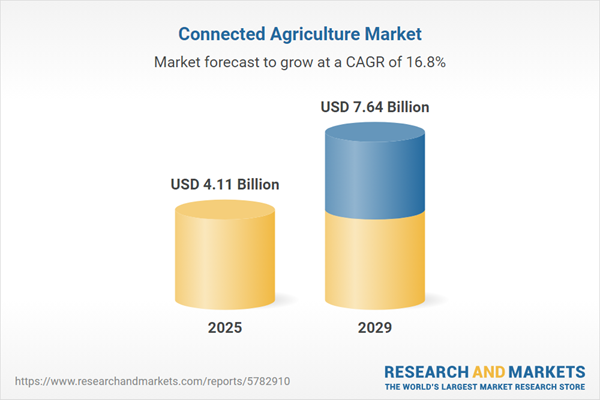

The connected agriculture market size is expected to see rapid growth in the next few years. It will grow to $7.64 billion in 2029 at a compound annual growth rate (CAGR) of 16.8%. The growth in the forecast period can be attributed to focus on soil health monitoring, efforts to bridge the digital divide, focus on yield optimization, environmental conservation initiatives, smart irrigation systems. Major trends in the forecast period include adoption of IoT technologies, precision farming practices, use of drones and UAVs, smart irrigation systems, farm management software, emergence of agri-tech startups, telematics in equipment monitoring.

Increasing demand for crops is expected to propel the growth of the connected agriculture market going forward. Crops, in agriculture, refer to a plant or plant product that can be widely cultivated and harvested for income or dietary needs. Connected agriculture helps boost crop yields from existing land by tracking, evaluating, controlling, and ultimately enhancing crucial agricultural processes at all points in the farming cycle. For instance, India sets the target for total food grain production at 328 million tons for the years 2022-23, compared to 316 million tons of total food grain production in 2021-22. Therefore, increasing demand for crops will drive the growth of the connected agriculture market.

The connected agriculture market is poised for growth, driven by the increasing demand for advanced farming solutions. This trend encompasses a spectrum of innovative technologies and practices aimed at enhancing the efficiency, sustainability, and productivity of agricultural operations. The synergy between advanced farming solutions and connected agriculture empowers farmers to achieve higher productivity, sustainability, and overall operational efficiency. Notably, in February 2023, Agtonomy, a US-based ag tech software company, unveiled its TeleFarmer Solution, allowing farmers to remotely execute labor-intensive field tasks like weeding, spraying, mowing, and transporting. This solution addresses labor shortages and rising costs, presenting a significant advancement in the connected agriculture sector.

Major players in the connected agriculture market are focused on launching next-generation solutions, such as agricultural robots, to deliver reliable services to customers. Agricultural robots are specifically designed for the agriculture industry, providing services such as harvesting, weed control, cloud seeding, seed planting, environmental monitoring, soil analysis, and livestock management to farmers, thereby enhancing overall production yields. For example, in May 2022, Solinftec, a Brazil-based ag-tech company, introduced Solix, an autonomous crop monitoring robot that operates plant-by-plant to optimize efficiency and productivity. This robot is intended to provide real-time insights into fields and functions as a connected agriculture platform. It is powered by solar energy and features lithium-ion batteries for energy storage. Solix is equipped with an onboard camera and sensors, along with artificial intelligence (AI) technology, to monitor plant health, identify insect damage, and detect changes in the field.

Major companies in the connected agriculture market are forming strategic collaborations to provide farmers with deeper insights into their cultivation practices, streamline connectivity, and facilitate easy integration with mixed-brand fleets. For example, in November 2022, Trimble Agriculture, a US-based provider of connected precision farming solutions, partnered with xFarm Technologies, an Italy-based startup focused on developing SaaS solutions for the digital transformation of agriculture, to assist farmers in improving farm management. Through this collaboration, Trimble aims to deliver additional valuable and efficient solutions to farmers by integrating with the xFarm smart farming app.

In May 2022, Trimble Inc., a US-based software company, acquired Bilberry for an undisclosed amount. This acquisition allows Trimble to incorporate AI-driven weed control solutions, thereby enhancing smart farming initiatives, especially by minimizing herbicide usage through targeted applications. Bilberry is a France-based company that offers connected agriculture technology for spraying, utilizing artificial intelligence (AI).

Major companies operating in the connected agriculture market are Cisco Systems Inc., IBM Corporation, SAP SE, Trimble Navigation Ltd., Vodafone PLC, Microsoft Corporation, American Telephone and Telegraph Inc., Deere & Company, Iteris Inc., Ag Leader Technology, Decisive Farming Corp., SWIIM System Ltd., Oracle Corporation, Fujitsu Limited, Hexagon AB, Raven Industries Inc., Topcon Corporation, AgJunction Inc., Agribotix LLC, CropX Inc., Granular Inc., PrecisionHawk Inc., The Climate Corporation, TerrAvion Inc., Descartes Labs Inc., Farmers Edge Inc., Mavrx Inc., Sentera Inc., Absolute Agronomy LLC, AgNext Technologies Private Limited, DeHaat, Cropin Technology Solutions, RML AgTech Pvt. Ltd.

North America was the largest region in the connected agriculture market in 2024. Asia Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the connected agriculture market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the connected agriculture market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Connected agriculture involves the utilization of digital technologies and the Internet in agriculture. It comprises software that facilitates the setup, control, and monitoring of Internet of Things (IoT) devices employed in farming operations. This technology assists in coordinating automated processes and collecting farm data, which is then analyzed by a centralized system to provide alerts about potential threats or guidance for farmers.

The primary components of connected agriculture include solutions, platforms, and services. Solutions encompass various technologies distributed via the internet or the cloud, enabling farmers and agricultural experts to enhance crop yields and quality, automate repetitive tasks, and generate valuable data across the organization. Platforms consist of device management, application enablement, and connectivity management, supporting applications such as farm planning and management, smart logistics, agriculture finance, and smart irrigation.

The connected agriculture market research report is one of a series of new reports that provides connected agriculture market statistics, including connected agriculture industry global market size, regional shares, competitors with a connected agriculture market share, detailed connected agriculture market segments, market trends and opportunities, and any further data you may need to thrive in the connected agriculture industry. This connected agriculture market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The connected agriculture market consists of revenues earned by entities by providing connected agriculture services such as animal tracking and navigation, feed management, telematics solutions, and others. The connected agriculture market also includes sales of sensors, measuring probes, disc harrows, and GPS/GNSS equipment that are used in providing connected agriculture services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Connected Agriculture Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on connected agriculture market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for connected agriculture? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The connected agriculture market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Component: Solution; Platforms; Services2) by Platform: Device Management; Application Enablement; Connectivity Management

3) by Application: Farm Planning and Management; Smart Logistics; Agriculture Finance; Smart Irrigation

Subsegments:

1) by Solution: Crop Management Solutions; Livestock Management Solutions; Soil Management Solutions2) by Platforms: Cloud-Based Platforms; IoT Platforms; Data Analytics Platforms

3) by Services: Consulting Services; System Integration Services; Maintenance and Support Services

Key Companies Mentioned: Cisco Systems Inc.; IBM Corporation; SAP SE; Trimble Navigation Ltd.; Vodafone PLC

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Connected Agriculture market report include:- Cisco Systems Inc.

- IBM Corporation

- SAP SE

- Trimble Navigation Ltd.

- Vodafone PLC

- Microsoft Corporation

- American Telephone and Telegraph Inc.

- Deere & Company

- Iteris Inc.

- Ag Leader Technology

- Decisive Farming Corp.

- SWIIM System Ltd.

- Oracle Corporation

- Fujitsu Limited

- Hexagon AB

- Raven Industries Inc.

- Topcon Corporation

- AgJunction Inc.

- Agribotix LLC

- CropX Inc.

- Granular Inc.

- PrecisionHawk Inc.

- The Climate Corporation

- TerrAvion Inc.

- Descartes Labs Inc.

- Farmers Edge Inc.

- Mavrx Inc.

- Sentera Inc.

- Absolute Agronomy LLC

- AgNext Technologies Private Limited

- DeHaat

- Cropin Technology Solutions

- RML AgTech Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.11 Billion |

| Forecasted Market Value ( USD | $ 7.64 Billion |

| Compound Annual Growth Rate | 16.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 34 |