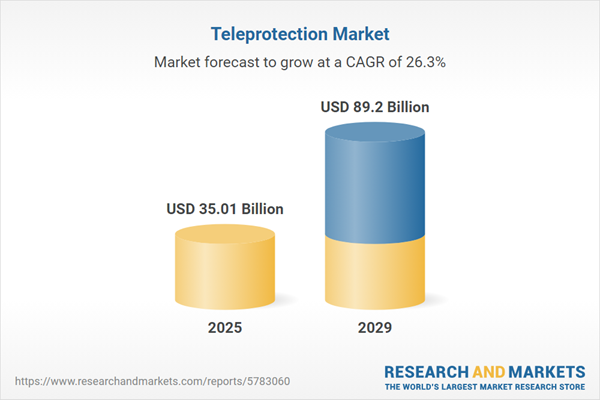

The teleprotection market size is expected to see exponential growth in the next few years. It will grow to $89.2 billion in 2029 at a compound annual growth rate (CAGR) of 26.3%. The growth in the forecast period can be attributed to rapid urbanization, electrification of transportation, integration of 5G technology, investments in transmission infrastructure, transition to cleaner energy sources. Major trends in the forecast period include adoption of blockchain technology, cloud-based teleprotection solutions, hybrid teleprotection solutions, human-machine collaboration, increasing use of predictive analytics.

The significant demand in the telecom sector is anticipated to propel the growth of the teleprotection market. The telecommunications industry encompasses businesses involved in wireless communication, telecom services, and telecom equipment, facilitating the transmission of data globally in the form of words, speech, audio, or video. This surge in demand for the telecom sector is driven by factors such as increased digitization, remote work arrangements, and online transactions. Teleprotection serves as the physical interface between telecommunications infrastructure and protective relays, activating circuit breakers or reclosers in response to faults to prevent network failures. For example, in February 2024, the Canadian Radio-television and Telecommunications Commission (CRTC), a government agency in Canada, reported that mobile services accounted for 55.5% of total revenues in 2022, representing a 5.7% increase from $29.2 billion in 2021 to $30.9 billion. Furthermore, the average mobile subscriber's data usage grew by 21.3% from 2021 to 2022. Therefore, the rising demand for the telecom sector is expected to lead to increased demand for teleprotection.

The growth of the teleprotection market is expected to be driven by the expansion of power infrastructure. Power infrastructure is essential for contemporary societies, providing energy for everything from basic residential requirements to complex industrial operations. Teleprotection systems are utilized within power infrastructure to monitor the condition of transmission lines, employing sensors and relays to identify abnormal situations such as overloads, short circuits, or ground faults. For instance, a report published by the International Energy Agency, a France-based intergovernmental organization, forecasts that global renewable power capacity will grow by 2,400 gigawatts (GW) from 2022 to 2027, which is equivalent to China's entire current power capacity. This anticipated increase is 30% higher than the growth projections made just a year earlier. Therefore, the expansion of power infrastructure is a key factor driving the growth of teleprotection.

The anticipated growth of the teleprotection market is expected to be fueled by an increasing demand for energy-saving solutions and seamless transmission. Energy-saving refers to the practice of using less energy and only consuming it when necessary, while seamless transmission involves providing power to the grid without any loss or generation failure. Factors such as rising household incomes, the electrification of transportation and heating, and a growing demand for digitally connected devices and air conditioning are expected to drive up power demand. Teleprotection plays a crucial role in minimizing power outages, enhancing the reliability of power supply to customers, and protecting personnel during electricity production. For instance, in October 2023, data published by the U.S. Energy Information Administration (EIA), a U.S.-based government agency, revealed that electric utilities in the United States had around 119 million smart/advanced metering infrastructure (AMI) installations in 2022, accounting for 72% of all electric meters, up from 118.7 million in 2021. Therefore, the growing demand for energy-saving and seamless transmission is a significant driver for the teleprotection market.

Partnerships and collaborations are prominent trends in the teleprotection market, with major companies leveraging such alliances to expand into new markets and tap into each other's resources. For example, in April 2022, Réseau de Transport d'Électricité (RTE), a France-based public utility company, entered into a partnership with Nokia, a Finland-based information and technology provider. The collaboration aimed to construct a new grid network for digital communication, facilitating the transportation of TDM flows for teleprotection and differential protection applications. The network was designed to handle various traffic flows, including back-office flows to enterprise sites and remote-control flows to SCADA.

Major companies in the teleprotection market are adopting cutting-edge technologies, such as security testing suites, to penetrate new markets and gain a competitive edge by optimizing available resources. Siemens AG, a Germany-based multinational technology conglomerate, exemplifies this trend by launching an all-in-one security testing suite for industrial networks in October 2023. This suite, incorporating teleprotection, serves as a comprehensive toolset for assessing the security posture of industrial communication networks. It streamlines one-time scanning of devices and network segments during maintenance, integrating leading security tools to enhance risk discovery and mitigation. The suite's capabilities contribute to minimizing the effort required for comprehensive cybersecurity testing in industrial environments.

Major companies operating in the teleprotection market include EnerNex SpA, Mitsubishi Electric Corporation, Siemens AG, General Electric Company, Cisco Systems Inc., Schneider Electric SE, ABB Ltd., Nokia Corp, Toshiba Corporation, Eaton Corporation, Amperion Inc., DNV GL, Schweitzer Engineering Laboratories Inc., Horizon Power Systems Inc., BPL Global, ARTECHE Group, Nova Systems Ltd., Efacec Power Solutions SA, L&T Electrical & Automation, OMICRON electronics GmbH, G&W Electric Company, NovaTech LLC, Quanta Technology LLC, RFL Electronics Inc., Rugged Controls LLC, NR Electric Co Ltd., ZIV Automation India Pvt Ltd., SEL Engineering Services Inc., Kalkitech, Moxa Inc., TC Communications Pvt Ltd.

North America was the largest region in the teleprotection market in 2024. The regions covered in the teleprotection market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the teleprotection market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Teleprotection is a system that rapidly transmits command signals to selectively disconnect malfunctioning parts to prevent system failure and damage. These systems rely on communication-aided coordination between relays to monitor and protect transmission lines. The protective relays, working in tandem with communication links, play a crucial role in selectively isolating vital components of high-voltage power lines, transformers, reactors, and other electrical equipment in the event of faults.

In the realm of teleprotection solutions, essential types include teleprotection units, communication network technology, and telecontrol software and services. Teleprotection units are crucial for monitoring the grid's health, identifying flaws, and preventing damage to vital components. These units serve as physical connections between protection relays and the telecommunications network. Components of teleprotection include intelligent electronic devices (IED), interface devices, communication network components, and teleprotection SCADA. Teleprotection applications span diverse industries such as power, telecom, information technology, oil and gas pipelines, transportation, aerospace and defense, among others.

The teleprotection market research report is one of a series of new reports that provides teleprotection market statistics, including teleprotection industry global market size, regional shares, competitors with a teleprotection market share, detailed teleprotection market segments, market trends and opportunities, and any further data you may need to thrive in the teleprotection industry. This teleprotection market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The teleprotection market consists of revenues earned by entities by teleprotection solution and services. The market value includes the value of related goods sold by the service provider or included within the service offering. The teleprotection market also includes sales of power line carrier and communication devices which are used in providing teleprotection services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Teleprotection Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on teleprotection market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for teleprotection? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The teleprotection market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Teleprotection Unit; Communication Network Technology; Telecontrol Software and Services2) By Component: Intelligent Electronic Device (IED); Interface Device; Communication Network Components; Teleprotection SCADA

3) By Application: Power; Telecom; Information Technology; Oil and Gas Pipelines; Transportation; Aerospace and Defense; Other Applications

Subsegments:

1) By Teleprotection Unit: Standalone Teleprotection Units; Integrated Teleprotection Systems2) By Communication Network Technology: Fiber Optic Communication; Microwave Communication; IP-Based Communication Networks

3) By Telecontrol Software and Services: Telecontrol Software Solutions; Configuration and Integration Services; Support and Maintenance Services

Key Companies Mentioned: EnerNex SpA; Mitsubishi Electric Corporation; Siemens AG; General Electric Company; Cisco Systems Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- EnerNex SpA

- Mitsubishi Electric Corporation

- Siemens AG

- General Electric Company

- Cisco Systems Inc.

- Schneider Electric SE

- ABB Ltd.

- Nokia Corp

- Toshiba Corporation

- Eaton Corporation

- Amperion Inc.

- DNV GL

- Schweitzer Engineering Laboratories Inc.

- Horizon Power Systems Inc.

- BPL Global

- ARTECHE Group

- Nova Systems Ltd.

- Efacec Power Solutions SA

- L&T Electrical & Automation

- OMICRON electronics GmbH

- G&W Electric Company

- NovaTech LLC

- Quanta Technology LLC

- RFL Electronics Inc.

- Rugged Controls LLC

- NR Electric Co Ltd.

- ZIV Automation India Pvt Ltd.

- SEL Engineering Services Inc.

- Kalkitech

- Moxa Inc.

- TC Communications Pvt Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 35.01 Billion |

| Forecasted Market Value ( USD | $ 89.2 Billion |

| Compound Annual Growth Rate | 26.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |