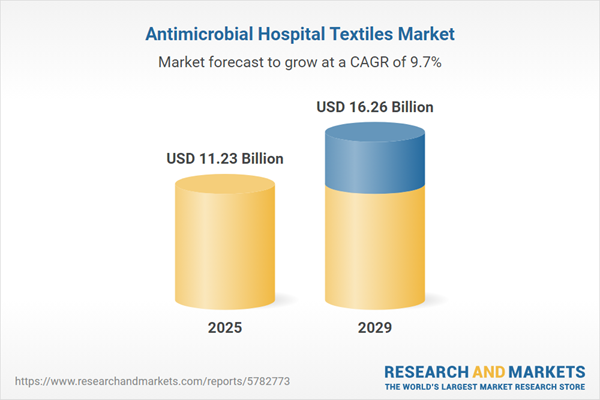

The antimicrobial hospital textiles market size is expected to see strong growth in the next few years. It will grow to $16.26 billion in 2029 at a compound annual growth rate (CAGR) of 9.7%. The growth in the forecast period can be attributed to global health crises, rise in healthcare infrastructure development, demand for sustainable and eco-friendly textiles, increasing geriatric population, government initiatives for healthcare hygiene, awareness of textile-related infections. Major trends in the forecast period include increased focus on infection control, advancements in antimicrobial technologies, demand for sustainable antimicrobial textiles, integration of smart textile technologies, collaborations and partnerships.

The growing awareness of hospital-acquired infections is anticipated to drive the expansion of the antimicrobial hospital textiles market in the future. Hospital-acquired infections are those contracted during medical care within a healthcare facility, typically from healthcare providers such as doctors or nurses. Antimicrobial hospital textiles are designed to mitigate the risk of these infections by targeting areas such as the digestive tract, urinary tract, skin, lungs, and bloodstream with agents that inhibit bacterial growth and spread. For instance, in May 2022, the World Health Organization (WHO) reported that around 7 out of 100 patients in high-income countries and 15 out of 100 in low- and middle-income countries develop at least one healthcare-associated infection (HAI) during their hospital stay. Despite these challenges, positive developments have been noted, including an increase in countries designating infection prevention and control (IPC) focal points, allocating dedicated budgets for IPC initiatives, and creating training programs for frontline healthcare workers. Furthermore, nations are focused on establishing national IPC guidelines, implementing programs for HAI surveillance, employing multimodal strategies for IPC interventions, and prioritizing hand hygiene compliance as a key national metric. As a result, the heightened awareness of hospital-acquired infections is propelling the growth of the antimicrobial hospital textiles market.

The growth of the antimicrobial hospital textiles market is expected to be propelled by the aging population. With an increasing proportion of elderly individuals within societies, antimicrobial hospital textiles are critical for infection control in this demographic. These textiles act as a protective barrier against pathogens, addressing infection-related concerns prevalent in healthcare settings serving the aging population. As projected by the World Health Organization in October 2022, by 2030, one in every six individuals globally will be 60 years or older, and this proportion is expected to rise to 1.4 billion people. Additionally, by 2050, the number of individuals aged 60 and above is projected to double to 2.1 billion, emphasizing the growing significance of antimicrobial textiles in healthcare facilities catering to this demographic.

Leading companies in the antimicrobial hospital textiles market are introducing sustainable antimicrobial fabric to meet escalating market demands. Sustainable antimicrobial fabric refers to textiles manufactured through environmentally conscious processes and materials, equipped with antimicrobial properties that combat microorganisms while minimizing environmental impact. For instance, in October 2022, Noble Biomaterials unveiled Ionic+ Botanical, an innovative antimicrobial fabric treatment utilizing renewable citric-based technology. This solution offers durability for up to 50 wash cycles and complements Noble's existing Ionic+ Mineral technology. The company collaborates with partners such as Salomon, Crystal Denim, and Trident to extend the application of Ionic+ products across various sectors like home textiles, luggage, and sports accessories, emphasizing sustainability and efficacy in antimicrobial fabric development.

Prominent companies in the antimicrobial hospital textiles sector are introducing novel solutions, particularly antimicrobial curtains tailored for healthcare settings. These specialized curtains are designed with materials or coatings that hinder microorganism growth, establishing a hygienic barrier to mitigate contamination risks in sensitive environments like healthcare facilities. For instance, in May 2022, Sereneview Armor, a US-based healthcare design firm, introduced Sereneview Armor curtains featuring Aegis Microbe Shield, a robust, non-leaching antimicrobial technology. The curtains incorporate a positively charged polymer that disrupts the negatively charged cell membranes of microbes, aiming to prevent hospital-acquired infections. Testing of the Armor fabric against the SARS-COVID-2 virus revealed promising results, demonstrating its efficacy compared to a control fabric lacking similar finishes.

In 2022, Nissin Electric, a Japan-based electrical equipment manufacturer, partnered with Tokyo Denki University to create a gas-permeable sheet featuring antibacterial properties derived from amorphous carbon. This collaboration seeks to investigate the potential applications of this technology within the medical sector, as the patent filed jointly highlights medical textiles among its applications. The partnership may pave the way for the creation of advanced medical textile products that provide improved antibacterial benefits.

Major companies operating in the antimicrobial hospital textiles market are Sinterama S.p.A., Trevira GmbH, PurThread Technologies Inc., LifeThreads LLC, Thai Acrylic Fiber Co. Ltd., Smith & Nephew PLC, Herculite Products Inc., Toyobo Co. Ltd., Mollyflex Srl, Swicofil AG, Baltex Group Limited, Microban International Ltd., Sciessent LLC, BASF SE, Lonza Group AG, BioCote Limited, Resil Chemicals Pvt. Ltd., Archroma Management LLC, HeiQ Materials AG, Milliken & Company, Vestagen Technical Textiles Inc., Bovie Medical Corporation, Copper Clothing Ltd., The Medicom Group, Foothills Industries Ltd., Resweater, Specialty Textile Group Inc., Gap Medical Insurance, Applied Silver Inc., Surgical Textiles, Integra LifeSciences Corporation, 3M Company, Ahlstrom-Munksjö Oyj, American Dawn Inc., Medline Industries Inc., Matguard USA, Ruhof Healthcare, BSN Medical Inc., Med Pride Inc., Colorite Inc., Angelica Corporation, Hospital Specialty Company Inc., Medtronic PLC, Cramer Products Inc.

Asia-Pacific was the largest region in the antimicrobial hospital textiles market in 2024. Asia-Pacific is expected to be the fastest-growing region in the antimicrobial hospital textiles market report during the forecast period. The regions covered in the antimicrobial hospital textiles market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the antimicrobial hospital textiles market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Antimicrobial hospital textiles are fabrics treated with chemicals or manufactured with antimicrobial properties to restrict the growth of bacterial germs on the material. These textiles find application in hospital settings for items such as beds, curtains, and linens.

The primary types of antimicrobial hospital textiles include cotton, polyester, polyamide, and other varieties such as polyethylene, polypropylene, acrylic, and cellulose acetate. Cotton, a staple fiber composed of numerous fibers of varying lengths, is used in both disposable and reusable forms, falling under FDA class I, class II, and class III categories. These textiles are employed in various hospital departments, including general wards, surgical rooms, infectious disease wards, ICUs, and others. Their versatile applications encompass medical uniforms and apparel, upholstery, surgical textiles, incontinence care garments, wound treatment, and various other medical uses.

The antimicrobial hospital textiles market research report is one of a series of new reports that provides antimicrobial hospital textiles market statistics, including antimicrobial hospital textiles industry global market size, regional shares, competitors with an antimicrobial hospital textiles market share, detailed antimicrobial hospital textiles market segments, market trends, and opportunities, and any further data you may need to thrive in the antimicrobial hospital textiles industry. This antimicrobial hospital textiles market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The antimicrobial hospital textiles market consists of sales of medical curtains, bed sheets and pillow coverings, and mattresses. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Antimicrobial Hospital Textiles Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on antimicrobial hospital textiles market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for antimicrobial hospital textiles? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The antimicrobial hospital textiles market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Type: Cotton; Polyester; Polyamide; Other Types (Polyethylene, Polypropylene, Acrylic, and Cellulose Acetate)2) by Usability: Disposable; Reusable

3) by FDA Class: Class I; Class II; Class III

4) by Hospital Department: General Ward; Surgical Room; Infectious Disease Ward; ICU; Other Hospital Departments

5) by Application: Medical Uniform and Apparels; Upholstery; Surgical textiles; Incontinence Care Garments; Wound Treatment; Other Applications

Subsegments:

1) by Cotton: Conventional Cotton; Organic Cotton; Blended Cotton2) by Polyester: Regular Polyester; Recycled Polyester; Blended Polyester

3) by Polyamide: Nylon 6; Nylon 66; Blended Polyamide

4) by Other Types: Polyethylene; Polypropylene; Acrylic; Cellulose Acetate

Key Companies Mentioned: Sinterama S.p.a.; Trevira GmbH; PurThread Technologies Inc.; LifeThreads LLC; Thai Acrylic Fiber Co. Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Antimicrobial Hospital Textiles market report include:- Sinterama S.p.A.

- Trevira GmbH

- PurThread Technologies Inc.

- LifeThreads LLC

- Thai Acrylic Fiber Co. Ltd.

- Smith & Nephew PLC

- Herculite Products Inc.

- Toyobo Co. Ltd.

- Mollyflex Srl

- Swicofil AG

- Baltex Group Limited

- Microban International Ltd.

- Sciessent LLC

- BASF SE

- Lonza Group AG

- BioCote Limited

- Resil Chemicals Pvt. Ltd.

- Archroma Management LLC

- HeiQ Materials AG

- Milliken & Company

- Vestagen Technical Textiles Inc.

- Bovie Medical Corporation

- Copper Clothing Ltd.

- The Medicom Group

- Foothills Industries Ltd.

- Resweater

- Specialty Textile Group Inc.

- Gap Medical Insurance

- Applied Silver Inc.

- Surgical Textiles

- Integra LifeSciences Corporation

- 3M Company

- Ahlstrom-Munksjö Oyj

- American Dawn Inc.

- Medline Industries Inc.

- Matguard USA

- Ruhof Healthcare

- BSN Medical Inc.

- Med Pride Inc.

- Colorite Inc.

- Angelica Corporation

- Hospital Specialty Company Inc.

- Medtronic PLC

- Cramer Products Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 11.23 Billion |

| Forecasted Market Value ( USD | $ 16.26 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 45 |