In the last few years, several countries across the globe have legalized the use of medical cannabis and recreational-use cannbis / adult-use cannabis. This can be attributed to the therapeutic potential of cannabis and cannabis-infused products that has been acknowledged recently. Studies have shown that cannabis can provide substantial relief from adverse effects, such as chemotherapy-induced nausea and chronic pain associated with multiple sclerosis. In fact, three cannabis-derived prescription medications have already been approved for sale across the US. Further, the recent legalization of cannabis across several countries, including Canada, Germany and Thailand, has prompted several stakeholders to develop and manufacture cannabis-infused products. However, the illicit market with questionable product quality still remains the primary source of cannabis and cannabis-infused products for the masses. Further, the high potency of the cannabinoids and presence of contaminants, including microbes, pesticides, heavy metals and residual solvents in cannabis-infused products, compromise their shelf life as well as the consumer safety. This inherent lack of quality raises various concerns, challenging the future of this market. In order to overcome these challenges, it becomes imperative that cannabis-infused products comply with the regulatory standards, stringent testing protocols to maintain the safety thresholds and protect consumer health. With rise in demand for safe and compliant cannabis-infused products, the cannabis testing market is anticipated to witness steady growth in the upcoming decade, offering various testing solutions to a number of end-users, including cultivators, product manufacturers, and research institutes.

Key Market Insights

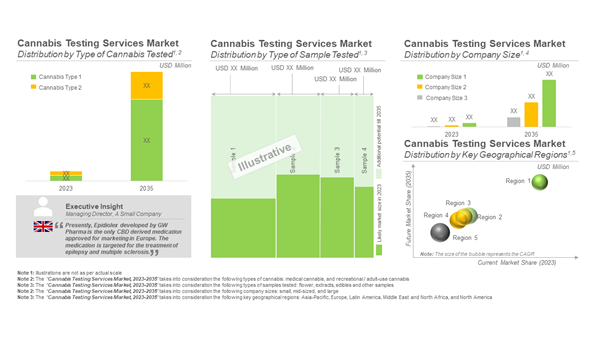

The Cannabis Testing Market: Distribution by Type of Cannabis Tested (Medical Cannabis and Recreational / Adult-use Cannabis), Type of Sample Tested (Flowers, Extracts, Edibles and Other Type of Samples), Company Size (Small, Mid-sized and Large Companies), and Key Geographical Regions (North America, Europe, Asia-Pacific, Latin America, and Middle East and North Africa): Industry Trends and Global Forecasts, 2023-2035 report features an extensive study of the current market landscape and the likely future potential of the cannabis testing market, over the next 12 years. It highlights the efforts of various stakeholders engaged in this rapidly emerging segment of the cannabis testing industry. Key inclusions of the report are briefly discussed below.

Growing Demand for Cannabis Legalization and Cannabis-infused Products

There has been a steady increase in the consumption of cannabis, also known as marijuana; since 2018, the number of young-adults consuming the plant in any form has increased by 5%. Moreover, the consumption of cannabis increased by 20% during the COVID-19 pandemic. Presently, many countries have legalized medicinal use of cannabis, while 10 such countries have also approved recreational use of the plant. According to the National Organization for the Reform of Marijuana Laws, there were at least 21 US states and District of Columbia that have legalized medical cannabis or adult-use cannabis. Consequently, there is an increasing demand for a diverse range of cannabis-infused products (in terms of applications, medical or recreational), including tinctures, salves, edibles, vape oils and raw plant materials. In order to ensure the quality of different cannabis-infused products, over 350 cannabis testing labs equipped with novel equipment and software have been established globally. These cannabis testing labs provide regulatory-compliant testing of the products, ensuring quality and consumer safety. All these developments have paved way for growth in the cannabis / marijuana testing market.

Need for Cannabis Testing Labs

The recent legalization of medicinal cannabis across the US and many other regions, coupled with the decriminalization of the plant for recreational use, has revolutionized the field. Stringent regulatory standards have been imposed in order to ensure the quality of the product and safety of consumers. To comply with these regulatory standards, an increasing number of cultivators, manufacturers and research institutes are leveraging the superior technical expertise of cannabis testing labs. These service providers offer analysis along with options for testing multiple product samples / final products with quick turnaround times, aiding the quality compliance of the products, as well as fortifying consumer safety. In some US states, such as Massachusetts, the cannabis testing labs have also come together to form an association, showing their responsibility towards building a safe market for the consumers.

Growing Number of Cannabis Testing Labs

The cannabis testing market features more than 160 companies that claim to possess the necessary technical expertise for providing testing services for cannabinoid potency and contaminants, catering to the biopharmaceutical, agricultural and food industries. The market is currently dominated by small companies (1-50 employees), which represent 44% of the total number of players. It is interesting to highlight that companies testing medical-grade cannabis products represent more than 75% of the total players in this market. In addition, recent developments in this industry indicates that substantial number of analytical laboratories have included testing of recreational / adult-use cannabis in their service portfolios. In June 2022, Trichome Analytical became the first cannabis testing lab to receive license for adult-use cannabis testing in New Jersey. In the same month, Bia Diagnostics received license for adult-use cannabis testing in the state of Vermont, which legalized the use of adult-use cannabis in 2018, but the adult-use dispensaries started selling marijuana for recreational purpose in October 2022.

It is also worth highlighting that close to 40 companies world-wide offer cannabis testing products, including analytical instruments, consumables, reagents, and software solutions to these cannabis testing labs. Notably, more than 25% of these players also offer cannabis testing services along with testing products. The increasing number of cannabis testing labs across the world, serving the growing cannabis market, will drive the market to grow at a CAGR of ~22% over the forecast period.

Key Challenges in the Cannabis Testing Market

The legalization of cannabis across the globe has led to an increase in the number of cannabis products that comply with regulatory requirements and are safe for human consumption. However, the testing protocols for such products are not standardized across different labs. In addition to this, the market is witnessing various kinds of matrices including candles, edibles, transdermal patches and e-liquids infused with cannabis, which needs a different testing procedure to be followed. This results in inconsistent testing results, compromising the product quality and subsequently, consumer safety. While service providers are striving to tackle these challenges through innovation in design and standardization of methods, the increasing costs of procuring novel equipment and ensuring that they align with the customers' budget, remain a pressing concern. Stringent regulations, including lab accreditations, will be imperative to ensure consumer safety, specifically in the next 2-3 years as medical cannabis / adult-use cannabis is being legalized in several countries. However, these can restrict the market growth potential of cannabis testing labs.

Cannabis Testing Services Market Size

Driven by the rising demand for novel cannabis-infused medicinal and recreational products, the cannabis testing services market is anticipated to witness noteworthy growth in the foreseen future. Specifically, in terms of type of cannabis tested, the market is anticipated to be driven by the high demand for medicinal cannabis. Currently, majority of the revenues are generated from the testing of flower samples; however, in the near future, market for testing extracts and edibles is anticipated to grow at a relatively higher CAGR.

Emerging Markets to Drive Cannabis Testing Market Growth

At present there are limited cannabis testing labs in the emerging markets of Latin America, Asia-Pacific, and Africa. South Africa’s first cannabis testing lab was opened by Afriplex in March 2019. Since then, several other laboratories like Qure and CannaLab have set up operations in the country. In Latin America, Colombia is anticipated to cater over 40% of the global medical cannabis demand. Presently, under Asia-Pacific, Australia legalized the use of cannabis for recreational applications in 2016; Thailand legalized the plant for medical use in 2018. Following this, it is expected that more countries across the region will legalize the plant for either medical or recreational use in the foreseen future.

Although North America holds the largest share of the cannabis testing market at present, the emerging markets will push the market growth as these markets look to regulate their cannabis industry.

Emerging Trends in Cannabis Testing Market

In recent years, the cannabis testing market has witnessed various innovations in testing equipment as well as integration of software solutions in the laboratory workflow. Novel techniques, such as chromatographic methods in parallel with UV spectrometric analysis, improve the overall accuracy and sensitivity of the analytical assays. The integration of laboratory information management systems (LIMS) enables better customer relationship management, enterprise resource management, and overall product outcomes. Moreover, it offers uniform testing results, improved adherence to the regulatory standards, and a higher rate of efficiency. Further, stakeholders in this market have forged several strategic alliances in order to enhance their existing service portfolios and consolidate their presence within the industry. It is worth highlighting that most of these partnership agreements inked were mergers and acquisitions of other key players in the industry. For instance, in January 2023, GrowerIQ partnered with High North Laboratories, to improve the testing processes offered by High North enabling the seamless testing and regular data integration with GrowerIQ’s digital record.

Key Players Engaged in Cannabis Testing Market

Examples of key players engaged in this market (which have also been captured in this report) include Abko Labs, ACT Laboratories, BelCosta Labs, CDX Analytics, Digipath, LGC, Medicinal Genomics, SGS, Steep Hill and Tentamus.

Scope of the Report

The study presents an in-depth analysis of the various firms / organizations that are engaged in this industry, across different segments.

Amongst other elements, the report includes:

- An executive summary of the insights captured during our research. It offers a high-level view on the current state of the cannabis testing market and its likely evolution in the mid-long term.

- A general introduction to cannabis testing, along with details related to the applications and needs for testing cannabis infused products. In addition, this section presents information on different types of testing protocols mandated by the regulatory authorities to ensure consumer safety. Further, it concludes with a discussion on the emerging trends in cannabis testing and future perspectives in this market.

- A detailed assessment of the overall market landscape of cannabis testing labs based on several relevant parameters, such as year of establishment, company size (in terms of employee count), location of headquarters, type of offering(s) (cannabis testing services or cannabis testing services & products), type of company (private company or public company), number of facilities (less than 5 facilities, 5 to 10 facilities, and more than 10 facilities), type of accreditation(s) / certification(s) (ISO, PJLA, DEA, A2LA, USDA, FDA, ELAP, AOAC, CDPHE, UKAS, NCIA, NELAP, DCC, ORELAP, HIA, CLIA, ANAB ANSI, and Others), number of accreditation(s) / certification(s) (less than 5 accreditations, 5-10 accreditations, and undisclosed), type of testing solution(s) offered (potency testing, terpenes testing, microbial analysis, pesticides testing, residual solvent testing, heavy metals testing, mycotoxins testing, moisture analysis, DNA genotyping, vitamin E acetate testing, and flavonoid testing), type of sample(s) tested (edibles & infused products, cannabis bud / flower, cannabis extract / concentrates, and cannabis oil), type of cannabis and hemp tested (medical cannabis, hemp, recreational / adult-use cannabis, and others), and end-user(s) (cannabis cultivators / growers, cannabis drug / product manufacturers, cannabis edible manufacturers, and other research institutes).

- An insightful competitiveness analysis of cannabis testing labs based on company strength (in terms of years of experience), portfolio strength (in terms of type of company, number of facilities, type of offerings, number of testing solutions offered, number of samples tested, type of cannabis and hemp tested, and number of end-users) and number of accreditations / certifications.

- Elaborate profiles of key cannabis testing labs (shortlisted based on a proprietary criterion); each profile includes a brief overview of the company, along with information on its financial information (if available), service portfolio, recent developments and an informed future outlook.

- A detailed assessment of the overall market landscape of cannabis testing product providers, based on several relevant parameters, such as their year of establishment, company size (in terms of employee count), location of headquarters, type of offering(s) (cannabis testing products or cannabis testing services & products), type of testing product(s) offered (analytical instruments, consumables, reagents and additional software solutions), type of analytical instrument(s) offered (chromatography instruments, spectroscopy instruments and others), and type of additional software solution(s) offered (Laboratory Information Management System (LIMS), Customer Relationship Management (CRM), Enterprise Resource Planning (ERP)).

- A detailed analysis of the partnerships that have been inked within the cannabis testing market, since 2018, based on several relevant parameters, such as year of partnership, type of partnership (mergers and acquisitions, research and development agreements, service alliances, technology integration agreements, distribution agreements, licensing agreements and other agreements), type of partner (industry and non-industry), geographical location of the companies involved, and most active players (in terms of number of partnerships).

- An in-depth analysis of recent events (webinars / conferences / expos / summits) that were organized across different regions of the globe for stakeholders in this market, based on several relevant parameters, such as year of event, event platform, type of event, year and type of event, distribution of events by geography, evolutionary trends in event agenda / key focus area, most popular event organizers, most active industry players, most active non-industry players, most active speakers (in terms of number of events), details of the designation of speakers, affiliated department of event speakers and a geographical mapping of upcoming events.

One of the key objectives of the report was to estimate the current opportunity and the future growth potential of the cannabis testing market over the coming years. We have provided an informed estimate on the likely evolution of the market for the period 2023-2035. Our year-wise projections of the current and forecasted opportunity have been further segmented based on relevant parameters, such as type of cannabis tested (medical cannabis and recreational / adult-use cannabis), type of sample tested (flowers, extracts, edibles and other types of samples), company size (small, mid-sized and large companies), and key geographical regions (North America, Europe, Asia-Pacific, Latin America, and Middle East and North Africa). In order to account for future uncertainties associated with some of the key parameters and to add robustness to our model, we have provided three market forecast scenarios, portraying the conservative, base and optimistic scenarios of the industry’s evolution.

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders in this industry.

The report features detailed transcripts of interviews held with the following individuals (in alphabetical order):

- Catherine Wilson (Managing Director, Hip Services)

- Laura Willoughby (Co-founder and Director of Partnerships, Club Soda)

- Markus Roggen (President, Chief Scientific Officer, DELIC Labs)

- Nicholas Clarkson (Chief Scientific Officer, PhytoVista Laboratories)

All actual figures have been sourced and analyzed from publicly available information forums and primary research discussions. Financial figures mentioned in this report are in USD, unless otherwise specified.

Frequently Asked Questions

Question 1: What are the medical applications of cannabis?

Answer: The consumption of cannabis has shown therapeutic efficacy against chronic pain associated with cancer, chemotherapy-induced nausea, epilepsy and multiple sclerosis. Moreover, the plant has also been used to treat certain neurodegenerative disorders including Tourette syndrome, Huntington’s disease, Parkinson’s disease, post-traumatic stress syndrome (PTSD), anxiety, depression as well as sleep disorders.

Question 2: Which countries have legalized cannabis for medical use?

Answer: Examples of countries that have legalized the use of cannabis for medical purposes include Argentina, Australia, Canada, Chile, Colombia, Croatia, Cyprus, Czechia, Denmark, Finland, Germany, Greece, Israel, Italy, Jamaica, Lesotho, Luxembourg, Macedonia, Malta, Mexico, the Netherlands, Norway, Peru, Poland, Romania, San Marino, Switzerland, Turkey, Uruguay, the US and Zimbabwe.

Question 3: Which are the top players in the cannabis testing market?

Answer: Presently, more than 160 companies are engaged in providing cannabis testing services worldwide. Examples of top players engaged in this market (which have also been captured in this report) include Abko Labs, ACT Laboratories, BelCosta Labs, CDX Analytics, Digipath, LGC, Medicinal Genomics, SGS, Steep Hill and Tentamus.

Question 4: What are the various factors driving cannabis testing market?

Answer: The factors driving the cannabis testing market include increasing legalization of cannabis across different regions and surge in demand for novel biopharmaceuticals and other products infused with cannabis extracts, such as tinctures and gummies.

Question 5: Which region has the highest market share in cannabis testing market?

Answer: North America captures around 58% share in the current cannabis testing services market. It is worth highlighting that Asia-Pacific is anticipated to grow at the highest growth rate.

Question 6: Which are the leading market segments of the cannabis testing market?

Answer: Currently, in terms of the type of sample tested, flower samples capture the largest share of this market. However, extracts are likely to witness higher annual growth rates in the upcoming years, owing to their more demand and increased utilization in different cannabis-infused products. Further, in terms of the type of cannabis tested, medical cannabis is anticipated to capture a prominent share of the current and future market.

Question 7: What is the growth rate (CAGR) of the cannabis testing market?

Answer: The cannabis testing services market size is projected to grow at a CAGR of ~22% in the coming years.

Question 8: What are the upcoming trends in the cannabis testing market?

Answer: The legalization of cannabis has witnessed a substantial traction in the last few decades. In fact, the demand for medicinal cannabis and recreational cannabis-infused products has also increased. In order to ensure that these products are compliant with the regulatory standards and testing protocols run within the precise time limits with optimized accuracy, several players have integrated software solutions in the laboratory workflow that offer various additional benefits, such as laboratory information management, improving customer relationship and increasing the overall productivity of the labs by reducing turnaround times.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A2LA

- ABKO Labs

- Accelerated Technology Laboratories

- Accurate Test Lab

- AccuScience Labs

- ACS Laboratory

- ACT Laboratories

- ADACT Medical

- Adams Independent Testing

- Afriplex

- Agilent

- AGQ Green Nature

- AGQ Labs

- Agricor Laboratories

- Agrozen Life Sciences

- Alkemist Labs

- Alpha-Cat

- American Trade Association for Cannabis and Hemp (ATACH)

- Americanna Laboratories

- Analogic Corporation

- Analytical Food Laboratories (AFL) (acquired by Tentamus)

- Analytical Resource Laboratories

- Anresco Laboratories

- Anton Paar

- AOAC International

- Applied BioSciences

- Applied DNA Sciences

- AQUATEST

- Atlantic Test Labs

- Auriga Research

- Aurum Labs

- Australian Cannabis Laboratories (ACLabs)

- Avazyme

- Avicanna

- AZ Biopharm

- BADGER LABORATORIES

- BC Craft Supply

- BelCosta Labs

- Bia Diagnostics

- Biopharmaceutical Research Company

- Bio-Rad Laboratories

- Biotrax Testing Laboratories

- Bluebonnet Labs

- Botanacor Laboratories

- Botanica Testing (acquired by ACS Laboratory)

- Brightlabs

- Brightside Scientific

- Broughton

- C3 Labs (acquired by EVIO)

- C4 Laboratories

- California Ag Labs

- California Cannabis Testing Labs

- Caligreen Laboratory

- Canadian Analytical Laboratories

- CaniBrands

- Cannabilab

- Cannabis Science and Technology

- Cannabiz Laboratory

- CannaBusiness Laboratories

- Canna-Centers

- CannaLab

- CannaLabs

- Cannalabs (a subunit of EkotechLAB)

- Cannalytics Laboratories

- Cannalytics Labs

- Cannalytix

- CannTest

- Canopy Growth

- CARP (Canadian Association of Retired Persons)

- CASPR Technologies

- CB Labs

- CB Scientific

- CBD-Test

- CC Pharma

- CDX Analytics (acquired by ACT Laboratories)

- CERESLabs

- ChRi Labs

- Clearwater Biotech

- CLIP Labs

- Coastal Analytical

- ColdHaus Direct

- Colorado State University Pueblo

- CompuGroup Medical

- Confidence Analytics

- Confident Cannabis

- Conquer Scientific

- Cornell University

- Council for Federal Cannabis Regulation (CFCR)

- Cultivo

- CV Sciences

- CW Analytical Laboratories

- DB Labs (acquired by Kaycha Labs)

- Decibel Cannabis

- DELIC Labs

- Delta 9 Analytical

- Digipath

- E&H Services

- Ecogreen Analytics

- Ecolab

- Eiken Chemical

- Eirlab

- Eldan Electronic Instruments

- EMMAC Life Sciences

- ENCORE LABS

- Engineering Systems

- Epsilon Healthcare

- Ethos Analytics

- Eurofins Scientific

- Eurox Pharma

- EVIO Labs (acquired by Kaycha Labs)

- Excelbis Labs

- Fera Science

- Fidelity Diagnostics

- FoodChain ID

- Front Range Biosciences (FRB)

- Fundación CANNA

- G7 Labs

- GAAS Analytical

- GemmaCert

- GenTech Scientific

- Gexin Analytical Labs

- Global Laboratory Services (GLS)

- Gobi Labs

- Green Analytics

- Green Country Testing (GCT)

- Green Leaf Lab

- Green Orchard Labs

- Green Scientific Labs

- GrowerIQ

- GTR

- Hamilton

- Harrens Lab

- Harvest 360

- Hemp and Cannabinoid Science Institute (HCSI)

- High North Laboratories

- Higher Testing

- Highgrade Labs

- Hill Laboratories

- Hylabs

- Icon Scientific

- IFS Laboratories

- Imperial College London

- Indian Industrial Hemp Association (IIHA)

- Infinite Chemical Analysis Labs

- Integrity Testing Laboratories

- Ionization Labs

- Iridium Consulting

- IRON Laboratories

- Kaycha Labs

- KCA Laboratories

- Kennebec Analytical Services

- Keystone State Testing

- KJ Scientific

- Kloris CBD

- Knauer

- Phytocontrol – Analysis Laboratory

- LabPlex

- Labstat

- LabWare

- LabX

- Lake Superior State University

- Leaf Detective (acquired by EVIO Labs)

- Leaf Laboratories

- Legend Technical Services

- Level One Labs

- Lexachrom Analytical Laboratory

- LGC

- LightWave Science

- Linneo Health

- Lucidity Systems

- LUX Leaf Diagnostics

- Massachusetts Cannabis Research Labs (MCR Labs)

- Materia Deutschland

- MB Laboratories

- MD Hemp Lab

- Medic Pro

- Medical Engineering Technologies

- Medicinal Genomics

- Medicine Creek Analytics

- Merck

- MilliporeSigma

- Minova Laboratories

- MoCann Testing

- Modern Canna

- Molecular Science

- MyDx

- New Bloom Labs

- NKore Biotherapeutics

- Nordic Analytical Laboratories

- Nova Analytic Labs

- Nutrasource

- Orange Photonics

- Orochem

- PathogenDx

- Pathogenia

- Precision Botanical Laboratories

- PerkinElmer

- pH Solutions (acquired by PSI Labs)

- PharmaHemp Laboratories

- PharmLabs

- Phenomenex

- PHRlabs

- Phyto-Farma Labs

- PhytoVista Laboratories (acquired by Sativa Investments)

- PREE Laboratories

- Premium CBD Labs (acquired by ABKO Labs)

- ProVerde Laboratories

- PSI Labs

- PuEr Lab

- Pure Analytics

- PureLabs

- Purity-IQ

- Purpl Scientific

- QPLab

- Quality Forensic Toxicology

- Qure

- Reassure

- Restek

- Rio Grande Analytics

- Rocky Mountain Instrumental Laboratories

- Rylie's Sunshine

- Sage Analytics

- Saguaro Testing

- Sartorius

- Saskatchewan Research Council (SRC)

- Sativa Investments

- Sativa Testing Laboratories

- Saxonia Diagnostics

- SC Labs

- Sciex

- SGS

- SH Lab

- Shimadzu

- Sigma Analytical Services

- Signature Science

- Sinceritas

- SJ Labs and Analytics

- SmartLedger

- Smithers

- SNDL

- Sniffer Labs

- Sonoma Lab Works

- Sorbent Technologies

- Spectrum CannaLabs

- Spectrum CBD

- Steep Hill

- Stellar Scientific

- Stillwater Laboratories

- Sunderstorm

- Sunrise Labs

- Sure Laboratories

- Talon Analytical

- Tantalus Labs

- Tentamus

- TEQ Analytical Laboratories

- Terramor Technologies

- THCG

- The Good Lab

- The Hebrew University of Jerusalem

- The Hemp Mine

- The Niva Labs

- The Real CBD

- The Valens Company (acquired by SNDL)

- Thermo Fisher Scientific

- Trace Analytics (acquired by Applied Biosciences)

- Trichome Analytical

- True Labs

- TruTrace Technologies

- UgenTec

- University of California, Davis

- US Cannalytics (acquired by BelCosta Labs)

- US Department of Agriculture (USDA) Agricultural Research Service (ARS)

- Valens Labs (a division of The Valens Company)

- Veda Scientific

- Viridis Laboratories

- Vivariant Laboratories

- VRX Labs

- VSSL (acquired by Digipath)

- Vyripharm Enterprises

- Waters

- Zef Scientific

Methodology

LOADING...