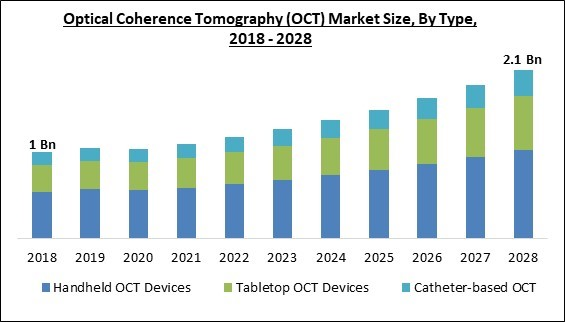

The Global Optical Coherence Tomography (OCT) Market size is expected to reach $2.1 billion by 2028, rising at a market growth of 8.9% CAGR during the forecast period.

Optical coherence tomography (OCT) is a novel optical imaging modality that utilizes low coherence light to capture 2D and 3D micrometer resolution images. By detecting backscattered or back reflected light, optical coherence tomography (OCT) carries out high-resolution cross-sectional tomographic imaging of the interior microstructure in materials and biological systems. OCT images are essentially two-dimensional data sets that depict the optical backscattering in the tissue in a cross-sectional plane.

One to two magnitude orders more image resolution ranging between 1 and 15 micrometers than traditional ultrasound can be attained. Imaging can be done live and on the spot. This technology's special qualities enable various scientific and therapeutic applications. The deeper tissues found in the eyes, skin, and heart can be studied with optical coherence tomography since it often employs light in the near-infrared wavelength range, with a depth of penetration of a few hundred microns in tissue.

Commercially available OCT systems are utilized in various applications, including diagnostic imaging solutions in ophthalmology and optometry, which can be used to get precise images inside the retina. Lately, they have been utilized to aid in identifying coronary artery disease in interventional cardiology and to enhance the diagnosis of skin conditions. Optical coherence tomography (OCT) has attained sub-micrometer resolution (where every wide-spectrum source generates over a range of 100 nm in wavelength), depending on the characteristics of the light source.

A type of optical tomographic method includes optical coherence tomography. Commercial OCT systems are utilized in various applications, such as the conservation of artwork and diagnostic medicine. Frequency-domain OCT, a relatively new use of optical coherence tomography, offers advantages in the signal-to-noise ratio, allowing for faster signal capture. Contrary to popular belief, optical coherence tomography (OCT) is not similar to optical coherence microscopy (OCM) since OCM is a microscopic adaptation of optical coherence tomography (OCT) and can be used to reconstruct 3D images using back-scattered or coherent light's inherent contrasting.

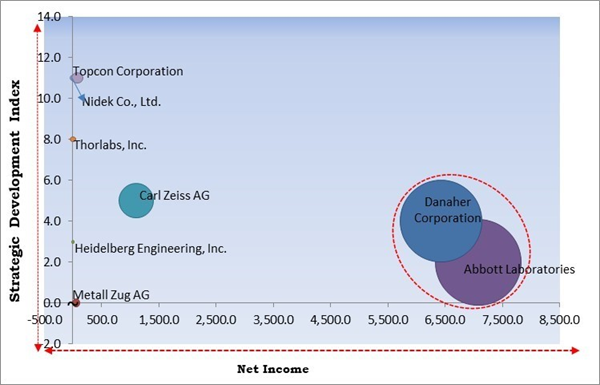

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Danaher Corporation, and Abbott Laboratories are the forerunners in the Optical Coherence Tomography (OCT) Market. Companies such as Carl Zeiss AG, Topcon Corporation, and Thorlabs, Inc. are some of the key innovators in Optical Coherence Tomography (OCT) Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Abbott Laboratories, Carl Zeiss AG, Danaher Corporation, Metall Zug AG (Haag-Streit AG), Nidek Co., Ltd., Thorlabs, Inc., Topcon Corporation, Agfa-Gevaert N.V. (IG arben), Heidelberg Engineering, Inc. (Heidelburg Engeneering GmbH), and Novacam Technologies Inc.

Optical coherence tomography (OCT) is a novel optical imaging modality that utilizes low coherence light to capture 2D and 3D micrometer resolution images. By detecting backscattered or back reflected light, optical coherence tomography (OCT) carries out high-resolution cross-sectional tomographic imaging of the interior microstructure in materials and biological systems. OCT images are essentially two-dimensional data sets that depict the optical backscattering in the tissue in a cross-sectional plane.

One to two magnitude orders more image resolution ranging between 1 and 15 micrometers than traditional ultrasound can be attained. Imaging can be done live and on the spot. This technology's special qualities enable various scientific and therapeutic applications. The deeper tissues found in the eyes, skin, and heart can be studied with optical coherence tomography since it often employs light in the near-infrared wavelength range, with a depth of penetration of a few hundred microns in tissue.

Commercially available OCT systems are utilized in various applications, including diagnostic imaging solutions in ophthalmology and optometry, which can be used to get precise images inside the retina. Lately, they have been utilized to aid in identifying coronary artery disease in interventional cardiology and to enhance the diagnosis of skin conditions. Optical coherence tomography (OCT) has attained sub-micrometer resolution (where every wide-spectrum source generates over a range of 100 nm in wavelength), depending on the characteristics of the light source.

A type of optical tomographic method includes optical coherence tomography. Commercial OCT systems are utilized in various applications, such as the conservation of artwork and diagnostic medicine. Frequency-domain OCT, a relatively new use of optical coherence tomography, offers advantages in the signal-to-noise ratio, allowing for faster signal capture. Contrary to popular belief, optical coherence tomography (OCT) is not similar to optical coherence microscopy (OCM) since OCM is a microscopic adaptation of optical coherence tomography (OCT) and can be used to reconstruct 3D images using back-scattered or coherent light's inherent contrasting.

COVID-19 Impact Analysis

Due to lockdown restrictions, many ophthalmologists were also unable to observe patients in person. Because fewer patients visited for monitoring and diagnosis of eye diseases as a result of COVID-19, the optical coherence tomography (OCT) market was significantly impacted. However, in 2021 the market resumed growth due to an increase in patient visits for eye and cardiovascular disease screenings. The market also grew favorably in 2022 as a result of an increase in patient screening for skin-related illnesses along with cardiovascular diseases and eye disorders. In conclusion, the COVID-19 pandemic had a negative impact on the optical coherence tomography (OCT) market.Market Growth Factors

Increasing prevalence of disorders like cardiovascular, eye, and cancer

A significant reason for boosting the demand for optical coherence tomography is the rising prevalence of cardiovascular diseases and eye problems worldwide. This trend is likely to persist for the duration of the forecast period. The World Health Organization (WHO) estimates that 2.2 billion people worldwide have near- or farsightedness due to eye conditions like glaucoma, cataracts, diabetic retinopathy, refractive error, and other causes. The prevalence of various eye disorders is increasing the demand for cutting-edge diagnostic techniques for diseases, like optical coherence tomography devices. Hence, thereby boosting the market growth.Rising advancements in healthcare infrastructure along with the increase in geriatric population

A novel platform named Spectral Contrast Optical coherence tomography for ophthalmology Angiography (SC-OCTA) was developed in 2019 by a Northwestern University research team. This platform uses cutting-edge 3D technology to detect minute changes in capillary organization and offers in-depth knowledge and insight into the middle region of the human circulatory system. Growing advanced healthcare innovation in emerging markets, R&D activities to increase the efficiency of tomography devices, and a rise in OCT for ophthalmology application sectors, including critical imaging procedures, contribute to market growth.Market Restraining Factors

Limitations of optical coherence tomography systems

The operator had to precisely position the picture over the target disease in the early OCT models. As a result, later photos could be taken that were off-axis compared to earlier images when serial images were captured over time (such as during treatment for AMD with anti-VEGF medication). Eye tracking devices and other more recent technologies reduce the possibility of acquisition error. Therefore, the limitations associated with this technology increase the appreciation for its contemporary technologies and, thus, limit the market's growth.Type Outlook

Based on type, the optical coherence tomography (OCT) market is categorized into catheter-based OCT, handheld OCT devices, and tabletop OCT devices. The handheld OCT segment garnered the highest revenue share in the optical coherence tomography (OCT) market in 2021. The increased use of these devices, which enables primary-care physicians to identify retinal disorders, including diabetic retinopathy, glaucoma, and macular degeneration early on, is driving the segment's growth. In order to aid in the early diagnosis of numerous eye conditions, handheld OCT devices combine 3D imaging with microelectromechanical systems (MEMS).Application Outlook

On the basis of application, the optical coherence tomography (OCT) market is divided into ophthalmology, cardiovascular, and others. The ophthalmology segment acquired the largest revenue share in the optical coherence tomography (OCT) market in 2021. Growing instances of choroidal and retinal abnormalities, which lead to a rise in optical coherence tomography (OCT) devices, are responsible for the segment's expansion. Moreover, the growing necessity of early disease identification and increased public knowledge of better treatment choices using OCT devices will foster growth.End-use Outlook

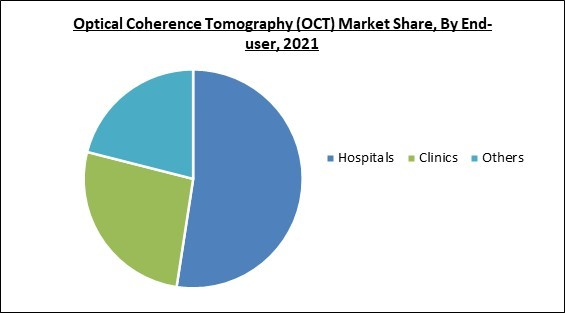

Based on end user, the optical coherence tomography (OCT) market is segmented into hospitals, clinics, and others. The clinics segment garnered a remarkable growth rate in the optical coherence tomography (OCT) market in 2021. It is anticipated that the need for OCT devices for medical applications will increase. The rise in cardiovascular diseases and eye disorders and the increasing need for early diagnosis of these conditions to begin appropriate treatment are the factors driving the growth of this market. Furthermore, the rising demand for better ophthalmic diagnostic tools, and the growing use of next-generation optical biometry devices like biometers based on swept-source optical coherence tomography (OCT) in clinics have increased the visits of patients to clinics.Regional Outlook

On the basis of region, the optical coherence tomography (OCT) market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment procured the highest revenue share in the optical coherence tomography (OCT) market in 2021. Increased use of advanced imaging systems like optical coherence tomography (OCT), an increase in the prevalence of eye diseases like diabetic retinopathy, and an increase in the number of major companies producing advanced OCT devices all contribute to the segment's growth.The Cardinal Matrix - Optical Coherence Tomography (OCT) Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Danaher Corporation, and Abbott Laboratories are the forerunners in the Optical Coherence Tomography (OCT) Market. Companies such as Carl Zeiss AG, Topcon Corporation, and Thorlabs, Inc. are some of the key innovators in Optical Coherence Tomography (OCT) Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Abbott Laboratories, Carl Zeiss AG, Danaher Corporation, Metall Zug AG (Haag-Streit AG), Nidek Co., Ltd., Thorlabs, Inc., Topcon Corporation, Agfa-Gevaert N.V. (IG arben), Heidelberg Engineering, Inc. (Heidelburg Engeneering GmbH), and Novacam Technologies Inc.

Strategies Deployed in Optical Coherence Tomography (OCT) Market

Partnerships, Collaborations and Agreements:

- Feb-2023: NIDEK came into partnership with HOYA Vision Care, a key player in optical technology innovation. The partnership delivers eye care professionals a chance to access a comprehensive portfolio of optical instruments and products. Further, this partnership enables NIDEK to furnish ECPs with flawless eyecare solutions, thereby enabling ECPs to deliver enhanced patient satisfaction.

- Aug-2021: Topcon partnered with RetInSight, an Austria-based developer of retina AI solutions. The partnership aims at expanding retinal fluid monitoring and detection to eye care providers, and jointly developing and deploying automated, OCT-backed monitoring and screening applications intended for geographic atrophy (GA).

- Aug-2021: Carl Zeiss teamed up with Resolve Biosciences, a Germany-based developer of the Molecular Cartography platform. The collaboration involves jointly working to advance 3D imaging and microscopy solutions intended for subcellular spatial analysis. Additionally, the collaboration aims at enabling researchers to obtain more insights into subcellular spatial biology.

- Mar-2021: Topcon collaborated with Iridex, a US-based provider of ophthalmic laser-based medical products. The collaboration involves Topcon acting as an exclusive distributor for Iridex's laser systems, disposable probes, and delivery devices, and Iridex acquiring Topcon's PASCAL product line's manufacturing and design operation. Through this partnership, the companies intend to integrate their product design and development efforts to improve their current and future glaucoma and retina product offerings.

Product Launches and Product Expansions:

- Feb-2023: NIDEK introduced AL-Scan M Optical Biometer and MV-1 Myopia Viewer software. The AL-Scan is important for evaluating young children and provides smooth patient flow. The biometer measures axial length, which is believed to be an excellent parameter for evaluating myopia.

- Nov-2021: Heidelberg Engineering unveiled the Spectralis platform. The new platform is equipped with shift technology, enhances productivity in OCTA and OCT, and further enables clinicians to swap OCT scan speed for a more personalized judgment. The Spectralis platform offers three scan speeds, 20 kHz, 85 kHz, and 125 kHz.

- Oct-2021: NIDEK launched Retina Scan Duo 2. The new system is an integration of a fundus camera and OCT. The Retina Scan Duo 2 is equipped with features that improve screening, and clinical efficiency, and further supports improving clinical workflow.

Acquisitions and Mergers:

- Jan-2023: Thorlabs took over JML Optical, a US-based precision optics firm. The addition of JML Optical broadens Thorlabs' optical components offerings. Cashing on JML's optic capabilities and manufacturing & design presence in Rochester, New York enables Thorlabs to deliver revolutionary innovations for the photonics market.

- Aug-2021: Danaher took over Aldevron, a US-based developer of biological products. The addition of Aldevron broadens Danaher's capabilities in the genomic medicine field. Further, the acquisition benefits Danaher's clients by enabling them to introduce more life-saving therapies in the market.

- Jul-2021: Topcon completed the acquisition of VISIA Imaging, an Italy-based manufacturer of ophthalmic medical devices. The addition of Topcon improves Topcon’s manufacturing and development capabilities and further strengthens the acquirer's market position in the ophthalmic diagnostic device manufacturing market.

Approvals and Trials::

- Aug-2021: US FDA approved Abbott's Optical Coherence Tomography (OCT) imaging platform. The platform is supported by Abbott's Ultreon software. The imaging platform integrates OCT and AI, providing physicians with an improved, all-inclusive view of coronary blood flow and blockages to support informed decision-making and the best track to follow for the treatment.

Scope of the Study

By Type

- Handheld OCT Devices

- Tabletop OCT Devices

- Catheter-based OCT

By End-user

- Hospitals

- Clinics

- Others

By Application

- Ophthalmology

- Cardiovascular

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Abbott Laboratories

- Carl Zeiss AG

- Danaher Corporation

- Metall Zug AG (Haag-Streit AG)

- Nidek Co., Ltd.

- Thorlabs, Inc.

- Topcon Corporation

- Agfa-Gevaert N.V. (IG Farben)

- Heidelberg Engineering, Inc. (Heidelburg Engeneering GmbH)

- Novacam Technologies Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 3. Competition Analysis - Global

Chapter 4. Global Optical Coherence Tomography (OCT) Market by Type

Chapter 5. Global Optical Coherence Tomography (OCT) Market by End-user

Chapter 6. Global Optical Coherence Tomography (OCT) Market by Application

Chapter 7. Global Optical Coherence Tomography (OCT) Market by Region

Chapter 8. Company Profiles

Companies Mentioned

- Abbott Laboratories

- Carl Zeiss AG

- Danaher Corporation

- Metall Zug AG (Haag-Streit AG)

- Nidek Co., Ltd.

- Thorlabs, Inc.

- Topcon Corporation

- Agfa-Gevaert N.V. (IG Farben)

- Heidelberg Engineering, Inc. (Heidelburg Engeneering GmbH)

- Novacam Technologies Inc.