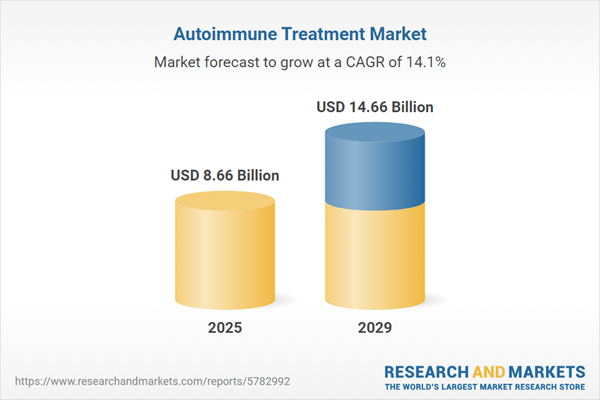

The autoimmune treatment market size is expected to see rapid growth in the next few years. It will grow to $14.66 billion in 2029 at a compound annual growth rate (CAGR) of 14.1%. The growth in the forecast period can be attributed to precision medicine approaches, emergence of small molecule therapies, targeting novel pathways, gene therapy innovations, increasing biopharmaceutical investments, biosimilar market growth. Major trends in the forecast period include advancements in biologics and targeted therapies, immunomodulatory therapies, focus on rare autoimmune diseases, telemedicine and remote monitoring, regulatory initiatives and drug approvals, integration of digital health tools.

The autoimmune treatment market is set to experience significant growth due to increased investments in research and development (R&D) for drugs targeting autoimmune diseases. R&D initiatives facilitate the innovation and introduction of new products and services. Specifically, R&D efforts in autoimmune disease drugs enable the creation of more precise, low-molecular-weight, orally active, and well-characterized immune suppressive drugs with tolerable long-term treatment profiles. Notably, in January 2022, Eli Lilly and Company, a US-based pharmaceutical giant, raised its R&D investment from $7 billion in 2021 to $7.19 billion in 2022, elevating its R&D expenditure as a percentage of revenue from 24.8% to 25.19%. This surge in R&D investments propels growth within the autoimmune treatment market.

The increasing healthcare expenditures are anticipated to drive the growth of the autoimmune treatment market in the future. Healthcare expenditures encompass all costs related to providing health services, including family planning activities, nutrition programs, and emergency health assistance. An uptick in healthcare spending is likely to facilitate the development of more effective therapies and medical technologies for treating autoimmune disorders. For example, the economic forecast from the Office for Budget Responsibility (OBR) and Treasury indicates that the UK's planned health expenditure is projected to rise to £192 billion ($244.43 billion) in 2024/25, an increase from £182 billion ($231.7 billion) in 2022/23. Similarly, the National Health Expenditures Accounts (NHEA) from KFF, an independent health policy research organization in the US, predict that health spending will grow by 5% from 2023 to 2024, reaching $4.9 trillion. Therefore, the increase in healthcare expenditures is fueling the growth of the autoimmune treatment market.

Technological advancements emerge as a pivotal trend shaping the landscape of the autoimmune treatment market. Major market players are actively investing in advanced technologies to solidify their positions. Notably, in June 2023, Belgium-based pharmaceutical company UCB received approval from the U.S. Food and Drug Administration (FDA) for RYSTIGGO (rozanolixizumab-noli) to treat generalized myasthenia gravis (gMG) in adults who test positive for anti-acetylcholine receptor (AchR) or anti-muscle-specific tyrosine kinase (MuSK) antibodies. This approval, expedited under Priority Review, marks RYSTIGGO as the exclusive FDA-approved therapy for both anti-AchR and anti-MuSK antibody-positive gMG, encompassing the two most prevalent subtypes of this autoimmune condition. This breakthrough signifies a potential enhancement in provider efficiency, treatment efficacy, and overall patient care within the autoimmune illness domain.

Prominent players in the autoimmune treatment market are intensifying their focus on introducing cutting-edge clinical trial platforms as a strategic move to gain a competitive advantage. These innovative platforms in autoimmune treatment capitalize on advanced technologies and personalized methodologies to enhance treatment efficacy, safety, and overall patient outcomes. For instance, in August 2023, the Scleroderma Research Foundation, a US-based non-profit organization, introduced the CONQUEST trial platform. This groundbreaking initiative aims to advance research and therapeutic approaches for scleroderma, a rare autoimmune disease impacting connective tissues. The CONQUEST program addresses pivotal challenges in clinical development, fostering advancements in scleroderma treatment methodologies. Notably, the CONQUEST platform clinical trial represents a pioneering effort in rare autoimmune diseases, specifically focusing on swiftly evaluating potential treatments for interstitial lung disease associated with systemic sclerosis (SSc-ILD) and overall SSc outcomes, encompassing aspects such as skin and other disease manifestations.

In another significant development in August 2023, Eli Lilly and Company, a US-based pharmaceutical giant, completed the acquisition of DICE Therapeutics, Inc. for $2.4 billion. This strategic acquisition expands Lilly's portfolio in the realm of immunology products by integrating DICE's innovative oral therapeutic candidates. Notably, DICE Therapeutics, Inc., a US-based pharmaceutical firm, specializes in developing novel oral therapies targeting autoimmune and inflammatory conditions. Specifically, DICE's oral IL-17 inhibitors, presently undergoing clinical development, are poised to offer innovative treatment approaches for chronic immunological disorders, broadening Lilly's offerings in this therapeutic domain.

Major companies operating in the autoimmune treatment market are Abbott Laboratories, Amgen Inc., Johnson & Johnson Services Inc., Eli Lilly and Company, Pfizer Inc., Hoffmann-La Roche AG, AstraZeneca PLC, Bristol-Myers Squibb Company, Autoimmune Inc., Siemens Healthcare Private Limited, Thermo Fisher Scientific Inc., Biogen Idec Inc., Bayer Schering Pharma AG, GSK PLC, Genentech Inc., AbbVie Inc., Celgene Corporation, Gilead Sciences Inc., Merck & Co. Inc., Novartis International AG, Sanofi SA, Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., UCB SA, Alexion Pharmaceuticals Inc., Amarin Corporation PLC, AnaptysBio Inc., Apellis Pharmaceuticals Inc., Arena Pharmaceuticals Inc., Aurinia Pharmaceuticals Inc., BioCryst Pharmaceuticals Inc., Biohaven Pharmaceutical Holding Company Ltd., BioMarin Pharmaceutical Inc., bluebird bio Inc., Cabaletta Bio Inc., Catabasis Pharmaceuticals Inc., ChemoCentryx Inc., Coherus BioSciences Inc., Corbus Pharmaceuticals Holdings Inc., CSL Limited, Cumberland Pharmaceuticals Inc., CytoDyn Inc.

North America was the largest region in the autoimmune treatment market in 2024. The regions covered in the autoimmune treatment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the autoimmune treatment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Autoimmune treatment encompasses the strategic management and support provided to patients to address autoimmune diseases or disorders. In these conditions, the immune system targets the body's own cells. The application of autoimmune treatment aims to effectively address and manage autoimmune diseases.

In the realm of autoimmune treatment, the primary product categories comprise consumables and assay kits, instruments, and services. Consultation denotes the act of seeking guidance from physicians or healthcare professionals for diagnostic studies, therapeutic interventions, or related services. Diagnosis, on the other hand, involves the systematic identification of the nature of an illness or problem through the examination of signs and symptoms. The principal service types encompass consultation and diagnosis, therapy and monitoring, and drug development, with a focus on various diseases such as rheumatoid arthritis, systemic lupus erythematosus, sjögren’s syndrome, thyroiditis, scleroderma, among others. Key drug classes integral to autoimmune treatment include anti-inflammatory agents, anti-hyperglycemics, NSAIDs, interferons, and others. Clinical laboratories, hospitals, and similar entities constitute the primary end users in this domain.

The autoimmune treatment market report is one of a series of new reports that provides autoimmune treatment statistics, including autoimmune treatment industry global market size, regional shares, competitors with an autoimmune treatment market share, detailed autoimmune treatment market segments, market trends and opportunities, and any further data you may need to thrive in the autoimmune treatment industry. This autoimmune treatment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The autoimmune treatment includes revenues earned by entities by providing immunosuppressive therapy, biological treatment, immuno-suppressing medications services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Autoimmune Treatment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on autoimmune treatment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for autoimmune treatment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The autoimmune treatment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Consumables and Assay Kits; Instruments; Services2) by Service Type: Consultation and Diagnosis; Therapy and monitoring; Drug development

3) by Disease: Rheumatoid Arthritis; Systemic Lupus Erythematosus; Sjögren’s Syndrome; Thyroiditis; Scleroderma; Other Diseases

4) by Drug Class: Anti-Inflammatory; Anti-Hyperglycemic; NSAIDs; Interferons; Other Drug Class

Subsegments:

1) by Consumables and Assay Kits: ELISA Kits; Reagents and Antibodies; Sample Collection Kits2) by Instruments: Diagnostic Equipment; Imaging Systems

3) by Services: Testing and Diagnostics Services; Consultation and Support Services; Data Analysis and Interpretation Services

Key Companies Mentioned: Abbott Laboratories; Amgen Inc.; Johnson & Johnson Services Inc.; Eli Lilly and Company; Pfizer Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Autoimmune Treatment market report include:- Abbott Laboratories

- Amgen Inc.

- Johnson & Johnson Services Inc.

- Eli Lilly and Company

- Pfizer Inc.

- Hoffmann-La Roche AG

- AstraZeneca PLC

- Bristol-Myers Squibb Company

- Autoimmune Inc.

- Siemens Healthcare Private Limited

- Thermo Fisher Scientific Inc.

- Biogen Idec Inc.

- Bayer Schering Pharma AG

- GSK PLC

- Genentech Inc.

- AbbVie Inc.

- Celgene Corporation

- Gilead Sciences Inc.

- Merck & Co. Inc.

- Novartis International AG

- Sanofi SA

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

- UCB SA

- Alexion Pharmaceuticals Inc.

- Amarin Corporation PLC

- AnaptysBio Inc.

- Apellis Pharmaceuticals Inc.

- Arena Pharmaceuticals Inc.

- Aurinia Pharmaceuticals Inc.

- BioCryst Pharmaceuticals Inc.

- Biohaven Pharmaceutical Holding Company Ltd.

- BioMarin Pharmaceutical Inc.

- bluebird bio Inc.

- Cabaletta Bio Inc.

- Catabasis Pharmaceuticals Inc.

- ChemoCentryx Inc.

- Coherus BioSciences Inc.

- Corbus Pharmaceuticals Holdings Inc.

- CSL Limited

- Cumberland Pharmaceuticals Inc.

- CytoDyn Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 8.66 Billion |

| Forecasted Market Value ( USD | $ 14.66 Billion |

| Compound Annual Growth Rate | 14.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 43 |