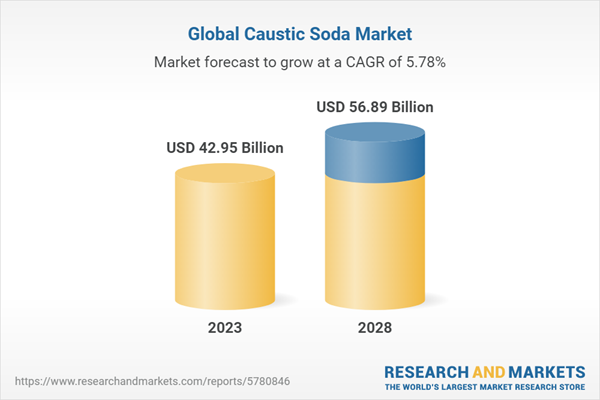

Caustic soda or sodium hydroxide is an odorless, highly corrosive, non-flammable white solid which can also be used as an esterification and transesterification reagent and cleaning agent. It is widely consumed in chemical pulping involving sulphite, sulphate, and soda, among others. In 2022, the global caustic soda market was valued at US$40.61 billion, and is probable to reach US$56.89 billion by 2028. The global caustic soda market production capacity stood at 100.57 million tonnes in 2022 and is expected to reach 112.57 million tonnes in 2028.

The global caustic soda market growth is driven by various industries like pulp and paper industry, soap and detergent market, alumina market. There is an increasing demand for PVC globally and the expanding use of caustic soda in mining, metal processing, glass production, food and textile industry. Increase in innovation and development in manufacturing processes of caustic soda is anticipated to provide growth opportunities for the market growth. The global caustic soda market value is projected to grow at a CAGR of 5.78%, during the forecast period of 2023-2028. The global caustic soda market by production capacity would augment at a CAGR of 1.89% during the estimated period of 2023-2028

Market Segmentation Analysis:

- By Production Process: According to the report, the global caustic soda market is segmented into three production process: Membrane Cell, Diaphragm Cell and Others. Membrane Cell segment acquired majority of share in the market in 2022, owing to its environment friendly nature and low energy consumption. The membrane process for manufacturing caustic soda is considered as environmentally-safer than the diaphragm process due to use of asbestos in the latter leading to ESG concerns. Whereas, Diaphragm Cell segment is the fastest growing in the production process, as it has various advantages such as low electricity consumption and it can run on dilute impure brine and is compact in size.

- By Application: According to the report, the global caustic soda market is bifurcated into seven applications: Organic Chemicals, Inorganic Chemicals, Pulp and Paper, Alumina, Soap and Detergent, Water Treatment and Others. Organic Chemicals segment acquired majority of share in the market in 2022, as about 60% of all chemical products are produced, directly or indirectly, using chlorine and/or caustic soda. Whereas, pulp and paper segment is expected to have the highest CAGR in the future as caustic soda is an crucial element in the production of paper and pulp because it is used to separate and dissolve cellulose fibers from lignin and also aids in the degradation of wood, which results in pulp.

- By Region: The report provides insight into the caustic soda market based on the geographical operations, namely North America, Europe, Asia Pacific, and Rest of the World. Asia Pacific caustic soda market enjoyed the highest market share in 2022, primarily owing to rapid industrialization, urbanization, and population growth. Asia Pacific is largest producer of paper and pulp across the globe, which has led to the development of various caustic soda manufacturing companies. China is the greatest producer and consumer of caustic soda. The expansion of the textile sector in rising economies such as China, India, Vietnam, and Taiwan is primarily responsible for high product demand. Furthermore, Asia Pacific region is expected to grow at the fastest CAGR during the forecast period owing to rising use in industries such as aluminum and textiles.

Global Caustic Soda Market Dynamics:

- Growth Drivers: Caustic soda is frequently used to extract alumina, the most prevalent oxides of aluminum. Because of its lightweight and durability, aluminum is suitable for carrying energy across great distances. Aluminum can be rolled into the correct shape and thickness using a continuous casting and cold rolling process. Therefore, leading to the growth in the caustic soda market. Further, the market is expected to increase due to rising demand for alumina in the industry, rapid urbanization, surge in demand for pulp and paper, mounting use of caustic soda in textile industry, etc.

- Challenges: Highly corrosive nature and stringent government regulations can become a challenge for caustic soda market in several ways as when used in large quantities, sodium hydroxide can be extremely dangerous, causing serious burns to the skin and eyes. When caustic soda comes into contact with the eyes, it can cause irreversible eye damage and blindness. The other challenge that caustic soda market faces is energy-intensive production processes and major environmental concerns, etc.

- Trends: A major trend gaining pace in caustic soda market is surging demand for caustic soda in the water treatment industry. The water treatment industry is a key user of caustic soda, and the increasing demand for caustic soda in this industry would drive the caustic soda market's expansion. Caustic soda is used in the water treatment industry to adjust pH, neutralize water, and remove pollutants. More trends in the market are believed to augment the growth of caustic soda market during the forecasted period include growing importance of chlor-alkali products, technology advancements, augmenting demand from emerging economies, etc.

Impact Analysis of COVID-19 and Way Forward:

The market was negatively impacted by the COVID-19 pandemic in 2020. The coronavirus's impact on demand for chlorine derivatives has squeezed the supply of caustic soda, a by-product of chlorine production. However, the rising prevention due to the spread of COVID-19 increased the demand for soaps, which further propelled the demand for caustic soda, thereby driving the industry's growth.

Competitive Landscape and Recent Developments:

Global caustic soda market is fragmented. Key players of global caustic soda market are:

- Solvay SA

- SABIC

- INEOS Group Holdings S.A.

- The Dow Chemical Company

- Formosa Plastics Corp

- BASF SE

- Olin Corporation

- Occidental Petroleum Corporation

- Tata Chemicals Limited

- Grasim Industries Limited

- Hanwha Chemical Group

- Tosoh Corporation

- Westlake Corporation

- Shin-Etsu Chemical Co., Ltd

The key players are constantly investing in strategic initiatives, such as new product launches, introducing their products to emerging markets and more, to maintain a competitive edge in this market. For instance, February 2022, Occidental Petroleum's chemical division is considering an overhaul of some chlor-alkali plants to increase capacity to produce higher-value caustic soda. This will give it the chance to make a big change to its current capacity in order to meet the growing demand for its key products. Also, In January 2021, Shin-Etsu Chemical Co. announced the plans to further increase its production capacity of caustic soda by 390,000 m.t. /yr. The project construction is expected to be completed by end of 2023.

Table of Contents

1. Executive Summary

Companies Mentioned

- Solvay SA

- SABIC

- INEOS Group Holdings S.A.

- The Dow Chemical Company

- Formosa Plastics Corp

- BASF SE

- Olin Corporation

- Occidental Petroleum Corporation

- Tata Chemicals Limited

- Grasim Industries Limited

- Hanwha Chemical Group

- Tosoh Corporation

- Westlake Corporation

- Shin-Etsu Chemical Co., Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 159 |

| Published | April 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 42.95 Billion |

| Forecasted Market Value ( USD | $ 56.89 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |