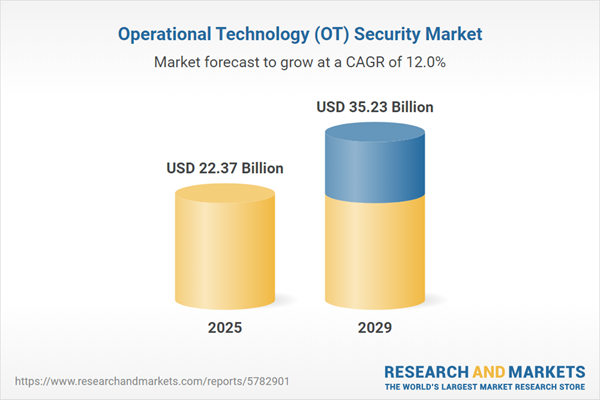

The operational technology (OT) security market size is expected to see rapid growth in the next few years. It will grow to $35.23 billion in 2029 at a compound annual growth rate (CAGR) of 12%. The growth in the forecast period can be attributed to 5G integration, regulatory evolution, cloud migration, adoption of biometric security measures, blockchain integration. Major trends in the forecast period include zero trust framework, behavioral analytics, predictive maintenance security, human element emphasis, automated incident response.

The growing adoption of digital technologies in industrial systems is expected to drive the expansion of the operational technology (OT) security market in the future. Digital technologies in these systems encompass enhanced automation, preventative maintenance, self-optimization of process improvements, and, importantly, a new level of efficiency and customer responsiveness. OT security is considered a crucial component in both operational and enterprise environments, as it provides a robust foundation for addressing challenges associated with digital technologies, encourages the adoption of new technologies in operational settings, and ensures safety and security. For instance, in November 2022, Statistics Canada, the country’s national statistical agency, reported that in 2023, 7% of Canadian businesses with five or more employees used AI software or hardware, marking a 3 percentage point increase from 2021. Thus, the rising use of digital technologies in industrial systems is driving growth in the operational technology (OT) security market.

The rise of remote work is anticipated to enhance the growth of the operational technology (OT) security market in the coming years. Remote work refers to the practice of performing job duties outside a conventional office setting. In such scenarios, managing sensitive operational data requires the implementation of OT security measures to ensure data privacy, comply with regulations, and protect against unauthorized access to confidential information. For example, in September 2023, the Bureau of Labor Statistics, a U.S.-based Department of Labor, reported that the telework rate - indicating the percentage of workers who telecommuted or worked from home for pay - ranged from 17.9% to 20% between October 2022 and August 2023. Therefore, the increasing trend of remote work is driving the growth of the operational technology (OT) security market.

Major players in the operational technology (OT) security market are leveraging critical infrastructure smart technologies, such as artificial intelligence (AI), to gain a competitive edge. AI enhances OT security by improving threat detection and response, automating vulnerability management, and strengthening overall security posture through predictive analytics, behavioral analysis, and real-time monitoring of industrial environments. For example, in October 2024, Palo Alto Networks, Inc., a U.S.-based cybersecurity solution provider, introduced new features in its OT Security solution, including the industry's first fully integrated, risk-based guided virtual patching powered by Precision AITM. Additionally, they launched the Prisma® Access Browser with Privileged Remote Access and ruggedized, machine learning-driven Next-Generation Firewalls (NGFWs) designed for harsh industrial environments. These enhancements enable OT security teams to securely and efficiently manage access to critical OT systems for authorized users, including contractors. The guided virtual patching feature facilitates the rapid mitigation of critical vulnerabilities without disrupting operations, while also automating asset inventory and risk assessment.

Major players within the operational technology (OT) security market are strategically embracing partnerships to offer holistic security platforms tailored for operational technology (OT) environments. These strategic partnerships involve companies leveraging each other's strengths and resources to attain mutual benefits and foster success. A pertinent example occurred in June 2023 when L&T Technology Services Limited, an India-based technology company, collaborated with Palo Alto Networks, a US-based provider specializing in operational technology (OT) security. Through this partnership, LTTS and Palo Alto Networks aim to provide comprehensive security services and solutions, particularly focusing on 5G and operations technology (OT) across diverse industries. LTTS has now established itself as a Palo Alto Networks Managed Security Services Partner (MSSP), enabling the provision of an array of security services, including 5G, OT, and IT/OT Converged SOC services. This collaboration empowers end customers in industrial sectors to effectively mitigate security risks within their OT environments through a managed service offering centered around the Palo Alto Networks Zero Trust OT Security solution. This strategic alliance underscores a commitment to fortifying OT security by amalgamating expertise and resources to deliver robust, tailored solutions addressing the evolving challenges within operational technology landscapes.

In September 2023, Sapphire, a cyber security solutions provider based in the UK, successfully acquired Awen Collective for an undisclosed amount. This strategic acquisition positions Sapphire to expand its service portfolio, providing support to UK organizations seeking to integrate their IT and OT infrastructures while reinforcing cybersecurity defenses against cyber threats. The acquisition encompasses Awen Collective's intellectual property and assets, featuring its comprehensive technology stack. This includes Dot, specializing in OT asset discovery and vulnerability management, along with Profile, an industrial cyber compliance management system. Awen Collective, the acquired company, is a UK-based provider of operational technology (OT) security solutions.

Major companies operating in the operational technology (OT) security market include Honeywell International Inc., Siemens AG, General Electric Company, Accenture plc, IBM Corporation, Cisco Systems Inc., Schneider Electric SE, Broadcom Inc., ABB Ltd., VMware Inc., Rockwell Automation Inc., Palo Alto Networks Inc., Fortinet Inc., Belden Inc., Check Point Software Technologies Ltd., Trend Micro Incorporated, Zscaler, Kaspersky Lab, Darktrace Limited, FireEye Inc., Dragos Inc., Cyberbit Ltd., PAS Global LLC, Clavister AB, Nozomi Networks Inc., Mocana Corporation, Radiflow Ltd., Bayshore Networks Inc., Forescout Technologies Inc., Claroty Ltd., Owl Cyber Defense Solutions LLC, Innominds Software Inc., Tempered Networks Inc., CyberArk Software Ltd., Senstar Corporation, Securicon LLC, SecuriThings Ltd., Applied Risk B.V., Tenable Inc., OSIsoft LLC, Radware Ltd.

North America was the largest region and Western Europe was the second largest region in the operational technology (OT) security market in 2024. The regions covered in the operational technology (ot) security market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the operational technology (ot) security market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Operational Technology (OT) security plays a crucial role in protecting people, assets, and information, while also overseeing and managing physical objects, processes, and events across various industries such as manufacturing and oil and gas. The term encompasses a diverse range of security technologies, including Next-Generation Firewalls (NGFWs), Security Information and Event Management (SIEM) systems, as well as Identity Authorization and Management systems. These technologies are deployed to ensure the resilience and security of operational processes, safeguarding against potential threats and vulnerabilities in critical infrastructures.

Operational technology (OT) security primarily encompasses solutions and services tailored for industrial systems. OT security solutions entail specialized software and protocols, facilitating interface capabilities with legacy and proprietary systems. These tools are instrumental in monitoring and managing the operations of industrial machinery within manufacturing, essential infrastructure (e.g., power and water systems), and related sectors. These security measures are deployed via cloud or on-premises setups, catering to both large enterprises and SMEs. The application of operational technology security spans across industries such as power and electrical, mining, transportation, manufacturing, and others.

The operational technology (OT) security market research report is one of a series of new reports that provides operational technology (OT) security market statistics, including operational technology (OT) security industry global market size, regional shares, competitors with operational technology (OT) security market share, detailed operational technology (OT) security market segments, market trends and opportunities, and any further data you may need to thrive in the operational technology (OT) security industry. This operational technology (OT) security market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The operational technology (OT) security market includes revenues earned by entities by 24*7 monitoring, incident detection and response, training and consulting, deployment, testing, and support and maintenance. The market value includes the value of related goods sold by the service provider or included within the service offering. The market value includes the value of related goods sold by the service provider or included within the service offering. The operational technology (OT) security market also includes sales of integrated platforms and standalone tools which are used in providing operational technology (OT) security services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Operational Technology (OT) Security Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on operational technology (ot) security market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for operational technology (ot) security? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The operational technology (ot) security market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Offering: Solutions; Services2) By Deployment Mode: Cloud; on-Premise

3) By Organization Size: Large Enterprises; Small and Medium Enterprises (SMEs)

4) By Industry: Power and Electrical; Mining; Transportation; Manufacturing; Other Industries

Subsegments:

1) By Solutions: Industrial Automation Solutions; SCADA (Supervisory Control and Data Acquisition) Systems; IoT (Internet of Things) Solutions For OT; Advanced Analytics and Data Management Solutions2) By Services: Consulting and Advisory Services; Implementation and Integration Services; Maintenance and Support Services; Training and Education Services

Key Companies Mentioned: Honeywell International Inc.; Siemens AG; General Electric Company; Accenture plc; IBM Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Honeywell International Inc.

- Siemens AG

- General Electric Company

- Accenture plc

- IBM Corporation

- Cisco Systems Inc.

- Schneider Electric SE

- Broadcom Inc.

- ABB Ltd.

- VMware Inc.

- Rockwell Automation Inc.

- Palo Alto Networks Inc.

- Fortinet Inc.

- Belden Inc.

- Check Point Software Technologies Ltd.

- Trend Micro Incorporated

- Zscaler

- Kaspersky Lab

- Darktrace Limited

- FireEye Inc.

- Dragos Inc.

- Cyberbit Ltd.

- PAS Global LLC

- Clavister AB

- Nozomi Networks Inc.

- Mocana Corporation

- Radiflow Ltd.

- Bayshore Networks Inc.

- Forescout Technologies Inc.

- Claroty Ltd.

- Owl Cyber Defense Solutions LLC

- Innominds Software Inc.

- Tempered Networks Inc.

- CyberArk Software Ltd.

- Senstar Corporation

- Securicon LLC

- SecuriThings Ltd.

- Applied Risk B.V.

- Tenable Inc.

- OSIsoft LLC

- Radware Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 22.37 Billion |

| Forecasted Market Value ( USD | $ 35.23 Billion |

| Compound Annual Growth Rate | 12.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 41 |