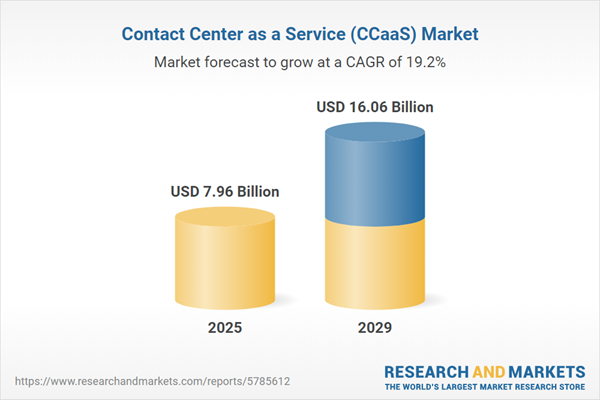

The contact center as a service (CCaaS) market size is expected to see rapid growth in the next few years. It will grow to $16.06 billion in 2029 at a compound annual growth rate (CAGR) of 19.2%. The growth in the forecast period can be attributed to subscription-based models, evolving customer expectations, customization and personalization, rise in remote work, integration with corm systems. Major trends in the forecast period include AI-powered customer engagement, cloud adoption, omnichannel experience, analytics and insights, remote workforce enablement.

The growing number of internet users worldwide is anticipated to drive the expansion of the contact center as a service (CCaaS) market in the future. Internet users are individuals who engage actively in online communities or utilize the Internet. The Internet serves as a vast network of interconnected computer systems that provide access to information resources across various private, public, commercial, academic, and governmental networks. CCaaS enables companies and consumers to share and obtain information online seamlessly. For example, in September 2023, the International Telecommunication Union, a Switzerland-based United Nations agency focusing on information and communication technologies, reported that 67% of the global population, or 5.4 billion people, were using the Internet, up from 5.3 billion people (66% of the world’s population) in 2022. Thus, the rising number of internet users globally will contribute to the growth of the contact center as a service (CCaaS) market.

The escalating utilization of cloud computing services is poised to be a significant driver propelling the growth of the contact center as a service (CCaaS) market. Cloud computing services involve provisioning computing resources such as storage, processing power, and applications over the internet. In the realm of Contact Center as a Service (CCaaS), cloud computing plays a pivotal role by eliminating the necessity for costly on-premises infrastructure, offering scalability to manage fluctuations in call volumes during peak periods or unforeseen changes. For instance, data from the European Commission in December 2023 revealed that 45.2% of EU enterprises invested in cloud computing services. Notably, email services emerged as the most popular (82.7%), closely followed by file storage (68%) and office software. This burgeoning adoption of cloud computing services across various sectors underpins the driving force behind the growth trajectory of the contact center as a service (CCaaS) market.

Major players in the contact center as a service (CCaaS) market are concentrating on developing innovative solutions, including cloud-based standalone platforms, to improve customer interactions and operational efficiency. These cloud-based standalone platforms are integrated, cloud-hosted solutions that allow businesses to manage customer interactions across various channels without the need for additional software or infrastructure. For example, in June 2024, Microsoft Corporation, a US-based technology company, introduced a standalone CCaaS solution that enables businesses to handle customer interactions across multiple channels, including voice, email, chat, and social media, without requiring extra software or infrastructure. This solution provides flexibility and scalability, allowing businesses to swiftly deploy and adapt their contact center operations based on demand. It features omnichannel support, real-time analytics, and AI-powered tools, such as chatbots, to enhance customer service and operational efficiency. Furthermore, the standalone CCaaS can integrate with third-party systems like CRM, making it a comprehensive solution for managing customer communications.

Major players within the contact center as a service (CCaaS) market are spearheading innovative product developments, notably the introduction of cloud contact centers. These solutions involve outsourcing the management of essential software, hardware, and infrastructure to a third-party vendor, hosted in the cloud. For instance, in February 2022, Zoom Video Communications, Inc. unveiled the Zoom Contact Centre, marking the inaugural omnichannel cloud contact center platform. This platform revolutionizes customer service experiences by integrating various communication channels such as video, SMS, voice, and web chat. Since its inception, the Zoom Contact Centre has rapidly evolved into a comprehensive customer experience suite, incorporating over 600 new features within 18 months. Notably, it introduced the Workforce Engagement Management solution, catering to agent coaching and forecasting, thereby enhancing operational efficiency and customer satisfaction within contact centers. This demonstrates a significant leap in advancing customer service capabilities through cloud-based contact center solutions in the CCaaS market.

In May 2024, Avaya, a technology company based in the US, acquired Edify for an undisclosed amount. This acquisition aimed to strengthen Avaya's leadership in the customer experience (CX) solutions market, particularly by enhancing its cloud and AI capabilities. Edify is a US-based provider of cloud-native contact center platforms, specializing in unified communications (UC), contact center as a service (CCaaS), and communications platform as a service (CPaaS) solutions.

Major companies operating in the contact center as a service (CCaaS) market include Amazon.com Inc., Microsoft Corporation, AT&T Inc., Accenture LLP, IBM Corporation, Cisco Systems Inc, Content Guru Limited, Capgemini, CenturyLink Inc., NICE Systems Ltd, Genesys, Alcatel Lucent Enterprise, Vonage Holdings Corp., Mitel Networks Corporation, Unify Inc, 8x8 Inc, NICE inContact, Zendesk Inc., Oracle Corporation, Talkdesk Inc, Anywhere365 Enterprise Dialogue Management, Liveops Inc., Evolve IP LLC, Enghouse Interactive Inc, 3CLogic, Computer Talk Technology Inc, Luware AG, Serenova, Intrado Corporation, Elevio, Vocalcom, Sharpen.

North America was the largest region in the contact center as a service (CCaaS) market in 2024. The regions covered in the contact center as a service (ccaas) market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the contact center as a service (ccaas) market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Contact Center as a Service (CCaaS) empowers customer service organizations to manage multichannel interactions through cloud-based contact center infrastructure.

Contact Center as a Service (CCaaS) offers various functions integral to its operation, including automatic call distribution, call recording, computer telephony integration, customer collaboration, dialer, interactive voice response, reporting and analytics, and workforce optimization, among others. Automatic call distribution efficiently routes incoming calls to available staff members, aiding contact centers in managing high call volumes without overwhelming the staff. CCaaS is applicable across different enterprise sizes, catering to both large enterprises and small to medium-sized enterprises (SMEs). Its user industries span BFSI (Banking, Financial Services, and Insurance), IT and telecommunications, government, healthcare, consumer goods and retail, travel and hospitality, media and entertainment, and several other industries.

The contact center as a service (CCaaS) market research report is one of a series of new reports that provides contact center as a service (CCaaS) market statistics, including contact center as a service (CCaaS) industry global market size, regional shares, competitors with a contact center as a service (CCaaS) market share, detailed contact center as a service (CCaaS) market segments, market trends and opportunities, and any further data you may need to thrive in the contact center as a service (CCaaS) industry. This contact center as a service (CCaaS) market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The contact center as a service market includes revenues earned by entities by offering digital platforms which enable customer service agents to communicate with buyers for more personalized customer experiences. Establishments that provide cloud-based contact center solutions are included in this market. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Contact Center As a Service (CCaaS) Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on contact center as a service (ccaas) market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for contact center as a service (ccaas)? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The contact center as a service (ccaas) market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Function: Automatic Call Distribution; Call Recording; Computer Telephony Integration; Customer Collaboration; Dialer; Interactive Voice Response; Reporting and Analytics; Workforce Optimization; Other Functions2) By Enterprise Size: Large Enterprises; Small and Medium Enterprises (SMEs)

3) By Industry: BFSI; IT and Telecommunications; Government; Healthcare; Consumer Goods and Retail; Travel and Hospitality; Media and Entertainment; Other Industries

Subsegments:

1) By Automatic Call Distribution (ACD): Skill-Based Routing; Time-Based Routing; IVR-Based Routing2) By Call Recording: Cloud-Based Call Recording; on-Premises Call Recording; Voice and Screen Recording

3) By Computer Telephony Integration (CTI): Integrated Voice Response (IVR); Call Center Software Integration; CRM Integration

4) By Customer Collaboration: Omnichannel Support (Voice, Email, Chat, Social Media); Co-Browsing; Video Collaboration; Chatbots and Virtual Assistants

5) By Dialer: Predictive Dialer; Preview Dialer; Power Dialer; Progressive Dialer

6) By Interactive Voice Response (IVR): Cloud-based IVR; Speech Recognition IVR; DTMF-based IVR; Visual IVR

7) By Reporting and Analytics: Real-Time Analytics; Historical Analytics; Performance Metrics (Kpis); Sentiment Analysis

8) By Workforce Optimization: Workforce Management; Workforce Scheduling; Quality Monitoring; Training and Coaching Tools

9) By Other Functions: Multi-channel Routing; Voice Biometrics; Speech Analytics

Key Companies Mentioned: Amazon.com Inc.; Microsoft Corporation; AT&T Inc.; Accenture LLP; IBM Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Amazon.com Inc.

- Microsoft Corporation

- AT&T Inc.

- Accenture LLP

- IBM Corporation

- Cisco Systems Inc

- Content Guru Limited

- Capgemini

- CenturyLink Inc.

- NICE Systems Ltd

- Genesys

- Alcatel Lucent Enterprise

- Vonage Holdings Corp.

- Mitel Networks Corporation

- Unify Inc

- 8x8 Inc

- NICE inContact

- Zendesk Inc.

- Oracle Corporation

- Talkdesk Inc

- Anywhere365 Enterprise Dialogue Management

- Liveops Inc.

- Evolve IP LLC

- Enghouse Interactive Inc

- 3CLogic

- Computer Talk Technology Inc

- Luware AG

- Serenova

- Intrado Corporation

- Elevio

- Vocalcom

- Sharpen

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.96 Billion |

| Forecasted Market Value ( USD | $ 16.06 Billion |

| Compound Annual Growth Rate | 19.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |