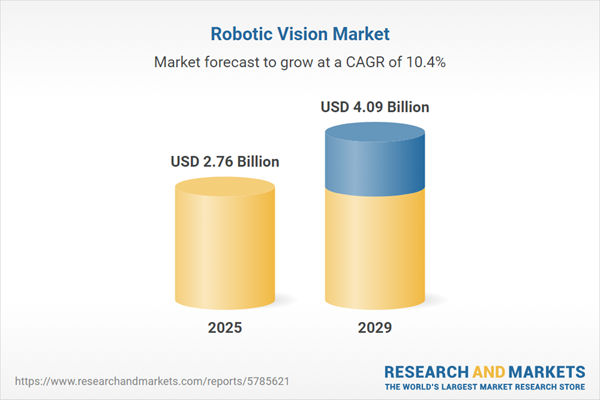

The robotic vision market size is expected to see rapid growth in the next few years. It will grow to $4.09 billion in 2029 at a compound annual growth rate (CAGR) of 10.4%. The growth in the forecast period can be attributed to expansion of autonomous vehicles, deployment in smart cities, application in hazardous environments, customization for small and medium-sized enterprises, increased adoption in logistics and supply chain. Major trends in the forecast period include integration with ai and machine learning, advancements in 3d vision technology, collaborative robots (cobots), edge computing for real-time processing, robotics as a service (RaaS) models, enhanced object recognition and tracking, IoT integration for connectivity, cybersecurity for robotic systems.

The increasing demand for smart cameras in robotic vision is a key driver for the growth of the robotic vision market. Smart cameras, which go beyond traditional recording and picture-taking functions, serve as modular standalone solutions for robotic vision in common factory applications. These devices are user-friendly and easily integrable, contributing to the market's expansion. As of July 2023, DataProt reported a global surge in the popularity of smart home camera systems, with approximately 98.8 million households utilizing them. This number is anticipated to double by 2027, reaching about 180.7 million households, underscoring the escalating demand for smart cameras in the field of robotic vision.

The rapid advancement of Industry 4 is expected to drive substantial growth in the robotic vision market. Industry 4.0, synonymous with the fourth industrial revolution, involves the transformation of traditional manufacturing practices through the integration of modern smart technology. Robotic vision plays a crucial role in enhancing automation by enabling robots to navigate and interact with their surroundings, execute precise tasks, and contribute to a more adaptable and responsive production environment. A notable indication of Industry 4.0's momentum was observed in October 2022 when IoT Business News reported a 140-fold increase in public search interest, the publication of 50,000 research papers in 2021, $3 billion in annual funding for start-ups from Q3 2021 to Q3 2022, and a doubling of M&A activity.

Major companies in the robotic vision market are concentrating on introducing advanced industrial robot vision systems designed to enhance automation in manufacturing. An advanced industrial robot vision system refers to sophisticated technology integrated into industrial robots that enables them to "see" and interpret their environment. This system operates at high speeds, features exceptional recognition capabilities, and is user-friendly due to its innovative high-speed sensing technology. For example, in May 2024, Nikon Corporation, a Japan-based company, launched the NSP-150-1, NSP-250-1, and NSP-500-1 advanced industrial robot vision systems. These systems utilize image processing technology to achieve high-speed measurements of up to 250 frames per second (fps) in both 2D and 3D formats. Additionally, the system supports offline operations via cloud connectivity, allowing for centralized management of multiple robot vision systems.

To maintain their competitive edge in the robotic vision market, major companies are introducing innovative products, such as machine vision systems. Machine vision systems involve technologies that enable machines, typically computers, to interpret and make decisions based on visual information extracted from images or video. A notable example is SiLC Technologies, a US-based machine vision solutions provider, which launched the Eyeonic Vision System in December 2022. This system stands out as the most compact and powerful coherent vision system available in the market, featuring a sensor with the highest resolution, precision, and range. Notably, it is the sole FMCW (frequency-modulated, continuous-wave) lidar offering polarization data. SiLC Technologies leverages photonics technology to provide bionic vision, empowering the next generation of machine vision applications and facilitating flexibility for manufacturers aiming to integrate machine vision into their products. The Eyeonic Vision System finds applications in robotics, autonomous vehicles, and smart cameras.

In March 2022, Zebra Technologies, a US-based digital solutions, hardware, and software company, disclosed the acquisition of Matrox Imaging for an undisclosed amount. This strategic move aligns with Zebra Technologies' objective to expand its presence in the machine vision space and enhance its software capabilities. Matrox Imaging, headquartered in Canada, is a manufacturer of vision software, smart cameras, 3D sensors, vision controllers, I/O cards, and frame grabbers. The acquisition strengthens Zebra Technologies' position in the market, leveraging Matrox Imaging's expertise and product portfolio to further its growth in the dynamic field of machine vision.

Major companies operating in the robotic vision market are Cognex Corporation, Omron Corporation, Keyence Corporation, Teledyne DALSA, Tordivel AS, ISRA VISION AG, Basler AG, SICK AG, Hexagon AB, Yaskawa Electric Corporation, Fanuc America Corporation, ABB Ltd., Google LLC, MVTEC Software GmbH, Kawasaki Heavy Industries Ltd., Acieta LLC, Nikon Metrology NV, KUKA AG, Cisco Systems Inc., Robert Bosch, Microsoft Corporation, Intel Corporation, National Instruments Corporation, Qualcomm Technologies Inc., DENSO Corporation, Mitsubishi Electric Corporation, Universal Robots A/S, Nachi Fujikoshi Corp., Stäubli International AG, Yamaha Robotics, Toshiba Machine Co. Ltd., Adept Technology Inc., Scape Technologies A/S, Blue River Technology Inc., Sight Machine Inc.

Asia-Pacific was the largest region in the robotic vision market share in 2024. North America is expected to be the fastest-growing region in the forecast period. The regions covered in the robotic vision market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the robotic vision market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Robotic vision empowers a robot with visual perception capabilities, encompassing various calibrated algorithms, calibration processes, and sensors for tasks such as temperature detection, each varying in complexity and application.

The primary components of robotic vision include hardware and software. Hardware facilitates sensing and digitization tasks by capturing visual data through cameras focused on the target object. In this context, hardware constitutes the tangible components of computers and similar devices. Robotic vision technologies encompass 2D and 3D vision, catering to industries such as electrical and electronics, metals and machinery, precision engineering and optics, automotive, pharmaceuticals and cosmetics, food and beverages, as well as chemical, rubber, plastic, and other sectors. These technologies play a vital role in enhancing automation and efficiency within these diverse industries.

The robotic vision market research report is one of a series of new reports that provides robotic vision market statistics, including robotic vision industry global market size, regional shares, competitors with a robotic vision market share, detailed robotic vision market segments, market trends and opportunities, and any further data you may need to thrive in the robotic vision industry. This robotic vision market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The robotic vision market consists of revenues earned by entities by providing robotic vision products and services that are used by automated robotics to enhance object recognition, navigation, object discovery, inspection, and handling capabilities prior to application. The market value includes the value of related goods sold by the service provider or included within the service offering. The robotic vision market also includes the sales of one or more 2D area-scan or 3D camera units, defined LED/laser lighting, and vision software. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Robotic Vision Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on robotic vision market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for robotic vision ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The robotic vision market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Component: Hardware; Software2) by Technology: 2D Vision; 3D Vision

3) by Industry: Electrical and Electronics; Metals and Machinery; Precision Engineering and Optics; Automotive; Pharmaceuticals and Cosmetics; Food and Beverages; Chemical, Rubber, and Plastic; Other Industries

Subsegments:

1) by Hardware: Cameras (2D and 3D); Image Sensors; Lighting Systems; Processing Units; Lenses and Optics2) by Software: Image Processing Software; Machine Learning Algorithms; Computer Vision Software; Integration Software; Development Platforms

Key Companies Mentioned: Cognex Corporation; Omron Corporation; Keyence Corporation; Teledyne DALSA; Tordivel AS

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Robotic Vision market report include:- Cognex Corporation

- Omron Corporation

- Keyence Corporation

- Teledyne DALSA

- Tordivel AS

- ISRA VISION AG

- Basler AG

- SICK AG

- Hexagon AB

- Yaskawa Electric Corporation

- Fanuc America Corporation

- ABB Ltd.

- Google LLC

- MVTEC Software GmbH

- Kawasaki Heavy Industries Ltd.

- Acieta LLC

- Nikon Metrology NV

- KUKA AG

- Cisco Systems Inc.

- Robert Bosch

- Microsoft Corporation

- Intel Corporation

- National Instruments Corporation

- Qualcomm Technologies Inc.

- DENSO Corporation

- Mitsubishi Electric Corporation

- Universal Robots A/S

- Nachi Fujikoshi Corp.

- Stäubli International AG

- Yamaha Robotics

- Toshiba Machine Co. Ltd.

- Adept Technology Inc.

- Scape Technologies A/S

- Blue River Technology Inc.

- Sight Machine Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.76 Billion |

| Forecasted Market Value ( USD | $ 4.09 Billion |

| Compound Annual Growth Rate | 10.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 36 |