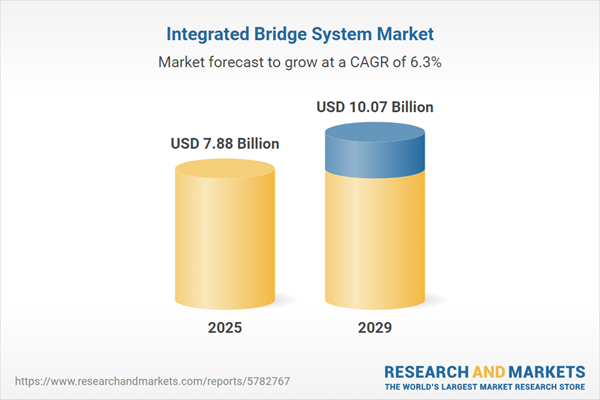

The integrated bridge system market size is expected to see strong growth in the next few years. It will grow to $10.07 billion in 2029 at a compound annual growth rate (CAGR) of 6.3%. The growth in the forecast period can be attributed to increasing vessel traffic in ports, shift toward autonomous shipping, increased emphasis on environmental compliance, expansion of cruise and passenger shipping, rising demand for offshore support vessels, focus on remote monitoring and diagnostics. Major trends in the forecast period include digitalization and connectivity, advanced navigation and maneuvering capabilities, cybersecurity integration, compliance with navigation standards and regulations, human-centered design, upgradation to meet e-navigation requirements, collaborations and partnerships.

The growth of world seaborne trade is expected to propel the integrated bridge system (IBS) market. Seaborne trade refers to the balance between the volumes of loaded and discharged goods. IBS facilitates the acquisition and management of sensor data for various tasks, including passage execution, communication, machinery control, safety and security, and support for maritime commerce. For instance, in July 2024, the Department for Transport, a UK-based government department, reported that in 2023, tonnage traffic for deep-sea trade increased for both imports and exports, with imports rising by 7% compared to 2022, while exports saw a more substantial growth of 10%. Therefore, the rising world seaborne trade is driving the expansion of the integrated bridge system market.

The rise in defense expenditure is expected to drive the growth of the integrated bridge systems (IBS) market in the coming years. Defense expenditure refers to the financial resources allocated by a state for raising and maintaining armed forces and other necessary defense measures. The increase in defense spending facilitates the procurement and implementation of advanced IBS solutions, which are crucial for enhancing maritime security, improving situational awareness, and optimizing the operational efficiency of naval fleets. For example, in April 2023, the Stockholm International Peace Research Institute, a Sweden-based independent resource on global security, reported that global military spending rose by 3.7 percent in 2022. Therefore, the growing defense expenditure is fueling the expansion of the integrated bridge systems market.

Technological advancement emerges as a pivotal trend in the integrated bridge systems market. Key industry players are focused on innovating new product solutions to enhance their market position. For example, in May 2022, China Railway Hi-tech Industry Corporation introduced intelligent pile-beam integrated bridge-building machines based on BeiDou positioning technology. This innovation significantly boosts efficiency, reduces construction costs, environmental impact, and enhances construction safety compared to traditional methods.

Innovation remains a cornerstone strategy for major companies within the integrated bridge systems market. These innovations involve continuous development and integration of advanced features to optimize maritime navigation, safety, and operational efficiency. For instance, in November 2022, Radio Zeeland DMP launched the Z-bridge - a comprehensive solution tailored for land and marine seismic crews. This system integrates navigation displays, controls, and communication equipment for enhanced safety and operational functionalities, offering a holistic approach to customers with a focus on automation, security, and connectivity.

In March 2023, Dieter Murmann Beteiligungsgesellschaft (DMB), a German industrial firm, completed the undisclosed acquisition of Anschütz. This strategic move bolsters DMB's maritime portfolio significantly, positioning them to broaden their customer reach through Anschütz's extensive German and international maritime research initiatives. Anschütz, renowned for its ship navigation systems and maritime solutions, operates out of Germany.

Major companies operating in the integrated bridge system market are Sperry Marine Northrop Grumman, Praxis Automation Technology B.V., Admarel BV, Hensoldt UK, Prime Mover Controls Inc., OSI Maritime Systems, Wartsila Valmarine AS, Alphatron Marine, Consilium Marine & Safety Ab, Danelec Marine A/S, Furuno Electric Co Ltd., Norwegian Electric Systems As, GEM elettronica, L3 Mapps Inc., Mackay Communications Inc., Marine Technologies LLC, Alfa Laval Corporate AB, Atlas Elektronik GmbH, BAE Systems PLC, Elcome International LLC, Emerson Electric Co., Fincantieri S.p.A., Garmin Ltd., General Dynamics Corporation, Hatteland Display AS, Honeywell International Inc., Hyundai Heavy Industries Co. Ltd., Japan Radio Co. Ltd., Kelvin Hughes Limited, Leonardo S.p.A., Lilaas AS, Mitsubishi Electric Corporation, Navico Holding AS, Raytheon Technologies Corporation, Rolls-Royce Holdings PLC, Saab AB.

Asia-Pacific was the largest region in the integrated bridge system market in 2024. The regions covered in the integrated bridge system market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the integrated bridge system market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

An Integrated Bridge System (IBS) represents an interconnected network of systems facilitating centralized access to sensor data or command and control. Its purpose is to enhance the safe and efficient management of ships by duly certified personnel. This system allows for centralized monitoring of multiple navigational tools.

The key components encompass both hardware and software. Hardware denotes the tangible elements of computers and related devices. Ship categories encompass commercial and defense vessels. Subsystems within this system include an integrated navigation system, voyage data recorder, automatic weather observation system, automatic identification system, among others. These subsystems are applied across various vessels such as megayachts, tankers, container ships, cruise ships, and naval surface ships. They find utilization in both Original Equipment Manufacturer (OEM) setups and aftermarket installations.

The integrated bridge system market research report is one of a series of new reports that provides integrated bridge system market statistics, including integrated bridge system industry global market size, regional shares, competitors with an integrated bridge system market share, detailed integrated bridge system market segments, market trends and opportunities, and any further data you may need to thrive in the integrated bridge system industry. This integrated bridge system market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The integrated bridge system market consists of ship movement control systems, navigation systems, mapping systems, radar systems, and other types. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Integrated Bridge System Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on integrated bridge system market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for integrated bridge system? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The integrated bridge system market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Component: Hardware; Software2) by Ship Type: Commercial; Defense

3) by Subsystem: Integrated Navigation System; Voyage Data Recorder; Automatic Weather Observation System; Automatic Identification System; Other Subsystems

4) by Application: Vessels; Megayachts; Tankers; Container Ships; Cruise Ships; Naval Surface Ships

5) by End-User: OEM; Aftermarket

Subsegments:

1) by Hardware: Display Systems; Navigation Sensors; Communication Equipment; Control Consoles; Computer Systems2) by Software: Navigation Software; Integrated Management Systems; Data Processing and Analysis Software; User Interface Software; Maintenance and Diagnostics Software

Key Companies Mentioned: Sperry Marine Northrop Grumman; Praxis Automation Technology B.V.; Admarel BV; Hensoldt UK; Prime Mover Controls Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Integrated Bridge System market report include:- Sperry Marine Northrop Grumman

- Praxis Automation Technology B.V.

- Admarel BV

- Hensoldt UK

- Prime Mover Controls Inc.

- OSI Maritime Systems

- Wartsila Valmarine AS

- Alphatron Marine

- Consilium Marine & Safety Ab

- Danelec Marine A/S

- Furuno Electric Co Ltd.

- Norwegian Electric Systems As

- GEM elettronica

- L3 Mapps Inc.

- Mackay Communications Inc.

- Marine Technologies LLC

- Alfa Laval Corporate AB

- Atlas Elektronik GmbH

- BAE Systems PLC

- Elcome International LLC

- Emerson Electric Co.

- Fincantieri S.p.A.

- Garmin Ltd.

- General Dynamics Corporation

- Hatteland Display AS

- Honeywell International Inc.

- Hyundai Heavy Industries Co. Ltd.

- Japan Radio Co. Ltd.

- Kelvin Hughes Limited

- Leonardo S.p.A.

- Lilaas AS

- Mitsubishi Electric Corporation

- Navico Holding AS

- Raytheon Technologies Corporation

- Rolls-Royce Holdings PLC

- Saab AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.88 Billion |

| Forecasted Market Value ( USD | $ 10.07 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 37 |