Increasing Popularity of Liquid Biopsy Leading to Easier Screening

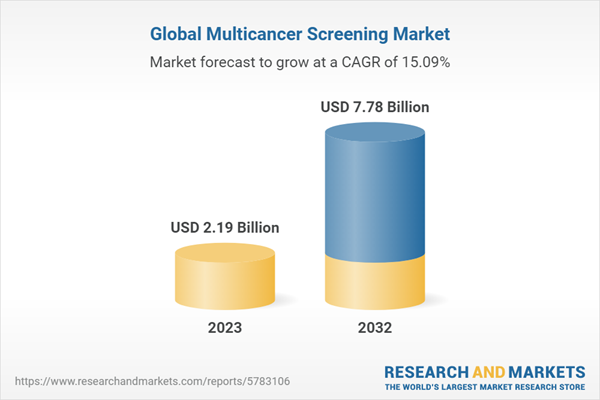

The global multicancer screening market is projected to reach $7.78 billion by 2032 from $1.90 billion in 2022, growing at a CAGR of 15.09% during the forecast period 2023-2032. The growth in the global multicancer screening market is expected to be driven by the increased use of liquid biopsy testing and increasing prevalence of cancers.

Market Lifecycle Stage

Multicancer screening is a cancer screening test that has the potential to screen for more than one cancer type with a single test. This test can be tissue-based or liquid biopsy-based. Most of the newly developed multicancer screening tests in the market right now are liquid biopsy-based, which detects cancer biomarkers in bodily fluids such as blood, saliva, urine, etc. Biomarkers/genetic markers from RNA, DNA, or protein are analyzed from these samples. If any of these biomarkers or gene mutations are positive in the analysis, further follow-up tests need to be performed to confirm the findings.

Some multicancer screening tests can also identify the tissue of the origin of cancer, while others need imaging tests to verify the origin. There are a lot of laboratory-based multicancer screening tests available in the market right now, and a few have also received U.S. Food and Drug Administration (FDA) and conformité européenne (CE) approvals as well. Multicancer screening tests are also important because, according to the America Cancer Society, Inc., 70% of all cancer deaths are from cancers that still do not have any proven individual screening tests. This can be extremely decreased with the advent of new biomarkers through increasing funding investments in multicancer screening tests.

Impact

- For instance, in October 2020, Exact Sciences Corporation launched Oncotype MAP Pan-Cancer Tissue test for patients with metastatic, advanced, recurrent, or refractory cancer. The Oncoptype MAP test provides clinically actionable information from hundreds of cancer-related genes that allows physicians to understand the tumor profile of patients and recommend effective clinical trials or targeted therapies.

- In February 2022, GRAIL, LLC. (Illumina, Inc.) collaborated with Point32Health for a two-phased pilot trial of Galleri, which is GRAIL's proprietary multicancer blood test. With this collaboration, Point32Health is the first health plan that would work with GRAIL to complement the recommended cancer screenings.

Impact of COVID-19

In 2019, the world was hit by a pandemic. The culprit is coronavirus disease (COVID-19), which is an illness caused by the severe acute respiratory syndrome coronavirus-2 (SARS-CoV-2) virus. SARS-CoV-2 was found to be a novel type of coronavirus that started causing severe illness and deaths around the world. The global pandemic began in early 2020, causing mild respiratory tract infections to serious lower respiratory infections. The first case of coronavirus was reported in Wuhan, China, in December 2019.

According to an electronic medical record company, there was approximately an 80%-90% decline in screenings of breast, cervical, and colorectal cancers in patients during March and April of 2020 as compared to the same months in 2019. Even though screenings did increase in June 2020, they were still down by 29%-36%. Additionally, according to the Centers for Disease Control and Prevention, HPV vaccinations dropped by 73% between February and April 2020. The full impact of these delays will be realized in the coming years.

Market Segmentation

Segmentation 1: by Test Type

- Laboratory Developed Tests (LDTs)

- In-Vitro Diagnostics (IVDs)

The global multicancer screening market (by test type) is expected to be dominated by the laboratory developed tests (LDTs) segment during the forecast period 2023-2032. The in-vitro diagnostics (IVDs) segment is expected to grow with a high CAGR and have a market share of 35.72% till 2032.

Segmentation 2: by Technology

- Next-Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Immunohistochemistry (IHC)

- Fluorescence In-Situ Hybridization (FISH)

- Other Technologies

The global multicancer screening market (by technology) is expected to be dominated by the next-generation sequencing (NGS) segment during the forecast period 2023-2032. This is because it is the most efficient and accurate technology currently available when it comes to gene analysis.

Segmentation 3: by Sample

- Tissue

- Blood

- Saliva and Buccal Swab

- Others

The global multicancer screening market (by sample) is expected to be dominated by the tissue segment during the forecast period 2023-2032. This is due to the high validation and trust on these tests as compared to the newer liquid biopsy-based tests.

Segmentation 4: by Method

- DNA

- RNA

- Proteins

The DNA segment is expected to dominate the global multicancer screening market (by method) during the forecast period 2023-2032. This growth in this segment is attributed to the fact that DNA analysis is the most convenient, even with the fast-growing liquid biopsy methods.

Segmentation 5: by Cancer Type

- Breast and Gynecologic

- Gastrointestinal

- Endocrine

- Genitourinary

- Skin

- Brain/Nervous System

- Sarcoma

- Hematological Malignancies

- Lung

- Head and Neck

- Other Cancer Types

The global multicancer screening market (by cancer type) is expected to be dominated by the breast and gynecological segment during the forecast period 2023-2032. This is because the high prevalence of these cancer types and high number of known biomarkers makes them easy to screen for.

Segmentation 6: by Application

- Clinical

- Research

As of 2021, the global multicancer screening market (by application) was dominated by the research segment, holding a 85.06% market share.

Segmentation 7: by End User

- Hospitals

- Diagnostic and Clinical Laboratories

- Academic and Research Institutions

- Other End Users

As of 2021, the global multicancer screening market (by end user) was dominated by the academic and research institutions segment, holding a 62.17% market share.

Segmentation 8: by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Rest-of-the-World

North America is expected to dominate the global multicancer screening market with a revenue of $0.87 billion in 2021. However, the Asia-Pacific (APAC) region, constituting several emerging economies, is expected to register the highest CAGR of 17.60% during the forecast period 2023-2032.

Recent Developments in Global Multicancer Screening Market

- In March 2021, Agilent Technologies, Inc. made an agreement to acquire Resolution Bioscience Inc. to expand the company's NGS-based cancer diagnostics and its fast-growing precision medicine segment. This agreement was made for $550 million in cash at closing and an additional $145 million when the company achieves future performance milestones.

- In December 2022, Integrated DNA Technologies, Inc. acquired Invitae Corporation.'s next-generation sequencing (NGS) research assays with the Archer trademark for $48 million.

- In January 2023, Laboratory Corporation of America Holdings. acquired Personal Genome Diagnostics for $450 million and for another $125 million as contingent milestone payments. Personal Genome Diagnostics was a next-generation sequencing test maker, and with this acquisition, Laboratory Corporation of America Holdings. has increased its NGS testing portfolio.

- In January 2023, FOUNDATION MEDICINE, INC. (F. Hoffmann-La Roche Ltd) got FDA approval for its FoundationOne Liquid CDx as a companion diagnostic for Rozlytrek. This test is relevant for ROS1+NSCLC patients and NTRK fusion-positive solid tumors patients.

- In January 2023, Burning Rock DX got an FDA Breakthrough Device Designation for its Multi-Cancer Detection Blood Test called OverC. This test is intended for the detection of lung, liver, ovarian, esophageal, and pancreatic cancer for adults aged between 50 and 75 years.

Demand - Drivers and Limitations

The following are the demand drivers for the global multicancer screening market:

- Early Detection of Cancer Leads to Higher Survival Chances and Better Treatment

- Increasing Popularity of Liquid Biopsy Leading to Easier Screening

- Reduced Treatment Cost Due to Earlier Cancer Detection

The market is expected to face some limitations too due to the following challenges:

- Lack of Awareness about the Multicancer Screening Tests

- Too Costly to be Used as Preventive Care

How can this report add value to an organization?

Product/Innovation Strategy: The report considers multicancer screening kit/panel and assay product-based companies. The industry is seeing constant development and product launches with new and innovative upgrades. Additionally, new discoveries of specific biomarkers related to various cancer types are increasing researchers' trust in multicancer sequencing.

Growth/Marketing Strategy: The key components in multicancer screening are the kits and the related technologies for sample analysis. The advancements in new analysis methods like liquid biopsy are influencing the growth of this market. Additionally, the discovery of biomarkers and other genes for various diseases is helping panel manufacturers curate precise kits and assays for multicancer screening of various cancer types.

Competitive Strategy: The key players in the global multicancer screening market have been analyzed and profiled in the study, consisting of most product-based companies, as well as a few emerging companies. Moreover, a detailed competitive benchmarking of the players operating in the global multicancer screening market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts, analyzing company coverage, product portfolio, and market penetration.

The top segment players leading the market include in-vitro diagnostics (IVDs) and laboratory developed tests (LDTs). IVD kit providers constitute around 30.54% of the presence in the market, and LDT kit providers constitute 69.46% of the multicancer screening market.

Key Companies Profiled

- Agilent Technologies, Inc.

- Atara Biotherapeutics, Inc.

- Burning Rock DX

- Danaher Corporation

- Exact Sciences Corporation

- F. Hoffmann-La Roche Ltd

- Fulgent Genetics.

- Genecast Biotechnology Co., Ltd

- Guardant Health, Inc.

- Illumina, Inc.

- Konica Minolta, Inc.

- Laboratory Corporation of America Holdings.

- Myriad Genetics, Inc.

- Tempus

- Thermo Fisher Scientific Inc.

Table of Contents

Companies Mentioned

- Agilent Technologies, Inc.

- Atara Biotherapeutics, Inc.

- Burning Rock DX

- Danaher Corporation

- Exact Sciences Corporation

- F. Hoffmann-La Roche Ltd

- Fulgent Genetics.

- Genecast Biotechnology Co., Ltd

- Guardant Health, Inc.

- Illumina, Inc.

- Konica Minolta, Inc.

- Laboratory Corporation of America Holdings.

- Myriad Genetics, Inc.

- Tempus

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 228 |

| Published | April 2023 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 2.19 Billion |

| Forecasted Market Value ( USD | $ 7.78 Billion |

| Compound Annual Growth Rate | 15.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |