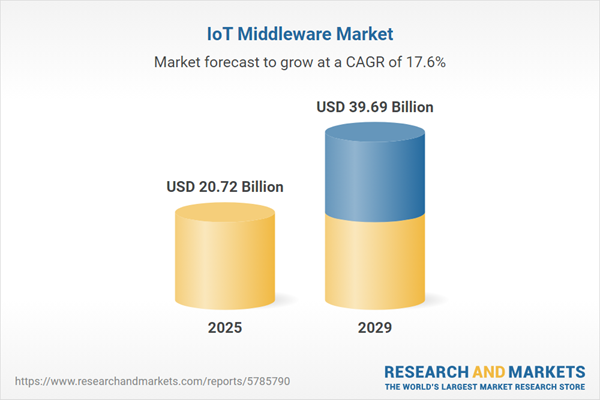

The IoT middleware market size is expected to see rapid growth in the next few years. It will grow to $39.69 billion in 2029 at a compound annual growth rate (CAGR) of 17.6%. The growth in the forecast period can be attributed to evolving customer expectations, cost-efficient solutions, standardization initiatives, cloud integration, industry-specific solutions. Major trends in the forecast period include remote work and connectivity, cost efficiency, hybrid deployment models, demand for real-time analytics, interoperability and standards.

The growth of the IoT middleware market is anticipated to be driven by the increasing availability of high-speed network connectivity. High-speed internet refers to internet access delivered through a network of servers that transfers data via high-speed cables, satellites, and wireless connections, making it significantly faster than traditional analog dial-up services. The demand for high-speed connectivity is rising due to the growing number of connected devices and the need for supporting complex functions. As high-speed network connectivity expands, there will be a greater need for improved IoT middleware solutions that enhance connectivity between devices and facilitate faster operations. For example, reports from Ookla, a US-based web service that analyzes internet performance metrics, indicated that fixed broadband speeds increased by at least 28%, and mobile speeds grew nearly 17% from November 2021 to November 2022. Consequently, the rise in high-speed network connectivity is set to propel the growth of the IoT middleware market.

The growth of the IoT middleware market is expected to accelerate due to the rising adoption of IoT devices. IoT devices, or Internet of Things devices, are physical objects equipped with sensors, software, and network connectivity that collect and exchange data over the internet. IoT middleware is essential for connecting and managing these devices within the IoT ecosystem, acting as a bridge between diverse devices and the applications that utilize their data. It provides a layer of abstraction that simplifies device management, data collection, and communication. For instance, a report from Demandsage in December 2023 indicated that there were approximately 6.8 billion smartphone users globally, with an increase of 6.6 billion users compared to the previous year. Thus, the growing adoption of IoT devices is a significant driver of the IoT middleware market's expansion.

Key players in the IoT middleware market are forming strategic partnerships to broaden their market offerings. Strategic partnerships involve companies utilizing each other's strengths and resources to achieve mutual benefits and success. For example, in October 2023, Milesight, a China-based provider of innovative sensing products and solutions, collaborated with Asteria Corporation, a Japan-based enterprise software firm, to streamline the implementation of Internet of Things (IoT) solutions across various sectors. By integrating Milesight's LoRaWAN gateways and sensors with Asteria’s Node Computing Platform, Gravio, this partnership allows users to create business processes using IoT data collected from Milesight sensors, both at the edge and in the cloud. By combining their technologies, the two companies aim to facilitate global digital transformation and assist organizations in harnessing on-site data. Ultimately, this initiative is intended to accelerate the adoption of IoT solutions across a range of industries.

Leading companies in the IoT middleware market are developing innovative technologies, such as cellular IoT, to secure a competitive advantage. Cellular IoT refers to the utilization of cellular networks for communication between devices and systems within the Internet of Things (IoT). For example, in March 2023, AllIoT Technologies Ltd., a UK-based IoT solutions provider, launched the Symbius IoT middleware platform. This platform is designed to address the challenges of cellular IoT adoption by converting recorded data into a standardized format. A key feature of Symbius is its ability to act as an intermediary between NB-IoT and LTE-M sensors and users' dashboards, eliminating the need for manual development efforts. By tackling the issue of lacking a common protocol in cellular IoT, Symbius aims to enhance accessibility and usability, enabling partners to concentrate on developing solutions without the complications of disparate data formats.

In July 2024, Espressif Systems, a China-based IoT and semiconductor company, acquired M5Stack for an undisclosed amount. This acquisition aims to strengthen Espressif's ecosystem by capitalizing on M5Stack's expertise in industrial IoT applications. The collaboration is expected to enhance Espressif's offerings in AIoT technology, which encompasses chips, software, cloud middleware, and logistics support. M5Stack Technology, also based in China, specializes in developing IoT solutions and IoT middleware.

Major companies operating in the IoT middleware market are Microsoft Corporation, International Business Machines Corporation, SAP SE, Cisco Systems Inc., Google LLC, Hitachi Ltd., Oracle Corporation, General Electric Company, Schneider Electric SE, ClearBlade Inc., PTC Inc., Robert Bosch GmbH, Siemens AG, ABB Ltd., AVEVA Group PLC, Alitzon Inc., Eurotech S.p.A., Fujitsu Ltd., Hewlett Packard Enterprise Development LP, Huawei Technologies Co. Ltd., Intel Corporation, Litmus Automation Inc., Mocana Corporation, Nebbiolo Technologies Inc., Nokia Corporation, Particle Industries Inc., Progress Software Corporation, ThingWorx Inc., Wind River Systems Inc., KaaIoT Technologies LLC.

North America was the largest region in the IoT middleware market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the iot middleware market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the iot middleware market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

IoT middleware refers to software acting as a bridge between IoT components, enabling communication among elements that might not naturally connect. This middleware resolves the connectivity of diverse and existing programs that were not initially designed to integrate.

The primary platform categories of IoT middleware include device management, application management, and connectivity management. Device management involves overseeing the setup, operation, and maintenance of computers or networks, employing administrative tools vital for smooth functionality. IoT middleware within device management facilitates device connection and management. It's utilized by both small and medium-sized enterprises and large corporations across sectors like manufacturing, government and defense, automotive and transportation, energy and utilities, healthcare, retail, BFSI (banking, financial services, and insurance), among others.

The IoT middleware market research report is one of a series of new reports that provides IoT middleware market statistics, including IoT middleware industry global market size, regional shares, competitors with an IoT middleware market share, detailed IoT middleware market segments, market trends and opportunities, and any further data you may need to thrive in the IoT middleware industry. This IoT middleware market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The IoT middleware market includes revenues earned by entities by providing message-oriented middleware and database middleware. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

IoT Middleware Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on iot middleware market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for iot middleware? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The iot middleware market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Platform Type: Device Management; Application Management; Connectivity Management2) by Organization Size: Small and Medium-Sized Enterprises; Large Enterprises

3) by Vertical: Manufacturing; Government and Defense; Automotive and Transportation; Energy and Utilities; Healthcare; Retail; BFSI (Banking, Financial Services, and Insurance); Other Verticals

Subsegments:

1) by Device Management: Device Provisioning; Device Configuration; Device Monitoring; Firmware Over-the-Air (FOTA) Updates2) by Application Management: Application Development Platforms; Application Integration Services; Analytics and Reporting Tools

3) by Connectivity Management: Network Connectivity Solutions; Data Routing and Processing; Network Monitoring and Optimization

Key Companies Mentioned: Microsoft Corporation; International Business Machines Corporation; SAP SE; Cisco Systems Inc.; Google LLC

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this IoT Middleware market report include:- Microsoft Corporation

- International Business Machines Corporation

- SAP SE

- Cisco Systems Inc.

- Google LLC

- Hitachi Ltd.

- Oracle Corporation

- General Electric Company

- Schneider Electric SE

- ClearBlade Inc.

- PTC Inc.

- Robert Bosch GmbH

- Siemens AG

- ABB Ltd.

- AVEVA Group PLC

- Alitzon Inc.

- Eurotech S.p.A.

- Fujitsu Ltd.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co. Ltd.

- Intel Corporation

- Litmus Automation Inc.

- Mocana Corporation

- Nebbiolo Technologies Inc.

- Nokia Corporation

- Particle Industries Inc.

- Progress Software Corporation

- ThingWorx Inc.

- Wind River Systems Inc.

- KaaIoT Technologies LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 20.72 Billion |

| Forecasted Market Value ( USD | $ 39.69 Billion |

| Compound Annual Growth Rate | 17.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |