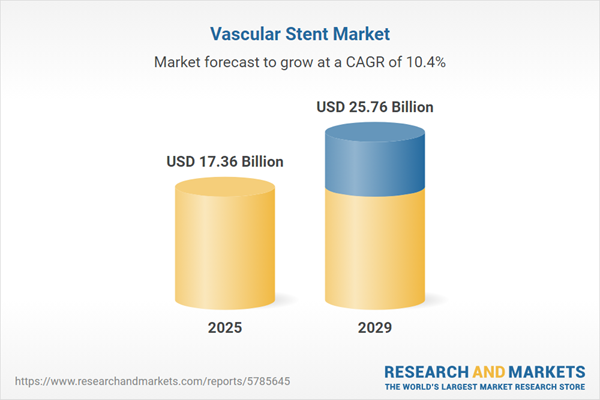

The vascular stent market size is expected to see rapid growth in the next few years. It will grow to $25.76 billion in 2029 at a compound annual growth rate (CAGR) of 10.4%. The growth in the forecast period can be attributed to focus on preventive cardiovascular care, shift towards outpatient procedures, cost-effectiveness and value-based healthcare, bioabsorbable stents and next-generation materials, expansion of endovascular interventions. Major trends in the forecast period include advancements in stent coatings and materials, patient education and awareness, shift towards outpatient settings, focus on cost-effectiveness.

The growing incidence of vascular diseases is expected to drive the vascular stent market's growth in the future. Vascular disease, which affects the blood vessels (both arteries and veins), falls under the category of cardiovascular diseases (CVD). Vascular stents are used to treat various vascular diseases by facilitating the flow of oxygen-rich blood to the heart. For example, in May 2023, the Centers for Disease Control and Prevention (CDC), a federal agency in the United States focused on public health, reported that approximately 702,880 individuals died from heart disease in 2022, which translates to 1 in every 5 deaths. As a result, the rising prevalence of cardiovascular diseases (CVDs) will contribute to the growth of the vascular stent market.

The rise in healthcare expenditure is anticipated to boost the growth of the vascular stent market. Healthcare expenditure refers to the total resources allocated, typically measured in monetary terms, by a country, organization, or individual for healthcare-related goods and services over a specific period. Higher healthcare spending leads to better infrastructure, enhanced healthcare facilities, and increased awareness, all of which positively influence the diagnosis and treatment of vascular diseases. For example, in June 2023, the Centers for Medicare & Medicaid Services (CMS), a U.S.-based organization that administers major healthcare programs, reported in the National Health Expenditure Projections 2023-2024 that health expenditure growth rates in the United States are expected to be 5% this year and 5.1% the following year. Consequently, rising healthcare expenditure is propelling the vascular stent market forward.

Technological advancement is a significant trend gaining traction in the vascular stent market. Numerous companies are investing in bio-sensing devices, state-of-the-art integrated stents, and drug-eluting coronary stent systems to secure a competitive advantage. For example, in 2022, Translumina, a medical equipment manufacturer based in India, introduced the VIVO ISAR, a next-generation dual drug polymer-free coated stent (DDCS) that combines a stent with an enhanced safety profile without sacrificing drug release kinetics. It utilizes Probucol, an antioxidant and lipid-lowering agent, as a carrier to release Sirolimus (an anti-restenosis medication), thus creating a polymer-free drug-eluting stent platform with uncompromised safety and effectiveness.

Major companies are strategically partnering with start-ups and mid-sized firms in the vascular stent market to expand their product and service offerings. Such collaborations and partnership agreements enable companies to enhance their existing product portfolios and extend their geographical reach. For instance, in September 2023, The Electrospinning Company, a UK-based manufacturer of advanced biomaterials for implantable tissue-regenerative devices, collaborated with Relisys Medical Devices, an India-based producer of highly innovative cardiovascular medical devices, to develop groundbreaking products that could enhance cardiovascular care and transform patient outcomes. Through this partnership, the Electrospinning Company’s Caladrix technology allows for the deposition of a thin, functional polymer coating without the need for sutures, enabling the manufacturing of vascular stents with improved production rates and yields while maintaining efficacy.

In January 2024, Olympus Corporation, a Japan-based company specializing in the development, manufacture, and sale of medical technology and precision instruments, acquired Taewoong Medical Co., Ltd. for $0.37 billion. This acquisition is intended to strengthen Olympus Corporation's gastrointestinal product portfolio, enhance patient outcomes, and broaden its global market presence in the GI medical device sector. Taewoong Medical Co., Ltd., a manufacturing company based in South Korea, produces vascular stents designed to treat narrowed blood vessels and improve circulation.

Major companies operating in the vascular stent market are Medtronic PLC, Abbott Laboratories, Boston Scientific Corporation, Biotronik SE & Co. KG, B. Braun Melsungen AG, Terumo Corporation, Meril Life Sciences Pvt. Ltd., JOTEC GmbH, W. L. Gore & Associates Inc., MicroPort Scientific Corporation, Translumina GmbH, Lepu Medical Technology Co. Ltd., Purple Medical Solution Pvt. Ltd., Sahajanand Medical Technologies Pvt. Ltd., Stentys SA, Osypka AG, Cook Medical Inc., Cordis Corporation, Endologix Inc., Johnson & Johnson Inc., EP Medsystems Inc.

North America was the largest region in the vascular stent market share in 2024. The regions covered in the vascular stent market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the vascular stent market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Vascular stents are intricately designed metal mesh tubes utilized in medical procedures to prevent vessel closure and enhance blood flow in narrowed or blocked veins and arteries. This intervention, commonly referred to as 'vascular stenting,' aims to minimize the risk of late restenosis while supporting swift recovery by widening obstructed arteries, thus reducing the likelihood of infections and physical complications.

The primary categories of vascular stent products include coronary stents, peripheral vascular stents, and EVAR stent grafts. Coronary stents specifically target constricted arteries supplying oxygenated blood to the heart, playing a crucial role in maintaining arterial patency post-angioplasty. Within the vascular stent market, these stents encompass various types such as bare metal stents, bio-engineered and bioresorbable vascular scaffolds, drug-eluting stents, and dual therapy stents. These stents are crafted from materials like cobalt-chromium, platinum-chromium, nickel titanium, stainless steel, and polymers. Their deployment methods involve balloon-expandable and self-expanding stents, utilized across ambulatory surgical centers, cardiac facilities, and hospitals.

The vascular stent market research report is one of a series of new reports that provides vascular stent market statistics, including vascular stent industry global market size, regional shares, competitors with a vascular stent market share, detailed vascular stent market segments, market trends and opportunities, and any further data you may need to thrive in the vascular stent industry. This vascular stent market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The vascular stent market consists of sales of bare metal stents, bioresorbable scaffold systems, and drug-eluting balloons. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Vascular Stent Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on vascular stent market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for vascular stent ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The vascular stent market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Coronary Stents; Peripheral Vascular Stents; Ever Stent Grafts2) by Type: Bare Metal Stent; Bio-Engineered Stent; Bioresorbable Vascular Scaffold; Drug Eluting Stent; Dual Therapy Stent

3) by Material: Metallic Stents; Cobalt-Chromium; Platinum Chromium; Nickel Titanium; Stainless Steel; Polymers Stents

4) by Mode of Delivery: Balloon-Expandable Stent; Self-Expanding Stent

5) by End-User: Ambulatory Surgical Center; Cardiac Center; Hospital

Subsegments:

1) by Coronary Stents: Drug-Eluting Coronary Stents; Bare Metal Coronary Stents2) by Peripheral Vascular Stents: Drug-Eluting Peripheral Stents; Bare Metal Peripheral Stents

3) by EVAR Stent Grafts (Endovascular Aneurysm Repair): Aortoiliac Stent Grafts; Fenestrated Stent Grafts; Branch Stent Grafts

Key Companies Mentioned: Medtronic PLC; Abbott Laboratories; Boston Scientific Corporation; Biotronik SE & Co. KG; B. Braun Melsungen AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Vascular Stent market report include:- Medtronic PLC

- Abbott Laboratories

- Boston Scientific Corporation

- Biotronik SE & Co. KG

- B. Braun Melsungen AG

- Terumo Corporation

- Meril Life Sciences Pvt. Ltd.

- JOTEC GmbH

- W. L. Gore & Associates Inc.

- MicroPort Scientific Corporation

- Translumina GmbH

- Lepu Medical Technology Co. Ltd.

- Purple Medical Solution Pvt. Ltd.

- Sahajanand Medical Technologies Pvt. Ltd.

- Stentys SA

- Osypka AG

- Cook Medical Inc.

- Cordis Corporation

- Endologix Inc.

- Johnson & Johnson Inc.

- EP Medsystems Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 17.36 Billion |

| Forecasted Market Value ( USD | $ 25.76 Billion |

| Compound Annual Growth Rate | 10.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |