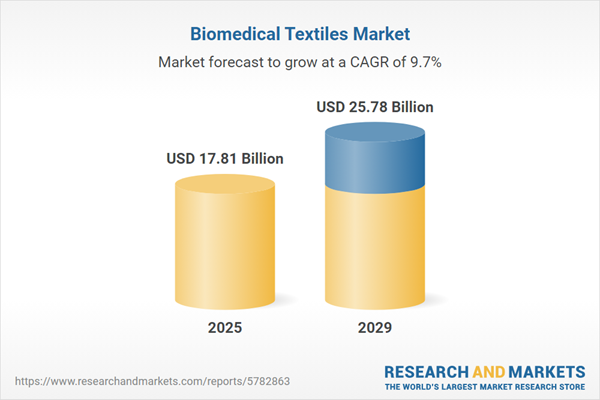

The biomedical textiles market size is expected to see strong growth in the next few years. It will grow to $25.78 billion in 2029 at a compound annual growth rate (CAGR) of 9.7%. The growth in the forecast period can be attributed to consumer health and wellness trends, global health preparedness, military and defense applications, personalized medicine needs, telemedicine and wearable health. Major trends in the forecast period include advancements in medical technology, research collaborations, sustainable textiles trend.

The increasing prevalence of chronic diseases is driving growth in the biomedical textiles market moving forward. Chronic diseases require ongoing medical attention and persist for over a year. The rise in chronic disease cases has led to a greater emphasis on surgical procedures. Biomedical textiles are utilized in managing chronic diseases for wound closure during surgeries and to prevent chronic wounds. For example, reports from the Office for Health Improvement & Disparities, a UK government body, indicated that in the first half of 2023, there were 3,940 excess deaths attributed to chronic lower respiratory diseases, representing a 30% increase compared to expected rates. By the end of the year, this figure rose to 5,363, reflecting an overall increase of 22%. Therefore, the growing prevalence of chronic diseases is expected to drive the biomedical textiles market.

The increasing healthcare expenditure is projected to drive growth in the biomedical textiles market in the future. Healthcare expenditure encompasses the total amount spent on healthcare goods and services, including medical equipment, pharmaceuticals, hospital care, physician services, and other healthcare-related costs. This spending directly impacts investments in advanced medical treatments, technologies, and healthcare infrastructure. As healthcare expenditure rises, so does the investment in innovative medical treatments and technologies, which has further increased the demand for specialized biomedical textile materials. For example, a report published by the Office for National Statistics, a UK government department, indicated that between 2022 and 2023, healthcare spending in the UK grew by 5.6%, compared to a growth of 0.9% in 2022. The UK healthcare expenditure was approximately $317.63 billion (£292 billion) in 2023. Therefore, the rising healthcare expenditure is driving the growth of the biomedical textiles market.

In the biomedical textiles market, product innovations emerge as a key trend, with major industry players focusing on research and development to introduce cutting-edge solutions. In March 2022, Fabiosys Innovations launched Fabium, a medical textile utilizing Hi-PAT technology for enhanced efficacy against viruses, bacteria, and fungi. This innovation involves processing raw cotton fabric with proprietary chemical formulas through standard textile equipment. The pursuit of novel products through innovation remains a cornerstone in shaping the dynamics of the biomedical textiles market.

Major companies operating in the biomedical textiles sector are strategically collaborating to introduce smart textile platforms that revolutionize the development of biomedical textiles. These partnerships enable the integration of medicine, wellness, and health benefits into clothing, leveraging the combined expertise of the collaborating entities. In August 2023, Nufabrx partnered with Enventys Partners to launch HealthWear, a groundbreaking smart-textile platform that seamlessly administers topical medications activated by body heat and moisture. This strategic collaboration exemplifies the industry's drive to enhance biomedical textiles through innovative solutions.

Strategic acquisitions are bolstering companies' positions in the biomedical textiles market. In April 2022, Integer acquired Aran Biomedical for $131 million. This acquisition enables Integer to integrate Aran Biomedical's technological expertise and knowledge in biomaterial-focused medical implant products with its industry-leading production scale and delivery methods. Aran Biomedical, based in Ireland, contributes to the advancement of biomedical textiles in the context of medical implant products.

Major companies operating in the biomedical textiles market are Confluent Medical Technologies, Cardinal Health Inc, Johnson & Johnson Services Inc, B. Braun Melsungen AG, Smith & Nephew PLC, Meister & Cie AG, Medline Industries Inc, 3M Company, ATEX Technologies, Integra Life Sciences Corporation, Paul Hartmann AG, BSN Medical GMBH, Elkem ASA, Bally Ribbon Mills, Asahi Kasei Corporation, Freudenberg Medical LLC, Getinge AB, Halyard Health, Kimberly-Clark Corporation, Milliken & Company, Molnlycke Health Care AB, Precision Fabrics Group Inc., Secant Group LLC, Stradis Healthcare, Tietex International Ltd., Trelleborg AB, United Medical Industries Co. Ltd., Vestagen Protective Technologies Inc., W.L. Gore & Associates Inc., Weaving Machinery UK Ltd., Welspun Group, Zimmer Biomet Holdings.

North America was the largest region in the biomedical textiles market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the biomedical textiles market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the biomedical textiles market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Biomedical textiles refer to fibrous textile constructions crafted from synthetic or natural materials with advanced properties, providing resistance against various elements such as fungi, fire, bacteria, dirt, and water. These textiles serve as medical devices utilized either inside or outside the biological environment to enhance patient health.

The primary product types within biomedical textiles include non-implantable and implantable categories. Non-implantable biomedical textiles are employed for external wound dressings. These substances are applied externally to the body, potentially coming into contact with the skin. They are manufactured using various fabrics, such as non-woven biomedical textiles, woven biomedical textiles, and knitted biomedical textiles, and can be composed of non-biodegradable or biodegradable fibers. Applications span across ophthalmology, neurology, cardiology, dentistry, orthopedics, general surgery and treatment, and other medical fields. Biomedical textiles find utilization in hospitals, ambulatory centers, clinics, community healthcare, and other end-user settings.

The biomedical textiles market research report is one of a series of new reports that provides biomedical textiles market statistics, including biomedical textiles industry global market size, regional shares, competitors with a biomedical textiles market share, detailed biomedical textiles market segments, market trends and opportunities, and any further data you may need to thrive in the biomedical textiles industry. This biomedical textiles market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The biomedical textiles market consists of sales of textiles for sutures & ligatures, vascular implants, soft tissue implants, hard tissue implants and hernia repair. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Biomedical Textiles Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on biomedical textiles market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for biomedical textiles? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The biomedical textiles market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product Type: Non Implantable; Implantable2) by Fabric: Non-Woven Biomedical Textiles; Woven Biomedical Textiles; Knitted Biomedical Textiles

3) by Fiber Type: Non Biodegradable; Biodegradable

4) by Applications: Ophthalmology; Neurology; Cardiology; Dentistry; Orthopedics; General Surgery and Treatment; Other Applications

5) by End Users: Hospitals; Ambulatory Centers; Clinics; Community Healthcare; Other End Users

Subsegments:

1) by Non-Implantable: Surgical Textiles; Wound Dressings; Bandages and Plasters; Compression Garments2) by Implantable: Sutures; Mesh Materials; Tissue Engineering Scaffolds; Vascular Grafts

Key Companies Mentioned: Confluent Medical Technologies; Cardinal Health Inc; Johnson & Johnson Services Inc; B. Braun Melsungen AG; Smith & Nephew PLC

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Biomedical Textiles market report include:- Confluent Medical Technologies

- Cardinal Health Inc

- Johnson & Johnson Services Inc

- B. Braun Melsungen AG

- Smith & Nephew PLC

- Meister & Cie AG

- Medline Industries Inc

- 3M Company

- ATEX Technologies

- Integra Life Sciences Corporation

- Paul Hartmann AG

- BSN Medical GMBH

- Elkem ASA

- Bally Ribbon Mills

- Asahi Kasei Corporation

- Freudenberg Medical LLC

- Getinge AB

- Halyard Health

- Kimberly-Clark Corporation

- Milliken & Company

- Molnlycke Health Care AB

- Precision Fabrics Group Inc.

- Secant Group LLC

- Stradis Healthcare

- Tietex International Ltd.

- Trelleborg AB

- United Medical Industries Co. Ltd.

- Vestagen Protective Technologies Inc.

- W.L. Gore & Associates Inc.

- Weaving Machinery UK Ltd.

- Welspun Group

- Zimmer Biomet Holdings

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 17.81 Billion |

| Forecasted Market Value ( USD | $ 25.78 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |