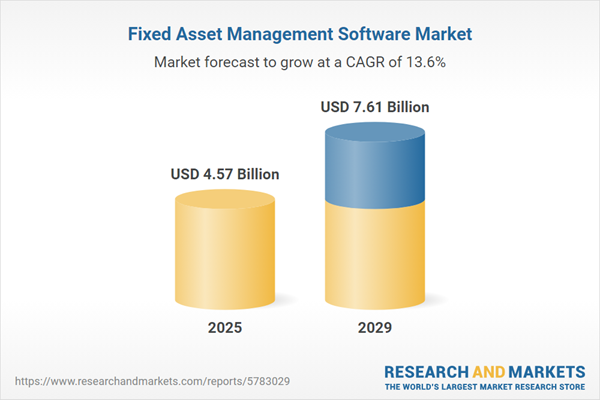

The fixed asset management software market size is expected to see rapid growth in the next few years. It will grow to $7.61 billion in 2029 at a compound annual growth rate (CAGR) of 13.6%. The growth in the forecast period can be attributed to AI-driven decision-making, industry-specific solutions development, remote monitoring sophistication, cost efficiency priority, integration with business systems, mobile accessibility enhancement, rise in remote work. Major trends in the forecast period include digitization of asset management, advancements in technology, compliance requirements, and data security concerns.

The growing demand for fixed assets across various sectors is expected to drive the demand for fixed asset management software in the future. Fixed assets are those utilized in corporate operations that provide long-term financial benefits. Companies use fixed assets to produce goods and services, thereby generating revenue. These assets are neither sold to customers nor held as investments. Given the advantages of investing in fixed assets, businesses implement fixed asset management software to track equipment and vehicles, assess their condition, maintain them in optimal working order, minimize lost inventory, equipment failures, and downtime, and enhance the asset's lifetime value. For example, in July 2022, a report from the Government of China indicated that from January to June, national fixed asset investment (excluding rural households) amounted to 27.14 trillion Yuan, reflecting a 6.1% year-on-year increase. Furthermore, private fixed asset investment reached 15.3 trillion Yuan, marking a 3.5% year-on-year rise. Thus, the increasing investment and demand for fixed assets across multiple sectors will drive the fixed asset management software market.

The rising number of IoT-connected devices is anticipated to accelerate the growth of the fixed asset management software market in the future. IoT-connected devices are nonstandard computing devices that wirelessly connect to a network and can transmit data. The expanding presence of IoT-linked devices enhances fixed asset management software by supplying real-time data, facilitating predictive maintenance, optimizing utilization, and improving overall efficiency and effectiveness in asset management processes. For example, a report from Ericsson, a telecommunications company based in Sweden, published in November 2022, noted that broadband IoT (4G/5G), which connects most cellular IoT devices, reached 1.3 billion connections in 2022. By the end of 2028, nearly 60% of cellular IoT connections are expected to be broadband IoT connections, with 4G making up the majority. Currently, North East Asia leads in cellular IoT connections, with predictions indicating it will exceed 2 billion connections in 2023. Thus, the growing number of IoT-connected devices is propelling the growth of the fixed asset management software market.

Technological advancements are a prevailing trend in the fixed asset management software market. Advanced solutions now encompass IT asset lifecycle programs that furnish precise data for informed decision-making by asset managers. Major companies like Aptean are focused on innovating new technologies to bolster their market positions. For instance, Aptean's March 2022 launch of Aptean EAM, a cloud-based enterprise asset management solution for manufacturers, integrates comprehensive features, including advanced analytics, to streamline preventative maintenance, manage work orders, automate approvals, track spare parts inventories, and conduct mobile compliance inspections.

In a bid to elevate asset management capabilities for customers, major companies operating in the fixed asset management software market are increasingly adopting strategic partnerships. These alliances allow firms to leverage each other's strengths and resources for mutual growth. For example, the partnership between Yokogawa Electric Corporation and Radial Software Group B.V. in February 2023 aims to enhance asset management capabilities through an AI-powered solution. This partnership enables Yokogawa to provide customers with an innovative solution for improved asset management, offering a unified view of technical information, reducing risks, fostering operational excellence, and facilitating digital transformation through the Yokogawa Cloud platform.

In August 2024, Aptean Inc., a software solution company based in the US, acquired SSG Insight for an undisclosed sum. The acquisition aims to enhance Aptean's global presence and bolster its cloud-based Enterprise Asset Management (EAM) offerings for asset-intensive sectors by incorporating SSG's expertise and solutions. SSG Insight, located in the UK, specializes in providing computerized maintenance management software (CMMS) and asset maintenance solutions to a variety of businesses.

Major companies operating in the fixed asset management software market are International Business Machines Corporation, Infor Inc., Tracet Enterprise, Microsoft Corporation, Oracle America Inc., Sage Software Inc., Aptean India Pvt Ltd., Aveva Group PLC, SAP SE, Ramco Systems Limited, FMIS Ltd., AssetWorks LLC, RCS Tech LLP, ManageEngine AssetExplorer, UpKeep Technologies Inc., InvGate Assets, AssetCloud by Wasp Barcode Technologies, Cheqroom NV, Ivanti Inc., Bloomberg Tax Fixed Assets, FlexiInternational Software Inc., Deltek Inc., Reftab LLC, EZOfficeInventory.

Asia-Pacific was the largest region in the fixed asset management software market share in 2024 and is expected to be the fastest-growing region in the forecast period. The regions covered in the fixed asset management software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the fixed asset management software market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Fixed asset management software is a specialized tool designed to oversee the complete lifecycle of Maintenance, Repair, and Operations (MRO) for assets like buildings, vehicles, equipment, and various non-cash items. Its primary objective is to monitor depreciation values, streamline asset tracking, and optimize their lifecycle to prevent inventory losses, equipment breakdowns, and downtime, thereby enhancing the overall value of assets.

The key components of fixed asset management software encompass both software and services. The software aspect involves comprehensive tools that facilitate the efficient management of fixed assets, ensuring a transparent process from acquisition to disposition. This software consists of programmed instructions and data used to manage and streamline asset-related activities. It can be deployed through on-premises or cloud-based systems, catering to the needs of large enterprises as well as small and medium-sized organizations. Industries such as energy and utilities, manufacturing, IT, telecom, media, transportation, logistics, healthcare, life sciences, and others benefit from the functionalities offered by fixed asset management software.

The fixed asset management software market research report is one of a series of new reports that provides fixed asset management software market statistics, including fixed asset management software industry global market size, regional shares, competitors with a fixed asset management software market share, detailed fixed asset management software market segments, market trends and opportunities, and any further data you may need to thrive in the fixed asset management software industry. This fixed asset management software market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The fixed asset management software market includes revenues earned by entities by providing asset tracking, creating a checklist, setting reorder level, and providing reports and analytics. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Fixed Asset Management Software Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on fixed asset management software market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for fixed asset management software? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The fixed asset management software market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Component: Software; Services2) by Deployment Type: on-Premises; Cloud

3) by Organization Size: Large enterprises; Small-and Medium-Sized Enterprises

4) by End Users: Energy and utilities; Manufacturing; IT, Telecom and media; Transportation and logistics; Healthcare and life science; Others End Users (BFSI, Retail, and Government)

Subsegments:

1) by Software: Asset Tracking Software; Depreciation Management Software; Reporting and Analytics Software2) by Services: Implementation Services; Consulting Services; Maintenance and Support Services

Key Companies Mentioned: International Business Machines Corporation; Infor Inc.; Tracet Enterprise; Microsoft Corporation; Oracle America Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Fixed Asset Management Software market report include:- International Business Machines Corporation

- Infor Inc.

- Tracet Enterprise

- Microsoft Corporation

- Oracle America Inc.

- Sage Software Inc.

- Aptean India Pvt Ltd.

- Aveva Group PLC

- SAP SE

- Ramco Systems Limited

- FMIS Ltd.

- AssetWorks LLC

- RCS Tech LLP

- ManageEngine AssetExplorer

- UpKeep Technologies Inc.

- InvGate Assets

- AssetCloud by Wasp Barcode Technologies

- Cheqroom NV

- Ivanti Inc.

- Bloomberg Tax Fixed Assets

- FlexiInternational Software Inc.

- Deltek Inc.

- Reftab LLC

- EZOfficeInventory

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.57 Billion |

| Forecasted Market Value ( USD | $ 7.61 Billion |

| Compound Annual Growth Rate | 13.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |