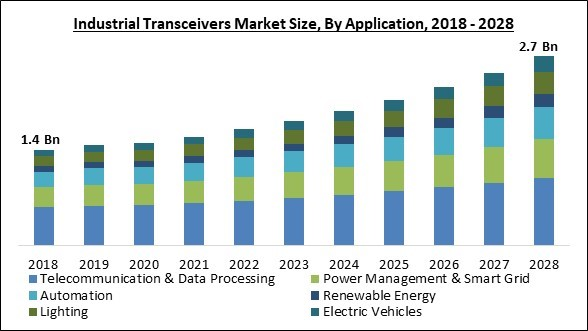

The Global Industrial Transceivers Market size is expected to reach $2.7 billion by 2028, rising at a market growth of 8.5% CAGR during the forecast period.

A device that can send and receive signals is referred to as a transceiver. It performs the duties of both a transmitter and a receiver in a single device. Transceivers are frequently used in networking, radio transmission, and telecommunications applications. Industrial transceivers are radios created specifically for use in commercial environments. The complex environmental conditions that these transceivers are frequently made to survive include extreme temperatures, dust, dampness, and vibration.

Due to a rise in the demand for reliable and effective communication in industrial settings, the market for industrial transceivers has been expanding rapidly in recent years. Industrial control systems, automated machinery, and other industrial applications frequently use industrial transceivers since they are made for usage in challenging settings. Moreover, they are a crucial part of contemporary industrial communication systems because they allow data and control signals to be transmitted between different systems and devices.

Many factors are driving the industrial transceiver market, including the rise in internet usage, the rising need for the Industrial Internet of Things (IIoT), and the uptake of data storage,cloud computing, and transmission. A further significant element fueling the expansion of the industrial transceiver market is the increased use of automation and robotics in the manufacturing sector for reliable and effective interaction among various machines and devices. Moreover, the development of 5G technology gives the industrial transceiver market a great opportunity to grow and prosper as 5G delivers quicker and more reliable wireless communication, providing the market with bright growth possibilities.

Processes used in industry have been changed by the fourth industrial revolution. Benefits include increased process innovation, decreased manufacturing costs, and increased company effectiveness. The demand for industrial transceivers is driven by the quick acceptance and implementation of technologies from the Industrial Revolution 4.0.

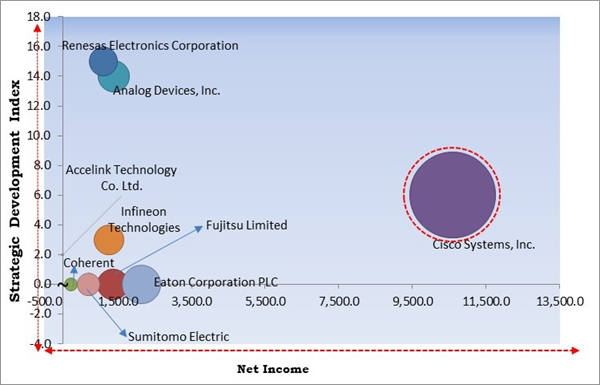

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Cisco Systems, Inc. is the forerunner in the Industrial Transceivers Market. Companies such as Renesas Electronics Corporation, Analog Devices, Inc., and Infineon Technologies AG are some of the key innovators in Industrial Transceivers Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Cisco Systems, Inc., Analog Devices, Inc., Renesas Electronics Corporation, Fujitsu Limited, Eaton Corporation PLC, Infineon Technologies AG, Accelink Technology Co. Ltd., Sumitomo Electric Industries, Ltd., Coherent, Inc. (Finisar Corporation) and AMS Technologies AG.

A device that can send and receive signals is referred to as a transceiver. It performs the duties of both a transmitter and a receiver in a single device. Transceivers are frequently used in networking, radio transmission, and telecommunications applications. Industrial transceivers are radios created specifically for use in commercial environments. The complex environmental conditions that these transceivers are frequently made to survive include extreme temperatures, dust, dampness, and vibration.

Due to a rise in the demand for reliable and effective communication in industrial settings, the market for industrial transceivers has been expanding rapidly in recent years. Industrial control systems, automated machinery, and other industrial applications frequently use industrial transceivers since they are made for usage in challenging settings. Moreover, they are a crucial part of contemporary industrial communication systems because they allow data and control signals to be transmitted between different systems and devices.

Many factors are driving the industrial transceiver market, including the rise in internet usage, the rising need for the Industrial Internet of Things (IIoT), and the uptake of data storage,cloud computing, and transmission. A further significant element fueling the expansion of the industrial transceiver market is the increased use of automation and robotics in the manufacturing sector for reliable and effective interaction among various machines and devices. Moreover, the development of 5G technology gives the industrial transceiver market a great opportunity to grow and prosper as 5G delivers quicker and more reliable wireless communication, providing the market with bright growth possibilities.

Processes used in industry have been changed by the fourth industrial revolution. Benefits include increased process innovation, decreased manufacturing costs, and increased company effectiveness. The demand for industrial transceivers is driven by the quick acceptance and implementation of technologies from the Industrial Revolution 4.0.

COVID-19 Impact Analysis

On the market for industrial transceivers, the COVID-19 pandemic has had a conflicting effect. The need for specific industrial transceivers, such as those used for remote monitoring and managing industrial processes, has significantly increased. This is a result of the pandemic-related requirement for greater automation and remote working capabilities. Internet-based communication and data transfer have become more prevalent due to remote work and online education. Also, the pandemic hastened the digitalization of many industries, increasing the need for fast and dependable communication infrastructure.Market Growth Factors

Growing need for energy efficient and compact transceivers

In telecom and data center applications, the rising demand for inexpensive transceivers with energy-efficient qualities enhanced their sales. Smaller, more affordable, and more energy-efficient optical transceivers are currently in high demand on the market. Since the arrival of the CFP module, various technological advancements have supported the development of small form factors. Data centers and businesses require longer reach & high data transmission rates, which has led to a rise in port density and power consumption efficiency. This is sufficient to enhance the demand for affordable optical transceivers. The increase in demand for low-cost transceivers stimulated the growth of this market sector, which is dominated by well-established companies.Growth of telecom industry across emerging economies

The expansion of telecommunications infrastructure will have a significant, positive impact on developing nations. With the introduction of AI, IoT, and big data, there is a growing demand for smart gadgets and many other connected applications. Integrated technologies across telecommunications sectors play a significant role in acquiring, translating, and transmitting data into useful information essential for improving urban infrastructure. The backbone of this type of infrastructure development is a high-speed fiber optics network, which can quickly carry massive volumes of data from one end to the other. Hence, expanding telecommunications infrastructure in developing nations will propel the industrial transceivers market in the upcoming years.Market Restraining Factor

Grown network complexity

The existing network infrastructure is disjointed and primarily geared toward expanding individual domains rather than a unified strategy centered on customers. To reduce the network complexity, which is a factor that may inhibit the expansion of the market for industrial transceivers during the projection period, the organizations in this market need to take a creative and network-oriented approach to their business strategies.Technology Outlook

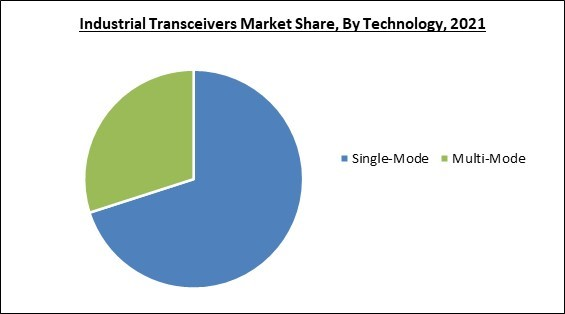

Based on technology, the industrial transceivers market is segmented into single-mode, and multi-mode. In 2021, the multi-mode segment covered a considerable revenue share in the industrial transceivers market. Compared to previous technologies, multi-mode industrial transceivers have a larger core and handle several mode transmissions. The expansion of the industrial transceiver market is predicted to reach new heights due to government initiatives to speed up the creation of smart cities.Application Outlook

On the basis of application, the industrial transceivers market is bifurcated into telecommunication & data processing, automation, power management & smart grid, electric vehicles, renewable energy, and lighting. In 2021, the power generation & smart grids segment recorded a remarkable revenue share in the industrial transceivers market. This is because industrial transceivers use significantly less power and space than other types of transceivers because of shared housing and circuitry features, which results in substantially lower assessment and power consumption costs. Moreover, the industrial transceiver market will benefit from the faster deployment of these devices for industry-grade automation during the projected period.Regional Outlook

Region wise, the industrial transceivers market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the Asia Pacific region led the industrial transceivers market by generating the highest revenue share. A growing number of people are using phones, more people are using the internet, more people are connected to the network, and more people are using programs that demand a lot of bandwidth. As a result, huge investments and company growth are now concentrated in the APAC region. With commercial deployments now in place in South Korea and prepared for deployment in Japan and China, Asian markets contribute to the growth of 5G mobile technology.The Cardinal Matrix - Industrial Transceivers Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Cisco Systems, Inc. is the forerunner in the Industrial Transceivers Market. Companies such as Renesas Electronics Corporation, Analog Devices, Inc., and Infineon Technologies AG are some of the key innovators in Industrial Transceivers Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Cisco Systems, Inc., Analog Devices, Inc., Renesas Electronics Corporation, Fujitsu Limited, Eaton Corporation PLC, Infineon Technologies AG, Accelink Technology Co. Ltd., Sumitomo Electric Industries, Ltd., Coherent, Inc. (Finisar Corporation) and AMS Technologies AG.

Recent Strategies Deployed in Industrial Transceivers Market

Partnerships, Collaborations and Agreements:

- Oct-2022: Cisco teamed up with SoftBank, a Japan-based multinational conglomerate company. The collaboration involves deploying network architectures to deliver an advanced digital experience. Cisco's QSFP 100G ZR4 pluggable optical transceivers support SoftBank in reducing power consumption and carbon footprint.

- Sep-2022: Renesas came into partnership with Jariet Technologies, a US-based manufacturer and supplier of digital microwave integrated circuits and modules. The partnership strengthens Renesas' wireless transceiver solutions offerings. Jariet's competence in analog and mixed-signal technology would enable Renesas to field RF front-end reference designs that would fulfill the potential requirements of 5G wireless infrastructure.

- Oct-2020: Analog Devices teamed up with NEC, a Japan-based technology firm. The collaboration involves jointly delivering 5G O-RAN Massive MIMO Radio for Rakuten Mobile. The collaboration further advances the fundamentals of 5G connectivity.

- Feb-2020: Analog Devices (ADI) collaborated with Marvell, a US-based fabless chip maker. The collaboration involves cashing on ADI's RF transceiver technology and Marvell's 5G digital platform to provide optimized solutions for 5G base stations. Further, the collaboration benefits ADI's customers by enabling them to develop high-performance products.

Product Launches and Product Expansions:

- Nov-2022: Infineon unveiled MMIC CTRX8181 transceiver. The transceiver is high-performance, reliable, and intended for automotive radar. The CMOS transceiver features, an enhanced signal-to-noise ratio, high system-level performance, and resilience.

- Nov-2022: Renesas Electronics launched RAA270205 4x4-channel, a 76-81 GHz HD transceiver. The product is developed for imaging radar, 4D radar, corner & central processing radar, and long-range forward-looking radar. The transceiver delivers 4 Rx and 4Tx channels and supports up to 16 MIMO channels.

- Feb-2022: Renesas introduced two 2.4 GHz RF transceiver technologies. The new transceiver technologies support Bluetooth Low Energy (LE) low-power, near-field communication standards. Further, the transceiver technologies feature reduced board cost, reduction in power consumption, and smaller size.

- Oct-2021: Renesas introduced RAA78815x transceiver family of 5V differential RS-485/422 transceivers. The new transceivers feature electrical fast transient (EFT) immunity ±5000V, and ESD protection up to ±16,000V, making these solutions well suited for noise-sensitive industrial communication networks. The new transceivers are RS-485 and RS-422 communication standards compliant.

- Mar-2021: Analog Devices introduced an ASIC-based radio platform intended for O-RAN-compliant 5G radio units. The radio platform includes software-defined transceivers, signal processing, power, and baseband ASIC. The new platform is intended to enhance performance and develop factor improvements to cater to the cost and critical power consumption challenges.

- Jul-2020: Analog Devices introduced ADRV9002 RF transceiver. The new transceiver is well suited for mission-critical communication applications, including private Long-Term Evolution (LTE) networks, satellite communications, and first responder radios. Further, the ADRV9002 RF transceiver has the power to accurately decipher a signal in a heavily congested spectrum environment.

Acquisitions and Mergers:

- Oct-2022: Renesas completed the acquisition of Steradian, an India-based developer of 4D imaging radar products. The addition of Steradian's radar technology and human capital would enhance Renesas’ sensing solution offerings.

- Aug-2021: Analog Devices (ADI) took over Maxim Integrated, a US-based designer of mixed-signal and analogue semiconductor products. The addition of Maxim makes ADI in a better position to design and develop comprehensive, state-of-the-art solutions for its clients. Further, the acquisition aims at working together to develop a better, safer, and more sustainable future.

- Mar-2021: Cisco acquired Acacia Communications, a US-based manufacturer of optical interconnect products. The addition of Acacia strengthens Cisco's commitment to optics.

Scope of the Study

By Application

- Telecommunication & Data Processing

- Power Management & Smart Grid

- Automation

- Renewable Energy

- Lighting

- Electric Vehicles

By Technology

- Single-Mode

- Multi-Mode

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Cisco Systems, Inc.

- Analog Devices, Inc.

- Renesas Electronics Corporation

- Fujitsu Limited

- Eaton Corporation PLC

- Infineon Technologies AG

- Accelink Technology Co. Ltd.

- Sumitomo Electric Industries, Ltd.

- Coherent, Inc. (Finisar Corporation)

- AMS Technologies AG

Unique Offerings

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 3. Competition Analysis - Global

Chapter 4. Global Industrial Transceivers Market by Application

Chapter 5. Global Industrial Transceivers Market by Technology

Chapter 6. Global Industrial Transceivers Market by Region

Chapter 7. Company Profiles

Companies Mentioned

- Cisco Systems, Inc.

- Analog Devices, Inc.

- Renesas Electronics Corporation

- Fujitsu Limited

- Eaton Corporation PLC

- Infineon Technologies AG

- Accelink Technology Co. Ltd.

- Sumitomo Electric Industries, Ltd.

- Coherent, Inc. (Finisar Corporation)

- AMS Technologies AG