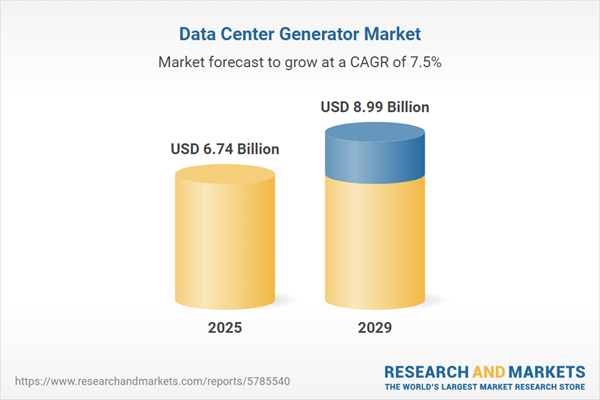

The data center generator market size is expected to see strong growth in the next few years. It will grow to $8.99 billion in 2029 at a compound annual growth rate (CAGR) of 7.5%. The growth in the forecast period can be attributed to increased data consumption, focus on business continuity, renewable energy integration, shift to edge computing, energy efficiency standards. Major trends in the forecast period include focus on reliability and durability, adoption of fuel efficiency technologies, rapid deployment solutions, predictive maintenance, remote and unmanned data centers.

The growth in the number of data centers is anticipated to drive the expansion of the data center generator market. A data center is a large collection of interconnected computer servers that companies commonly use for the remote processing, archiving, or transmission of substantial amounts of data. The demand for data center capacity is soaring to unprecedented levels due to digital transformation and the surge in cloud services. Consumer-oriented cloud providers and hyperscale operators are aggressively expanding their operations, which necessitates data center generators. These generators provide backup power in the event of a utility power outage. For example, in April 2024, Brightlio, a US-based technology solutions provider, reported that there were approximately 10,978 data centers worldwide in 2023. The leading countries include the United States (5,388), Germany (522), the U.K. (517), China (449), and Canada (336). Thus, the increasing number of data centers is expected to fuel the growth of the data center generator market.

The rise in cyber threats is expected to drive the growth of the data center generator market in the future. A cyber threat is defined as a malicious and potentially damaging activity, process, or event in the digital domain that aims to exploit weaknesses in computer systems, networks, or online platforms, intending to compromise data, disrupt operations, or gain unauthorized access to sensitive information. The increasing frequency and complexity of cyber-attacks emphasize the vital need for data center resilience and business continuity, prompting data centers to invest in reliable backup power solutions like generators to ensure uninterrupted operations, protect against cyber threats, and maintain the integrity of their services. For instance, in September 2023, AAG, an IT support services provider, reported that 39% of UK companies indicated they had experienced a cyber-attack in 2022. Additionally, in the first half of 2022, cybercrime affected 53.35 million individuals in the US. Thus, the escalating cyber threats are fueling the growth of the data center generator market.

Leading companies in the data center generator market are embracing a strategic partnership approach to explore technologies enabling the use of hydrogen as an eco-friendly fuel for critical data center infrastructure. Strategic partnerships involve companies leveraging each other's strengths and resources for mutual benefits. In September 2022, Equinix Inc., a US-based Internet services company, collaborated with the center for Energy Research & Technology (CERT), a Singapore-based interdisciplinary energy research center. This partnership aims to launch the world's first research initiative comparing the efficiency of proton-exchange membrane (PEM) fuel cells and fuel-flexible linear generator technologies. PEM fuel cells, known for their prominence in hydrogen energy, and fuel-flexible linear generators, offering flexibility in transitioning between clean fuel choices, have the potential to reduce carbon emissions while meeting the rising demand for data, colocation, and interconnection services. The Equinix-CERT research initiative will comprehensively assess the suitability of these technologies for tropical data centers, considering local climatic conditions, site limitations, power requirements, supply chain considerations, fuel storage capabilities, and adherence to regulatory policies. The adoption of hydrogen-based technologies presents an environmentally conscious solution for the evolving data center landscape.

Major companies in the data center generator market are creating innovative products like diesel generators to cater to larger customer bases, boost sales, and increase revenue. A diesel generator is a type of electrical generator that runs on diesel fuel. For example, in March 2022, Mitsubishi Heavy Industries Engine & Turbocharger Ltd., a Japan-based company specializing in engines and turbochargers, launched the MGS-R Series of diesel generator sets. Designed to meet the growing demands of the digital economy, particularly focusing on data centers in Asian and Middle Eastern markets, this new series serves as a reliable backup power solution for commercial establishments, including data centers. The series offers outputs ranging from 500 to 2,750 kVA for 50Hz and 460 to 2,000 kVA for 60Hz in standby configurations. Recent improvements to turbocharger specifications, fuel systems, and exhaust systems across all models enable a startup time of just 10 seconds. The series features a compact, high-power 12-cylinder engine produced by MHIET for the 1,500 kVA rating at 50Hz - the best-selling option in the lineup - resulting in the smallest installation area in its class. Moreover, the overhaul interval has been more than doubled by analyzing the operational aspects of generator sets across various locations.

In June 2022, Compass Datacenters LLC, a US-based data center company, formed a partnership with Foster Fuels. This collaboration aims to make Compass Datacenters LLC the first data center provider to use Hydrogenated Vegetable Oil-based biodiesel (HVO) for its on-site generators. Foster Fuels is a US-based fuel company that supplies fuel for data center generators.

Major companies operating in the data center generator market are Alphabet Inc., Amazon.com Inc., Equinix Inc., Microsoft Corp., Oracle Corp., SAP SE, International Business Machines Corp., Cisco Systems Inc., Huawei Investment & Holding Co. Ltd., Google LLC, Meta Platforms Inc., Digital Realty, CyrusOne, GDS Holdings Limited, KDDI’s Telehouse, Hewlett Packard Enterprise Company LP, Dell Technologies Inc., Fujitsu Limited, Schneider Electric SE, Eaton Corporation, Vertiv Co., Delta Electronics Inc., Rittal GmbH & Co. KG, ABB Ltd., Siemens AG, Hitachi Ltd., NEC Corporation.

North America was the largest region in the data center generator market share in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the data center generator market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the data center generator market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A data center generator serves as a reliable and cost-effective backup power solution in the event of a utility power failure, requiring periodic maintenance to ensure its effectiveness.

The primary product categories for data center generators include diesel, gas, and other options, categorized by capacity as < 1 MW, 1 MW-2 MW, and >2 MW. Diesel, also known as distillate fuel oil, is the fuel of choice for running diesel generators in data centers. These generators adhere to tier standards, namely tier I & II, tier III, and tier IV, signifying varying levels of reliability and redundancy.

The data center generator market research report is one of a series of new reports that provides data center generator market statistics, including data center generator industry global market size, regional shares, competitors with a data center generator market share, detailed data center generator market segments, market trends and opportunities, and any further data you may need to thrive in the data center generator industry. This data center generator market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The data center generator market consists of sales of backup power controls, redundant data connections, and communications, server room cooling units, and security controls. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Data Center Generator Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on data center generator market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for data center generator? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The data center generator market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Diesel; Gas; Other Products2) by Capacity: < 1 MW; 1 MW-2MW; >2MW

3) by Tier Standard: Tier I and II; Tier III; Tier IV

Subsegments:

1) by Diesel: Standard Diesel Generators; Tier 4 Diesel Generators2) by Gas: Natural Gas Generators; Biogas Generators

3) by Other Products: Propane Generators; Hybrid Generators; Renewable Energy Generators

Key Companies Mentioned: Alphabet Inc.; Amazon.com Inc.; Equinix Inc.; Microsoft Corp.; Oracle Corp.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Data Center Generator market report include:- Alphabet Inc.

- Amazon.com Inc.

- Equinix Inc.

- Microsoft Corp.

- Oracle Corp.

- SAP SE

- International Business Machines Corp.

- Cisco Systems Inc.

- Huawei Investment & Holding Co. Ltd.

- Google LLC

- Meta Platforms Inc.

- Digital Realty

- CyrusOne

- GDS Holdings Limited

- KDDI’s Telehouse

- Hewlett Packard Enterprise Company LP

- Dell Technologies Inc.

- Fujitsu Limited

- Schneider Electric SE

- Eaton Corporation

- Vertiv Co.

- Delta Electronics Inc.

- Rittal GmbH & Co. KG

- ABB Ltd.

- Siemens AG

- Hitachi Ltd.

- NEC Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 6.74 Billion |

| Forecasted Market Value ( USD | $ 8.99 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |