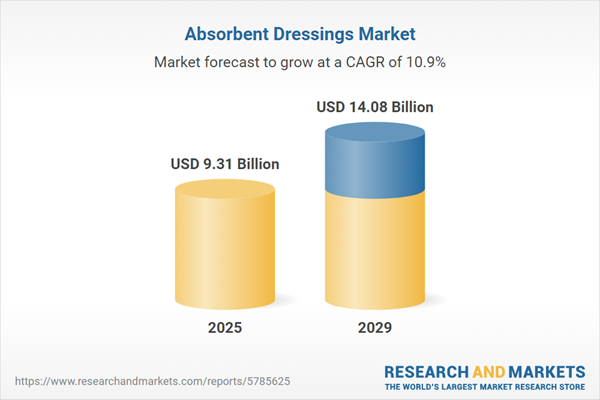

The absorbent dressings market size is expected to see rapid growth in the next few years. It will grow to $14.08 billion in 2029 at a compound annual growth rate (CAGR) of 10.9%. The growth in the forecast period can be attributed to global healthcare infrastructure development, focus on wound healing properties, patient-centric solutions, home healthcare market growth, heightened infection control measures. Major trends in the forecast period include wound care advancements, rise in surgical procedures, prevalence of chronic wounds, patient preference for comfort and convenience, demand from home healthcare settings.

The anticipated rise in chronic wounds is poised to be a driving force behind the expansion of the absorbent dressings market. Chronic wounds denote injuries that exhibit delayed progression through the normal phases of wound healing. Absorbent dressings play a crucial role in managing wounds caused by surgical incisions, burns, accidents, diabetic wounds, skin grafts, and venous ulcers by absorbing exudate. For example, in December 2022, as per data from the Mission Regional Medical Center, a medical facility based in the US, it is estimated that 6.7 million individuals presently live with chronic wounds, with an anticipated growth rate of more than 2% over the next decade. Consequently, the escalation in chronic wounds is propelling the expansion of the absorbent dressings market.

The burgeoning aging population is expected to be a catalyst for the growth of the absorbent dressings market in the foreseeable future. This demographic phenomenon denotes a gradual increase in the proportion or count of elderly individuals within a population. Elderly individuals often encounter delayed wound healing, rendering absorbent dressings indispensable for effective wound management and better outcomes. These dressings contribute significantly to wound healing, infection prevention, and overall comfort, thereby supporting the well-being and quality of life of the elderly. For instance, in October 2022, as stated by the World Health Organization, the global populace aged 60 years or older is projected to reach six individuals by 2030, up from one billion in 2020 to 1.4 billion. By 2050, this age group is expected to double to 2.1 billion, with an additional 426 million individuals aged 80 years or older compared to the present. Hence, the growing aging population is steering the expansion of the absorbent dressings market.

Innovations in product offerings stand out as a prominent trend gaining traction within the absorbent dressings market. Major companies active in this sector are dedicated to developing novel products featuring enhanced healing capabilities and efficacy, aiming to fortify their market standing. For example, in April 2022, Global Health Technology, a MedTech company headquartered in Norway, introduced Erland Care Protective Skin, a cutting-edge wound dressing. This protective skin incorporates a distinctive, highly absorbent, and skin-friendly material facilitating breathability and creating optimal healing conditions for wounds. Notably, this dressing is waterproof and its silicone adhesive ensures easy removal, marking a significant advancement in wound care technology.

Prominent players in the absorbent dressings market are placing their focus on pioneering technological advancements, notably the development of advanced foam dressings, to attain a competitive advantage within the industry. Advanced foam absorbent dressings represent a specialized type of wound dressing crafted for advanced wound care purposes. These dressings possess high absorbency levels and are tailored for managing wounds that exhibit varying degrees of exudate, fostering a moist wound environment conducive to healing. For example, in January 2023, Convatec Group PLC, a UK-based medical device company, introduced ConvaFoam in the US market - a range of advanced foam dressings catering to the requirements of healthcare providers and patients. The ConvaFoam dressings integrate AQUACEL hydrofiber technology alongside a superabsorbent layer, rendering them suitable for managing both exuding and non-exuding wounds while ensuring intact skin protection. This series of dressings feature innovations such as a superabsorbent layer, a patterned film design aiding in exudate monitoring, an extended usage duration of up to seven days, heightened fluid absorbency capabilities, and enhanced silicone technology for improved adhesion. Furthermore, its customizable nature allows for easy cutting to fit complex areas during application.

In February 2022, Argentum Medical, a US-based medical device company, completed the undisclosed acquisition of Anacapa Technologies, thereby consolidating its position in the wound care market by integrating Anacapa Technologies' Anasept and Silver-Sept antimicrobial wound cleansers, irrigation solutions, and gels. Anacapa Technologies Inc., a US-based enterprise specializing in skin and wound care products, became part of Argentum Medical through this strategic acquisition. This integration marked a significant stride for Argentum in bolstering its offerings within the wound care sector by assimilating Anacapa Technologies' range of antimicrobial products, thereby expanding its portfolio and reinforcing its position in the industry.

Major companies operating in the absorbent dressings market are 3M Company, MPM Medical Inc., Alliqua BioMedical Inc., DeRoyal Industries Inc., Smith & Nephew PLC, Coloplast A/S, Johnson & Johnson, B. Braun Melsungen AG, Mölnlycke Health Care AB, Brightwake Limited, Hollister Incorporated, Integra LifeSciences Holdings Corporation, DermaRite Industries LLC, Birchwood Laboratories Inc., Medline Industries Inc., Acelity L.P. Inc., Argentum Medical LLC, ConvaTec Inc., Derma Sciences Inc., HARTMANN GROUP, Lohmann & Rauscher International GmbH & Co. KG, Medtronic PLC, Nitto Denko Corporation, Paul Hartmann AG, Systagenix Wound Management Ltd., Urgo Medical Ltd., Winner Medical Co. Ltd., 4L Health Co. Ltd., Aso LLC, Gentell Inc., Essity AB, Adynxx Inc., BSN Medical GmbH.

North America was the largest region in the absorbent dressings market in 2024, and is expected to be the fastest-growing region in the forecast period. The regions covered in the absorbent dressings market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the absorbent dressings market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

An absorbent dressing is composed of a super absorbent polymer, utilizing materials such as iodine gel, fibrous fabric, alginate, sodium chloride, calcium, and other compounds. Its primary function is to safeguard wounds from the external environment while effectively absorbing moisture.

The main types of absorbent dressings include non-adherent, adherent, and low-adherent dressings. Non-adherent absorbent dressings are characterized by their low-adhering material, facilitating easy removal of the dressing. These dressings find diverse applications in hospitals, clinics, and home care settings, catering to both inpatient and outpatient facilities.

The absorbent dressings market research report is one of a series of new reports that provides absorbent dressings market statistics, including absorbent dressings industry global market size, regional shares, competitors with an absorbent dressings market share, detailed absorbent dressings market segments, market trends and opportunities, and any further data you may need to thrive in the absorbent dressings industry. This absorbent dressing’s market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The absorbent dressings market consists of sales of gel pads, polyurethane foams, cotton or rayon, moisture control pads, alginate pads, AMD sponge dressing, and others. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Absorbent Dressings Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on absorbent dressings market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for absorbent dressings? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The absorbent dressings market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Non-Adherent; Adherent; Low-Adherent2) by Application: Hospital; Clinic; Home Care

3) by End-User: Inpatient Facilities; Outpatient Facilities

Subsegments:

1) by Non-Adherent: Foam Dressings; Hydrocolloid Dressings; Alginate Dressings2) by Adherent: Gauze Dressings; Adhesive Dressings; Transparent Film Dressings

3) by Low-Adherent: Semi-Permeable Dressings; Silicone Dressings; Specialized Low-Adherent Dressings

Key Companies Mentioned: 3M Company; MPM Medical Inc.; Alliqua BioMedical Inc.; DeRoyal Industries Inc.; Smith & Nephew PLC

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Absorbent Dressings market report include:- 3M Company

- MPM Medical Inc.

- Alliqua BioMedical Inc.

- DeRoyal Industries Inc.

- Smith & Nephew PLC

- Coloplast A/S

- Johnson & Johnson

- B. Braun Melsungen AG

- Mölnlycke Health Care AB

- Brightwake Limited

- Hollister Incorporated

- Integra LifeSciences Holdings Corporation

- DermaRite Industries LLC

- Birchwood Laboratories Inc.

- Medline Industries Inc.

- Acelity L.P. Inc.

- Argentum Medical LLC

- ConvaTec Inc.

- Derma Sciences Inc.

- HARTMANN GROUP

- Lohmann & Rauscher International GmbH & Co. KG

- Medtronic PLC

- Nitto Denko Corporation

- Paul Hartmann AG

- Systagenix Wound Management Ltd.

- Urgo Medical Ltd.

- Winner Medical Co. Ltd.

- 4L Health Co. Ltd.

- Aso LLC

- Gentell Inc.

- Essity AB

- Adynxx Inc.

- BSN Medical GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 9.31 Billion |

| Forecasted Market Value ( USD | $ 14.08 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 34 |