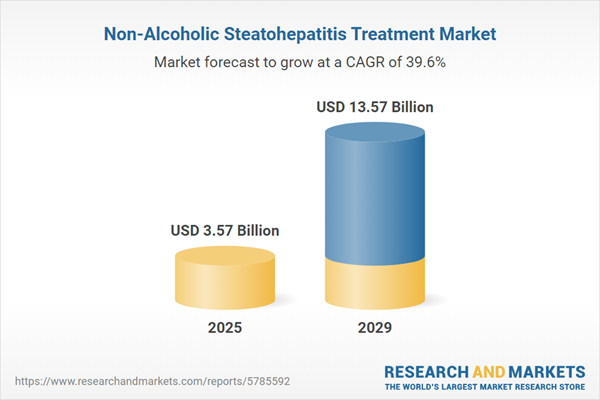

The non-alcoholic steatohepatitis treatment market size is expected to see exponential growth in the next few years. It will grow to $13.57 billion in 2029 at a compound annual growth rate (CAGR) of 39.6%. The growth in the forecast period can be attributed to advancements in drug development, increased disease awareness, rising prevalence and risk factor, shift towards personalized medicine. Major trends in the forecast period include patient-centric approach, technological advancements, targeted therapies, regulatory landscape, advancements in research.

The forecast of 39.6% growth over the next five years reflects a modest reduction of 0.4% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Trade tensions could hinder U.S. liver research by inflating prices of peroxisome proliferator-activated receptor agonists and c-c chemokine receptor type 2 and 5 antagonists developed in Germany and France, resulting in slower non-alcoholic steatohepatitis drug development and higher clinical trial costs. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The rising prevalence of insulin resistance has significantly contributed to the growth of the non-alcoholic steatohepatitis (NASH) treatment market. Insulin resistance occurs when muscle, fat, and liver cells fail to respond adequately to insulin, making it difficult for them to absorb glucose from the bloodstream, which leads to elevated blood sugar levels. This condition is often linked to an unhealthy lifestyle, excessive sugar intake, and genetic factors. The focus on insulin resistance has intensified due to the increasing rates of diabetes and other liver-related conditions that require NASH treatment. For instance, in January 2022, a report from the International Diabetes Federation, a Belgium-based global diabetes organization, indicated that diabetes currently affects 537 million people aged 20 to 79, representing one in every ten individuals. This number is projected to rise to 643 million by 2030 and 783 million by 2045. Additionally, in January 2024, the American Cancer Society, a U.S.-based nonprofit organization focused on cancer advocacy, forecasted that the number of new liver cancer cases would increase to 41,630 in 2024, up from 41,210 in 2023. Consequently, the growing prevalence of insulin resistance due to various liver and diabetes-related diseases will drive demand for NASH treatment.

The escalating obesity rates significantly contribute to the burgeoning growth of the non-alcoholic steatohepatitis treatment market. Obesity, characterized by excessive body fat accumulation, is associated with various health complications, including the rising incidence of NASH. The World Health Organization reported over 1 billion individuals affected by obesity globally in March 2022. This figure is expected to rise, impacting 167 million people by 2025. This surge in obesity cases directly correlates with an increased prevalence of NASH. This connection drives the demand for non-alcoholic steatohepatitis treatments worldwide.

A prominent trend in the non-alcoholic steatohepatitis treatment market is the development of innovative drugs tailored to mitigate drug side effects. Pfizer Inc., in May 2022, secured FDA fast-track designation for their investigational combination therapy targeting NASH with liver fibrosis. Ervogastat (a DGAT2 inhibitor) and Clesacostat (an ACCi) have shown promise as potential NASH drugs. This FDA-backed initiative by Pfizer underscores the industry's inclination towards developing drugs addressing NASH and its associated complications.

In the realm of non-alcoholic steatohepatitis treatment, leading companies are pioneering innovative solutions like endogenous hormones to expand their market reach, drive sales, and bolster revenue. A noteworthy example is 89bio Inc's milestone achievement in September 2023, securing the U.S. FDA's Breakthrough Therapy Designation (BTD) for Pegozafermin, targeting individuals grappling with nonalcoholic steatohepatitis (NASH). Pegozafermin, an engineered glycoPEGylated analog of fibroblast growth factor 21, represents a unique approach in NASH and severe hypertriglyceridemia (SHTG) treatment. Its distinctive formulation integrates specialized glycoPEGylation technology, enabling an extended half-life without compromising potency. This innovative design significantly enhances the product's efficacy in modulating critical factors associated with lipid metabolism, NASH, and hypertriglyceridemia, exhibiting promise in reducing triglycerides, managing glycemic levels, mitigating steatosis, inflammation, and fibrosis.

In July 2022, Advanz Pharma, a pharmaceutical company headquartered in the UK, completed the acquisition of Intercept Pharmaceuticals for an undisclosed sum. This acquisition encompasses the rights outside the United States for the commercialization of Ocaliva® (obeticholic acid), an orphan drug utilized in treating primary biliary cholangitis (PBC). Intercept Pharmaceuticals, Inc., based in the United States, specializes in the development of innovative synthetic bile acid analogs targeting chronic liver diseases and non-alcoholic steatohepatitis.

Major companies operating in the non-alcoholic steatohepatitis treatment market are AstraZeneca PLC, Galmed Pharmaceuticals Ltd., Genfit S.A., Zydus Cadila Healthcare Limited, Bristol-Myers Squibb Company, Gilead Sciences Inc., Novo Nordisk A/S, Immuron Ltd., Inventiva Pharma SA, NGM Biopharmaceuticals Inc., Galectin Therapeutics Inc., Madrigal Pharmaceuticals Corporation, Intercept Pharmaceuticals Inc., Cirius Therapeutics Inc., Viking Therapeutics Inc., Eli Lilly and Company, Terns Pharmaceuticals Inc., Pfizer Inc., Merck & Co. Inc., AbbVie Inc., Johnson & Johnson Private Limited, Sanofi S.A., F. Hoffmann-La Roche Ltd., C.H. Boehringer Sohn AG & Co. KG.

North America was the largest region in the non-alcoholic steatohepatitis treatment market share in 2024. The regions covered in the non-alcoholic steatohepatitis treatment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the non-alcoholic steatohepatitis treatment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The non-alcoholic steatohepatitis treatment market research report is one of a series of new reports that provides non-alcoholic steatohepatitis treatment market statistics, including non-alcoholic steatohepatitis treatment industry global market size, regional shares, competitors with a non-alcoholic steatohepatitis treatment market share, detailed non-alcoholic steatohepatitis treatment market segments, market trends and opportunities, and any further data you may need to thrive in the non-alcoholic steatohepatitis treatment industry. This non-alcoholic steatohepatitis treatment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Non-alcoholic steatohepatitis treatment involves lifestyle modifications such as adhering to a healthy diet, regulating blood sugar levels, and achieving weight loss to address liver disease. This form of treatment targets individuals who consume minimal or no alcohol but develop fatty liver conditions. Such conditions trigger liver cell damage and inflammation, which may progress to cirrhosis.

The primary drugs used in non-alcoholic steatohepatitis treatment include vitamin E, pioglitazone, ocaliva, elafibranor, selonsertib, cenicriviroc, obeticholic acid, among others. Vitamin E and pioglitazone play pivotal roles in treating this condition. Vitamin E, a crucial fat-soluble nutrient vital for immune health, works to ameliorate NASH by reducing oxidative stress on hepatocytes, thereby mitigating liver injury and inflammation. Conversely, pioglitazone aids in enhancing insulin sensitivity and managing elevated blood sugar levels associated with type 2 diabetes. Diagnosis and assessment of treatment typically involve blood tests, liver biopsy, and imaging procedures conducted in hospital pharmacies, retail outlets, specialty pharmacies, and other medical facilities.

The non-alcoholic steatohepatitis treatment market includes revenues earned by entities by providing services such as liver related ?medical diagnosis and tests, fatty liver management and treatment, abdominal ultrasound. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Non-Alcoholic Steatohepatitis Treatment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on non-alcoholic steatohepatitis treatment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for non-alcoholic steatohepatitis treatment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The non-alcoholic steatohepatitis treatment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Drug Type: Vitamin E and Pioglitazone; Ocaliva; Elafibranor; Selonsertib and cenicriviroc; Obeticholic Acid; Other Drugs Types2) By Test Type: Blood Tests; Liver Biopsy; Imaging Procedures

3) By End User: Hospital Pharmacies; Retail and Specialty Pharmacies; Other End Users

Subsegments:

1) By Vitamin E and Pioglitazone: Vitamin E Supplements; Pioglitazone-Based Formulations.2) By Ocaliva: Ocaliva (Obeticholic Acid) For NASH

3) By Elafibranor: Elafibranor-Based Treatments

4) By Selonsertib and Cenicriviroc: Selonsertib Formulations; Cenicriviroc Formulations

5) By Obeticholic Acid: Other Formulations of Obeticholic Acid

6) By Other Drug Types: Novel Agents in Clinical Trials; Combination Therapies

Companies Mentioned: AstraZeneca PLC; Galmed Pharmaceuticals Ltd.; Genfit S.A.; Zydus Cadila Healthcare Limited; Bristol-Myers Squibb Company; Gilead Sciences Inc.; Novo Nordisk a/S; Immuron Ltd.; Inventiva Pharma SA; NGM Biopharmaceuticals Inc.; Galectin Therapeutics Inc.; Madrigal Pharmaceuticals Corporation; Intercept Pharmaceuticals Inc.; Cirius Therapeutics Inc.; Viking Therapeutics Inc.; Eli Lilly and Company; Terns Pharmaceuticals Inc.; Pfizer Inc.; Merck & Co. Inc.; AbbVie Inc.; Johnson & Johnson Private Limited; Sanofi S.A.; F. Hoffmann-La Roche Ltd.; C.H. Boehringer Sohn AG & Co. KG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Non-Alcoholic Steatohepatitis Treatment market report include:- AstraZeneca PLC

- Galmed Pharmaceuticals Ltd.

- Genfit S.A.

- Zydus Cadila Healthcare Limited

- Bristol-Myers Squibb Company

- Gilead Sciences Inc.

- Novo Nordisk A/S

- Immuron Ltd.

- Inventiva Pharma SA

- NGM Biopharmaceuticals Inc.

- Galectin Therapeutics Inc.

- Madrigal Pharmaceuticals Corporation

- Intercept Pharmaceuticals Inc.

- Cirius Therapeutics Inc.

- Viking Therapeutics Inc.

- Eli Lilly and Company

- Terns Pharmaceuticals Inc.

- Pfizer Inc.

- Merck & Co. Inc.

- AbbVie Inc.

- Johnson & Johnson Private Limited

- Sanofi S.A.

- F. Hoffmann-La Roche Ltd.

- C.H. Boehringer Sohn AG & Co. KG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.57 Billion |

| Forecasted Market Value ( USD | $ 13.57 Billion |

| Compound Annual Growth Rate | 39.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |