Surgical Staplers: Introduction

Surgical staplers are medical devices used during surgical procedures to close wounds or incisions. They are commonly used in both open and minimally invasive surgeries, such as gastrointestinal, thoracic, and gynaecological procedures. Surgical staplers are designed to quickly and accurately close wounds or incisions, reducing the time required for suturing and minimizing the risk of infection. They can also be used to create anastomoses, which are connections between two structures in the body, such as the ends of the intestine after a segment has been removed. Surgical staplers come in different types, including disposable and reusable, and are available in various sizes and designs for use in different types of surgeries.Surgical Staplers: Application and Uses

Surgical staplers are medical devices used to close incisions and wounds during surgical procedures. They offer several advantages over traditional sutures, including faster closure time, reduced risk of infection, and increased accuracy and consistency of wound closure.

Surgical staplers are used in various surgeries, including gastrointestinal, thoracic, and gynaecologic procedures. They are also used in bariatric surgery, where the staples are used to reduce the size of the stomach to aid in weight loss. Additionally, surgical staplers are used in orthopaedic surgery to staple bone fragments together and in plastic surgery for skin closure.

Global Surgical Staplers Market Segmentations

Market Breakup by Product

- Manual Surgical Staplers

- Powered Surgical Staplers

Market Breakup by Type

- Reusable Surgical Staplers

- Disposable Surgical Staplers

Market Breakup by Application

- Abdominal Surgeries

- Orthopaedic Surgeries

- Cardiac Surgeries

- Oral and Throat

- Gastroenterology

- Dermatology

- General Surgeries

- Others

Market Breakup by End User

- Hospitals

- Ambulatory Surgical Centres

- Others

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Global Surgical Staplers Market Scenario

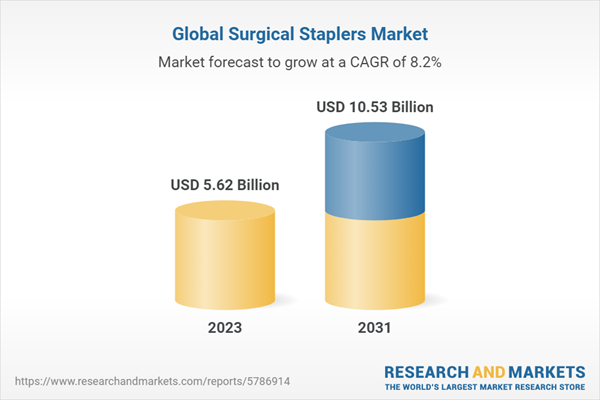

The global surgical staplers market size is expected to grow significantly in the coming years. The market growth can be attributed to the increasing demand for surgical staplers in various surgical procedures, such as gastrointestinal surgeries, bariatric surgeries, and thoracic surgeries, among others. The rise in the number of surgical procedures and the growing prevalence of chronic diseases, such as cancer and obesity, are some of the key factors driving the market growth.The market is also driven by the technological advancements in surgical staplers, including the development of powered staplers that offer better control and precision during surgeries. In addition, the increasing adoption of minimally invasive surgical procedures and the growing focus on reducing hospital stays and recovery time are also fuelling the demand for surgical staplers.

Geographically, the North American region is expected to hold a significant share of the market due to the high adoption of advanced surgical procedures and the presence of well-established healthcare infrastructure. The Asia-Pacific region is also expected to witness significant growth during the forecast period, attributed to the growing number of surgical procedures, rising healthcare expenditure, and increasing awareness regarding advanced surgical technologies

Key Players in the Global Surgical Staplers Market

The report gives an in-depth analysis of the key players involved in the global surgical staplers market. The companies included in the market are as follows:- Medtronic

- Smith & Nephew

- 3M

- B. Braun Melsungen AG

- Medical Devices Business Services, Inc

- Ethicon Inc

- CONMED Corporation

- Purple Surgical Inc

- Frankenman International Limited

- Welfare Medical Ltd

- Touchstone International Medical Science Co. Ltd

- Meril Life Sciences Pvt. Ltd

This product will be delivered within 5-7 business days.

Table of Contents

Companies Mentioned

- Medtronic

- Smith & Nephew

- 3M

- B. Braun Melsungen AG

- Medical Devices Business Services, Inc.

- Ethicon Inc.

- Conmed Corporation

- Purple Surgical Inc.

- Frankenman International Limited

- Welfare Medical Ltd.

- Touchstone International Medical Science Co. Ltd.

- Meril Life Sciences Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | April 2023 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 5.62 Billion |

| Forecasted Market Value ( USD | $ 10.53 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |