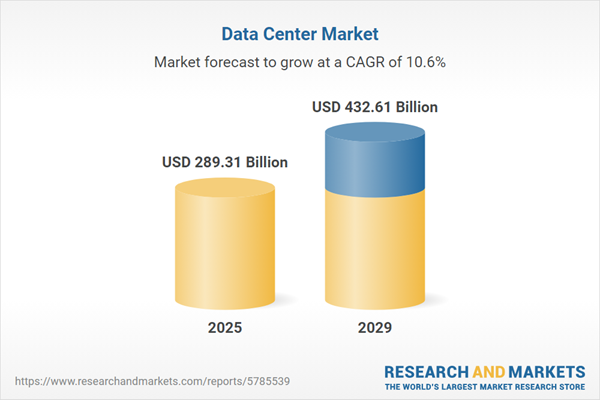

The data center market size is expected to see rapid growth in the next few years. It will grow to $432.61 billion in 2029 at a compound annual growth rate (CAGR) of 10.6%. The growth in the forecast period can be attributed to increasing digitalization, cloud services expansion, hybrid cloud adoption, sustainability and green initiatives, cybersecurity prioritization, remote workforce impacts. Major trends in the forecast period include edge computing expansion, cloud migration, hybrid cloud adoption, ai and machine learning integration, sustainability initiatives.

The anticipated increase in data volumes is set to drive the growth of the data centers market. Data, which refers to information processed for ease of use, is being generated and stored in large quantities by organizations of all types. This surge in data volume is a key driver for the data centers market, as these facilities play a crucial role in managing and storing the ever-growing data. For example, a December 2022 report from Firebolt Analytics Inc. revealed a significant rise in data volumes, with an expected increase from 107 terabytes (TB) in 2021 to 213 TB in 2023, indicating the ongoing expansion in the scale of data management within organizations. The growth in data volumes is a fundamental factor propelling the data center market.

The increasing prevalence of IoT-linked devices is expected to contribute to the growth of the data center market. IoT-linked devices, which are nonstandard computing devices connecting wirelessly to networks, generate substantial amounts of data. This growth in IoT devices necessitates sophisticated data center solutions capable of addressing the unique challenges posed by massive data, real-time processing needs, and requirements for scalability and security in the evolving IoT landscape. According to a November 2022 report from Ericsson, broadband IoT (4G/5G) connections, linking the majority of cellular IoT devices, reached 1.3 billion in 2022. The proliferation of IoT-linked devices, with an anticipated 60% of cellular IoT connections being broadband IoT by the end of 2028, is driving the demand for advanced data center solutions. The increasing number of IoT-linked devices is a significant factor fueling the growth of the data center market.

Technological advancements are emerging as key trends shaping the data center market, with major players introducing innovative products. Notably, Verakaria, a US-based cryptocurrency hosting and mining service provider, launched the Mobile Datacenter. This data center boasts superior power capability and a minimalist design, supporting up to 2.57 MW of power in a compact footprint. Designed to withstand varying weather conditions, the Mobile Datacenter is easily transportable and installable on-site, showcasing the industry's commitment to technological progress and adaptability.

Major companies in the data center market are focusing on product innovation, including the development of modular data centers, to cater to a broader customer base, drive increased sales, and boost revenue. Modular data centers employ a prefabricated approach to build and deploy data center infrastructure. For instance, in September 2022, Schneider Electric SE, a France-based provider of energy management and digital automation, launched Easy Modular all-in-one data centers. These data centers are recommended for scenarios where existing facilities reach full capacity or when rapid deployment is necessary, as in the case of relocations. Offering a standardized and pre-tested solution, Easy Modular's all-in-one data centers integrate power, cooling, and IT equipment within a single, pre-configured solution. This innovation caters to businesses and IT organizations pursuing an Edge strategy, aligning with the trend of seamlessly integrating critical components for efficient data center operations.

In February 2022, AtlasEdge, a prominent UK-based data center provider, successfully acquired a data center located in Leeds from Hardy Fisher Services. This strategic move was driven by AtlasEdge's objective to broaden its geographical coverage within the UK and solidify its standing in the market. The acquired data center was previously owned by Hardy Fisher Services, a reputable UK-based company specializing in cloud technology and data center services. This acquisition reflects AtlasEdge's commitment to strategic expansion and enhancing its capabilities in the competitive data center landscape.

Major companies operating in the data center market are Caterpillar Inc., Cummins Inc., ABB Ltd., Generac Power System Inc., KOHLER Group, Hitech Power Protection, Rolls Royce Power Systems AG, Aggreko Company, Eaton Corporation, F.G. Wilson, Atlas Copco, Himoinsa SL, MTU Friedrichshafen GmbH, Wärtsilä Corporation, Schneider Electric SE, Siemens AG, Emerson Electric Co., Socomec Group, Riello UPS, Vertiv Co., Delta Electronics Inc., Toshiba Corporation, Fuji Electric Co.Ltd., Kirloskar Electric Company, Yanmar Co. Ltd.

North America was the largest region in the data center market in 2024. The regions covered in the data center market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the data center market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Data centers represent physical facilities comprising networked computers, storage systems, servers, computational infrastructure, and application-delivery controllers. They are essential for businesses to conduct operations and store organizational data assets.

The primary types of data centers include colocation, hyperscale, edge, and other variations. Colocation involves a rental service catering to enterprise customers, allowing them to lease space for storing servers and other hardware crucial for daily business operations. The key components encompass solutions and services. Enterprise sizes utilizing data centers range from large enterprises to small and medium enterprises (SMEs). End users span various sectors such as BFSI, IT & telecom, government, energy & utilities, and other industries.

The data center market research report is one of a series of new reports that provides data center market statistics, including data center industry global market size, regional shares, competitors with a data center market share, detailed data center market segments, market trends, and opportunities, and any further data you may need to thrive in the data center industry. This data center market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The data center market consists of sales of IT infrastructure, electrical infrastructure, mechanical infrastructure, general construction, and other services that are used to store, process, and disseminate data and applications. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Data Center Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on data center market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for data center? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The data center market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Type: Colocation; Hyperscale; Edge; Other Types2) by Component: Solution; Services

3) by Enterprise Size: Large Enterprises; Small and Medium Enterprises (SMEs)

4) by End User: BFSI; IT and Telecom; Government; Energy and Utilities; Other End Users

Subsegments:

1) by Colocation: Retail Colocation; Wholesale Colocation2) by Hyperscale: Cloud Service Providers; Large-Scale Enterprises

3) by Edge: Micro Data Centers; Mobile Edge Computing

4) by Other Types: Modular Data Centers; Containerized Data Centers; Traditional Data Centers

Key Companies Mentioned: Caterpillar Inc.; Cummins Inc.; ABB Ltd.; Generac Power System Inc.; KOHLER Group

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Data Center market report include:- Caterpillar Inc.

- Cummins Inc.

- ABB Ltd.

- Generac Power System Inc.

- KOHLER Group

- Hitech Power Protection

- Rolls Royce Power Systems AG

- Aggreko Company

- Eaton Corporation

- F.G. Wilson

- Atlas Copco

- Himoinsa SL

- MTU Friedrichshafen GmbH

- Wärtsilä Corporation

- Schneider Electric SE

- Siemens AG

- Emerson Electric Co.

- Socomec Group

- Riello UPS

- Vertiv Co.

- Delta Electronics Inc.

- Toshiba Corporation

- Fuji Electric Co.Ltd.

- Kirloskar Electric Company

- Yanmar Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 289.31 Billion |

| Forecasted Market Value ( USD | $ 432.61 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |