions are significant contributors to its predominance.

The utilization and amount of colonoscopy procedures performed at these facilities contributed to expanding the colonoscope market. Many instruments that enhance visibility angles, such as colonoscopes,short-run radius optics, colonoscopes, gastrointestinal devices with multiple lenses, and various auxiliary devices, contribute to market growth.

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Medtronic PLC is the forerunner in the Colonoscope Market. Companies such as Stryker Corporation, Fujifilm Holdings Corporation, Olympus Corporation are some of the key innovators in Colonoscope Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Medtronic PLC, Stryker Corporation, Olympus Corporation, Fujifilm Holdings Corporation, Ambu A/S, Boston Scientific Corporation, SonoScape Medical Corp., Daichuan Medical (Shenzhen) Co., Ltd. (EndoFresh), and EndoMed Systems GmbH.

The colonoscopy is the primary instrument used in basic colonoscopy. In circumstances where cecal intubation is problematic due to significant colonic stricture and curvature, this instrument has a longer length and diameter than a gastroscope. It includes a control section, an instrument channel with forceps, snare, injector, and clip device, a shaft to be introduced into the patient, the tip, a connecting section, and the line.

Certain variants additionally include a lever for varying stiffness. Colonoscopy requires the use of a colonoscope. It provides superior diagnostic specificity and sensitivity compared to barium enema,stool occult blood test, and computed tomography colonography. Colonoscopy permits accurate diagnosis and treatment without the need for invasive surgery. The increasing incidence of colorectal cancer is a major factor behind expanding the colonoscope market.

Moreover, as the therapeutic capacities of colonoscopes increase, the number of colonoscopy procedures is anticipated to skyrocket. The market for colonoscope is driven by the increasing inclination for minimally invasive treatments, technological advancements, and the prevalence of colorectal cancer. However, it is uncertain what causes colorectal cancer. Increased treatment rates, a high prevalence of colon cancer globally, and elevated drug expenses relative to other major regions are significant contributors to its predominance.

The utilization and amount of colonoscopy procedures performed at these facilities contributed to expanding the colonoscope market. Many instruments that enhance visibility angles, such as colonoscopes,short-run radius optics, colonoscopes, gastrointestinal devices with multiple lenses, and various auxiliary devices, contribute to market growth.

COVID-19 Impact Analysis

During the pandemic, elective surgical procedures were temporarily halted. Furthermore, to limit the danger of COVID-19 transmission, colonoscopy centers have postponed and canceled elective and semi-urgent patients. Hence, these variables indicate that the colonoscope market experienced a moderately negative influence during the pandemic. However,due to widespread vaccination, the colonoscope industry has accelerated. In addition, several organizations have made concerted attempts to encourage cancer screening through awareness campaigns over the past few months, which is anticipated to increase future market demand.Market Growth Factors

Rising advancements in technologies

The adoption of HD colonoscopes and upgrades in imaging techniques for excellent visibility of subtle lesions and small polyps are among the most significant technological developments in the colonoscopy. HD has increased the number of pixels on the video display, allowing for greater detail and a superior image for the spectator. Modern colonoscopy systems are able to create high-resolution, HD colonoscopes with an angle of view of 170 degrees, providing brighter images, higher resolution, and a field of vision 30 degrees broader than standard colonoscopy instruments. In light of all these factors, the colonoscope market is predicted to expand throughout the forecast period.Growing preference for minimally invasive procedures

The colonoscopy is a screening procedure that requires only a tiny portion of tissue removal and can detect any early signs of cancer, preventing it from progressing to a more dangerous stage. Colonoscopies are diagnostic procedures that include inspecting the lining of the large intestine by inserting a tiny camera into the rectum of the patient. The process takes only a short amount of time and is completely painless, and it has the potential to save the patient's life. As a direct consequence of this, the market for colonoscope is expected to expand during the time of the projection.Market Restraining Factors

High risks involved during the colonoscopy procedures

Post-polypectomy electrocoagulation syndrome is an extremely unusual complication involving bowel damage. It might lead to stomach discomfort and fever. Due to the increased likelihood of underlying health concerns, colonoscopies provide a larger risk of complications for patients over 75. In addition, older patients may have a more difficult time preparing for the operation. It may result in dehydration or electrolyte imbalance. These complications may discourage patients from undergoing these operations, consequently hindering the growth of the colonoscope market.Application Outlook

Based on application, the colonoscope market is segmented into colorectal cancer, ulcerative colitis, crohns disease and others. In 2021, the colorectal cancer segment held the highest revenue share in the colonoscope market. Age, family history, a sedentary lifestyle, consumption of alcohol, smoking, and unhealthy lifestyle behaviors are important contributors to the alarming increase in colorectal cancer cases. In both men and women, colorectal cancer is the third most prevalent cancer each year. This increased incidence of colorectal cancer is anticipated to expand the market.End-user Outlook

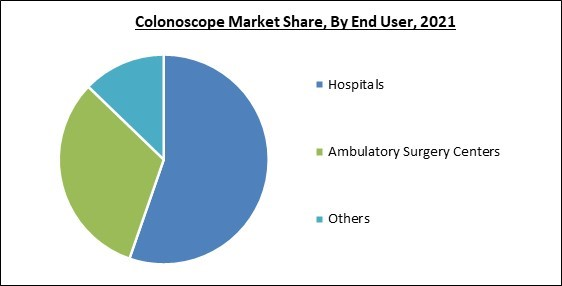

By end user, the colonoscope market is bifurcated into hospitals, ambulatory surgery centers and others. The ambulatory surgery centers segment recorded a remarkable revenue share in the colonoscope market in 2021. While ambulatory surgery centers offer to maintain a level of function and are less likely to provoke an immunological reaction, their market share is projected to expand. The procedure is possible there because ambulatory surgery centers are equipped with the necessary colonoscopy equipment. In addition, ambulatory surgery facilities do not require an overnight stay for procedures, contributing to their expansion.Regional Outlook

Region wise, the colonoscope market is analyzed across North America, Europe, Asia Pacific and LAMEA. The North America region led the colonoscope market by generating maximum revenue share in 2021. This is due to the high frequency of chronic diseases such as colon cancer & ulcerative colitis, the increasing number of market participants, and the rise in the variety of available devices in the region. In addition, the increase in research & development activities in the region contributes to expanding the market.The Cardinal Matrix - Colonoscope Market Competition Analysis

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Medtronic PLC is the forerunner in the Colonoscope Market. Companies such as Stryker Corporation, Fujifilm Holdings Corporation, Olympus Corporation are some of the key innovators in Colonoscope Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Medtronic PLC, Stryker Corporation, Olympus Corporation, Fujifilm Holdings Corporation, Ambu A/S, Boston Scientific Corporation, SonoScape Medical Corp., Daichuan Medical (Shenzhen) Co., Ltd. (EndoFresh), and EndoMed Systems GmbH.

Strategies Deployed in Colonoscope Market

Partnerships, Collaborations and Agreements:

- Jul-2022: Medtronic PLC entered into a partnership with MathWorks, an Israel-based medical technology company focused on cardiovascular disease. With this partnership, the company aimed to provide creative solutions and technologies from diagnosis to therapy.

- Nov-2021: Medtronic PLC is partnering with Amazon.com to deliver pill-sized cameras to patients' doorsteps. For Medtronic, the goal is to offer a wider array of PillCams for 2021-Nov: Medtronic formed a partnership with Amazon, an American company that focuses on online advertising, e-commerce, digital streaming, cloud computing, and artificial intelligence. The partnership is aimed at delivering pillcams for patients in their homes for gastrointestinal care.

Product Launches and Product Expansions:

- Nov-2021: Fujifilm revealed the ColoAssist PRO visualization system for colonoscopies. The new product allows clinicians to visualize the configuration of the endoscope throughout the procedure in real time by providing accurate navigation of the colonoscope inside the patient. The ColoAssist PRO reproduces a graphical model of the endoscope during the intubation.

- Apr-2021: FUJIFILM Medical Systems U.S.A., Inc. unveiled G-EYE 700 Series Colonoscope. The new product would assist with visualization, stabilization, and control during routine examinations that would improve polyp detection when compared to standard colonoscopy. The launch of the G-EYE 700 Series line would expand the offering of the company's colonoscope portfolio.

- Oct-2020: Olympus launched two colonoscopes, the PCF-H190T and the PCF-HQ190 in the market. The new PCF-H190T and the PCF-HQ190 offer extension to the existing capabilities for physicians for diagnosing and treating gastrointestinal tract disorders. Furthermore, the two new devices would improve physicians' access to and visualization of the anatomy.

- Sep-2020: Olympus Corporation unveiled ENDO-AID, a platform powered by artificial intelligence (AI). The new AI platform includes the endoscopy application ENDO-AID CADe for the colon. The ENDO-AID provides a real-time display of automatically detected suspicious lesions. With this launch. the company aimed to enhance the standard of endoscopy around the world.

Acquisitions and Mergers:

- Dec-2022: Olympus entered into an agreement to acquire Odin Vision, a British cloud-AI endoscopy start-up. The acquisition would enhance the company's capability to offer advanced AI-powered solutions and data-driven insights that can improve clinical and procedural workflows and potentially transform patient care.

- Nov-2022: Boston Scientific Corporation signed an agreement to acquire Apollo Endosurgery, Inc, a medical technology company focused on the development of advanced therapeutic endoscopy devices. The acquisition is aimed to enter the endobariatric market and provide strong, continued growth of the company's business.

- Aug-2022: Medtronic PLC completed the acquisition of Affera, Inc., a medical technology that delivers to address the cardiac arrhythmia market. Through this acquisition, the company aimed to expand its cardiac ablation portfolio that encompasses a fully integrated diagnostic, focal pulsed field, and radiofrequency ablation solution.

- Nov-2020: Stryker Corporation took over Wright Medical Group N.V., a medical device company that focuses on extremities and biologics. The acquisition enables the company to enhance its market position globally in the trauma and extremities field. Additionally, the company aimed to grow the business of both companies by providing solutions that improve patient outcomes.

- Aug-2020: Olympus Corporation came into an agreement to acquire Arc Medical Design Limited, a subsidiary of Norgine B.V. The acquisition showcases the company's commitment for developing advanced colonoscopy tools and its offering in gastrointestinal therapeutic devices. Moreover, with this acquisition, the company aimed to improve the early detection and treatment of colorectal cancer (CRC).

Trials and Approvals:

- Nov-2021: Medtronic PLC received approval for its PillCam™ Small Bowel 3 system from U.S. Food and Drug Administration for remote endoscopy procedures. PillCam SB3 system combines Medtronic's PillCam technology with Amazon logistics which offers a convenient option for a contactless procedure and helps ensure that patients can access care in a timely manner.

- May-2021: EndoFresh received approval from FDA for EndoFresh Disposable Digestive Endoscopy System. The new product features an all-in-one design with a camera system, disposable upper GI endoscope, and disposable colonoscope. The product would enable the company to allow physicians to visualize, diagnose and operate gastrointestinal endoscopy.

- Apr-2021: Medtronic PLC received de novo clearance from U.S. Food and Drug Administration for its GI Genius™ intelligent endoscopy module. The GI Genius module uses artificial intelligence (AI) to identify colorectal polyps. With the addition of AI in the GI Genius intelligent endoscopy module, the launch is aimed at improving colonoscopies and polyp detection and reducing variability in patient outcomes.

Scope of the Study

By Application

- Colorectal Cancer

- Ulcerative Colitis

- Crohns Disease

- Others

By End-user

- Hospitals

- Ambulatory Surgery Centers

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Australia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Medtronic PLC

- Stryker Corporation

- Olympus Corporation

- Fujifilm Holdings Corporation

- Ambu A/S

- Boston Scientific Corporation

- SonoScape Medical Corp.

- Daichuan Medical (Shenzhen) Co., Ltd. (EndoFresh)

- EndoMed Systems GmbH

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 3. Competition Analysis - Global

Chapter 4. Global Colonoscope Market by Application

Chapter 5. Global Colonoscope Market by End-user

Chapter 6. Global Colonoscope Market by Region

Chapter 7. Company Profiles

Companies Mentioned

- Medtronic PLC

- Stryker Corporation

- Olympus Corporation

- Fujifilm Holdings Corporation

- Ambu A/S

- Boston Scientific Corporation

- SonoScape Medical Corp.

- Daichuan Medical (Shenzhen) Co., Ltd. (EndoFresh)

- EndoMed Systems GmbH