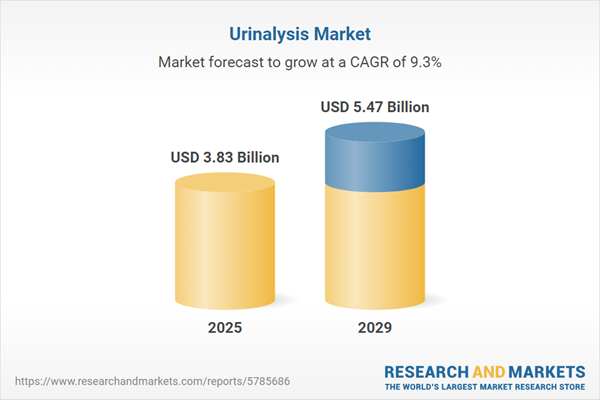

The urinalysis market size is expected to see strong growth in the next few years. It will grow to $5.47 billion in 2029 at a compound annual growth rate (CAGR) of 9.3%. The growth in the forecast period can be attributed to point-of-care testing (POCT), chronic disease management, aging population, preventive healthcare, remote monitoring and telemedicine. Major trends in the forecast period include innovative drugs approvals, technological innovations, personalized medicine, chronic disease monitoring.

The urinalysis market is anticipated to witness growth due to the rising geriatric population. The geriatric population, comprising individuals aged 65 and beyond, often experiences various diseases due to lower immunity and the effects of aging. Among the health concerns in this demographic, the increased risk of urinary tract infections (UTI) is notable. Urinalysis, which examines the visual, chemical, and microscopic components of urine, plays a crucial role in identifying and managing various illnesses prevalent in the geriatric population, including diabetes, kidney disease, and urogenital infections. According to the World Health Organization, by 2030, six people in the world will be aged 60 or older, reaching 1.4 billion individuals. The global population aged 60 and older is expected to double to 2.1 billion by 2050. The escalating number of elderly individuals, particularly those aged 80 and older, underscores the significance of urinalysis in addressing the healthcare needs of the geriatric population and, consequently, driving the urinalysis market.

The increasing incidence of chronic kidney disease is anticipated to drive the growth of the urinalysis market in the future. Chronic kidney disease is characterized by the kidneys' diminished ability to filter blood effectively due to gradual damage and loss of function. Urinalysis plays a crucial role in diagnosing, monitoring, and managing chronic kidney disease (CKD), offering valuable insights into kidney health and overall bodily function. For example, in June 2023, publications by the Oxford University Press, a UK-based department of the University of Oxford, projected that the prevalence of chronic kidney disease (CKD) in the UK would rise by 4%, increasing from 8.27 million to 8.61 million individuals between 2022 and 2032. Therefore, the rising prevalence of chronic kidney disease is fueling the growth of the urinalysis market.

Technologically advanced instruments, incorporating artificial intelligence (AI) technology in urine analysis devices, represent a key trend gaining popularity in the urinalysis market. Notably, Olive Diagnostics, an Israel-based health tech company, launched Olive KG in February 2022. This urinalysis sensor device, powered by AI, provides real-time health alerts and early detection of disease progression. Olive KG measures various parameters, including red blood cells, proteins, ketones, nitrites, pH, volume, pressure, color, and urine frequency. Designed as a toilet-mountable Internet of Medical Things (IoMT) device, Olive KG delivers real-time personal data while adhering to GDPR and HIPPA act criteria. The integration of AI technology in urinalysis instruments exemplifies a technological advancement that enhances the efficiency and capabilities of urine analysis, contributing to the market's growth.

Major players in the urinalysis market are actively engaged in developing innovative products, such as urine particle analyzers, to secure a competitive advantage. Urine analyzers are clinical devices designed for automated urine testing, offering capabilities for the detection and quantification of multiple analytes. Urine particle analyzers, in particular, provide enhanced accuracy and precision compared to manual microscopy, contributing to the standardization of urine particle analysis and reducing inter-observer variability. A notable example of this trend is Sysmex Europe SE, a Germany-based automated in vitro diagnostics provider, which introduced the UF-1500 Fully Automated Urine Particle Analyzer in April 2023. This innovative device is engineered to achieve a significant reduction in footprint (approximately 30%) while maintaining high levels of performance and usability. Leveraging cutting-edge fluorescence flow cytometry technology, similar to Sysmex's flagship UF-5000, the UF-1500 caters to diverse customer needs. It serves as a fully automated urinalysis workstation for both developed and emerging markets, as well as backup and satellite systems for extensive facilities that have previously installed the UN-Series. Additionally, the UF-1500 supports connectivity to Sysmex's UC-3500 urine chemistry analyzers.

In June 2022, Healthy.io Ltd., a US-based healthcare company specializing in remote clinical testing and services, acquired Inui Health for $9 million. This acquisition enabled Healthy.io Ltd. to acquire smartphone diagnostics platforms and various at-home testing services, which will enhance the company's growth in the smartphone diagnostic market. Inui Health is a US-based medical diagnostics company that offers consumers the ability to perform urinalysis at home using their smartphones.

Major companies operating in the urinalysis market are Siemens Healthineers AG, F. Hoffmann-La Roche Ltd., Cardinal Health Inc., Abbott Laboratories, Danaher Corporation, Beckman Coulter Inc., Sysmex Corporation, ARKRAY Inc., ACON Laboratories Inc., Bio-Rad Laboratories Inc., URIT Medical Electronic Group Co Ltd., 77 Elektronika Kft, Thermo Fisher Scientific Inc., Teco Diagnostics, Mindray Medical International Limited, Quidel Corporation, Becton Dickinson and Company, EKF Diagnostics, Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Guangzhou Wondfo Biotech Co. Ltd., Chembio Diagnostic Systems Inc, Immunostics Inc., Inova Diagnostics Inc., Meridian Bioscience Inc., Fapon Biotech Inc., Nanjing Norman Biological Technology Co. Ltd., OraSure Technologies Inc., Hologic Inc., Randox Laboratories Ltd., Qiagen N.V.

North America was the largest region in the urinalysis market in 2024. The regions covered in the urinalysis market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the urinalysis market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A urinalysis, commonly known as a urine test, is a diagnostic examination that assesses the visual, chemical, and microscopic elements present in urine. It evaluates the appearance, concentration, and content of urine, encompassing various tests to detect and measure compounds that are excreted in urine through a single sample. This diagnostic tool is employed to identify and manage a range of health conditions, including diabetes, kidney disease, and urogenital infections.

The primary test types within urinalysis include pregnancy and fertility tests, biochemical urinalysis, and sediment urinalysis. Pregnancy and fertility tests specifically focus on detecting a hormone, human chorionic gonadotropin (HCG), in blood or urine to confirm pregnancy or aid couples in family planning decisions. Regardless of pregnancy intentions, these tests assist in determining pregnancy status. Products used in urinalysis procedures consist of consumables and instruments, applied in diagnosing conditions such as urinary tract infections (UTIs), kidney disease, liver disease, diabetes, hypertension, among others. Urinalysis is utilized across various settings including diagnostic laboratories, hospitals, clinics, home care settings, as well as research laboratories and institutes.

The urinalysis market research report is one of a series of new reports that provides urinalysis market statistics, including urinalysis industry global market size, regional shares, competitors with a urinalysis market share, detailed urinalysis market segments, market trends and opportunities, and any further data you may need to thrive in the urinalysis industry. This urinalysis market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The urinalysis market consists of revenues earned by entities by providing urinalysis services by providing visual exam of urine, dipstick test, screening tests, reagents test, culture test and microscopic exam of urine. The market value includes the value of related goods sold by the service provider or included within the service offering. The urinalysis market also includes sales of automated urine analyzers, point of care analyzers, integrated urine analyzers, strip reader connect system equipment which are used in providing urinalysis services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Urinalysis Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on urinalysis market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for urinalysis ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The urinalysis market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include:

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Test Type: Pregnancy and Fertility Tests; Biochemical Urinalysis; Sediment Urinalysis2) by Product: Consumables; Instruments

3) by Application: Urinary Tract infections (UTI's); Kidney Disease; Liver Disease; Diabetes; Hypertension; Other Applications

4) by End Users: Diagnostic Laboratories; Hospitals and Clinics; Home Care Settings; Research Laboratories and Institutes

Subsegments:

1) by Pregnancy and Fertility Tests: Urine Pregnancy Tests; Ovulation Prediction Tests2) by Biochemical Urinalysis: Dipstick Tests; Reagent Strip Tests; Microalbumin Tests

3) by Sediment Urinalysis: Microscopic Examination; Chemical Analysis of Sediment; Culture Tests

Key Companies Mentioned: Siemens Healthineers AG; F. Hoffmann-La Roche Ltd.; Cardinal Health Inc.; Abbott Laboratories; Danaher Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Urinalysis market report include:- Siemens Healthineers AG

- F. Hoffmann-La Roche Ltd.

- Cardinal Health Inc.

- Abbott Laboratories

- Danaher Corporation

- Beckman Coulter Inc.

- Sysmex Corporation

- ARKRAY Inc.

- ACON Laboratories Inc.

- Bio-Rad Laboratories Inc.

- URIT Medical Electronic Group Co Ltd.

- 77 Elektronika Kft

- Thermo Fisher Scientific Inc.

- Teco Diagnostics

- Mindray Medical International Limited

- Quidel Corporation

- Becton Dickinson and Company

- EKF Diagnostics

- Shenzhen Mindray Bio-Medical Electronics Co. Ltd.

- Guangzhou Wondfo Biotech Co. Ltd.

- Chembio Diagnostic Systems Inc

- Immunostics Inc.

- Inova Diagnostics Inc.

- Meridian Bioscience Inc.

- Fapon Biotech Inc.

- Nanjing Norman Biological Technology Co. Ltd.

- OraSure Technologies Inc.

- Hologic Inc.

- Randox Laboratories Ltd.

- Qiagen N.V

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.83 Billion |

| Forecasted Market Value ( USD | $ 5.47 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |