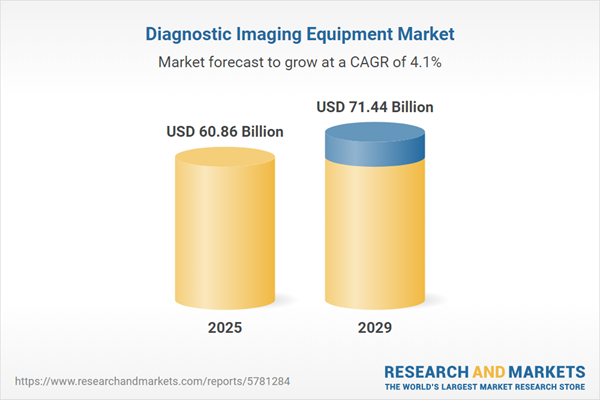

The diagnostic imaging equipment market size has grown strongly in recent years. It will grow from $56.96 billion in 2024 to $60.86 billion in 2025 at a compound annual growth rate (CAGR) of 6.9%. The growth in the historic period can be attributed to aging population, increasing disease burden, healthcare reimbursement, regulatory approvals.

The diagnostic imaging equipment market size is expected to see steady growth in the next few years. It will grow to $71.44 billion in 2029 at a compound annual growth rate (CAGR) of 4.1%. The growth in the forecast period can be attributed to artificial intelligence (AI) integration, remote imaging services, personalized medicine, emerging markets growth, minimally invasive procedures. Major trends in the forecast period include the adoption of 3D and 4D imaging techniques, point-of-care imaging, radiation dose reduction, hybrid imaging, environmental sustainability.

The global rise in chronic diseases is expected to drive the growth of the diagnostic imaging equipment market. Chronic diseases, which last for a year or longer and require continuous medical care, include conditions such as cancer, diabetes, and cardiovascular diseases. Diagnostic imaging techniques in radiology are essential for identifying these diseases, even in their asymptomatic stages. For example, in September 2023, the World Health Organization (WHO) reported that noncommunicable diseases (NCDs) account for 41 million deaths annually, representing 74% of global fatalities. Additionally, 17 million people die before the age of 70, with 86% of these deaths occurring in low- and middle-income countries. As the prevalence of chronic diseases increases globally, the demand for diagnostic imaging equipment is expected to grow.

The diagnostic imaging equipment market is anticipated to experience growth due to the rising prevalence of eye diseases. Eye diseases encompass a range of conditions and disorders that can adversely affect an individual's vision. Healthcare providers heavily rely on diagnostic imaging equipment to accurately diagnose and effectively manage various eye-related conditions. For instance, data from the International Agency for the Prevention of Blindness (IAPB), a global alliance headquartered in the UK that is dedicated to eliminating avoidable blindness and promoting eye health, indicates a projected 55% increase in vision loss by 2050. The number of people affected by vision loss is expected to grow from 1.1 billion in 2020 to 1.75 billion in 2050. As a result, the growing prevalence of eye diseases is expected to be a key driver of growth in the diagnostic imaging equipment market.

Major companies in the diagnostic imaging equipment market are increasingly focused on developing advanced technologies, such as medical imaging, to improve diagnostic accuracy and patient outcomes. These innovations are designed to streamline workflows and enhance accessibility to high-quality imaging. Medical imaging techniques, including X-rays, MRI, CT scans, and ultrasound, are essential for visualizing the interior of the body to support diagnosis and treatment. For example, in April 2022, Wipro Ltd., an India-based technology company, partnered with GE HealthCare Technologies, Inc., a US-based medical technology company, to enhance the Aspire CT scanner - a state-of-the-art computed tomography system made entirely in India. Aligned with the Atmanirbhar Bharat initiative, this next-generation scanner offers advanced imaging capabilities, operational efficiency with up to 50% higher throughput, and a 30% improvement in image quality. Produced at a new facility backed by over INR 100 crore in investment under the government’s Production Linked Incentives (PLI) Scheme, the scanner aims to improve access to quality healthcare, particularly in tier 2 and tier 3 cities.

The portable diagnostic equipment segment is expected to experience rapid growth, and industry competitors are placing a strong emphasis on developing novel and innovative portable equipment throughout the forecast period. These portable devices are gaining increasing adoption due to their ease of use and suitability for point-of-care applications, not only in hospital emergency and intensive care units but also within home care organizations. The demand for portable devices in emergency care units is also rising to facilitate easy and rapid use, expedite interventions during acute events, and improve monitoring capabilities. Prominent examples of such products include Samsung Electronics' 32-SLICE CT scanner, Brain Biosciences' CERPET portable PET scanner, Siemens Healthcare's Mobilett Mira Max portable X-ray systems, and Sonosite's MicroMaxx portable ultrasound system.

Major companies operating in the diagnostic imaging equipment market include Siemens AG, Koninklijke Philips NV, Fujifilm Holdings Corporation, General Electric Company, Elekta AB, Carestream Health Inc., Hologic Inc., Medtronic PLC, Mindray Medical International Limited, Canon Medical Systems Corporation, Esaote SpA, Shimadzu Medical Systems USA, Samsung Electronics Co. Ltd., Koning Corporation, Toshiba Medical Systems Corporation, Hitachi Medical Systems America Inc., Agfa-Gevaert NV, Analogic Corporation, Bracco Imaging SpA, Del Medical Inc., Esaote North America Inc., Imaging Dynamics Company Ltd., InfiMed Inc., Mediso Medical Imaging Systems Kft., NeuroLogica Corp., Planmed Oy, Shimadzu Corporation, SonoScape Medical Corp., SuperSonic Imagine SA, Terason, Toshiba America Medical Systems Inc., Ziehm Imaging GmbH, Zonare Medical Systems Inc.

Diagnostic imaging equipment plays a crucial role in enabling medical professionals to gain insight into the interior of the human body for the purpose of identifying potential health issues.

The primary categories of diagnostic imaging equipment encompass x-ray systems, ultrasound systems, computed tomography (CT) scanners, magnetic resonance imaging (MRI) systems, cardiovascular monitoring devices, and nuclear imaging equipment. Nuclear imaging devices employ specialized gamma cameras and single-photon emission-computed tomography (SPECT) imaging techniques. These gamma cameras capture the energy emissions produced by radiotracers within the body and transform them into visual representations. Funding for such equipment is derived from both public and private sources, while the products employed consist of instruments and equipment, as well as disposables. These imaging systems find application in various healthcare settings, including hospitals, clinics, diagnostic laboratories, and other medical facilities.

The diagnostic imaging equipment market research report is one of a series of new reports that provides diagnostic imaging equipment market statistics, including diagnostic imaging equipment industry global market size, regional shares, competitors with a diagnostic imaging equipment market share, detailed diagnostic imaging equipment market segments, market trends and opportunities, and any further data you may need to thrive in the diagnostic imaging equipment industry. This diagnostic imaging equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Western Europe was the largest region in the global diagnostic imaging equipment market in 2024. North America was the second largest region in the global diagnostic imaging equipment market. Africa. was the smallest region in the global diagnostic imaging equipment market. The regions covered in the diagnostic imaging equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the diagnostic imaging equipment market report are Australia, China, India, Indonesia, Japan, South Korea, Bangladesh, Thailand, Vietnam, Malaysia, Singapore, Philippines, Hong Kong, New Zealand, USA, Canada, Mexico, Brazil, Chile, Argentina, Colombia, Peru, France, Germany, UK, Austria, Belgium, Denmark, Finland, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Russia, Czech Republic, Poland, Romania, Ukraine, Saudi Arabia, Israel, Iran, Turkey, UAE, Egypt, Nigeria, South Africa.

The diagnostic imaging equipment market consists of sales of breast imaging devices, brain, neuroimaging devices, 3D medical imaging devices, and other devices. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Executive Summary

Diagnostic Imaging Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on diagnostic imaging equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for diagnostic imaging equipment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The diagnostic imaging equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: X-Ray Systems Devices and Equipment; Ultrasound Systems Devices and Equipment; Computed Tomography (CT) Scanners Devices and Equipment; Magnetic Resonance Imaging Systems Devices and Equipment; Cardiovascular Monitoring and Diagnostic Devices and Equipment; Nuclear Imaging Devices and Equipment2) By End User: Hospitals and Clinics; Diagnostic Laboratories; Other End Users

3) By Type of Expenditure: Public; Private

4) By Product: Instruments or Equipment; Disposables

Subsegments:

1) By X-Ray Systems Devices and Equipment: Analog X-Ray Systems; Digital X-Ray Systems; Fluoroscopy Systems; Portable X-Ray Systems; Mammography Systems2) By Ultrasound Systems Devices and Equipment: Diagnostic Ultrasound Systems; Therapeutic Ultrasound Systems; 2D Ultrasound Systems; 3D or 4D Ultrasound Systems; Portable Ultrasound Systems

3) By Computed Tomography (CT) Scanners Devices and Equipment: Conventional CT Scanners; Spiral or Helical CT Scanners; Multislice CT Scanners; Portable CT Scanners

4) By Magnetic Resonance Imaging Systems Devices and Equipment: Closed MRI Systems; Open MRI Systems; Extremity MRI Systems; High-Field MRI Systems; Low-Field MRI Systems

5) By Cardiovascular Monitoring and Diagnostic Devices and Equipment: ECG Systems; Echocardiography Systems; Stress Testing Systems; Cardiac Catheterization Equipment; Holter Monitoring Systems

6) By Nuclear Imaging Devices and Equipment: Positron Emission Tomography (PET) Scanners; Single-Photon Emission Computed Tomography (SPECT) Scanners; Hybrid PET or CT Scanners; Gamma Cameras

Key Companies Mentioned: Siemens AG; Koninklijke Philips NV; Fujifilm Holdings Corporation; General Electric Company; Elekta AB

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Diagnostic Imaging Equipment market report include:- Siemens AG

- Koninklijke Philips NV

- Fujifilm Holdings Corporation

- General Electric Company

- Elekta AB

- Carestream Health Inc.

- Hologic Inc.

- Medtronic plc

- Mindray Medical International Limited

- Canon Medical Systems Corporation

- Esaote SpA

- Shimadzu Medical Systems USA

- Samsung Electronics Co. Ltd.

- Koning Corporation

- Toshiba Medical Systems Corporation

- Hitachi Medical Systems America Inc.

- Agfa-Gevaert NV

- Analogic Corporation

- Bracco Imaging SpA

- Del Medical Inc.

- Esaote North America Inc.

- Imaging Dynamics Company Ltd.

- InfiMed Inc.

- Mediso Medical Imaging Systems Kft.

- NeuroLogica Corp.

- Planmed Oy

- Shimadzu Corporation

- SonoScape Medical Corp.

- SuperSonic Imagine SA

- Terason

- Toshiba America Medical Systems Inc.

- Ziehm Imaging GmbH

- Zonare Medical Systems Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 400 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 60.86 Billion |

| Forecasted Market Value ( USD | $ 71.44 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 34 |