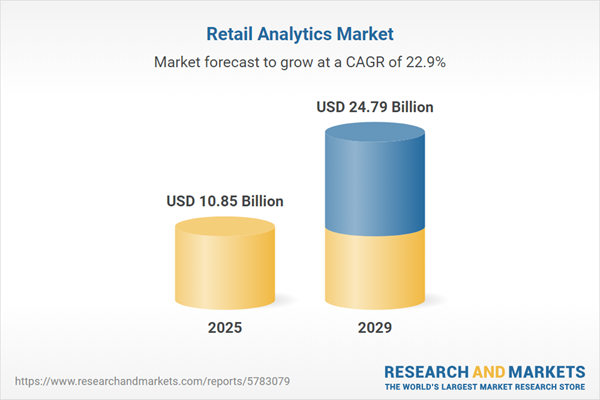

The retail analytics market size is expected to see exponential growth in the next few years. It will grow to $24.79 billion in 2029 at a compound annual growth rate (CAGR) of 22.9%. The growth in the forecast period can be attributed to enhanced fraud detection, expansion of omnichannel strategies, real-time analytics, demand for sustainability analytics, privacy and compliance concerns, international expansion of retail chains. Major trends in the forecast period include focus on customer experience analytics, omnichannel analytics for seamless integration, real-time analytics for instant decision-making, visual and image analytics, cloud-based analytics solutions, customer segmentation and targeted marketing, collaboration with analytics service providers.

The growth of the retail analytics market is being driven by the trend of digitalization to improve customer experience and retail operations. Digitalization involves transforming a business model through digital technologies, creating new opportunities for value generation and revenue growth. It allows businesses to engage with modern consumers and meet their expectations for a seamless customer experience, regardless of channel or location. For example, in February 2024, a report by gov.UK, a UK-based government website, indicated that provisional estimates for 2022 show the digital sector contributed £158.3 billion ($207.05 billion) to the UK economy, accounting for 7.2% of the total UK Gross Value Added (GVA), up from 7.1% in 2021. As a result, digitalization aimed at enhancing customer experience and retail operations is fueling the expansion of the retail analytics market.

The expansion of Information Technology (IT) infrastructure is expected to further propel the growth of the retail analytics market. IT infrastructure encompasses hardware, software, networks, data centers, and other components that support and enable an organization's information technology environment. A robust and well-maintained IT infrastructure is foundational for the successful implementation of retail analytics, providing support for data management, processing, and analysis. This infrastructure ensures that retailers can effectively leverage data to make informed decisions, enhance customer experiences, and optimize their operations. As evidenced by the substantial funds raised by fast-growing IT businesses in the UK in 2022, the growth in IT infrastructure is a driving force behind the expansion of the retail analytics market.

Leading companies in the retail analytics market are creating digital tools that integrate business data with AI to enhance customer insights, optimize inventory management, personalize marketing strategies, and boost overall operational efficiency. Advanced data visualization and analytics platforms utilize real-time data integration and AI-driven algorithms to assist retailers in making informed decisions, optimizing sales performance, and enhancing customer experiences. For example, in March 2023, KPMG International Ltd, based in the Netherlands, introduced Dash, a digital tool that employs AI algorithms to analyze large volumes of data, providing predictions and recommendations that help retailers understand customer behavior, target catchment areas, and assess competition. The platform is designed for user-friendliness and accessibility for businesses of all sizes, requiring minimal lead time for implementation. Importantly, there are no upfront fees, making it financially viable for a wide range of retail businesses.

Major players in the retail analytics market are actively introducing innovative technological products, such as the Retail Prescriptive Analytics System, to enhance profitability and competitiveness in the market. Prescriptive analytics, a form of data analytics, offers recommendations on what actions to take next by analyzing historical performance and trends, helping businesses make informed decisions to achieve future objectives. A notable example is Kepler Analytics, an Australia-based retail analytics company, which launched the Retail Prescriptive Analytics System in January 2023. This system empowers retailers to establish optimal prices, promotions, and assortments at granular levels, catering to their best customers and fostering loyalty. Retail prescriptive analytics systems serve as valuable tools for making intelligent decisions at scale, allowing retailers to analyze various data sets, including geolocation, trends, product availability, and peak shopping hours.

In October 2023, MarketDial Inc., a US-based company, acquired Marketdial Inc. for an undisclosed amount. This acquisition is part of MarketDial's strategy to enhance its portfolio by integrating Marketdial's expertise in retail analytics, which includes in-store traffic analytics. Marketdial Inc. specializes in providing retail analytics solutions.

Major companies operating in the retail analytics market are Microsoft Corporation, HCL Technologies Limited, IBM Corporation, 1010data Inc., FLIR Systems Inc., Radius Networks Inc., Manthan Software Services Pvt. Ltd., Wipro Limited, Capgemini SE, TIBCO Software Inc., Adobe Inc., Cisco Systems Inc., Amazon.com Inc., Teradata Corporation, MicroStrategy Incorporated, Tableau Software LLC, FICO, Fiserv, Inc., Verisk Analytics Inc., Nielsen Holdings PLC, Experian PLC, Mastercard Incorporated, Visa Inc., PayPal Holdings Inc., Square Inc., Shopify Inc., Facebook Inc., Dor Technologies Inc., True Fit Corporation, Orbital Insight Inc., Cuebiq Inc., Rubikloud Technologies Inc.

North America was the largest region in the retail analytics market in 2024. The Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the retail analytics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the retail analytics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Retail analytics involves the provision of analytical insights into inventory levels, supply chain operations, consumer demands, sales patterns, and other essential factors pivotal in making informed marketing and procurement decisions.

The primary components within retail analytics comprise solutions and services. Solutions refer to tailored products or services designed to address common or specific client issues. These encompass functions related to customer management, merchandising, store operations, supply chain management, strategy, and planning. These solutions are deployed through various models including on-premise and cloud-based systems and are utilized by both offline and online end-users.

The retail analytics market research report is one of a series of new reports that provides retail analytics market statistics, including retail analytics industry global market size, regional shares, competitors with a retail analytics market share, detailed retail analytics market segments, market trends and opportunities, and any further data you may need to thrive in the retail analytics industry. This retail analytics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The retail analytics market includes revenues earned by entities by descriptive analytics, diagnostic analytics, predictive analytics, and prescriptive analytics. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Retail Analytics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on retail analytics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for retail analytics ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The retail analytics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Component: Solutions; Services2) by Function: Customer Management; Merchandising; Store Operations; Supply Chain; Strategy and Planning

3) by Deployment Model: on-Premise; Cloud

4) by End User: Offline; Online

Subsegments:

1) by Solutions: Predictive Analytics Software; Descriptive Analytics Software; Prescriptive Analytics Software; Visualization Tools; Customer Analytics Solutions; Inventory Management Solutions2) by Services: Consulting Services; Implementation Services; Managed Services; Support and Maintenance Services

Key Companies Mentioned: Microsoft Corporation; HCL Technologies Limited; IBM Corporation; 1010data Inc.; FLIR Systems Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Retail Analytics market report include:- Microsoft Corporation

- HCL Technologies Limited

- IBM Corporation

- 1010data Inc.

- FLIR Systems Inc.

- Radius Networks Inc.

- Manthan Software Services Pvt. Ltd.

- Wipro Limited

- Capgemini SE

- TIBCO Software Inc.

- Adobe Inc.

- Cisco Systems Inc.

- Amazon.com Inc.

- Teradata Corporation

- MicroStrategy Incorporated

- Tableau Software LLC

- FICO

- Fiserv, Inc.

- Verisk Analytics Inc.

- Nielsen Holdings PLC

- Experian PLC

- Mastercard Incorporated

- Visa Inc.

- PayPal Holdings Inc.

- Square Inc.

- Shopify Inc.

- Facebook Inc.

- Dor Technologies Inc.

- True Fit Corporation

- Orbital Insight Inc.

- Cuebiq Inc.

- Rubikloud Technologies Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 10.85 Billion |

| Forecasted Market Value ( USD | $ 24.79 Billion |

| Compound Annual Growth Rate | 22.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |