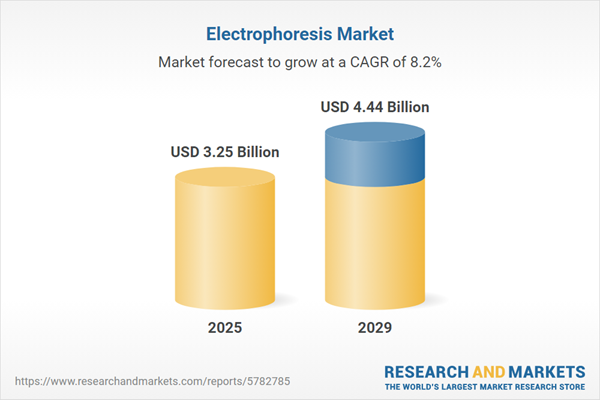

The electrophoresis market size is expected to see strong growth in the next few years. It will grow to $4.44 billion in 2029 at a compound annual growth rate (CAGR) of 8.2%. The growth in the forecast period can be attributed to shift towards capillary electrophoresis, demand for high-throughput analysis, expansion in food and beverage testing, diagnostic applications in infectious diseases, advancements in microfluidic electrophoresis. Major trends in the forecast period include next-generation sequencing (NGS) and omics technologies, integration of artificial intelligence (AI) in data analysis, customization and personalization of electrophoresis systems, market expansion in emerging economies, strategic acquisitions and mergers.

The rising prevalence of cancer, infectious diseases, and genetic disorders is expected to drive the growth of the electrophoresis market. Infectious diseases with pandemic potential, such as plague, cholera, flu, and severe acute respiratory syndrome, continue to emerge and spread. Additionally, cancer, which has multiple causes like diabetes and heart disease, further influences the demand for electrophoresis. This technique is used to detect and separate DNA, RNA, or protein molecules, aiding in the determination of antibiotic concentrations, thereby improving dosage accuracy. For instance, in June 2022, data from Macmillan Cancer Support, a UK-based cancer charity, revealed that the number of people living with cancer reached 3 million in 2022, with projections estimating nearly 3.5 million by 2025 and 4 million by 2030 in the UK. Therefore, the growing incidence of cancer and infectious diseases will fuel the expansion of the electrophoresis market.

The increase in research activities is expected to further propel the growth of the electrophoresis market. Research activities involve systematic efforts undertaken by individuals, teams, or institutions to gather, analyze, and generate new knowledge or insights within a specific field. Electrophoresis is a critical technique in molecular biology and biochemistry research, providing an essential tool for separating and analyzing macromolecules such as DNA, RNA, and proteins. This technique allows researchers to study genetic information, protein structures, and molecular interactions, offering valuable insights in areas like genetics, genomics, proteomics, and drug discovery. For example, in April 2023, Statistics New Zealand, a government department, reported that the business sector spent $3.1 billion on internal R&D in 2022, marking a 9 percent increase from 2021. Thus, the rise in research activities is driving the growth of the electrophoresis market.

Technological advancements have become a significant trend gaining traction in the electrophoresis market. Leading companies in the market are embracing new technological innovations to maintain their competitive edge. For example, in May 2023, US-based life sciences company miniPCR bio introduced the GELATO electrophoresis system for rapid DNA analysis. The GELATO system integrates gel electrophoresis with transillumination technology, allowing for the separation and visualization of nucleic acids in one compact design.

Leading companies in the electrophoresis market are forming strategic partnerships to strengthen their market position. A strategic partnership is a formal collaboration between two or more businesses, typically established through contracts or business agreements. For instance, in February 2023, Advanced Electrophoresis Solutions (AES), a Canada-based company specializing in electrophoresis systems, partnered with Medispec Ltd, an India-based distributor in the healthcare sector. The partnership aims to improve the distribution and accessibility of AES's critical electrophoresis solutions throughout India. Through this collaboration, AES seeks to broaden its presence in the Indian market by providing advanced electrophoresis technologies crucial for research, diagnostics, and other applications. Medispec Limited is a prominent company focusing on the marketing, distribution, and installation of biomedical and analytical equipment, along with in-vitro diagnostic products.

In October 2022, CMP Scientific Corp., a US-based company specializing in advancing capillary electrophoresis-mass spectrometry (CE-MS) technologies, partnered with Agilent Technologies. This collaboration merges CMP Scientific's expertise in capillary electrophoresis with Agilent’s mass spectrometry technology to improve CE-MS systems, enabling more efficient and precise applications in drug discovery and proteomics. Agilent Technologies, also a US-based company, is a leading global player in life sciences, diagnostics, and applied chemicals, including capillary electrophoresis.

Major companies operating in the electrophoresis market are Bio-Rad Laboratories Inc., Thermo Fisher Scientific Inc., Danaher Corporation, Agilent Technologies Inc., Merck Group, PerkinElmer Inc., QIAGEN N.V., Lonza Group Limited, Shimadzu Corporation, Harvard Bioscience Inc., C.B.S. Scientific Company Inc., Takara Bio Inc., Sebia Group, Analytik Jena AG, Biochrom Ltd., Biometra GmbH, Cleaver Scientific Ltd., Helena Laboratories Corporation, Hoefer Inc., Labnet International Inc., Major Science Co. Ltd., Prona Technologies Inc., Alfa Wassermann Inc., Eppendorf SE, Promega Corporation, Corning Inc., LI-COR Biosciences.

North America was the largest region in the electrophoresis market in 2024. The regions covered in the electrophoresis market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the electrophoresis market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Electrophoresis is a laboratory technique employed to segregate DNA, RNA, or protein molecules based on their charged particles within a fluid, using an electrical charge field. In this process, an electric current propels the molecules through a gel or similar matrix. This method is instrumental in enabling researchers to ascertain antibiotic concentrations, thus refining dosage precision.

The primary products associated with electrophoresis encompass electrophoresis reagents, electrophoresis systems, gel documentation systems, and electrophoresis software. Electrophoresis reagents are formulations tailored to streamline the separation and analysis of samples during electrophoretic procedures. This technique finds applications across research, diagnostics, quality control, and process validation, catering to diverse end-users including academic and research institutions, pharmaceutical and biotechnology firms, hospitals, and other relevant entities.

The electrophoresis market research report is one of a series of new reports that provides electrophoresis market statistics, including electrophoresis industry global market size, regional shares, competitors with an electrophoresis market share, detailed electrophoresis market segments, market trends and opportunities, and any further data you may need to thrive in the electrophoresis industry. This electrophoresis market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The electrophoresis market includes revenues earned by entities by providing capillary electrophoresis, routine electrophoresis, polyacrylamide gel electrophoresis, 2D electrophoresis, pulsed field electrophoresis, isoelectric focusing, and immunochemical electrophoresis. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Electrophoresis Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on electrophoresis market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for electrophoresis? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The electrophoresis market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Electrophoresis Reagents; Electrophoresis Systems; Gel Documentation Systems; Electrophoresis Software2) by Application: Research; Diagnostics; Quality Control and Process Validation

3) by End User: Academic and Research Institutes; Pharmaceutical and Biotechnology Companies; Hospitals; Other End Users

Subsegments:

1) by Electrophoresis Reagents: Gel Staining Solutions; Running Buffers; Sample Preparation Reagents2) by Electrophoresis Systems: Horizontal Electrophoresis Systems; Vertical Electrophoresis Systems; Capillary Electrophoresis Systems

3) by Gel Documentation Systems: UV Transilluminators; Gel Imaging Systems; Software For Gel Analysis

4) by Electrophoresis Software; Data Analysis Software; Gel Image Analysis Software; Electrophoresis Experiment Management Software

Key Companies Mentioned: Bio-Rad Laboratories Inc.; Thermo Fisher Scientific Inc.; Danaher Corporation; Agilent Technologies Inc.; Merck Group

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Electrophoresis market report include:- Bio-Rad Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Agilent Technologies Inc.

- Merck Group

- PerkinElmer Inc.

- QIAGEN N.V.

- Lonza Group Limited

- Shimadzu Corporation

- Harvard Bioscience Inc.

- C.B.S. Scientific Company Inc.

- Takara Bio Inc.

- Sebia Group

- Analytik Jena AG

- Biochrom Ltd.

- Biometra GmbH

- Cleaver Scientific Ltd.

- Helena Laboratories Corporation

- Hoefer Inc.

- Labnet International Inc.

- Major Science Co. Ltd.

- Prona Technologies Inc.

- Alfa Wassermann Inc.

- Eppendorf SE

- Promega Corporation

- Corning Inc.

- LI-COR Biosciences

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.25 Billion |

| Forecasted Market Value ( USD | $ 4.44 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |