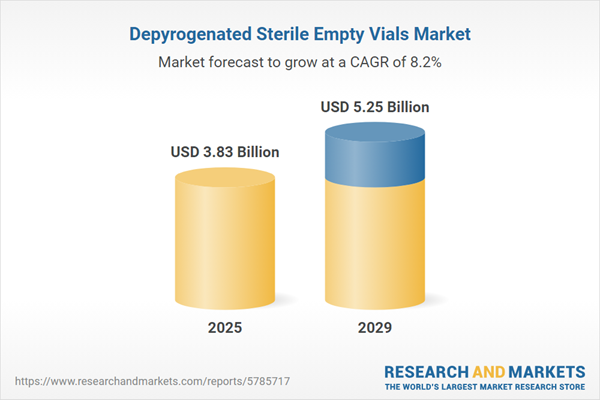

The depyrogenated sterile empty vials market size is expected to see strong growth in the next few years. It will grow to $5.25 billion in 2029 at a compound annual growth rate (CAGR) of 8.2%. The growth in the forecast period can be attributed to focus on advanced drug delivery systems, increasing regulatory emphasis on container closure integrity, rise in personalized medicine approaches, expansion of biomanufacturing facilities, focus on sustainable packaging, digitalization of supply chain management, demand for high-value oncology drugs. Major trends in the forecast period include single-use technologies, biological drug development, quality by design (QBD) approaches, biodegradable and sustainable materials, digitalization in supply chain management, smart packaging technologies, advancements in aseptic filling technologies, collaborations and partnerships,.

The rising prevalence of infectious diseases worldwide is expected to drive the growth of the depyrogenated sterile empty vials market. Infectious diseases are conditions caused by harmful microorganisms such as bacteria, viruses, parasites, and fungi. Depyrogenated sterile vials are used for storing injectable medications involved in the treatment of these infectious diseases. Furthermore, depyrogenated sterile empty vials are also utilized for collecting laboratory samples. For example, in February 2024, the Health Security Agency, a UK-based government agency, reported a 10.7% increase in tuberculosis (TB) cases in England in 2023 compared to 2022. The number of cases grew from 4,380 in 2022 to 4,850 in 2023. As a result, the increasing prevalence of infectious diseases globally is expected to boost the growth of the depyrogenated sterile empty vials market.

The increase in the geriatric population is expected to drive the growth of the depyrogenated sterile empty vials market in the future. The geriatric population refers to elderly individuals aged 65 years and older. Depyrogenated sterile empty vials are used in this population to ensure medication safety and prevent infections, reducing the risk of pyrogenic reactions, which can cause fever and other adverse effects, particularly in older individuals. For example, in October 2022, according to the World Health Organization, a US-based specialized health agency, 1 in 6 people globally will be 60 or older by 2030, and the number of individuals in this age group will double to 2.1 billion by 2050. Additionally, in June 2021, according to the UK Parliament's House of Commons Library, a UK-based information resource, by 2043, the senior population in the UK is expected to rise, making up 24% of the total population (17.4 million people). Therefore, the growing geriatric population is fueling the growth of the depyrogenated sterile empty vials market.

Technological advancements have become a key trend gaining traction in the depyrogenated sterile empty vials market. Leading companies in the market are focusing on integrating advanced technologies into depyrogenated sterile empty vials to improve quality and maintain their competitive position. For example, in November 2022, Gerresheimer AG, a Germany-based drug packaging company, in collaboration with Stevanato Group S.p.A., an Italy-based provider of drug containment, delivery, and diagnostic solutions, launched the EZ-fill Smart platform. This new Ready-To-Fill solution for the global vial market aims to enhance drug packaging quality, lower total cost of ownership (TCO), and reduce lead times for customers. As an evolution of Stevanato Group's pioneering EZ-fill platform, EZ-fill Smart introduces key improvements that can significantly enhance customer product offerings, addressing the increasing demand for ready-to-use vials.

Leading companies in the depyrogenated sterile empty vials market are focusing on product innovation, such as Ready-to-Use (RTU) sterile 100 ml molded glass vials, to gain a competitive advantage. These vials are specifically designed for packaging high-value parenteral drugs in large volumes. For example, in March 2022, SGD Pharma, an India-based company specializing in glass pharmaceutical packaging services, launched Ready-to-Use (RTU) sterile 100 ml molded glass vials. These vials feature no glass-to-glass contact, reducing particle generation to enhance patient safety. They are compatible with various injectable applications and are sterile and depyrogenated, ensuring they are free from contaminants.

In June 2023, ALK-Abelló, Inc., a pharmaceutical company based in Denmark known for manufacturing sterile empty vials, entered into a strategic partnership with Galenova Inc., a Canada-based pharmaceutical company. Through this collaboration, ALK-Abelló, Inc. aims to enhance its distribution network by providing dependable and high-quality glass vials to pharmacies and hospitals throughout Canada. Galenova Inc. specializes in pharmaceutical products, including the provision of depyrogenated sterile empty vials. This partnership reflects a joint effort to strengthen the supply chain and deliver essential pharmaceutical components to the Canadian healthcare system.

Major companies operating in the depyrogenated sterile empty vials market are APG Pharma, Corning Inc., DWK Life Sciences, Nipro PharmaPackaging, Schott AG, Thermo Fisher Scientific, Gerresheimer AG, Stevanato Group, SGD Pharma, Merck KGaA, SiO2 Materials Science, Shandong Pharmaceutical Glass Co. Ltd., West Pharmaceutical Services Inc., Ompi Srl, AptarGroup Inc., Pacific Vial Manufacturing Inc., Adelphi Healthcare Packaging Limited, Acme Vial and Glass Company LLC, Amposan S.A., BMT Corporation, Cangzhou Four Stars Glass Co. Ltd., Ciron Drugs & Pharmaceuticals Pvt. Ltd., Zhejiang Pharmaceutical-Packaging Co. Ltd., Verpakkingsindustrie B.V.,

North America was the largest region in the depyrogenated sterile empty vials market in 2024. The regions covered in the depyrogenated sterile empty vials market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the depyrogenated sterile empty vials market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Depyrogenated sterile empty vials are borosilicate glass containers equipped with butyl-rubber stoppers and aluminum seals, designed for the storage of injectable drugs. Depyrogenation is a process that involves the removal of pyrogenic substances, including bacterial endotoxins, through the application of heat.

The main product types of depyrogenated sterile empty vials include 2 ml, 5 ml, 10 ml, 20 ml, and those exceeding 20 ml in volume. For example, a 2 ml vial refers to a container with a volume of 2 milliliters, commonly used for injectable drug storage. These vials are available in standard and large opening variations, typically used with aluminum seals. Depyrogenated sterile empty vials come in glass and plastic packaging, serving the needs of clinical labs, compounding labs, pharmaceutical companies, contract manufacturing organizations, and distributors.

The depyrogenated sterile empty vials market research report is one of a series of new reports that provides depyrogenated sterile empty vials market statistics, including depyrogenated sterile empty vials industry global market size, regional shares, competitors with a depyrogenated sterile empty vials market share, detailed depyrogenated sterile empty vials market segments, market trends and opportunities, and any further data you may need to thrive in the depyrogenated sterile empty vials industry. This depyrogenated sterile empty vials market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The depyrogenated sterile empty vials market consists of sales of type I borosilicate glass, and molded and tabular glass depyrogenated sterile empty vials. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Depyrogenated Sterile Empty Vials Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on depyrogenated sterile empty vials market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for depyrogenated sterile empty vials? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The depyrogenated sterile empty vials market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: 2 ML; 5 ML; 10 ML; 20 ML; >20 ML2) by Packaging: Glass; Plastic

3) by End User: Clinical Labs; Compounding Labs; Pharmaceutical Companies; Contract Manufacturing Organization; Distributors

Subsegments:

1) by 2 ML: Single-Use Vials; Multi-Dose Vials2) by 5 ML: Single-Use Vials; Multi-Dose Vials

3) by 10 ML: Single-Use Vials; Multi-Dose Vials

4) by 20 ML: Single-Use Vials; Multi-Dose Vials

5) by >20 ML: Single-Use Vials; Multi-Dose Vials

Key Companies Mentioned: APG Pharma; Corning Inc.; DWK Life Sciences; Nipro PharmaPackaging; Schott AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Depyrogenated Sterile Empty Vials market report include:- APG Pharma

- Corning Inc.

- DWK Life Sciences

- Nipro PharmaPackaging

- Schott AG

- Thermo Fisher Scientific

- Gerresheimer AG

- Stevanato Group

- SGD Pharma

- Merck KGaA

- SiO2 Materials Science

- Shandong Pharmaceutical Glass Co. Ltd.

- West Pharmaceutical Services Inc.

- Ompi Srl

- AptarGroup Inc.

- Pacific Vial Manufacturing Inc.

- Adelphi Healthcare Packaging Limited

- Acme Vial and Glass Company LLC

- Amposan S.A.

- BMT Corporation

- Cangzhou Four Stars Glass Co. Ltd.

- Ciron Drugs & Pharmaceuticals Pvt. Ltd.

- Zhejiang Pharmaceutical-Packaging Co. Ltd.

- Verpakkingsindustrie B.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.83 Billion |

| Forecasted Market Value ( USD | $ 5.25 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |