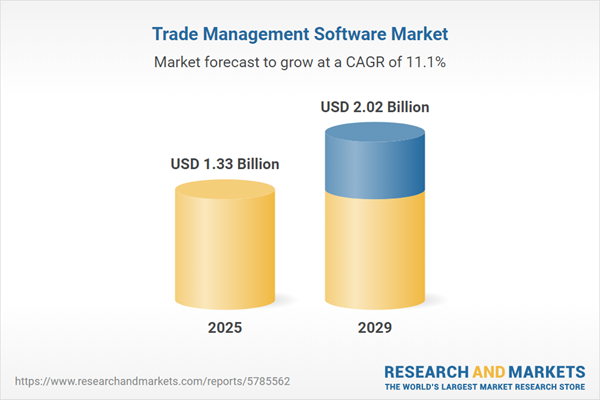

The trade management software market size is expected to see rapid growth in the next few years. It will grow to $2.02 billion in 2029 at a compound annual growth rate (CAGR) of 11.1%. The growth in the forecast period can be attributed to focus on sustainability in supply chains, dynamic trade regulations, digital transformation in trade, enhanced data analytics capabilities, geopolitical influences on trade, customer demand for transparency, customization and scalability. Major trends in the forecast period include cloud-based trade management solutions, real-time visibility and tracking, blockchain for supply chain transparency, mobile accessibility, automated customs documentation, trade finance integration, cybersecurity measures.

The increase in international trade activities is propelling the growth of the trade management software market. International trade involves the buying and selling of goods and services by companies across different countries. In the global marketplace, products such as consumer goods, raw materials, food, and machinery are traded. The rise in international trade is driven by changing consumer preferences and higher disposable incomes. Trade management software is utilized by importers and exporters to enhance collaboration with their trade partners and manage their global trade operations. This software supports multi-company, multi-location, and multi-currency functionalities. For instance, in August 2022, the OECD (The Organization for Economic Co-operation and Development), an intergovernmental organization, reported that the G20 countries (which include Argentina, Australia, Brazil, Canada, China, the EU, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, the UK, and the USA) experienced a 2.1% increase in merchandise exports and a 2.6% increase in imports in the second quarter of 2022, compared to increases of 4.8% and 6.2% in the previous quarter. Thus, the rising international trade activities are driving the trade management software market.

The expanding e-commerce industry is expected to further fuel the growth of trade management software in the future. E-commerce businesses encounter challenges related to regulatory compliance, customs documentation, supply chain visibility, and order fulfillment. Trade management software addresses these challenges by automating processes, ensuring compliance with international regulations, optimizing supply chains, and integrating with e-commerce platforms. Additionally, the software facilitates efficient returns management and scalability to support the rapid growth of e-commerce businesses. For example, in August 2024, a report from the Census Bureau of the Department of Commerce, a US government agency, indicated that U.S. retail e-commerce sales for the second quarter of 2024 reached approximately $291.6 billion, reflecting a 1.3% increase from the first quarter of 2024. Total retail sales during the same period were estimated at $1.82 trillion, a 0.5% increase from the previous quarter. Compared to the second quarter of 2023, e-commerce sales rose by 6.7%, while total retail sales grew by 2.1%. E-commerce represented 16% of total retail sales in the second quarter of 2024. Therefore, the expanding e-commerce industry is driving the growth of the trade management software market.

The adoption of cloud-based technologies emerges as a prominent trend in the trade management software market. Major companies in this market are increasingly leveraging cloud technology, enabling users to access storage, files, software, and servers through internet-connected devices. Notably, in September 2022, Newgen Software, an India-based digital transformation product provider, launched the world's first low-code Trade Finance platform. This cloud-native platform streamlines the complex trade finance process, allowing banks to go paperless, enhance compliance with domestic and international regulations, and achieve unified processing of trade transactions. The utilization of cloud-based technologies represents a key trend shaping the evolution of the trade management software market.

Major players in the trade management software market are creating AI-based trade solutions to secure a competitive advantage. For example, in September 2023, Flexport Inc., a US-based supply chain management firm, launched an all-in-one global trade solution. This platform provides instant access to financing, freight, fulfillment, and replenishment, streamlining the process from factory to customer. With a focus on empowering entrepreneurs, Flexport's AI-driven end-to-end solution enables seamless selling across major marketplaces and retail stores. The platform features innovative capabilities such as replenishment injection into key channels, priority shipping, and an exclusive membership program, Flexport+, which offers industry-leading financing and support services. Entrepreneurs can now concentrate on boosting sales while the AI-driven solution manages the complexities of global logistics, promising to revolutionize the supply chain management landscape.

In March 2022, e2open Parent Holdings Inc., a US-based software company that offers cloud-based, mission-critical supply chain management solutions, acquired Logistyx Technologies for $185 million. This acquisition was intended to enhance e2open's global presence in multi-carrier e-commerce shipment management, allowing companies to benefit from a wide range of shipping capabilities. Logistyx Technologies is a US-based company specializing in parcel and e-commerce shipping, as well as providing parcel shipping software.

Major companies operating in the trade management software market are Oracle Corporation, SAP SE, Thomson Reuters Corporation, QAD Inc., MIC Customs Solutions AG, E2open Parent Holdings Inc., Bamboo Rose LLC, QuestaWeb Inc., Precision Software Corporation, BPE Global Inc., The Descartes Systems Group Inc., WiseTech Global Limited, MercuryGate International Inc., TradeLanes Inc., TradeRocket Inc., TradeSocio Inc., TradeX LLC, TradeCloud Inc., TradeWaltz Inc., TradeWindow Inc., TradeTrust Inc., TradeFlow Inc.

North America was the largest region in the trade management software market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the trade management software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the trade management software market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Trade management software encompasses a suite of tools designed to oversee trade operations on a global scale. It facilitates the validation, approval, and processing of online transactions, handling trade-related electronic documents, and ensuring adherence to international trade laws and regulations. This software is equipped with functionalities such as trade compliance, custom management, finance oversight, trade analytics, and other features.

Trade compliance, a critical aspect, ensures that all import and export activities align with the specific laws and regulations of involved countries. The software is adept at maintaining compliance with these global trade guidelines. It's structured with solutions and services available through cloud-based and on-premises deployment options. Various sectors like defense, pharmaceuticals, energy, transportation, logistics, and consumer goods make use of trade management software to streamline their trade-related processes.

The trade management software market research report is one of a series of new reports that provides trade management software market statistics, including trade management software industry global market size, regional shares, competitors with a trade management software market share, detailed trade management software market segments, market trends and opportunities, and any further data you may need to thrive in the trade management software industry. This trade management software market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The trade management software market includes revenues earned by entities through invoice management, insurance management, vendor management, and import/export management. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Trade Management Software Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on trade management software market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for trade management software ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The trade management software market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Component: Solutions; Services2) by Function: Trade Compliance; Custom Management; Finance Management; Trade Analytics; Other Functions

3) by Deployment: Cloud; on-Premise

4) by End-User: Defense; Pharmaceuticals; Energy; Transportation and Logistics; Consumer Goods

Subsegments:

1) by Solutions: Trade Compliance Solutions; Trade Finance Solutions; Supply Chain Management Solutions; Risk Management Solutions; Analytics and Reporting Solutions2) by Services: Implementation Services; Training and Support; Maintenance and Upgrades; Consulting Services

Key Companies Mentioned: Oracle Corporation; SAP SE; Thomson Reuters Corporation; QAD Inc.; MIC Customs Solutions AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Trade Management Software market report include:- Oracle Corporation

- SAP SE

- Thomson Reuters Corporation

- QAD Inc.

- MIC Customs Solutions AG

- E2open Parent Holdings Inc.

- Bamboo Rose LLC

- QuestaWeb Inc.

- Precision Software Corporation

- BPE Global Inc.

- The Descartes Systems Group Inc.

- WiseTech Global Limited

- MercuryGate International Inc.

- TradeLanes Inc.

- TradeRocket Inc.

- TradeSocio Inc.

- TradeX LLC

- TradeCloud Inc.

- TradeWaltz Inc.

- TradeWindow Inc.

- TradeTrust Inc.

- TradeFlow Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.33 Billion |

| Forecasted Market Value ( USD | $ 2.02 Billion |

| Compound Annual Growth Rate | 11.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |