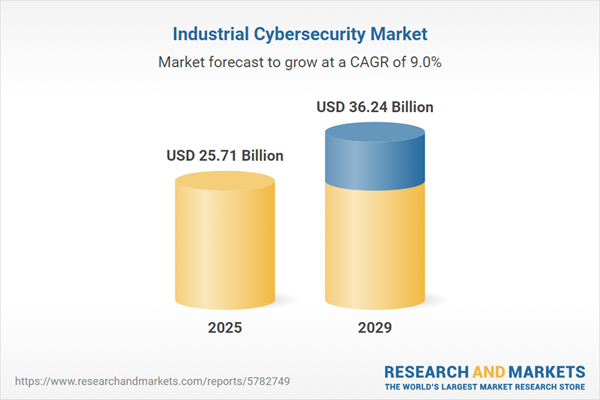

The industrial cybersecurity market size is expected to see strong growth in the next few years. It will grow to $36.24 billion in 2029 at a compound annual growth rate (CAGR) of 9%. The growth in the forecast period can be attributed to integration of physical and cybersecurity, increasing use of autonomous systems, cyber insurance adoption, continued regulatory evolution, emergence of industry 4.0. Major trends in the forecast period include integration of IT and OT security, focus on zero trust architecture, growing adoption of artificial intelligence (AI) and machine learning (ML), cloud-based security solutions, supply chain security, cybersecurity training and awareness, continuous monitoring and threat intelligence.

The surge in demand for industrial cybersecurity solutions and services is poised to propel growth within the industrial cybersecurity market. These solutions and services encompass technologies and measures aimed at securing various industrial layers while ensuring the uninterrupted flow of operational processes. The growing need for such solutions, including advanced security measures like firewalls, antivirus systems, and intrusion detection systems, drives the expansion of the industrial cybersecurity market. Notably, as per the Bureau of Labor Statistics report in 2022, the demand for information security analysts is projected to surge by 28%, adding 2.8k jobs, while the global industrial cybersecurity sector is anticipated to create 3.5 million jobs by 2025. Hence, the escalating need for industrial cybersecurity solutions and services is a significant driver behind the market's growth.

The increase in cybercrime incidents stands as a catalyst driving growth in the industrial cybersecurity market. Cybercrime, involving illicit activities using computers, networks, and the internet, poses significant threats like financial losses, reputational damage, and legal repercussions. Industrial cybersecurity plays a pivotal role in safeguarding critical infrastructure and manufacturing operations by implementing robust security measures, threat detection systems, and incident response strategies. According to the Australian Cyber Security center's February 2023 report, cybercrime reports surged to 76,000 in 2022, marking a 13% increase from the previous year. This upsurge in cybercrime cases fuels the growth of the industrial cybersecurity market.

Leading companies in the industrial cybersecurity market are harnessing artificial intelligence (AI) to drive innovation and gain a competitive edge. AI-driven industrial cybersecurity involves leveraging advanced AI algorithms to autonomously identify, analyze, and counter cyber threats within industrial environments, enhancing the overall security of critical infrastructure and manufacturing systems. For instance, Rubrik unveiled 'Ruby' in November 2023 - an AI-driven companion designed with Azure OpenAI and machine learning-driven data threat engines. Ruby streamlines cyber detection, recovery, and resilience processes, automating incident discovery, investigation, remediation, and reporting.

Key players in the industrial cybersecurity market are forging strategic partnerships to fortify their market positions. These alliances involve pooling resources and expertise to achieve mutual success. For instance, ABSG Consulting Inc. partnered with Dragos Inc. in October 2023. This collaboration amalgamates ABS Consulting's expertise in OT risk management with Dragos' top-notch cybersecurity technology specializing in industrial control systems (ICS) and operational technology (OT) security. The joint effort aims to meet the escalating cyber demands within critical infrastructure industries by providing comprehensive and well-resourced cybersecurity solutions tailored to industry needs.

In November 2023, Rockwell Automation Inc., a US-based leader in industrial automation and digital transformation, acquired Verve Industrial Protection for an undisclosed amount. This acquisition is intended to strengthen Rockwell Automation's cybersecurity capabilities, equipping customers with advanced tools for asset inventory and vulnerability management to better safeguard their operational technology environments from evolving cyber threats. Verve Industrial Protection, a US-based software company, specializes in integrating cybersecurity measures into industrial settings to protect operations against emerging cyber threats.

Major companies operating in the industrial cybersecurity market are IBM Corporation, Honeywell International Inc., Asea Brown Boveri Ltd., Schneider Electric SE, Rockwell Automation Inc., CrowdStrike Holdings Inc., SparkCognition Inc., Palo Alto Networks Inc., Check Point Software Technologies Ltd., Darktrace Ltd., Fortinet Inc., Microsoft Corporation, SkyHigh Security, SonicWall Inc., Splunk Inc., Tanium Inc., Broadcom Inc., Mandiant Solutions Inc., Siemens AG, CyberArk Software Ltd., Claroty Inc., Nozomi Networks Inc., Dragos Inc., Sumo Logic Inc., Fortalice Solutions LLC, ThreatConnect Inc., Cydive Inc., Forescout Technologies Inc., Indegy Inc.

North America was the largest region in the industrial cybersecurity market in 2024. The regions covered in the industrial cybersecurity market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the industrial cybersecurity market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Industrial cybersecurity represents a suite of technologies and services within industrial control systems, aimed at analyzing and fortifying the cybersecurity measures for computer-controlled systems. The goal is to reduce risks to a sustainable residual level, ensuring the security and integrity of industrial operations.

The primary categories of industrial cybersecurity include network security, endpoint security, application security, and cloud security. Network security integrates various technologies to uphold the functionality and integrity of a company's infrastructure by thwarting a broad spectrum of potential threats from infiltrating or spreading within a network. Components encompass a range of products, software, services, and solutions such as antivirus programs, firewalls, DDoS (Distributed Denial-of-Service) mitigation, SCADA (Supervisory Control and Data Acquisition), and other protective measures. These solutions cater to end-users across diverse sectors including energy and utilities, transportation systems, chemicals and manufacturing, among others, fortifying their cybersecurity measures.

The industrial cybersecurity market research report is one of a series of new reports that provides industrial cybersecurity market statistics, including industrial cybersecurity industry global market size, regional shares, competitors with an industrial cybersecurity market share, detailed industrial cybersecurity market segments, market trends and opportunities, and any further data you may need to thrive in the industrial cybersecurity industry. This industrial cybersecurity market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The industrial cybersecurity services market includes revenues earned by entities through wireless security, mobile security, and IoT security. The market value includes the value of related goods sold by the service provider or included within the service offering. The industrial cybersecurity services market also includes sales of gateways, routers and Ethernet switches. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Industrial Cybersecurity Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on industrial cybersecurity market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for industrial cybersecurity? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The industrial cybersecurity market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Type: Network Security; Endpoint Security; Application Security; Cloud Security2) by Component: Products; Software; Services

3) by Solutions: Antivirus; Firewall; DDOs; Scada; Other Solutions

4) by End-Use: Energy and Utilities; Transportation Systems; Chemicals and Manufacturing; Other End Users

Subsegments:

1) by Network Security: Intrusion Detection Systems (IDS); Firewalls; Virtual Private Networks (VPNs)2) by Endpoint Security: Antivirus Solutions; Endpoint Detection and Response (EDR); Mobile Device Management (MDM)

3) by Application Security: Web Application Firewalls (WAF); Application Security Testing (AST); Secure Software Development Lifecycle (SDLC) Tools

4) by Cloud Security: Cloud Access Security Brokers (CASB); Cloud Security Posture Management (CSPM); Data Loss Prevention (DLP) Solutions

Key Companies Mentioned: IBM Corporation; Honeywell International Inc.; Asea Brown Boveri Ltd.; Schneider Electric SE; Rockwell Automation Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Industrial Cybersecurity market report include:- IBM Corporation

- Honeywell International Inc.

- Asea Brown Boveri Ltd.

- Schneider Electric SE

- Rockwell Automation Inc.

- CrowdStrike Holdings Inc.

- SparkCognition Inc.

- Palo Alto Networks Inc.

- Check Point Software Technologies Ltd.

- Darktrace Ltd.

- Fortinet Inc.

- Microsoft Corporation

- SkyHigh Security

- SonicWall Inc.

- Splunk Inc.

- Tanium Inc.

- Broadcom Inc.

- Mandiant Solutions Inc.

- Siemens AG

- CyberArk Software Ltd.

- Claroty Inc.

- Nozomi Networks Inc.

- Dragos Inc.

- Sumo Logic Inc.

- Fortalice Solutions LLC

- ThreatConnect Inc.

- Cydive Inc.

- Forescout Technologies Inc.

- Indegy Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 25.71 Billion |

| Forecasted Market Value ( USD | $ 36.24 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |