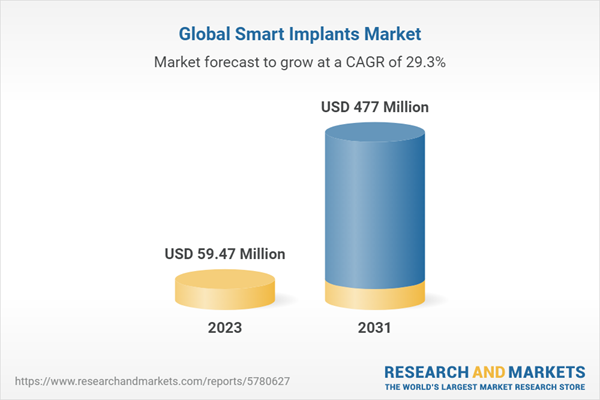

The global smart implants market size was valued at USD 46 million in 2022 and is projected to grow at a CAGR of 29.28% during the forecast period of 2023-2031 to reach a value of USD 477 million by 2031. The market growth can be attributed to the increasing incidence of chronic diseases, advancements in implant technology, and the growing demand for minimally invasive surgeries.

Technological advancements, such as the development of biocompatible materials, improved sensors, and wireless communication, are also expected to drive market growth. The need for personalized healthcare solutions and the emergence of innovative implant technologies are other significant drivers. Key trends in the market include the increasing adoption of minimally invasive procedures, rising demand for personalized healthcare, the growing prevalence of chronic diseases, and the emergence of innovative implant technologies. As the need for more efficient and effective healthcare solutions continues to rise, the smart implants market is expected to witness significant growth in the coming years.

The market for smart implants is expected to continue to grow in the coming years, as the demand for advanced medical devices and personalized healthcare solutions increases. Technological advancements, such as the development of biocompatible materials, improved sensors, and wireless communication, are also expected to drive market growth. The smart implants market presents vast opportunities for innovation and expansion, and it is expected to play a critical role in shaping the future of healthcare.

Global Smart Implants Market: Introduction

Smart implants refer to devices that incorporate advanced technologies, such as sensors, wireless communication, and artificial intelligence, to provide real-time monitoring and feedback. These devices are designed to improve patient outcomes, reduce the risk of complications, and enhance the effectiveness of medical treatments. The increasing incidence of chronic diseases such as cardiovascular and neurological diseases, coupled with the growing demand for minimally invasive surgeries, is driving the demand for smart implants.Technological advancements, such as the development of biocompatible materials, improved sensors, and wireless communication, are also expected to drive market growth. The need for personalized healthcare solutions and the emergence of innovative implant technologies are other significant drivers. Key trends in the market include the increasing adoption of minimally invasive procedures, rising demand for personalized healthcare, the growing prevalence of chronic diseases, and the emergence of innovative implant technologies. As the need for more efficient and effective healthcare solutions continues to rise, the smart implants market is expected to witness significant growth in the coming years.

Applications and Uses

The smart implants market has several applications, including orthopaedic, cardiovascular, neurological, and dental implants. These devices are used to monitor patient conditions, deliver drugs, provide real-time feedback, and improve treatment outcomes. Smart implants offer several advantages, such as reduced recovery time, improved patient comfort, and enhanced precision during surgeries. They also enable remote monitoring and telemedicine, which can help reduce healthcare costs and improve patient access to care. As the demand for more efficient and effective healthcare solutions continues to rise, the smart implants market is expected to witness significant growth in the coming years, driven by the increasing prevalence of chronic diseases and the need for personalized healthcare solutions.Smart Implants Market Segmentations

The market can be segmented based on product type, material, application, distribution channel, and region:Market Breakup by Product

Orthopaedic Implants

- Hip Reconstruction

- Knee Reconstruction

- Shoulder Reconstruction

- Spinal Implants

- Trauma Implants

- Dental Implants

Angiography Implants

- Vascular Closure Devices

- Angiography Accessories

- Others

Market Breakup by Material

- Bone Cement

Metal

- Cobalt

- Alloy

- Titanium

- Others

Market Breakup by Distribution Channel

- Hospitals

- Ambulatory Surgical Centres

- Clinics

- Research Laboratories

Telemedicine Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Smart Implants Market Scenario

The global smart implants market has experienced significant growth over the past few years, driven by factors such as increasing prevalence of chronic diseases, advancements in implant technology, and growing demand for minimally invasive surgeries. North America dominates the market due to the presence of major market players, high healthcare spending, and increasing demand for personalized healthcare solutions. Europe and Asia Pacific regions are also expected to witness significant growth in the smart implants market, driven by increasing healthcare expenditure and growing patient awareness about advanced medical treatments. The COVID-19 pandemic has also contributed to the growth of the smart implants market, as healthcare providers have been forced to adopt remote monitoring and telemedicine to reduce the risk of infection and ensure patient safety. The pandemic has accelerated the adoption of digital health technologies and created new opportunities for innovation and growth in the smart implants market.The market for smart implants is expected to continue to grow in the coming years, as the demand for advanced medical devices and personalized healthcare solutions increases. Technological advancements, such as the development of biocompatible materials, improved sensors, and wireless communication, are also expected to drive market growth. The smart implants market presents vast opportunities for innovation and expansion, and it is expected to play a critical role in shaping the future of healthcare.

Key Players in the Global Smart Implants Market

The report provides a detailed analysis of the key players involved in the smart implants market, including their business overview, product portfolio, recent developments, and financial analysis. Some of the major players operating in the market include:- Johnson & Johnson Services, Inc

- Medronic plc

- Abbott Laboratories

- Boston Scientific Corporation

- Nevro Corp

- Zimmer Biomet

- Cochlear Ltd

- Biotronik

- Seneonics, Inc

- Intelligent Implants

- Freudenberg Group

- AstraZeneca

- Integra LifeSciences

Table of Contents

1 Preface

4 Global Smart Implants Market

5 Trade Data Analysis by HS Code

6 Current Scenario Evaluation and Regulatory Framework

7 Global Smart Implants Market Dynamics

8 Supplier Landscape

10 Pricing Models and Strategies (Additional Insight)

11 Global Smart Implants Distribution Model (Additional Insight)

Companies Mentioned

- Johnson & Johnson Services, Inc.

- Medronic plc

- Abbott Laboratories

- Boston Scientific Corporation

- Nevro Corp.

- Zimmer Biomet

- Cochlear Ltd.

- Biotronik

- Seneonics, Inc.

- Intelligent Implants

- Freudenberg Group

- AstraZeneca

- Integra LifeSciences

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | March 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 59.47 Million |

| Forecasted Market Value ( USD | $ 477 Million |

| Compound Annual Growth Rate | 29.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |