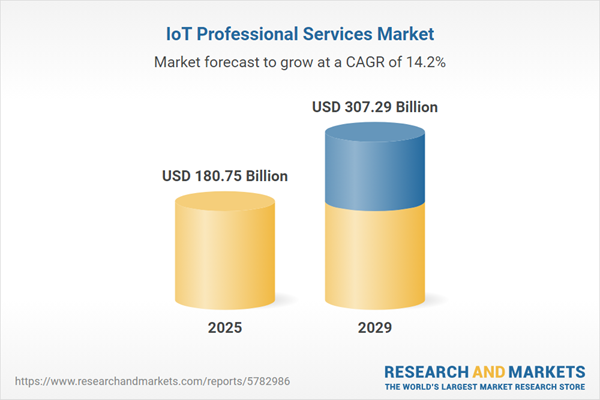

The IoT professional services market size is expected to see rapid growth in the next few years. It will grow to $307.29 billion in 2029 at a compound annual growth rate (CAGR) of 14.2%. The growth in the forecast period can be attributed to 5G adoption, growing emphasis on improving customer experience, proliferation of smart cities, rise of autonomous devices, increasing sophistication of cyber threats. Major trends in the forecast period include digital twins, augmented reality (AR) and virtual reality (VR) integration, rise of artificial intelligence, integration of blockchain technology, human augmentation.

The iot professional services market size is expected to see rapid growth in the next few years. It will grow to $266.35 billion in 2028 at a compound annual growth rate (CAGR) of 12.2%. The anticipated growth in the forecast period can be attributed to the adoption of 5G technology, an increasing emphasis on improving customer experience, the proliferation of smart cities, the rise of autonomous devices, and the increasing sophistication of cyber threats. Major trends expected in this period include the use of digital twins, the integration of augmented reality (AR) and virtual reality (VR) technologies, the rise of artificial intelligence (AI), the integration of blockchain technology, and advancements in human augmentation.

The integration of IoT across various industries, particularly in the automotive sector, is significantly driving the growth of the IoT market. The advent of IoT in the automotive industry has created new opportunities for both car manufacturers and consumers globally. IoT has emerged as a popular platform for diverse multifunctional applications within the automotive space, providing improved communication, control, and data delivery at various points in transportation. Leading companies such as Mercedes-Benz, Volkswagen, Volvo, Toyota, and Google Inc. are making substantial investments in developing smart vehicles equipped with advanced features that enhance driving experiences, making them healthier, more convenient, and more enjoyable. According to UBS, it is projected that by 2030, 12% of all cars sold will be for autonomous taxi fleets, resulting in approximately 26 million driverless taxis operating worldwide.

The rapidly increasing number of IoT connections is expected to drive the growth of the IoT professional services market in the coming years. The Internet of Things (IoT) refers to a network of physical devices embedded with sensors, software, and other technologies that connect and exchange data with other devices and systems over the internet. Professional services related to IoT help process device data into valuable insights, providing operators with comprehensive product analytics and assisting manufacturers in developing new products. For example, in April 2022, the CRO Forum, a Netherlands-based high-level discussion group for risk managers, projected that the number of IoT devices would reach 24.1 billion by 2030. Furthermore, in March 2023, Exploding Topics, a US-based platform offering insights into emerging trends, estimated that there would be 25.4 billion IoT devices by 2030. Consequently, the rapid growth in IoT connections is fueling the expansion of the IoT professional services market.

The rise in industrial automation is anticipated to drive the growth of the IoT professional services market in the future. Industrial automation involves the use of control systems, such as computers or robots, to manage various processes and machinery within an industry, thereby reducing the need for human intervention. IoT professional services facilitate the integration of sensors, devices, and control systems, allowing for real-time data collection, analysis, and decision-making, which enhances operational efficiency and supports predictive maintenance in manufacturing and industrial operations. For example, in September 2024, a report by the International Federation of Robotics, a Germany-based non-profit organization, indicated that industrial automation robot sales reached 4,281,585 units in 2024, marking a 10% increase from 541,302 units sold in 2023. Consequently, the surge in industrial automation is propelling the growth of the IoT professional services market.

Major players within the IoT professional services sector are innovating by introducing novel solutions such as IoT Services for Sustainability, aiming to establish a competitive edge in the market. IoT services for sustainability encompass a suite of IoT-based solutions and offerings specifically tailored to address environmental and social sustainability challenges. For instance, in May 2022, Nippon Telegraph and Telephone (NTT), a prominent Japanese telecommunications company, unveiled IoT services for sustainability - an end-to-end stack of solutions designed to assist businesses in advancing their sustainability objectives. This comprehensive suite comprises several features, including OCR Meter Reading for real-time data collection from various meters, Water Leak Management utilizing IoT technology to prevent water damage, Predictive Maintenance leveraging sensor data to anticipate operational events, and Environmental Monitoring to identify pollutants and monitor environmental conditions. Supported by NTT's LoRaWAN network, this stack ensures secure integration between IT and operational technology (OT), offering benefits such as energy cost reductions, emission reductions, operational efficiency enhancements, and improved work enablement. This launch echoes the increasing emphasis on leveraging IoT advancements to combat climate change and achieve sustainability goals.

Leading companies in the IoT professional services market are increasingly prioritizing strategic collaborations to develop new products and fortify their positions in the industry. Strategic collaborations entail mutually beneficial partnerships between independent entities working together to achieve shared goals that align with their individual strategic objectives. For example, in September 2023, Lexmark International Inc., a US-based company specializing in imaging products and laser printers, announced a collaboration with HARMAN Digital Transformation Solutions (DTS), a business unit of Harman International Industries, a US-based electronics company. Through this partnership, HARMAN will integrate Lexmark's Optra IoT technology into specific projects, combining it with AI capabilities to tackle challenges encountered by enterprises and public institutions. The collaboration aims to create innovative industrial IoT applications, including solutions for Industry 4.0, remote monitoring of manufacturing plants, medical devices, and connected products. One of the initial offerings resulting from this collaboration is an AI-powered solution designed to detect anomalies and defects in manufacturing processes, demonstrating significant improvements in inspection speed and error reduction. This partnership leverages Lexmark's expertise in IoT technology and HARMAN's domain competency and extensive integration expertise. Together, the companies are committed to delivering enhanced IoT solutions across various industries.

In April 2022, ACL Digital, a US-based technology consulting and engineering services company, acquired VOLANSYS for an undisclosed amount. This acquisition is aimed at enhancing ACL Digital's capabilities and reinforcing its position as a leading service provider in the Product Engineering, Digital Transformation, and IoT sectors. VOLANSYS, also based in the US, is known for providing end-to-end IoT professional services to enterprises and OEMs globally, covering everything from concept development to realization, testing, and deployment.

IoT professional services are offered by software companies to develop and support IoT applications. They help in defining, designing, and launching IoT initiatives across different industry verticals.

In the realm of IoT professional services, the key categories include IoT consulting services, IoT infrastructure services, system design and integration services, support and maintenance services, and education and training services. IoT consulting services involve offering IoT-based solutions to businesses, with deployment options including both cloud-based and on-premises setups. These services cater to organizations of varying sizes, including small and medium enterprises (SMEs) and large enterprises, and are utilized across different sectors such as smart buildings, smart manufacturing, smart transport and logistics, smart healthcare, smart retail, and others.

The iot professional services market size has grown rapidly in recent years. It will grow from $151.16 billion in 2023 to $168.05 billion in 2024 at a compound annual growth rate (CAGR) of 11.2%. The growth in the historic period can be attributed to growing need for connectivity, security concerns, surge in demand for professional services, adoption of smart devices, growth of e-commerce and online retail.

Major companies operating in the IoT professional services market include Google LLC, Microsoft Corporation, AT&T Inc., Robert Bosch GmbH, Hitachi Ltd., Amazon Web Services Inc., Siemens AG, General Electric Company, Accenture plc, IBM Corporation, Deloitte Touche Tohmatsu Limited, PricewaterhouseCoopers LLP, Cisco Systems Inc., Vodafone Group plc, Ernst & Young Global Limited, Oracle Corporation, Schneider Electric SE, Honeywell International Inc., KPMG International Ltd., Tata Consultancy Services Limited., Fujitsu Limited, NEC Corporation, NTT DATA Corporation, Capgemini SE, Cognizant Technology Solutions Corporation, Infosys Limited, DXC Technology Company, Atos SE, Wipro Limited, HCL Technologies Limited, Tech Mahindra Limited, LTIMindtree Ltd., Happiest Minds Technology Ltd.

North America was the largest region in the IoT professional services market in 2024. The regions covered in the iot professional services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the iot professional services market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The IoT professional services market includes revenues earned by entities by providing device optimization services, device test and support services, connected infrastructure, digital strategy services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

IoT Professional Services Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on iot professional services market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for iot professional services? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The iot professional services market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Service Type: IoT Consulting Service; IoT Infrastructure Service; System Designing and Integration Service; Support and Maintenance Service; Education and Training Service2) By Deployment Type: Cloud; on-Premises

3) By Organization Size: Small and Medium Enterprises (SMEs); Large Enterprises

4) By Application: Smart Buildings; Smart Manufacturing; Smart Transport and Logistics; Smart Healthcare; Smart Retail; Other Applications

Subsegments:

1) By IoT Consulting Service: Business Consulting; Technology Consulting; Strategy Development; Feasibility Assessment2) By IoT Infrastructure Service: Network Infrastructure Setup; Cloud Infrastructure Management; Security Infrastructure Implementation

3) By System Designing and Integration Service: IoT Solution Design; Device and Platform Integration; Data Integration and Middleware Services

4) By Support and Maintenance Service: Remote Monitoring and Support; Troubleshooting and Issue Resolution; Software Updates and Patches

5) By Education and Training Service: IoT Training Programs; Technical Workshops; Certification Programs

Key Companies Mentioned: Google LLC; Microsoft Corporation; AT&T Inc.; Robert Bosch GmbH; Hitachi Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Google LLC

- Microsoft Corporation

- AT&T Inc.

- Robert Bosch GmbH

- Hitachi Ltd.

- Amazon Web Services Inc.

- Siemens AG

- General Electric Company

- Accenture plc

- IBM Corporation

- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers LLP

- Cisco Systems Inc.

- Vodafone Group plc

- Ernst & Young Global Limited

- Oracle Corporation

- Schneider Electric SE

- Honeywell International Inc.

- KPMG International Ltd.

- Tata Consultancy Services Limited.

- Fujitsu Limited

- NEC Corporation

- NTT DATA Corporation

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Infosys Limited

- DXC Technology Company

- Atos SE

- Wipro Limited

- HCL Technologies Limited

- Tech Mahindra Limited

- LTIMindtree Ltd.

- Happiest Minds Technology Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 180.75 Billion |

| Forecasted Market Value ( USD | $ 307.29 Billion |

| Compound Annual Growth Rate | 14.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |