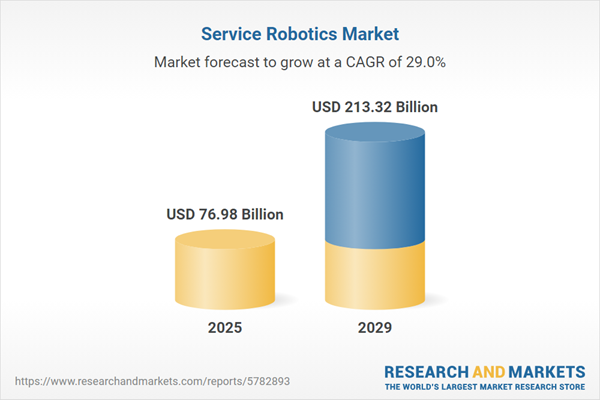

The service robotics market size is expected to see exponential growth in the next few years. It will grow to $213.32 billion in 2029 at a compound annual growth rate (CAGR) of 29%. The growth in the forecast period can be attributed to investment in research & development, regulatory adaptation, consumer robotics, smart city initiatives, robotics-as-a-service (RaaS). Major trends in the forecast period include adaptive and flexible robots, sustainability initiatives, digitization of data security and privacy, healthcare robotics, artificial intelligence integration.

The growing need for robots in the healthcare industry is anticipated to propel the expansion of the service robotics market. The healthcare sector encompasses businesses that provide medical services and manufacture medical equipment or pharmaceuticals. Service robots are employed in healthcare settings to manage routine logistical tasks and alleviate the daily pressures on healthcare professionals. This allows them to dedicate more time to urgent patient needs, ultimately enhancing the overall quality of patient care. For example, in June 2023, the International Federation of Robotics, a Germany-based non-profit organization dedicated to promoting and safeguarding the robotics industry globally, reported that the number of industrial robot installations in Europe reached 72,000 units in 2022, marking a 6% increase from 2021. Therefore, the rising demand for robots in the healthcare sector is driving the growth of the service robotics market.

The service robotics market is poised for growth, propelled by the expanding automotive industry. The automotive industry, covering companies involved in the design, development, manufacturing, marketing, and selling of motor vehicles, is increasingly integrating service robotics for various advantages. Service robotics in this sector enhances production efficiency, improves product quality, ensures worker safety, and aligns with industry trends. Notably, global motor vehicle production reached 85.4 million units in 2022, reflecting a significant 5.7% increase from the previous year, according to the European Automobile Manufacturers Association. Additionally, the automotive sector achieved approximately 78 million unit sales in 2022, marking a noteworthy 10% rise, as reported by Brand Finance plc in February 2022. This integration of service robotics in the automotive industry is a driving force behind the growth of the service robotics market.

Leading companies in the service robotics market are concentrating on creating innovative technological solutions, such as Pudu's proprietary mapping technology, to boost operational efficiency, enhance customer interactions, and broaden the applications of service robots across diverse industries. Pudu's mapping technology facilitates accurate navigation and obstacle avoidance for their service robots in dynamic environments. For example, in April 2024, a technology company based in China introduced BellaBot Pro. This model employs artificial intelligence to provide personalized greetings and interactions with customers, including advanced dish identification features that enhance the dining experience by accurately recognizing menu items.

Major players in the service robotics market are strategically investing in innovative products, particularly focusing on advanced solutions like robotic picking systems equipped with AI technology. This cutting-edge automation solution integrates robotic arms with artificial intelligence algorithms, enabling intelligent identification, grasping, and picking of items across diverse industries. A notable example of this innovation is showcased by Mecalux S.A., a Spain-based company specializing in manufacturing service robotics. In October 2023, Mecalux introduced a robotic picking system with AI technology, leveraging the SIMATIC S7-1500 programmable logic controller (PLC) in collaboration with artificial intelligence. This combination empowers collaborative robots to precisely and autonomously pick orders. The technology is characterized by its safety, user-friendliness, adaptability, and customization, catering to the distinct requirements of customers.

United Robotics Group, a Germany-based robotic solutions company, executed a significant acquisition in April 2022 by obtaining SoftBank Robotics Europe, a France-based manufacturer of robots. This strategic acquisition positions United Robotics Group to explore the potential of merging interaction robotics with industrial robotics, paving the way for the development of diverse robotic solutions. These strategic initiatives underscore the commitment of major companies to driving innovation and growth in the dynamic service robotics market.

Major companies operating in the service robotics market are Parrot SA, Aethon Inc., Honda Motor Co. Ltd., Panasonic Holdings Corporation, Yujin Robot Co. Ltd., Samsung Group, iRobot Corporation, Robert Bosch GmbH, Kongsberg Maritime, Daifuku Co. Ltd., Omron Corporation, SoftBank Group Corp., Boston Dynamics Inc., ABB Robotics, KUKA Roboter GmbH, FANUC Robotics America Inc., Yaskawa Motoman Robotics Inc., Universal Robots A/S, Clearpath Robotics Inc., Fetch Robotics Inc., Locus Robotics, Sarcos Robotics, Knightscope Inc., Seegrid Corporation, Simbe Robotics Inc.

North America was the largest region in the service robotics market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the service robotics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the service robotics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Service robots, machines designed for diverse tasks excluding industrial automation, execute valuable activities for people or machinery. Controlled internally, they enhance business efficiency by undertaking time-consuming and repetitive tasks. These robots are pivotal in the services industry, aiding human workers in completing monotonous or hazardous activities.

Service robotics encompass professional, personal, and domestic categories, supported by hardware and software. Professional service robots, semi-autonomous or fully autonomous, serve commercial purposes and are mobile. Commonly utilized outside manufacturing facilities, these robots contribute to safety, efficiency, and productivity. They serve various functions such as cleaning public areas, delivering goods in office or hospital settings, firefighting, rehabilitation, and performing surgeries in healthcare facilities. They function in aerial, ground, and marine environments and cater to industries like healthcare, defense, electronics, automotive, transportation, construction, and others.

The service robotics market research report is one of a series of new reports that provides service robotics market statistics, including service robotics industry global market size, regional shares, competitors with an service robotics market share, detailed service robotics market segments, market trends and opportunities, and any further data you may need to thrive in the service robotics industry. This service robotics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The service robotics market includes revenues earned by entities by field robots, professional cleaning, inspection and maintenance, construction and demolition, logistics systems (manufacturing and non-manufacturing), medical robots, rescue and security robots, and defense robots. The market value includes the value of related goods sold by the service provider or included within the service offering. The service robotics market also includes sales of airframes, sensors, cameras, actuators, navigation systems and propulsion systems. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Service Robotics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on service robotics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for service robotics ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The service robotics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Type: Professional; Personal and Domestic2) by Component: Hardware; Software

3) by Environment: Aerial; Ground; Marine

4) by End-User: Healthcare; Defense; Electronics; Automotive; Transportation; Construction; Other End Users

Subsegments:

1) by Professional: Healthcare Robots; Logistics Robots; Agriculture Robots; Security and Surveillance Robots; Cleaning Robots; Construction Robots2) by Personal: Companion Robots; Entertainment Robots; Educational Robots; Assistance Robots

3) by Domestic: Vacuum Cleaning Robots; Lawn Mowing Robots; Pool Cleaning Robots; Window Cleaning Robots; Home Security Robots

Key Companies Mentioned: Parrot SA; Aethon Inc.; Honda Motor Co. Ltd.; Panasonic Holdings Corporation; Yujin Robot Co. Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Service Robotics market report include:- Parrot SA

- Aethon Inc.

- Honda Motor Co. Ltd.

- Panasonic Holdings Corporation

- Yujin Robot Co. Ltd.

- Samsung Group

- iRobot Corporation

- Robert Bosch GmbH

- Kongsberg Maritime

- Daifuku Co. Ltd.

- Omron Corporation

- SoftBank Group Corp.

- Boston Dynamics Inc.

- ABB Robotics

- KUKA Roboter GmbH

- FANUC Robotics America Inc.

- Yaskawa Motoman Robotics Inc.

- Universal Robots A/S

- Clearpath Robotics Inc.

- Fetch Robotics Inc.

- Locus Robotics

- Sarcos Robotics

- Knightscope Inc.

- Seegrid Corporation

- Simbe Robotics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 76.98 Billion |

| Forecasted Market Value ( USD | $ 213.32 Billion |

| Compound Annual Growth Rate | 29.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |