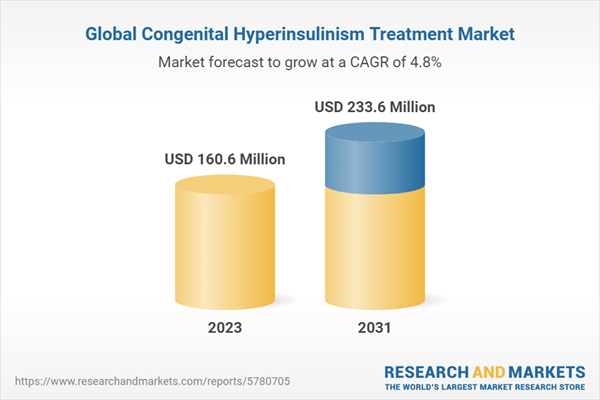

The global congenital hyperinsulinism market size was valued at USD 153.25 million in 2022 and is projected to grow at a CAGR of 4.80% during the forecast period of 2023-2031 to reach a value of USD 233.60 million by 2031. The market growth can be attributed to the rising awareness about the condition and advances in diagnostic and treatment options.

There are various genetic mutations associated with congenital hyperinsulinism, which can be inherited in an autosomal recessive or autosomal dominant manner. Mutations in genes such as ABCC8, KCNJ11, GLUD1, GCK, HADH, SLC16A1, UCP2, and HNF4A have been identified in individuals with congenital hyperinsulinism. These genetic mutations impact the function of pancreatic beta cells, leading to the excessive secretion of insulin and subsequent hypoglycaemia.

North America currently dominates the global congenital hyperinsulinism market, accounting for a significant share of the global market. The region's large market share is driven by factors such as a higher prevalence of congenital hyperinsulinism, a well-established healthcare infrastructure, and strong investment in research and development. In addition, the growing adoption of advanced diagnostic techniques and novel therapeutic approaches is further driving the growth of the market in North America.

Europe is also a significant market for congenital hyperinsulinism, with countries such as the United Kingdom, Germany, and France leading the way. The region's market growth is driven by factors such as a large population base, increasing awareness of congenital hyperinsulinism, and government initiatives to address rare diseases. Additionally, the region has a well-established healthcare system, which supports the delivery of diagnostic and treatment services.

Asia Pacific is another region that is experiencing significant growth in the congenital hyperinsulinism market. The region's market growth is driven by factors such as a large population base, increasing awareness of congenital hyperinsulinism, and the growing adoption of advanced diagnostic and treatment technologies. In addition, government initiatives to address rare diseases are helping to drive the growth of the market in the region.

Global Congenital Hyperinsulinism Market: Introduction

Congenital hyperinsulinism is a rare genetic disorder characterized by excessive insulin secretion, leading to hypoglycaemia. The condition primarily affects infants and can cause seizures, developmental delays, and other severe complications if left untreated. The increasing prevalence of congenital hyperinsulinism, along with growing awareness about the condition, is driving the demand for effective diagnostic and treatment options. Technological advancements in genetic testing and imaging techniques, coupled with the development of novel therapeutic approaches, are expected to drive market growth.Congenital Hyperinsulinism Epidemiology

The exact prevalence of congenital hyperinsulinism is unknown, but the prevalence of congenital hyperinsulinism is estimated to affect approximately 1 in 25,000 to 50,000 live births worldwide. However, this figure may vary across different populations and regions due to differences in genetic factors, demographics, and diagnostic practices. Some specific populations, such as those with consanguineous marriages or certain ethnic groups, may have a higher prevalence of congenital hyperinsulinism.There are various genetic mutations associated with congenital hyperinsulinism, which can be inherited in an autosomal recessive or autosomal dominant manner. Mutations in genes such as ABCC8, KCNJ11, GLUD1, GCK, HADH, SLC16A1, UCP2, and HNF4A have been identified in individuals with congenital hyperinsulinism. These genetic mutations impact the function of pancreatic beta cells, leading to the excessive secretion of insulin and subsequent hypoglycaemia.

Congenital Hyperinsulinism Market Segmentations

The market can be segmented based on diagnosis method, treatment methods, treatment channel, and region:Market Breakup by Diagnosis Methods

- Genetic Testing

- Blood Tests

- Others

Market Breakup by Treatment Methods

Medication

- Diazoxide

- Octreotide

- Glucagon

- Insulin

- Others

- Surgical Treatment

- Others

Market Breakup by Treatment Channel

- Private

- Publics

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Congenital Hyperinsulinism Market Analysis

The global congenital hyperinsulinism market has experienced significant growth over the past few years, driven by factors such as the increasing prevalence of congenital hyperinsulinism, rising awareness about the condition, and advances in diagnostic and treatment options. One key driver of growth in the congenital hyperinsulinism market is the increasing prevalence of the condition.North America currently dominates the global congenital hyperinsulinism market, accounting for a significant share of the global market. The region's large market share is driven by factors such as a higher prevalence of congenital hyperinsulinism, a well-established healthcare infrastructure, and strong investment in research and development. In addition, the growing adoption of advanced diagnostic techniques and novel therapeutic approaches is further driving the growth of the market in North America.

Europe is also a significant market for congenital hyperinsulinism, with countries such as the United Kingdom, Germany, and France leading the way. The region's market growth is driven by factors such as a large population base, increasing awareness of congenital hyperinsulinism, and government initiatives to address rare diseases. Additionally, the region has a well-established healthcare system, which supports the delivery of diagnostic and treatment services.

Asia Pacific is another region that is experiencing significant growth in the congenital hyperinsulinism market. The region's market growth is driven by factors such as a large population base, increasing awareness of congenital hyperinsulinism, and the growing adoption of advanced diagnostic and treatment technologies. In addition, government initiatives to address rare diseases are helping to drive the growth of the market in the region.

Key Players in the Global Congenital Hyperinsulinism Market

The report provides a detailed analysis of the key players involved in the congenital hyperinsulinism market, including their business overview, product portfolio, recent developments, and financial analysis. Some of the major players operating in the market include:- Eli Lilly

- Novo Nordisk

- Novartis AG

- Rezolute, Inc

- Eiger BioPharmaceuticals

- Zealand Pharma A/S

- Hanmi Pharmaceutical Co., Ltd

- Crinetics Pharmaceuticals, Inc

- AmideBio LLC

Table of Contents

1 Preface

4 Congenital Hyperinsulinism Overview

5 Patient Profile

6 Current Scenario Evaluation

7 Challenges and Unmet Needs

8 Global Congenital Hyperinsulinism Treatment Market

9 North America Congenital Hyperinsulinism Treatment Market

10 Europe Congenital Hyperinsulinism Treatment Market

11 Asia Pacific Congenital Hyperinsulinism Treatment Market

12 Latin America Congenital Hyperinsulinism Treatment Market

13 Middle East and Africa Congenital Hyperinsulinism Treatment Market

14 Congenital Hyperinsulinism Treatment Market Dynamics

15 Supplier Landscape

16 Global Congenital Hyperinsulinism Treatment Market- Distribution Model (Additional Insight)

17 Payment Methods (Additional Insight)

Companies Mentioned

- Eli Lilly

- Novo Nordisk

- Novartis AG

- Rezolute, Inc.

- Eiger BioPharmaceuticals.

- Zealand Pharma A/S

- Hanmi Pharmaceutical Co., Ltd.

- Crinetics Pharmaceuticals, Inc.

- AmideBio LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | March 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 160.6 Million |

| Forecasted Market Value ( USD | $ 233.6 Million |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |