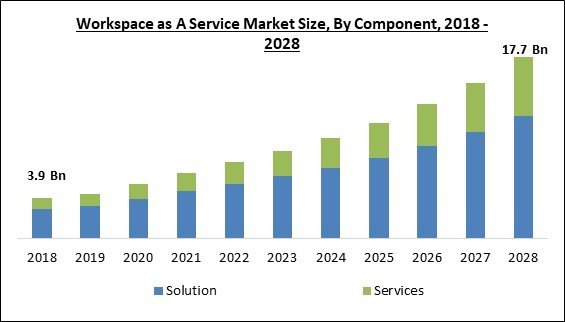

The Global Workspace as A Service Market size is expected to reach $17.7 billion by 2028, rising at a market growth of 15.4% CAGR during the forecast period.

Workspace as a service (WaaS) is an expansion of Desktop as a Service (DaaS), which offers a virtualized desktop environment without the other programs and utilities. Users who use WaaS have access to fully operational workspaces managed,maintained,and secured by a service provider. It goes further by giving staff members access to all the information and tools they require, whether seated at a desk or working remotely on a tablet or smartphone.

Also, users of this service only need to use their login credentials to access their work to gain access to everything they require, including business software that they might not be able to operate on their laptops or personal PCs. Additionally, this links any device anywhere and contains all of the features in a traditional office setting, including backup, VPN access,the cloud,security guidelines, and endpoint protection.

Workspace as a service solutions boost agility and productivity by enabling employees to work remotely, interact in real-time, and access their workplaces on any device. Employees may access the resources they require to work productively from any location, including the workplace, their homes, or while on the go, due to the workspace as a service solution.

In addition, employees may readily share information and collaborate in real-time, which helps boost collaboration and communication. Also, it can assist firms in automating procedures and streamlining operations, boosting output and lowering errors. Thus, the workspace as a service marketcan assist organizations in achieving their goals and propels market growth by giving employees the resources they need to work successfully and communicate.

Businesses can utilize WaaS solutions to have numerous users logged onto the same virtual Windows server. In addition, the additional maintenance requirements and expenses of the virtual desktop environments are also reduced as WaaS providers take care of resource provisioning, load balancing, and network difficulties. WaaS has thus evolved as an accessible solution that meets the enterprise's needs for desktop virtualization.

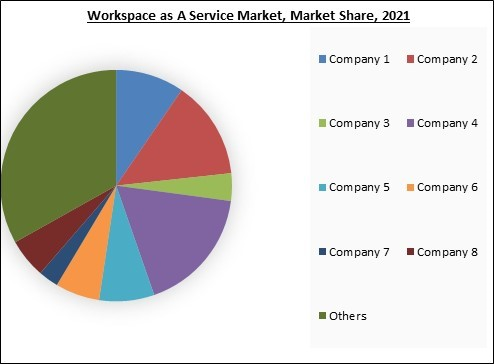

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

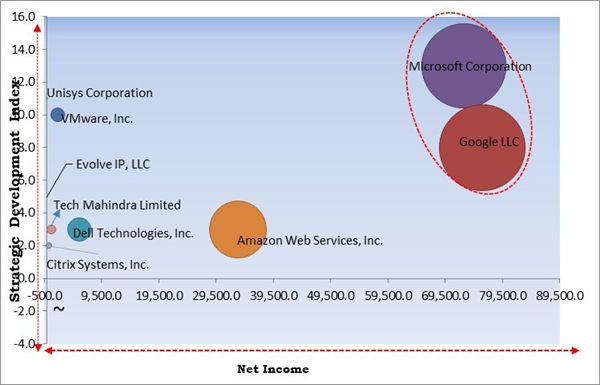

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Workspace as A Service Market. Companies such as Amazon Web Services, Inc. (Amazon.com, Inc.), VMware, Inc., and Dell Technologies, Inc. are some of the key innovators in Workspace as A Service Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Microsoft Corporation, Dell Technologies, Inc., VMware, Inc., Google LLC (Alphabet, Inc.), Unisys Corporation, Amazon Web Services, Inc. (Amazon.com, Inc.), Citrix Systems, Inc. (Cloud Software Group, Inc.), Tech Mahindra Limited, Colt Technology Services Group Limited (Fidelity Investments) and Evolve IP, LLC.

Workspace as a service (WaaS) is an expansion of Desktop as a Service (DaaS), which offers a virtualized desktop environment without the other programs and utilities. Users who use WaaS have access to fully operational workspaces managed,maintained,and secured by a service provider. It goes further by giving staff members access to all the information and tools they require, whether seated at a desk or working remotely on a tablet or smartphone.

Also, users of this service only need to use their login credentials to access their work to gain access to everything they require, including business software that they might not be able to operate on their laptops or personal PCs. Additionally, this links any device anywhere and contains all of the features in a traditional office setting, including backup, VPN access,the cloud,security guidelines, and endpoint protection.

Workspace as a service solutions boost agility and productivity by enabling employees to work remotely, interact in real-time, and access their workplaces on any device. Employees may access the resources they require to work productively from any location, including the workplace, their homes, or while on the go, due to the workspace as a service solution.

In addition, employees may readily share information and collaborate in real-time, which helps boost collaboration and communication. Also, it can assist firms in automating procedures and streamlining operations, boosting output and lowering errors. Thus, the workspace as a service marketcan assist organizations in achieving their goals and propels market growth by giving employees the resources they need to work successfully and communicate.

Businesses can utilize WaaS solutions to have numerous users logged onto the same virtual Windows server. In addition, the additional maintenance requirements and expenses of the virtual desktop environments are also reduced as WaaS providers take care of resource provisioning, load balancing, and network difficulties. WaaS has thus evolved as an accessible solution that meets the enterprise's needs for desktop virtualization.

COVID-19 Impact Analysis

The spread of COVID-19 has had a beneficial effect on the workspace as a service market. As a result of the pandemic outbreak, businesses worldwide have implemented work-from-home policies, which has resulted in an increased demand for WaaS solutions for the effective workflow of businesses. Because of the breakout of COVID-19, there has been a significant increase in the general use of business continuity tools and workplace solutions and the expanding demand for cloud-based business continuity products. In addition, organizations have devised new ways of delivering training, as well as enhancing team bonding and collaboration, with the assistance of virtual workplaces.Market Growth Factors

Growing trend of BYOD

The system allows employees to work outside the workplace. This enables people to work additional hours from their homes to fulfill deadlines. Additionally, BYOD policies enable the workspace as a service industry to save money and become more agile and flexible. Consequently, it is anticipated that the WaaS industry will expand as organizations attempt to optimize IT spending and capitalize on the benefits of BYOD policies. The workspace as a service market is mostly driven by the desire for organizations to reduce their capital expenditures. Hence, the workspace as a service market is anticipated to grow significantly due to the increased acceptance of BYOD policies.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Cost Effectiveness benefit of WaaS supporting market growth

Workspace-as-a-service solutions are more economical than traditional IT infrastructure solutions because they decrease the need for hardware, maintenance, and personnel. In addition, cloud computing technology simplifies time- and cost-intensive business operations, such as license management and software deployment, thereby dramatically reducing the workload of IT administration in businesses. In addition, with the workspace as a service model, new workplaces for additional employees may be set up fast. As a result, this can free up resources for firms to focus on other aspects of their operations, which can be especially advantageous for businesses pursuing development.Market Restraining Factors

Lack of knowledge and training among workforce

A team manager should be given all the instructions and training necessary to operate the solution after receiving a new resource performance tracker. To advance and change with the workplace transformation plan, firms must create training programs as ongoing processes before implementing digital workplace solutions and services. This, in turn, serves as a barrier to the adoption of solutions for the transformation of the digital workplace because they demand continuing organizational training initiatives. These elements may limit the growth of the workspace as a service market.Component Outlook

Based on component, the workspace as a service market is segmented into solution, and services. In 2021, the solution segment held the highest revenue share in the workspace as a service market. This is explained by organizations using virtual desktop infrastructure (VDI), unified endpoint management (UEM), application virtualization, and collaborative solutions to give employees secure and dependable access to their work environment from any location.Deployment Type Outlook

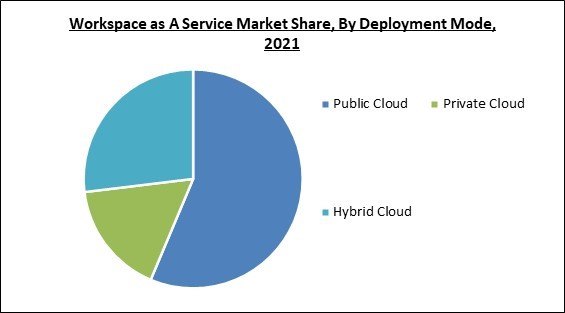

By deployment mode, the workspace as a service market is fragmented into public cloud, private cloud and hybrid cloud. In 2021, the hybrid cloud segment recorded a remarkable revenue witnessed the largest revenue share in the workspace as a service market. Due to its ability to store backup or legacy data for an extended period, hybrid clouds are commonly used. Hybrid clouds can also transform traditional IT infrastructure into a service model with improved flexibility, fewer operational activities made possible by automated administrative tasks, self-service access to infrastructure and applications, and best-practice IT resource usage.Enterprises Size Outlook

On the basis of enterprises size, the workspace as a service market is divided into large enterprises, and small & medium enterprises. The large enterprises segment dominated the workspace as a service market with maximum revenue share in 2021. Numerous large organizations are adopting cloud technology and novel solutions that are easy to consume and powered by artificial intelligence and other automation technologies or software. As a result, large corporations use desktop virtualization technology more than small and medium-sized businesses, contributing to the market's growth.Industry Vertical Outlook

Based on industry vertical, the workspace as a service market is bifurcated into BFSI, IT & telecom, retail, healthcare, manufacturing, government, travel & hospitality, education and others. The BFSI segment projected a prominent revenue share in the workspace as a service market in 2021. This is because the BFSI industry increasingly utilizes digital workplace services and solutions. In the BFSI industry, widespread deployment of digital workstations reduces office expenses and other associated with functional expenditures, certifies administrative regulations, and enhances operational capabilities.Regional Outlook

Region wise, the workspace as a service market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the North America region led the workspace as a service market by generating the highest revenue share. This is because there is a growing demand for workspace as a service solution customized to individual company requirements and an increased emphasis on security measures to guard against cyber threats. In addition, due to the region's considerable manufacturing, retailing, and automotive activities, software and robotics solutions are in great demand. In the end, this influences the growth of the regional market.The Cardinal Matrix - Workspace as A Service Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Workspace as A Service Market. Companies such as Amazon Web Services, Inc. (Amazon.com, Inc.), VMware, Inc., and Dell Technologies, Inc. are some of the key innovators in Workspace as A Service Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Microsoft Corporation, Dell Technologies, Inc., VMware, Inc., Google LLC (Alphabet, Inc.), Unisys Corporation, Amazon Web Services, Inc. (Amazon.com, Inc.), Citrix Systems, Inc. (Cloud Software Group, Inc.), Tech Mahindra Limited, Colt Technology Services Group Limited (Fidelity Investments) and Evolve IP, LLC.

Strategies Deployed in Workspace as A Service Market

Partnerships, Collaborations and Agreements:

- Oct-2022: Unisys came into partnership with ReadyWorks, a US-based provider of digital platform conductors. The partnership focuses on digital workplace and cloud, infrastructure, and applications solutions. This partnership improves Unisys' abilities to provide faster cloud migration and improve digital workplace experiences.

- May-2022: Citrix partnered with Microsoft, a US-based multinational technology corporation. The partnership focuses on introducing new integrations to Windows 365. Moreover, the partnership aims at providing users with easy and quick access to the data and applications they require.

- May-2022: Google extended its partnership with SAP, a Germany-based software company. The partnership aims to introduce new integrations between SAP's ERP, SAP S/4HANA Cloud, and Google Workspace. These integrations would enable users to link core SAP software with Google Sheets and Google Docs.

- Feb-2022: Evolve partnered with Cisco, a US-based technology company. The partnership involves jointly developing a new unified communications solution, Evolve Anywhere with Webex. Evolve Anywhere with Webex enables users to manage their special business requirements in today's remote working environment.

- Jul-2021: Microsoft came into partnership with NEC, a Japan-based multinational IT company. The partnership involves leveraging Microsoft's Azure & 365, and NEC's expertise in network and IT to advance digital transformation and cloud adoption across various markets. Additionally, the partnership includes jointly working to enhance digital services by transforming the workforce and workplace for customers across multiple markets.

- Jul-2020: Microsoft came into partnership with Citrix, a US-based cloud computing company. As per the partnership agreement, Microsoft would choose Citrix workspace as its favored digital workplace solution, and Citrix would select Microsoft as its preferred cloud platform. Through this partnership, the companies intend to work together to make digital workspace adoption and cloud transformation easy.

Product Launches and Product Expansions:

- Mar-2023: Microsoft introduced Microsoft Intune Suite, a unified endpoint management solution. The new suite integrates security solutions and endpoint management into a single platform. The Intune Suite has the ability to enhance Microsoft's customers' security posture and disentangle their endpoint management experience.

- Oct-2022: Google added new features to its Workspace platform. The new features include advanced email customization, mail merge, expanded global coverage, and increased cloud storage capacity.

- Sep-2022: AWS unveiled Amazon WorkSpaces Core. Amazon WorkSpaces Core is a Virtual Desktop Infrastructure service that integrates AWS' security, credibility, and cost efficiency with VDI management solutions. The new solutions allow the user to transform to the cloud at their speed.

- Aug-2022: VMware introduced multiple new features to its already existing Anywhere Workspace platform. The new features to be introduced are next-generation VMware Horizon Cloud, incorporating VMware Horizon and third-party managed and unmanaged devices in Workspace ONE UEM, adding platform breadth of support and depth of management in its UEM solution, etc.

- Jun-2022: VMware introduced new features to its already existing VMware Workspace ONE. The new features include improved update/patch management features for Windows OS devices, and Workspace ONE Mobile Threat Defense. Workspace ONE Mobile Threat Defense provides advanced mobile device security.

- Nov-2020: Tech Mahindra launched WORKSPACE NXT, an integrated digital workplace solution. The new workplace solutions integrate Intel, Dell, and VMware's technologies to deliver personalized and safe remote working experiences.

- Oct-2020: Google introduced Google Workspace. The new product by Google allows the teams to work without meeting physically, saves time, and enables the team members to focus on quality work, etc.

- Jan-2020: Evolve IP introduced Unified Workspace. The new workspace solution brings together hosted and SaaS application delivery, cloud desktops, and identify and access management. Unified Workspace enhances employee productivity by allowing employees to access all business applications from any device.

Acquisition and Mergers:

- Oct-2021: Microsoft acquired Ally.io, a B2B SaaS start-up. The acquisition of Ally.io aims at improving the acquirer's employee experience platform.

- Jun-2021: Unisys acquired Unify Square, a US-based IT company. The addition of Unify Square would broaden the acquirer's digital workplace offerings, and would also enhance revenue growth. Further, the addition of Unify would enable Unisys to provide its clients with higher-value solutions, that would improve their employee satisfaction and productivity.

Scope of the Study

By Component

- Solution

- Services

By Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Enterprises Size

- Large Enterprises

- Small & Medium Enterprises

By Vertical

- IT & Telecom

- Retail

- Healthcare

- Manufacturing

- Government

- Travel & Hospitality

- BFSI

- Education

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Microsoft Corporation

- Dell Technologies, Inc.

- VMware, Inc.

- Google LLC (Alphabet, Inc.)

- Unisys Corporation

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Citrix Systems, Inc. (Cloud Software Group, Inc.)

- Tech Mahindra Limited

- Colt Technology Services Group Limited (Fidelity Investments)

- Evolve IP, LLC

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 3. Competition Analysis - Global

Chapter 4. Global Workspace as A Service Market by Component

Chapter 5. Global Workspace as A Service Market by Deployment Mode

Chapter 6. Global Workspace as A Service Market by Enterprises Size

Chapter 7. Global Workspace as A Service Market by Vertical

Chapter 8. Global Workspace as A Service Market by Region

Chapter 9. Company Profiles

Companies Mentioned

- Microsoft Corporation

- Dell Technologies, Inc.

- VMware, Inc.

- Google LLC (Alphabet, Inc.)

- Unisys Corporation

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Citrix Systems, Inc. (Cloud Software Group, Inc.)

- Tech Mahindra Limited

- Colt Technology Services Group Limited (Fidelity Investments)

- Evolve IP, LLC