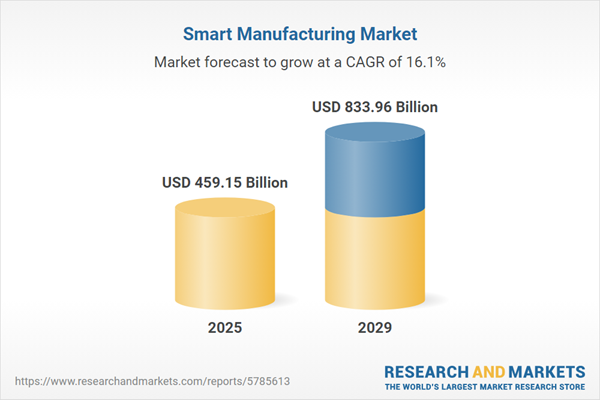

The smart manufacturing market size is expected to see rapid growth in the next few years. It will grow to $833.96 billion in 2029 at a compound annual growth rate (CAGR) of 16.1%. The growth in the forecast period can be attributed to focus on resilient and adaptive manufacturing, shift to servitization models, demand for rapid prototyping and additive manufacturing, focus on continuous improvement, enhanced security measures, prominence of circular economy practices. Major trends in the forecast period include industry 4 integration, digital twin adoption, advanced robotics and automation, IoT and sensor proliferation, edge computing for real-time processing, 5G connectivity for low-latency communication, artificial intelligence (ai) in manufacturing, human-machine collaboration.

The growing number of investments in Industry 4 is projected to propel the smart manufacturing market in the future. The fourth industrial revolution leverages data to connect the digital and physical realms, paving the way for new advancements in the manufacturing sector by enhancing data collection and analysis at the edge and uncovering deeper analytical insights. Industry 4 is reshaping how businesses produce, improve, and distribute their products. Manufacturers are integrating cutting-edge technologies such as the Internet of Things (IoT), cloud computing, analytics, AI, and machine learning into their manufacturing processes. For instance, the 2022 Conexus Tech Adoption Report, published by Conexus Indiana - a U.S.-based non-profit organization focused on advanced manufacturing and logistics - indicated that the implementation and pilot projects of Industry 4 technologies have increased by 35% year-over-year, with one in three companies considering Industry 4 a positive investment for growth. Therefore, the rising investments in Industry 4 are expected to drive the smart manufacturing market.

The increasing adoption of robotics across industries is expected to drive the growth of the smart manufacturing market in the future. Robotics encompasses the interdisciplinary field of science and engineering focused on the design, construction, operation, and utilization of robots. Smart manufacturing integrates intelligent technologies to optimize production processes, enhance efficiency, and facilitate adaptive and automated robotic systems. For example, in September 2023, the International Federation of Robotics (IFR), a Germany-based organization specializing in advancing robotics technologies, reported in its latest world robotics report that factories worldwide installed 553,052 new industrial robots in 2022, representing a 5% increase compared to the previous year. The report also highlighted that Asia accounted for 73% of these installations, while Europe and the Americas represented 15% and 10%, respectively. Thus, the rising adoption of robotics by industries is propelling the growth of the smart manufacturing market.

Major companies in the smart manufacturing market are increasingly focused on developing innovations, such as the Industrial Internet of Things (IIoT), to enable real-time data collection and analysis. The IIoT involves the integration of internet-connected devices and systems within industrial settings to improve operational efficiency, productivity, and decision-making. For example, in July 2022, the Indian Institute of Technology-Madras, a university based in India, launched the Smart Manufacturing & Digital Transformation Centre (SMDTC) to boost India’s manufacturing capabilities and promote self-reliance. This new center aims to democratize smart manufacturing and digital transformation for Indian MSMEs (Micro, Small, and Medium Enterprises). It will develop essential systems and software platforms that support Industry 4 practices, fostering self-reliance in manufacturing. The center emphasizes education, maturity assessments, collaborative research, and enabling technologies such as 5G. Its primary goals include enhancing stakeholder knowledge and encouraging collaboration between industry and academia to improve manufacturing processes.

Major companies in the smart manufacturing market are prioritizing the development of innovations, such as supply chain integration, to ensure seamless communication and coordination among suppliers, manufacturers, and distributors. Supply chain integration involves coordinating and streamlining various functions and processes within a supply chain to enhance efficiency, reduce costs, and improve overall performance. For example, in June 2022, Telkomsel, an Indonesia-based telecommunications company, launched IoT Smart Manufacturing, a comprehensive solution for managing the entire supply chain - from production to quality control and maintenance. This leading digital telecom company offers an innovative Internet of Things (IoT) solution designed to transform the manufacturing sector through end-to-end supply chain management integration. The service enhances production control and monitoring with real-time oversight, improves overall equipment efficiency, and employs computer vision technology for quality assurance. Additionally, it includes energy management solutions to optimize consumption, promoting sustainability and productivity across operations. This initiative aims to accelerate the adoption of Industry 4 in the region.

In January 2024, INFICON, a software development company based in Switzerland, acquired the assets of FabTime for an undisclosed amount. This acquisition is intended to enhance INFICON's capabilities within the semiconductor and electronics manufacturing sectors. By integrating FabTime's advanced software solutions, INFICON aims to improve its portfolio of process control and monitoring tools, allowing clients to optimize their manufacturing processes and boost efficiency. FabTime Inc. is a U.S.-based company specializing in innovative manufacturing solutions.

Major companies operating in the smart manufacturing market are Siemens AG, General Electric Company, Rockwell Automation, Schneider Electric SE, Honeywell International Inc., Emerson Electric, ABB India Limited, Amazon Web Services Inc., Robert Bosch Manufacturing Solutions GmbH, Cisco Systems Inc., 3D Systems Corporation, Plex Systems Inc., Cognex Corporation, PTC Inc., Mitsubishi Electric Corporation, HP Development Company L.P., SAP SE, Hitachi Ltd., IBM Corporation, Oracle Corporation, Microsoft Corporation, Intel Corporation, Accenture PLC, Fujitsu Limited, Fanuc Corporation, Kuka AG, Omron Corporation, Panasonic Corporation, Toshiba Corporation, Yokogawa Electric Corporation.

North America was the largest region in the smart manufacturing market share in 2024. The regions covered in the smart manufacturing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the smart manufacturing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Smart manufacturing is a process leveraging computer controls, modeling, big data, and automation to enhance manufacturing efficiencies. This methodology optimizes operations by analyzing machine and sensor data to improve productivity and prevent operational downtime.

The primary components of smart manufacturing comprise hardware, software, and services. Smart manufacturing hardware includes devices facilitating real-time reactions, predictive analysis, and preventive measures, fostering enhanced decision-making by providing comprehensive data visibility. Various smart manufacturing technologies encompass machine execution systems (MES), programmable logic controllers (PLC), enterprise resource planning (ERP), SCADA, discrete control systems (DCS), machine vision, 3D printing, and plant lifecycle management. These technologies cater to industries such as automotive, aerospace and defense, chemicals and materials, healthcare, industrial equipment, electronics, food and agriculture, oil and gas, and other sectors.

The smart manufacturing market research report is one of a series of new reports that provides smart manufacturing market statistics, including smart manufacturing industry global market size, regional shares, competitors with a smart manufacturing market share, detailed smart manufacturing market segments, market trends and opportunities, and any further data you may need to thrive in the smart manufacturing industry. This smart manufacturing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The smart manufacturing market consists of revenues earned by entities by providing smart manufacturing products and services that enable firms to swiftly and effectively adapt to changes on the production floor and throughout their value chain. The market value includes the value of related goods sold by the service provider or included within the service offering. The smart manufacturing market also includes the sales of internet-connected machinery. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Smart Manufacturing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on smart manufacturing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for smart manufacturing ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The smart manufacturing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Component: Hardware; Software; Services2) by Technology: Machine Execution Systems (MES); Programmable Logic Controller (PLC); Enterprise Resource Planning (ERP); SCADA; Discrete Control Systems (DCS); Machine Vision; 3D Printing; Other Technologies

3) by End-User: Automotive; Aerospace and Defense; Chemicals and Materials; Healthcare; Industrial Equipment; Electronics; Food and Agriculture; Oil and Gas; Other End-Users

Subsegments:

1) by Hardware: Sensors; Robotics; Industrial Control Systems; Machine Vision Systems; Connectivity Devices; Actuators2) by Software: Manufacturing Execution Systems (MES); Enterprise Resource Planning (ERP); Supply Chain Management Software; Product Lifecycle Management (PLM); Quality Management Software; Data Analytics Software

3) by Services: Consulting Services; System Integration Services; Maintenance and Support Services; Training Services; Managed Services

Key Companies Mentioned: Siemens AG; General Electric Company; Rockwell Automation; Schneider Electric SE; Honeywell International Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Smart Manufacturing market report include:- Siemens AG

- General Electric Company

- Rockwell Automation

- Schneider Electric SE

- Honeywell International Inc.

- Emerson Electric

- ABB India Limited

- Amazon Web Services Inc.

- Robert Bosch Manufacturing Solutions GmbH

- Cisco Systems Inc.

- 3D Systems Corporation

- Plex Systems Inc.

- Cognex Corporation

- PTC Inc.

- Mitsubishi Electric Corporation

- HP Development Company L.P.

- SAP SE

- Hitachi Ltd.

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- Intel Corporation

- Accenture PLC

- Fujitsu Limited

- Fanuc Corporation

- Kuka AG

- Omron Corporation

- Panasonic Corporation

- Toshiba Corporation

- Yokogawa Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 459.15 Billion |

| Forecasted Market Value ( USD | $ 833.96 Billion |

| Compound Annual Growth Rate | 16.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |