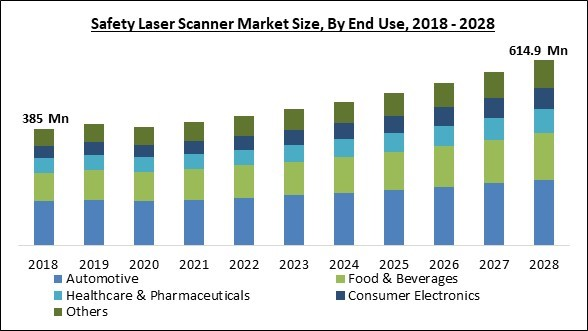

The Global Safety Laser Scanner Market size is expected to reach $614.9 Million by 2028, rising at a market growth of 6.2% CAGR during the forecast period.

A safety laser scanner is a tool that locates people or items in a specified space and offers safety precautions to prevent mishaps. A shielding zone is created around the area being scanned by the spinning laser beam that the scanner emits. The scanner detects when something or someone enters the restricted area and generates a signal to the management orcontrol system, which stops or slows down any nearby machinery or equipment.

Safety laser scanners are frequently used in various industriesto ensure employee safety and prevent accidents. The safety laser scanner is an improved electro-sensitive protective apparatus made to scan two-dimensional environments with infrared laser beams. In order to provide a high level of protection for employees and prevent accidents, the safety laser scanner is mainly utilized in manufacturing, logistics, automotive, and material handling industries.

Additionally, contemporary safety laser scanners are equipped with sophisticated features like field switching and dynamic protection zones that allow them to adjust to changing environmental circumstances and provide a more precise level of protection. Also, a complete safety system can be created by combining next-generation advancedsafety laser scanners with other security measures like light curtains and emergency stop buttons. A safety laser scanner checks to see if there are any people, animals, objects, etc., in the zone. It is assigned to guard rather than just motion.

These devices areset up to monitor a certain area, just like a motion detector. However, with a motion detector, if someone enters the monitored area and remains perfectly still, it will detect that nothing is there. On the other hand, people won't be able to trick a safety laser scanner. Safety laser scanners also detect intrusions to the area using lasers rather than sound waves or infrared light. Safety laser scanners are clever tools that may be set up with many levels of security, programmable alerts, dust filtering, as well asmuting on some models. Their wide-angle monitoring range, 275 degrees around the unit, may extend and pick objects up to about 40 meters away.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Sick AG, Panasonic Holdings Corporation, Keyence Corporation, Omron Corporation, IDEC Corporation, Rockwell Automation, Inc., Hans Turck GmbH & Co. KG, Hokuyo Automatic Co. Ltd., Banner Engineering Corporation, and Leuze Electronic GmbH + Co. KG.

A safety laser scanner is a tool that locates people or items in a specified space and offers safety precautions to prevent mishaps. A shielding zone is created around the area being scanned by the spinning laser beam that the scanner emits. The scanner detects when something or someone enters the restricted area and generates a signal to the management orcontrol system, which stops or slows down any nearby machinery or equipment.

Safety laser scanners are frequently used in various industriesto ensure employee safety and prevent accidents. The safety laser scanner is an improved electro-sensitive protective apparatus made to scan two-dimensional environments with infrared laser beams. In order to provide a high level of protection for employees and prevent accidents, the safety laser scanner is mainly utilized in manufacturing, logistics, automotive, and material handling industries.

Additionally, contemporary safety laser scanners are equipped with sophisticated features like field switching and dynamic protection zones that allow them to adjust to changing environmental circumstances and provide a more precise level of protection. Also, a complete safety system can be created by combining next-generation advancedsafety laser scanners with other security measures like light curtains and emergency stop buttons. A safety laser scanner checks to see if there are any people, animals, objects, etc., in the zone. It is assigned to guard rather than just motion.

These devices areset up to monitor a certain area, just like a motion detector. However, with a motion detector, if someone enters the monitored area and remains perfectly still, it will detect that nothing is there. On the other hand, people won't be able to trick a safety laser scanner. Safety laser scanners also detect intrusions to the area using lasers rather than sound waves or infrared light. Safety laser scanners are clever tools that may be set up with many levels of security, programmable alerts, dust filtering, as well asmuting on some models. Their wide-angle monitoring range, 275 degrees around the unit, may extend and pick objects up to about 40 meters away.

COVID-19 Impact Analysis

The COVID-19 pandemic severely hampered the development of manufacturing and automotive solutions. Throughout the pandemic, the need for safety laser scanner systems was greatly influenced by the slow growth of manufacturing solutions. In addition, the shortage of qualified staff brought on by the partial and total lockdown imposed by governments worldwide also slowed the expansion of the market for safety laser scanners during the pandemic. However, the demand for the Internet of Things and machine safety systems increased, which fueled the development of safety laser scanner systems and is anticipated to continue doing so during the projected period.Market Growth Factors

An increase in safety laser scanner demand in the automobile and electronics sectors

Car manufacturers are concentrating on technology advancements to raise the bar for passenger and commercial vehicle safety. An essential component of a car's safety is its navigation system. Safety laser scanners are employed in navigation systems for vehicles to find objects to avoid collisions and guide the vehicle. As a result, safety laser scanners are increasingly being employed in automobile navigation systems. Therefore, safety laser scanners widespread use in electronics and automobile sectors is expected to be one of the primary reasons boosting the growth of the market.Usability of safety laser scanner in multiple ways

The system can be set up to provide protection against hazardous points. A scanner can create a barrier between people and hazards when they emerge through an opening or breach in a machine. Furthermore, a scanner can be employed vertically to detect persons if their entire body crosses through the protective zone when access prevention is needed to prevent people from accessing an area with a hazard. Hence, the numerous usability that this device provides has made them quite successful in ensuring the safety of workers. Therefore, the safety laser scanner market will grow in the coming years owing to its adaptability.Market Restraining Factor

Extremely high price of safety laser scanners

Several sectors struggle with installation, maintenance, and service costs in addition to the initial cost. In addition, safety mats, which provide comparable protective measures for some industries, are another important reason, among others, that restrains market expansion during the projection period. Safety mats are highly robust and can work in virtually any environment. These are cost-effective as well. The major market participants for safety laser scanners are trying to cut costs and hence, most of them are more inclined towards using safety mats. Therefore, high cost is anticipated to be a significant roadblock to deploying safety laser scanners during the projected period and will impede this market's expansion.Type Outlook

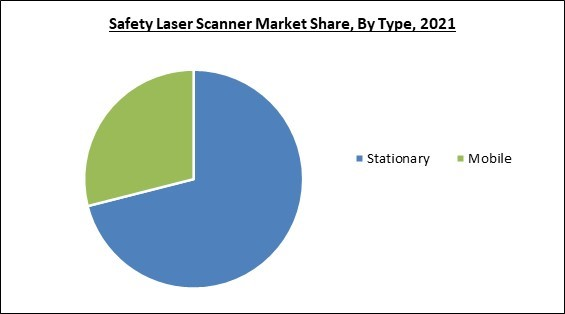

Based on type, the safety laser scanner market is categorized into mobile and stationary. The mobile segment procured a considerable growth rate in the safety laser scanner market in 2021. The segment is growing as more end-user businesses adopt it, including those in the automotive, electronics, healthcare, and pharmaceutical sectors. For example, mobile safety laser scanners enhance patient security and satisfaction in the healthcare industry. Also, these safety laser scanners are widely employed in the pharmaceutical manufacturing sector, which makes substantial use of infrared laser beam-based safety equipment.End-use Outlook

On the basis of end use, the safety laser scanner market is divided into automotive, food & beverages, healthcare & pharmaceuticals, consumer electronics, and others. The automotive segment acquired the largest revenue share in the safety laser scanner market in 2021. Due to the growing usage of automatic guided cars, the automotive industry has deployed safety laser scanners widely (AGVs). For example, when semi-automatic painting is done in a production facility, personnel must frequently enter the machine to remove the painted pieces. In these situations, a cutting-edge safety laser scanner allows for two-way protection of the machine, enabling entry for the operator to replace the finished part while simultaneously securing the region where it is operating on another part.Regional Outlook

Based on region, the safety laser scanner market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment witnessed the maximum revenue share in the safety laser scanner market in 2021. China has recently experienced increased labor costs and stricter restrictions, which have increased operational costs for businesses engaged in manufacturing. However, the region's robotics industry has experienced rapid expansion over the years. In addition, government programs like Make in India are boosting the region's industrial sector, which is anticipated to increase demand for safety devices that utilize infrared laser beams throughout the forecast period.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Sick AG, Panasonic Holdings Corporation, Keyence Corporation, Omron Corporation, IDEC Corporation, Rockwell Automation, Inc., Hans Turck GmbH & Co. KG, Hokuyo Automatic Co. Ltd., Banner Engineering Corporation, and Leuze Electronic GmbH + Co. KG.

Recent Strategies Deployed in Safety Laser Scanner Market

- Mar-2023: Turck unveiled CMVT, a vibration sensor combined with temperature monitoring applications. Turck's CMVT would analyze vibration and temperature data and quickly send warning signal if the set limit would be crossed.

- Sep-2021: Hokuyo Automatic Co., Ltd. and SiLC Technologies, Inc. (SiLC) signed a partnership for offering affordable 4D LiDAR solutions. With this partnership, SiLC's expertise in 4D+ Vision Chip would strengthen Hokuyo to develop advanced automated solutions for industrial and robotic applications.

- Sep-2021: Rockwell acquired Plex Systems, a cloud-based smart manufacturing platform. With this acquisition, Plex's SaaS manufacturing platform would be utilized by Rockwell to provide Rockwell's customers the cloud-driven solutions that would be easy to regulate.

- Jun-2021: Sick AG came into partnership with Maxim Integrated, a manufacturer and distributor of analog and mixed-signal integrated circuits, to manufacture the Smallest LiDAR Safety Laser Scanner. Through this partnership, Maxim's software-configurable digital IO products would aid in advancing Sick AG's microScan3 Core I/O LiDAR-based safety laser scanner and would reduce its size by 50%, allowing Sick AG to broaden the versatility of nanoScan3 Safety Laser Scanner leading to better serve the automobile industry.

- Mar-2021: Sick introduced ScanGrid2, a solid-state safety solution developed for line-guided tiny vehicles that would improve the productivity of small autonomous AGCs. The compact sensor utilizes LiDAR technology to intensify the performance of small autonomous and line-guided transport vehicles. Moreover, ScanGrid2 would safeguard dangerous regions up to performance level c and would decline the probability of collision.

- Feb-2021: Rockwell announced the launch of the SafeZone 3 laser scanner, an automated safety device to provide a high level of safety and productivity. SafeZone 3 laser scanner-enabled devices would offer insightful information to users enabling them to regulate the machine, enhance flexibility and provide high-level safety.

- Sep-2020: Sick AG unveiled microScan3, a safety laser scanner with an updated version for enhanced safety and improved navigation of driverless automobiles, mobile equipment, and autonomous platforms. The addition of several advanced features such as an improved safe range of up to nine meters would allow MicroScan3 to bring augmented productivity in mobile intralogistics empowering vehicles to easily detect people and hurdles too soon.

- Jun-2020: Hokuyo made enhancements by adding capabilities to UAM-05LP-T301, a firmware safety laser scanner. The updated version would fulfil the demands of customers and easily adjust to changing market trends. It would come with features such as a compact size and 5-meter protection range. Additionally, it would carry out jobs such as Interlocking, Muting, Reference monitoring, Area sequencing, and Eternal device monitoring.

- Apr-2020: Sick released nanoScan3, a super compact safety laser scanner. NanoScan3 would be a fusion of smart safety features and enhanced measurement data quality for providing error-free localization.

- May-2019: Sick unveiled outdoorScan3, a safety laser scanner that would work in all weather conditions and empower automated guided vehicle systems to safely go through open-air industrial settings.

- Apr-2019: Banner Engineering Corporation released a portfolio of Compact Safety Laser Scanners- SX Series for access points, areas, and mobile systems protection. The SX Series safety laser scanners would safeguard the workforce and equipment within user-defined warning and security zones.

Scope of the Study

By End-use

- Automotive

- Food & Beverages

- Healthcare & Pharmaceuticals

- Consumer Electronics

- Others

By Type

- Stationary

- Mobile

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Sick AG

- Panasonic Holdings Corporation

- Keyence Corporation

- Omron Corporation

- IDEC Corporation

- Rockwell Automation, Inc.

- Hans Turck GmbH & Co. KG

- Hokuyo Automatic Co. Ltd.

- Banner Engineering Corporation

- Leuze Electronic GmbH + Co. KG

Unique Offerings

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 4. Global Safety Laser Scanner Market by End-use

Chapter 5. Global Safety Laser Scanner Market by Type

Chapter 6. Global Safety Laser Scanner Market by Region

Chapter 7. Company Profiles

Companies Mentioned

- Sick AG

- Panasonic Holdings Corporation

- Keyence Corporation

- Omron Corporation

- IDEC Corporation

- Rockwell Automation, Inc.

- Hans Turck GmbH & Co. KG

- Hokuyo Automatic Co. Ltd.

- Banner Engineering Corporation

- Leuze Electronic GmbH + Co. KG